The AUD rose to a 2-week high - EBC Daily Snapshot

2023-10-25

Summary:

Summary:

On Wednesday, the USD stabilized as the AUD surged to a near two-week high due to strong inflation data, hinting at potential interest rate hikes.

EBC Forex Snapshot

25 Oct 2023

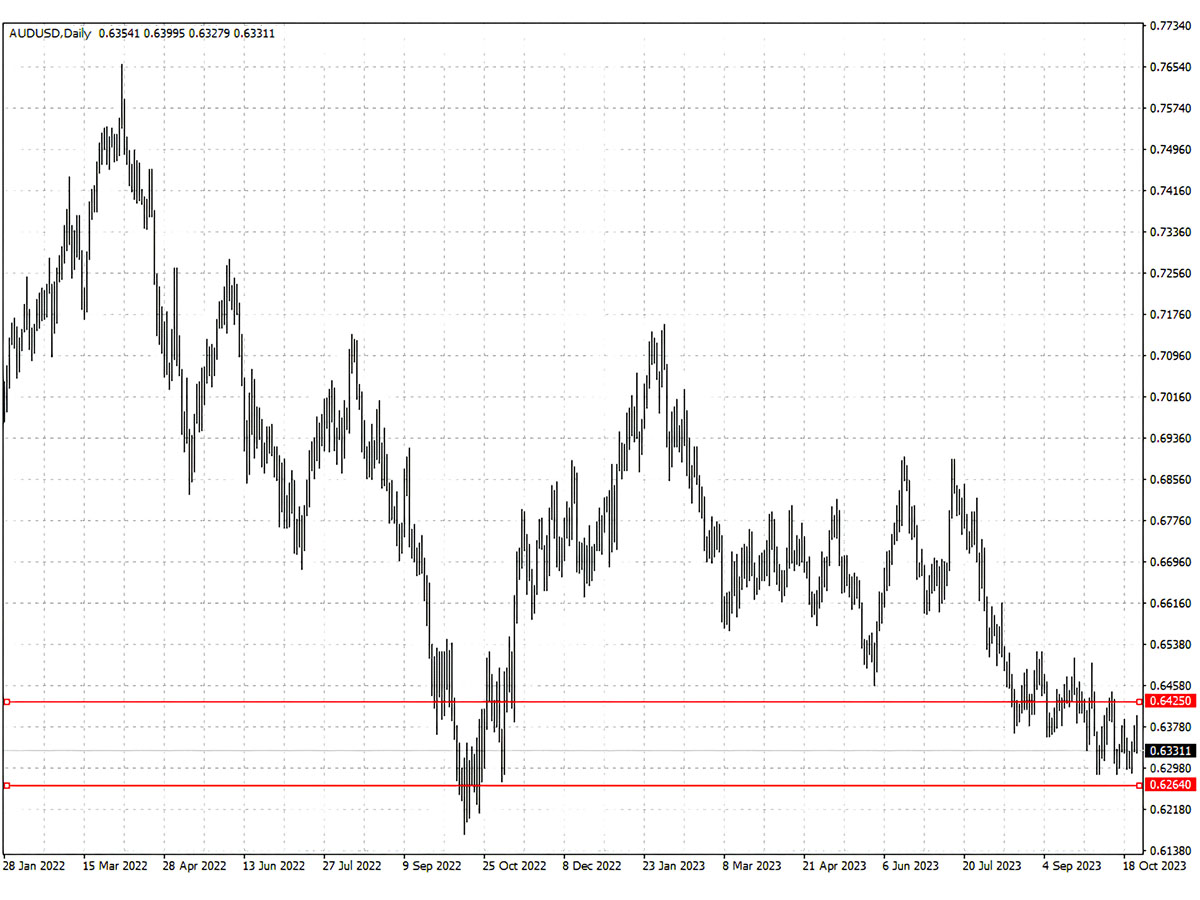

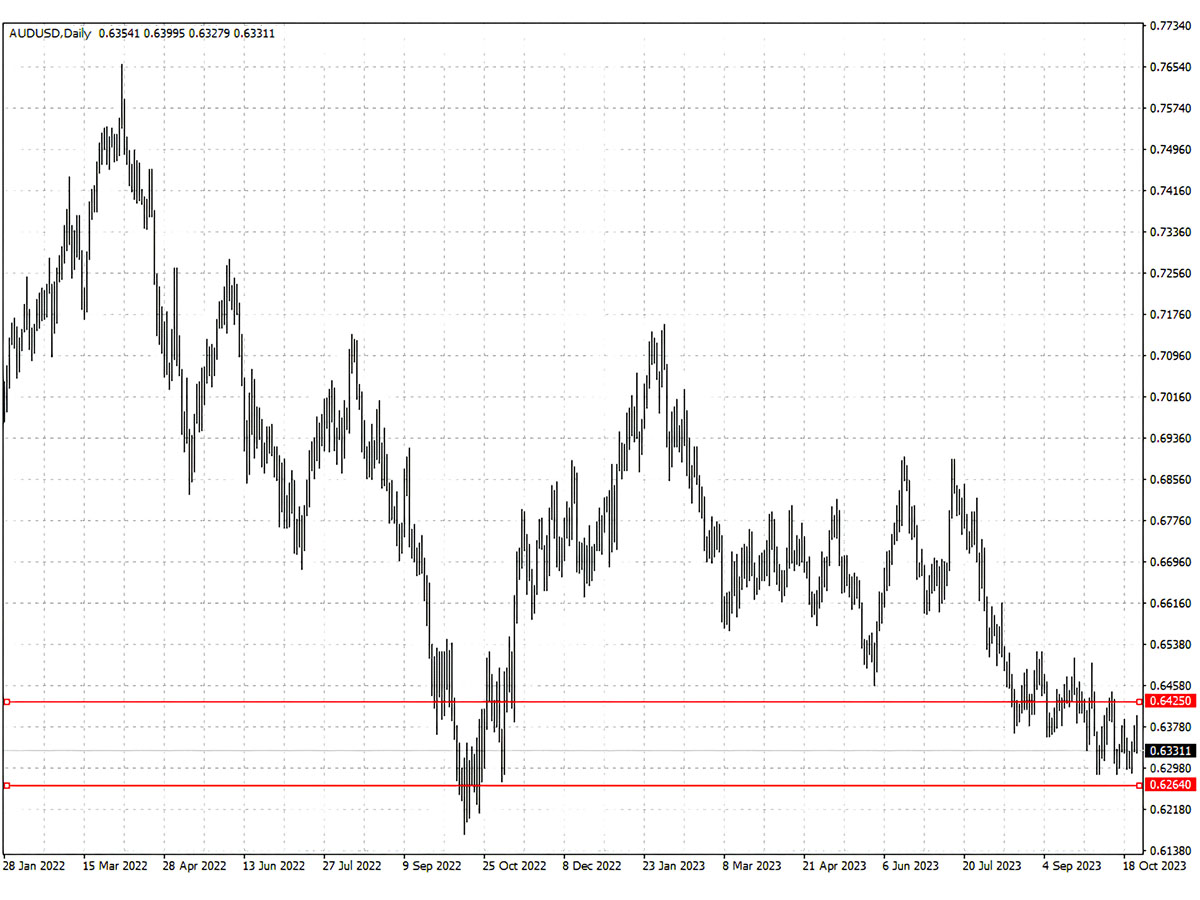

The dollar steadied on Wednesday while the australian dollar rose to a nearly

two-week high on the chance of interest rate hikes after surprisingly strong

inflation data.

Australia's consumer price index rose 1.2% in the third quarter due to higher

fuel prices, above market forecasts for 1.1% and up from a 0.8% increase the

previous quarter.

The British pound extended the previous day's losses as negative data

affirmed the view that the BOE will likely hold interest rates next week.

The S&P Global UK Purchasing Managers' Index reached a nine-month low of

49.2 in October. The reading chimes with the trend in the eurozone.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 16 Oct) |

HSBC (as of 24 Oct) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0443 |

1.0834 |

1.0517 |

1.0751 |

| GBP/USD |

1.2011 |

1.2387 |

1.2076 |

1.2378 |

| USD/CHF |

0.8745 |

0.9338 |

0.8793 |

0.9127 |

| AUD/USD |

0.6286 |

0.6522 |

0.6264 |

0.6425 |

| USD/CAD |

1.3381 |

1.3785 |

1.3576 |

1.3794 |

| USD/JPY |

146.00 |

150.16 |

148.56 |

150.44 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.