The key to investing in stocks lies in finding companies that are worth investing in, and this first requires a thorough understanding of the company. If a company is unable to pay its debts on time, it may face the risk of default, which not only weakens the market and investor confidence but also drags down the share price, thus directly affecting shareholders' interests. To avoid these risks, investors should focus on a company's liquidity, particularly its cash ratio, before investing. In the next section, we will delve into the definition, calculation, and application of cash ratios.

What is cash ratio?

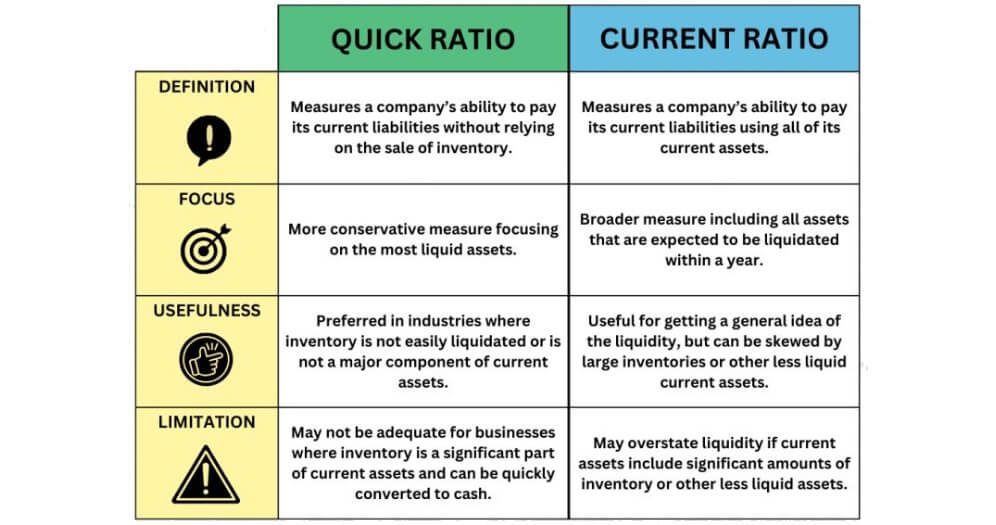

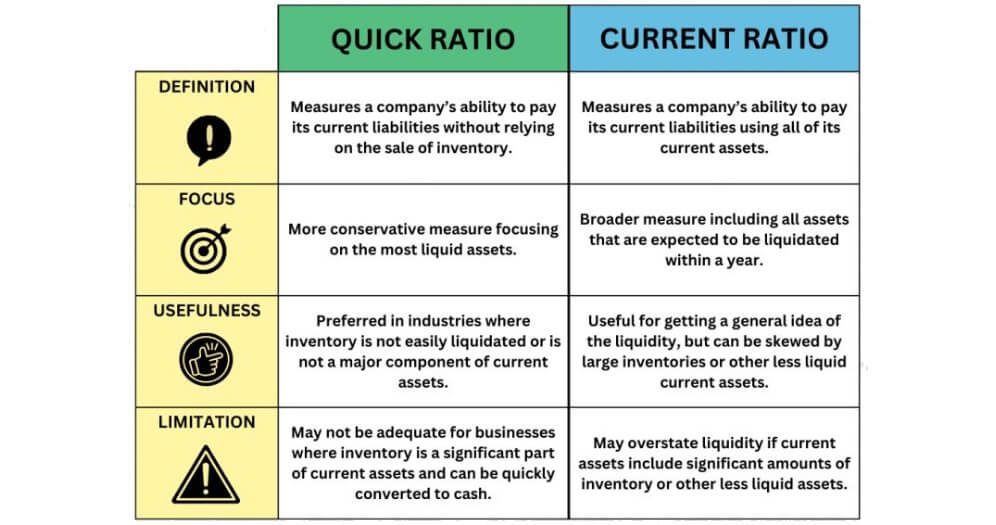

It is an important financial indicator for assessing a company's short-term solvency, reflecting the ability of a company to use cash and cash equivalents on hand to repay short-term liabilities in an emergency. Compared to the current ratio and quick ratio, the cash ratio is more stringent because it only considers cash and cash equivalents and does not include current assets such as accounts receivable or inventories.

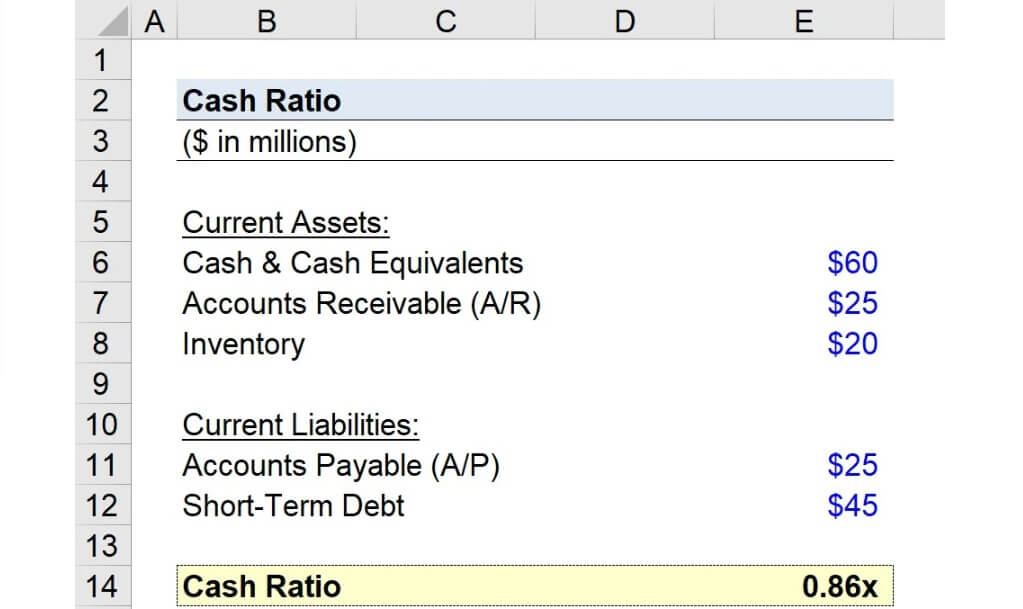

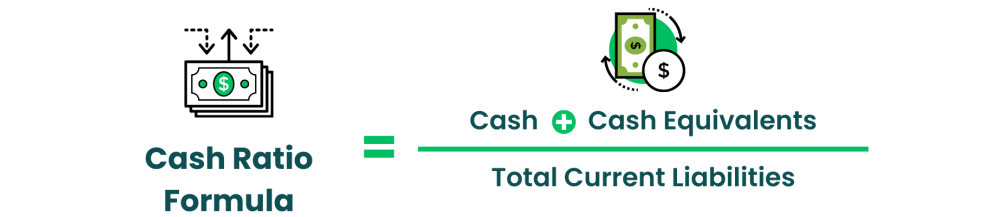

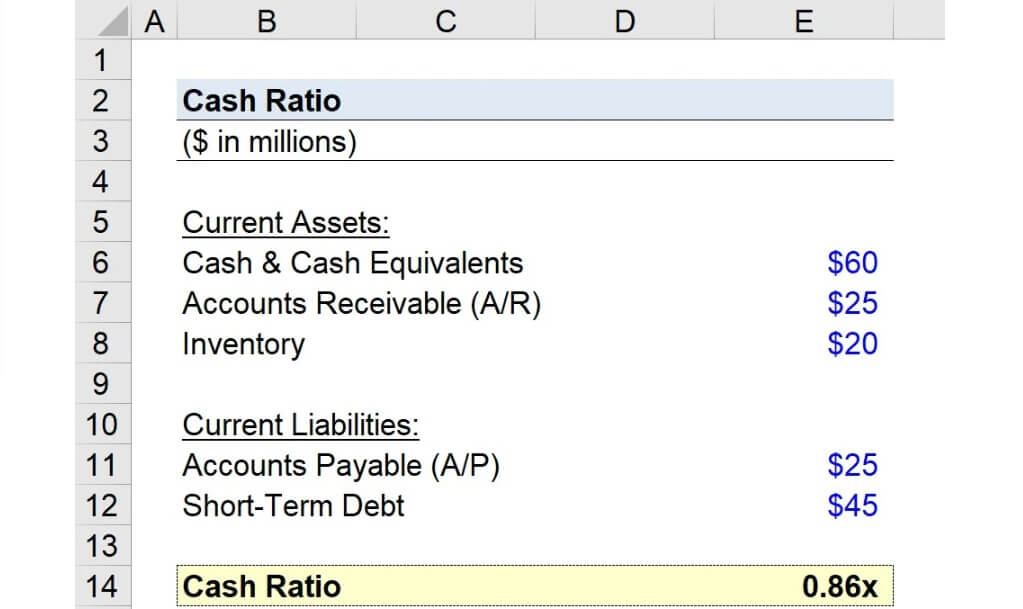

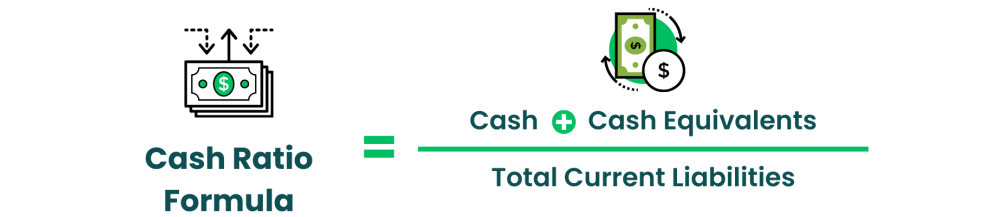

The cash ratio is calculated by dividing the total amount of cash and cash equivalents by current liabilities, usually expressed as a percentage. Suppose a company has the following financials: cash $50000; cash equivalents $30000; current liabilities $200000. then according to the calculation:

Cash ratio = (50.000 + 30.000) ÷ 200.000 = 80.000 ÷ 200.000 = 0.4. This indicates that 40% of the company's current liabilities can be paid off with cash and cash equivalents.

For the purposes of this calculation, cash refers to the actual cash held by the firm, which includes the amount of cash held in a bank account. Cash equivalents, on the other hand, include short-term investments that can be quickly converted to cash, such as Treasury bills and market-traded securities, which are highly liquid assets that can be realized in the short term at a price close to their book value.

Current liabilities, on the other hand, are debts that a business needs to repay within a year, including accounts payable, short-term borrowings, and other liabilities that are coming due. By calculating the cash ratio, companies and investors can get an accurate picture of how well a business can cope with short-term financial pressures and how secure its short-term liquidity is.

It specifically measures the proportion of liquidity that a business can quickly draw upon relative to its short-term liabilities, thereby assessing the ability of the business to repay its upcoming debts without relying on other assets. Through this ratio, investors and creditors can get a clearer picture of a business's short-term liquidity and financial health.

To know whether a business is financially sound or not, it is important to understand its short-term solvency. A high cash ratio indicates that a company has enough cash and cash equivalents to meet its short-term obligations as they fall due, in which case the company is able to use its liquidity quickly to repay its short-term liabilities, thus reducing the risk of financial stress.

At the same time, a higher cash ratio usually indicates that a firm has adopted a conservative financial strategy to cope with possible economic fluctuations or market pressures by keeping more cash reserves. This practice demonstrates prudence and foresight in financial management and enables companies to maintain stable operations in the face of unexpected events or market uncertainties.

Adequate cash reserves provide companies with greater resilience, such as the need to seek external financing or liquidate assets in times of economic downturn, thereby reducing financial risks and maintaining the long-term health of the business. This sound financial strategy not only enhances a company's ability to survive in an uncertain environment but also provides greater flexibility for future investment opportunities.

In addition, the cash ratio measures a firm's liquidity, specifically its ability to cope in the face of short-term funding needs. This indicator is particularly important as it reveals whether the firm is able to meet its short-term financial obligations in a timely manner without additional financing or realization of other assets.

Generally, its higher level indicates that the firm has sufficient cash reserves to respond quickly to unexpected expenses or market fluctuations and to reduce financial risk. The lower it is, the more likely it is to indicate that the enterprise may face a cash crunch in the short term and rely on external financing or asset realization to meet its financial needs.

Overall, the cash ratio is an important indicator for analyzing the short-term financial health of a business, providing information on its ability to cope with financial pressures in the short term. By analyzing it, investors and managers can better assess a firm's short-term financial stability and liquidity risk and thus make more informed decisions.

Cash ratio analysis

Generally speaking, as an indicator of a company's short-term solvency and liquidity, a high cash ratio usually indicates that a company has strong liquidity and is able to respond quickly to short-term liabilities, thereby reducing financial risk, especially in times of high market uncertainty or economic stress. However, a high ratio can also mean that a company is not investing its idle cash effectively, potentially missing out on growth opportunities and using capital less efficiently.

Conversely, a low cash ratio implies that a business is exposed to liquidity risk when it incurs short-term liabilities and may need to rely on short-term financing or asset realizations. It may increase financial stress in times of economic instability. At the same time, it may also indicate that a business is actively utilizing funds for expansion and investment, which can lead to higher returns, but needs to ensure sufficient liquidity to avoid financial risk.

It is important to note, however, that its higher level usually indicates that a firm has sufficient liquidity to meet its short-term obligations, which provides a strong financial cushion to be able to react quickly in the face of short-term financial needs or market volatility. However, in addition to considering short-term liquidity needs, a firm's long-term financial strategy and potential risks need to be factored into the assessment.

Its excessively high level may indicate that the enterprise is not fully utilizing the funds for business investment and growth and may miss opportunities to enhance long-term competitiveness and market share. Therefore, in assessing the ratio, it is important to take into account the long-term strategic objectives and financial risks of the enterprise to ensure the reasonableness and effectiveness of its cash reserves.

It is also important to analyze a business's cash ratio based on trends over time, which can provide important financial insights. If it continues to decline, this may indicate that the business' liquidity is weakening, suggesting a relative reduction in its cash reserves, which could lead to greater exposure to short-term financial stress and debt service risk.

Conversely, if it continues to rise, this may indicate that a firm's liquidity is increasing, suggesting that its cash reserves have increased and it is better able to cope with short-term liabilities and market volatility. Such trends can reveal adjustments in a company's capital management and financial strategies, thus helping to analyze its financial health and future operational risks.

In practice, the cash ratio can be analyzed to understand a company's short-term solvency and liquidity management level. However, it is only one of many financial indicators and should be used in conjunction with other financial ratios and a firm's actual operations to form a comprehensive assessment of a firm's financial position.

It is therefore important to compare it with the quick ratio and current ratio when assessing the liquidity of an enterprise. The quick ratio and current ratio cover more current assets, such as accounts receivable and inventories, and provide a more comprehensive view of liquidity. In contrast, the cash ratio, which considers only cash and cash equivalents, is typically lower and, while it provides a more rigorous standard of liquidity, may appear conservative. In addition, analyzing it in conjunction with the cash flow ratio provides a more comprehensive liquidity assessment.

Moreover, industry standards vary in their requirements for it. For example, the financial industry typically requires higher ratios to cope with regulatory requirements and market volatility in order to maintain sufficient liquidity to respond to unexpected financial needs. In contrast, the ratio is typically lower in the manufacturing and retail industries, where capital is primarily invested in production and inventory management and liquidity needs are relatively low.

At the same time, the size of the company and its business model can also affect the appropriate size of the ratio. Larger companies or those with stable cash flows are usually able to maintain lower cash ratios because they have greater flexibility and advantages in terms of funding operations and access to financing. Smaller enterprises or those in the growth stage, on the other hand, may need to maintain higher ratios to cope with the financial pressures arising from business expansion and market uncertainty in order to ensure sufficient liquidity to support their growth.

Therefore, when analyzing cash ratios, enterprises should take into account factors such as their own industry characteristics, mode of operation, and speed of capital turnover and compare them with other enterprises in the same industry in order to draw more accurate conclusions. At the same time, it should not be analyzed in isolation but should be considered together with other financial indicators such as the current ratio and quick ratio.

Normal range of cash ratio

The normal range of cash ratios varies depending on the industry and company. Because capital requirements and operating modes vary widely across industries, the specific appropriate level should be assessed in conjunction with industry standards, the company's operating mode, and financial strategy.

A cash ratio of more than 1 is usually considered conservative, indicating that a company holds a high level of cash and cash equivalents to cover short-term liabilities and market volatility. It is a good indicator of liquidity, showing that a company can easily meet its financial obligations in the short term. However, its being too high may also mean that the firm is not fully utilizing these cash resources for business development or expansion and may be missing out on potential investment opportunities and market growth.

In relative terms, a cash ratio between 0.5 and 1 is generally considered moderate, indicating that a company is actively utilizing funds to invest and operate its business while maintaining a certain level of liquidity. A ratio in this range indicates that a company is able to effectively balance liquidity and capital usage to meet short-term financial needs while supporting business growth and expansion, reflecting good financial management and strategic planning.

A ratio of less than 0.5 indicates that the enterprise has weak short-term solvency and faces some liquidity risk. In this case, the company may not have enough cash reserves to respond quickly to short-term liabilities or unexpected financial needs. This lower ratio may indicate that the firm has liquidity management challenges, especially when it is close to 0. The risk is more pronounced, and the firm may face difficulties in servicing its debt.

However, it is worth noting that a low cash ratio does not necessarily represent a complete liquidity crisis for a firm. Firms may rely on other liquid assets, such as accounts receivable or inventories, or on financing sources to cover short-term funding gaps. Therefore, when assessing a company's financial position, its overall liquidity structure and financing capacity should also be taken into account to obtain a more comprehensive risk assessment and financial health.

That said, a cash ratio between 0.2 and 0.5 is generally considered a reasonable range, regardless of industry characteristics, indicating that a company is able to effectively utilize funds for investment and business operations while maintaining a certain level of liquidity. However, this range only serves as an approximate reference value, and the exact reasonable range may vary depending on the characteristics of the industry, the size of the company, and the mode of operation.

Of course, in actual industries, the ideal ratio varies according to industry standards. For example, the financial industry usually requires a high cash ratio to meet stringent regulatory requirements and to cope with unexpected liquidity needs. This is because the financial industry has a higher demand for liquidity and safety of funds and needs to maintain sufficient cash reserves to cope with market volatility and unforeseen events.

In contrast, the manufacturing and retail sectors typically have lower ratios. In these industries, funds are mainly invested in production and inventory management, and the need for liquidity is relatively low. Manufacturing and retail businesses typically rely on large inventories and production facilities for their operations, so they can use more capital for business expansion and operations rather than holding large amounts of cash.

In addition, the specific conditions of a business can significantly affect the ideal cash ratio. A company's business model, market environment, and financial strategy play an important role in determining the appropriate range for the ratio. For example, high-tech companies or start-ups typically require higher ratios to support R&D activities and business expansion while dealing with market uncertainty and volatility. These businesses may face increased capital requirements and risks in the early stages and therefore need to retain adequate cash reserves.

Comparatively, mature manufacturing companies are usually able to maintain lower ratios because their funding needs are more stable and predictable. These companies usually have greater ability to operate capital and stable revenue streams, which enable them to manage cash flows and short-term liabilities effectively. As a result, mature companies can spend more on business expansion and capital investment rather than maintaining high cash reserves.

Therefore, when assessing the cash ratio, apart from referring to the above range, it is also necessary to take into account industry standards, the company's business model, and its financial position. Comparing the performance of companies in the same industry as well as the company's own operating characteristics and market environment, the liquidity and financial soundness of the company can be more accurately assessed so that reasonable investment and management decisions can be made.

Definition, calculation, and analysis of the cash ratio

| Category |

Content |

| Definition |

Measures a business’s ability to cover short-term liabilities with cash. |

| Calculation formula |

Cash ratio = (Cash + Cash Equivalents) / Current Liabilities. |

| Practical significance |

High means liquidity but idle cash; low means active use but more risk. |

| Normal range |

0.5 to 1 is typical, but varies by industry. |

| Practical application |

Assesses short-term financial strength with others. |

| Analytical notes |

Criteria vary by industry, size, and cash management. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.