The tech-heavy Nasdaq 100 has not continued to outperform from July, the

opposite of our expectation that signs of economic downturn might stop rate

hikes sooner and fuel defensive investing.

America’s economic outperformance is a marvel to behold, according to a

report from The Economist in April. Now it looks very much like a

self-fulfilling prophecy.

The Atlanta Federal Reserve’s GDPNow suggests that annualised real GDP growth

could come at an over 5% for the third quarter and professional economists see

growth topping 3%.

That marks an acceleration from growth of over 2% for the prior four

quarters. The Fed will most likely frown at it aggravating upward price

pressure.

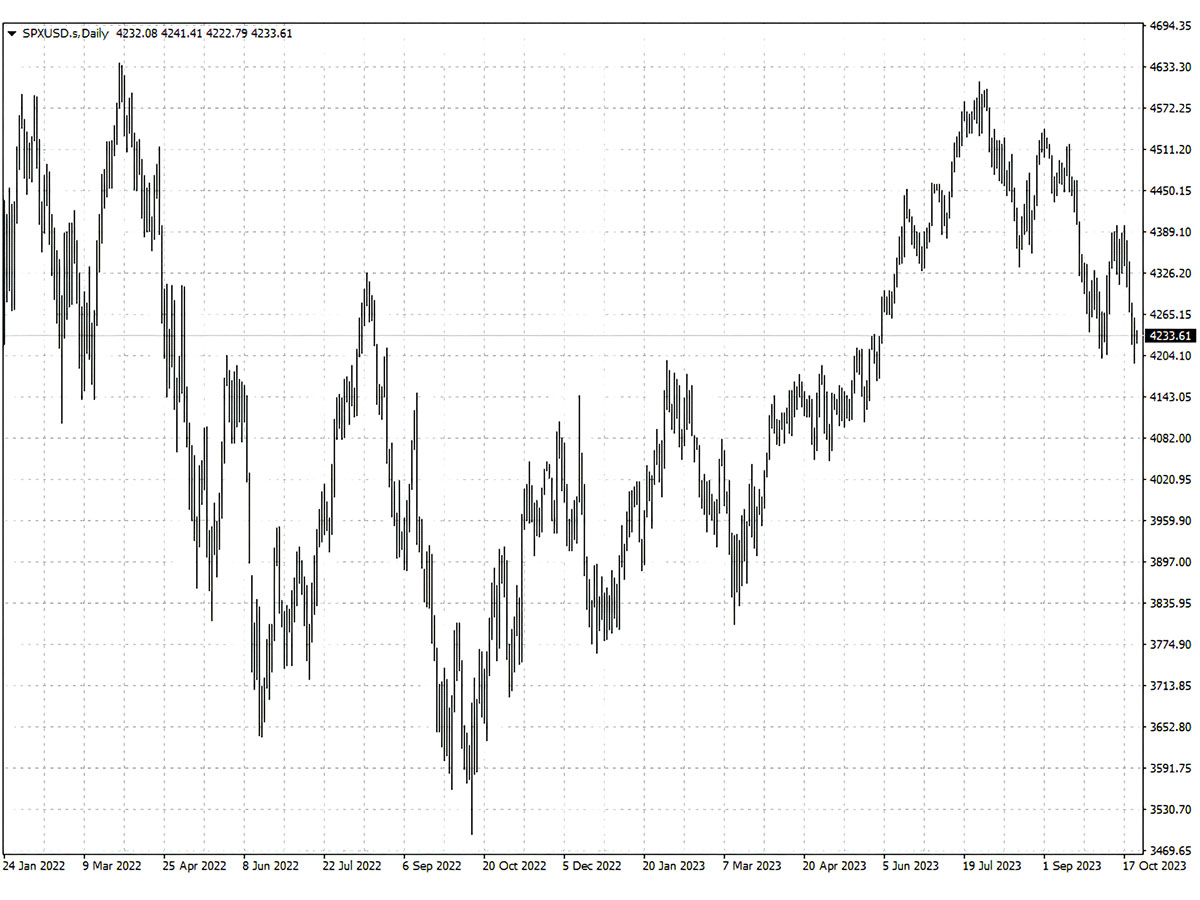

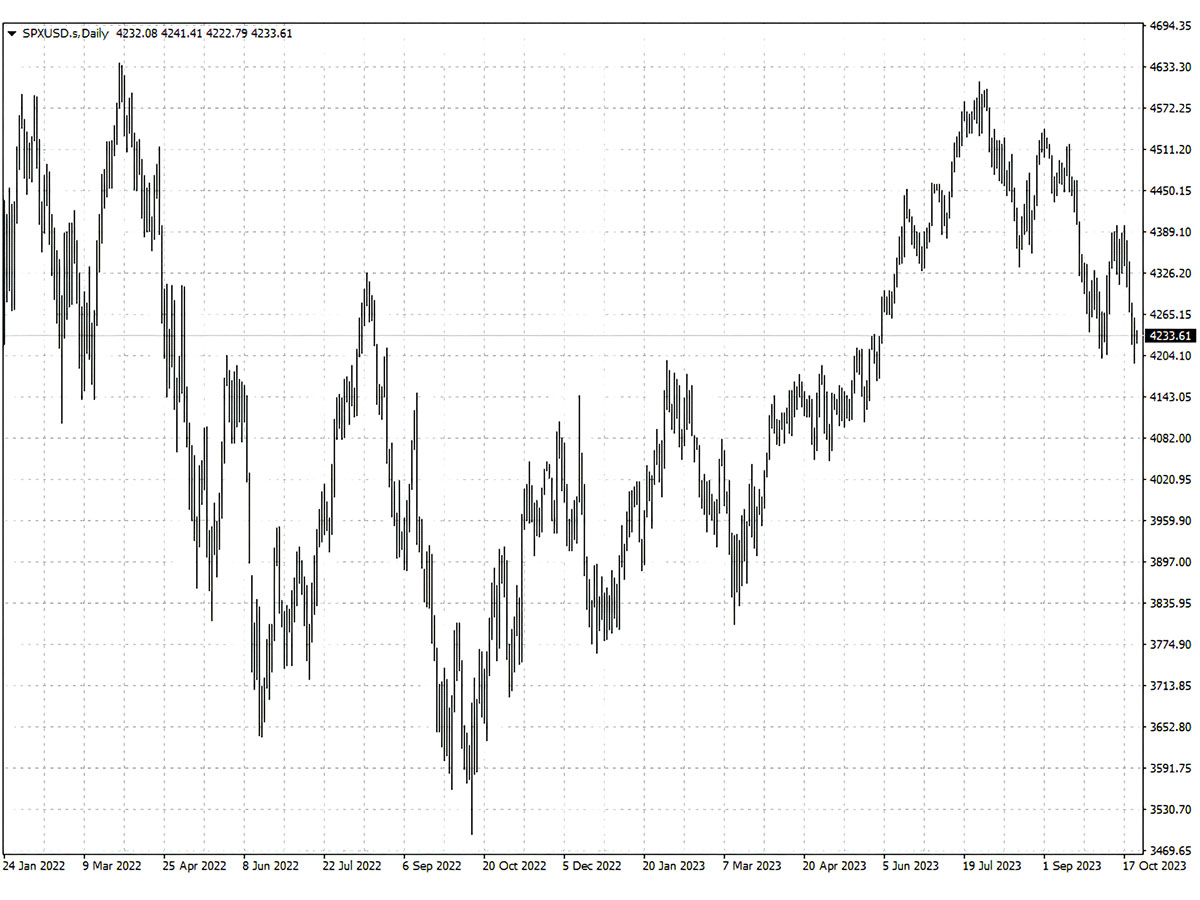

The S&P 500 has erased much of its gains in the past few months, rising

around 10% year-to-date. Relentless climb in Treasury yields, which was absent

for over a decade, are largely driving market action.

Only two of the eleven sectors generated positive return in the last quarter.

The clear winner was energy stocks as OPEC+ pushed up oil prices by coordinated

output cuts.

A Tougher Game

Stock investors have to confront a more volatile and less predictable

environment after waving goodbye to quantitative easing that offered unlimited

dry ammunition.

That is evident this year in particular. Equity strategist were blindsided by

a strong rally and stocks began to lose steam right after they changed their

pessimistic views.

JPMorgan Chase CEO Jamie Dimon warned that the fed funds rate may ellipse 7%

and that central banks and governments are not as credible in macroeconomic

projection as many believe.

“I want to point out the central banks 18 months ago were 100% dead wrong,”

he said. If so whatever lies ahead for stock markets is still predominately

murky.

The Fed are poised to leave short-term rates unchanged for a second time next

week, while keeping open the door to more rate hikes.

Policymakers said rising yields may be helpful in offsetting price pressures.

Markets were pricing in nearly 40% odds of an increase by year-end.

Meanwhile the fed also has to grapple with concerns about the US government’s

debt boom. The current fiscal path is widely seen as unsustainable and higher

borrowing costs only makes the problem less soluble.

Firms including Goldman Sachs and Deutsche Bank think earnings could drive

the S&P 500 another leg higher at year-end, while bears like Morgan Stanley see further downturn.

The S&P 500 Index peaked in July and is unlikely to trade beyond the

mid-4000s for the next six months as higher rates weigh on corporate earnings

growth, according to Stifel Chief Equity Strategist Barry Bannister.

The eminent forecaster accurately made a contrarian call on the stock rally

in the first part of 2023 and has since said gains would stall in the second

half of the year.

The benchmark is trading above 4,200 – a major support. While Bannister

believes that yields will top around 5% during the current cycle, he projects a

normalised 10-year yield of up to 6% during the mid-2020s.

The last time 10-year yields were this high 16 years ago, bond traders held

out on buying until real yields peaked at about 2.8%, said Truist co-chief

investment officer Keith Lerner.

While real rates have risen and inflation has largely fallen over the last

several months, the current roughly 2.5% adjusted rate is below the recent

historical high.

Tech Frenzy

Global hedge funds reduced their exposure to mega cap tech stocks in recent

days, ahead of the companies' third-quarter earnings, JPMorgan Chase and Goldman

Sachs both said.

But Megacap tech stocks continue to account for a relevant part of hedge

fund's book as stocks in other sectors were also being sold, the two Wall Street

banks added.

The so-called Big Tech are expected to post a 32.8% gain in earnings for the

full year, while the rest of the S&P 500 sees a 2.3% decline over the same

time, according to LSEG.

Blackrock is underweight broad equities for the next 6-12 months, but it

remains bullish on megacap companies. “The income in bonds is also more

attractive than stocks on a relative risk basis.”

Alphabet, Microsoft and Snap kicked off earnings season with strong sales

results for the quarter ended in September. But the Nasdaq 100 saw its worst day

this year on Wednesday.

At just below 22, the Nasdaq 100 is still way above its floor valuation of

around 19 in October of last year, and this with yields on 10-year Treasuries

hovering around 5%.

Franklin Templeton said the Big Tech could come under pressure next year if

AI enthusiasm wanes but the potential decline in interest rates may benefit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.