Understanding the stock market generally starts with its broader indices. For example, the SSE index of China's A-shares, the S&P 500 of the U.S., and the NASDAQ. And in the European stock market, there is also one such index—the Stoxx Europe 600. Whether you are looking for investment opportunities or just want to understand the overall trend of the market, it is a reference indicator that cannot be ignored. Next, we will delve into the definition, role, and investment strategies of the Stoke 600 Index.

What is the meaning of the STOXX 600 Europe Index?

What is the meaning of the STOXX 600 Europe Index?

The Stoke 600 Index (STOXX Europe 600 Index) is a broad index measuring the performance of European stock markets, compiled and managed by STOXX. The index covers the stock markets of the major European economies and is designed to comprehensively reflect the overall performance of the entire European market and is therefore regarded as an important benchmark for the European financial markets.

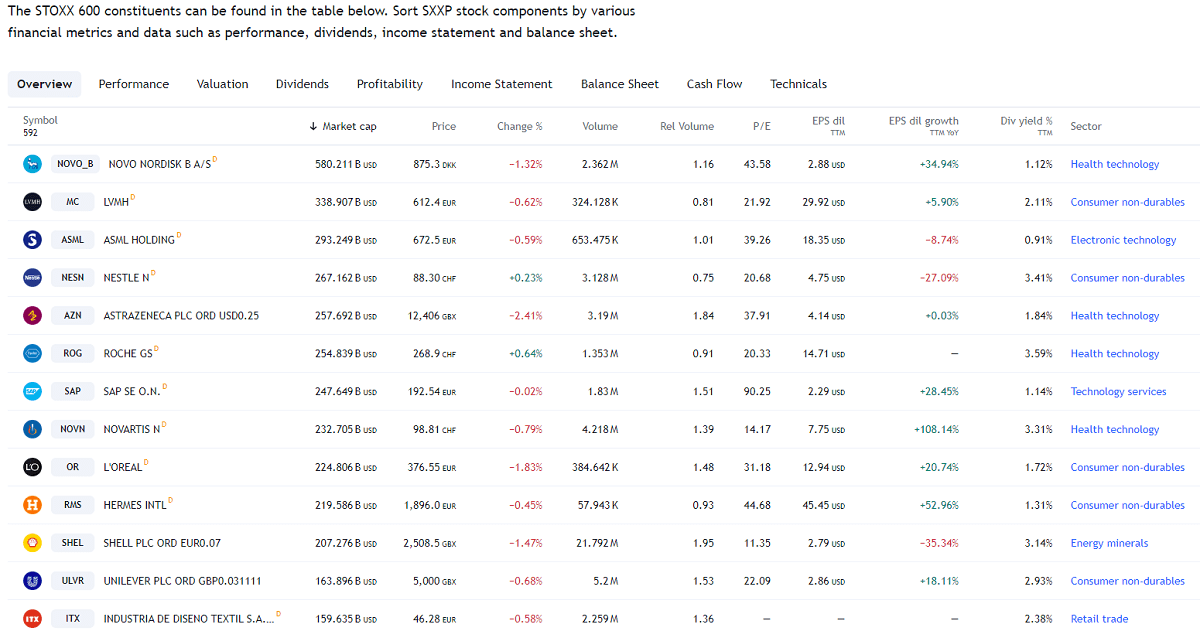

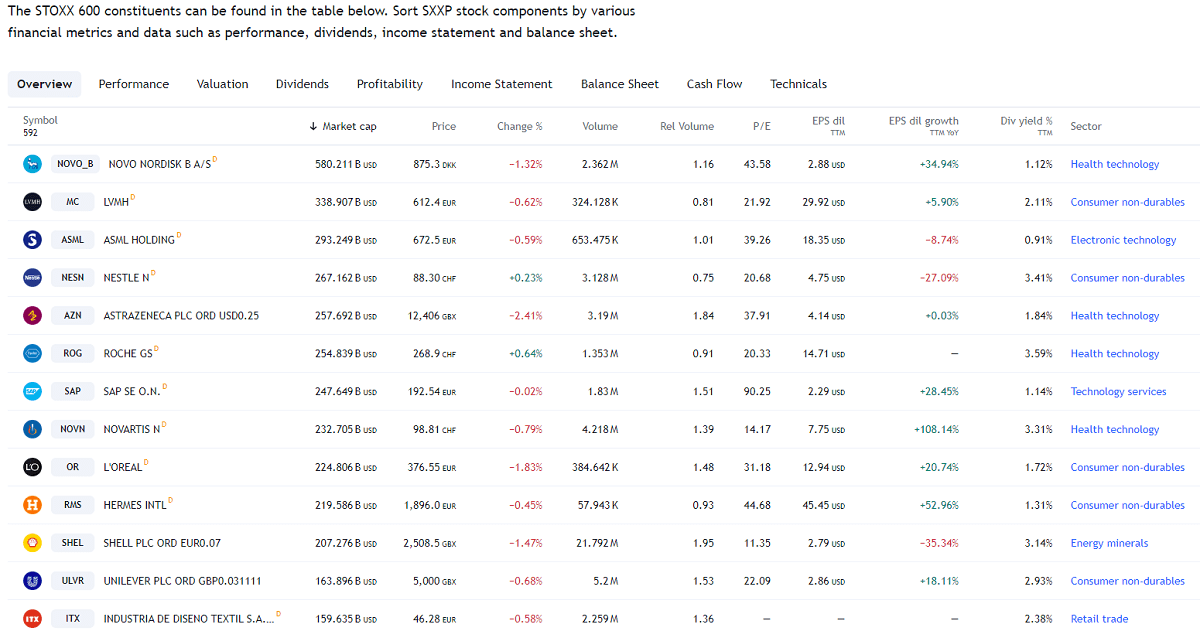

The index covers 600 companies in 18 European countries, including the UK, France, Germany, and Italy, across a number of key sectors, including financials, industrials, technology, consumer goods, energy, and health. This sector and geographic diversity allows the index to provide a comprehensive picture of different areas of the European economy, offering investors a panoramic view of the diversity of the European economy and its performance across sectors.

Due to its broad coverage of companies from multiple countries and different sectors, the Stoxx Europe 600 Index typically exhibits low volatility. This diversified constituent and sector coverage helps to balance the impact of volatility on individual companies or sectors, thus providing investors with more stable investment returns.

In addition, the index classifies its constituents into large-cap, mid-cap, and small-cap companies by market capitalization, thus ensuring a balanced composition that accurately reflects the market performance of companies of different sizes. This tiered structure not only enhances the representativeness of the index but also allows investors to gain insight into the European market as a whole through one comprehensive indicator.

The Stoxx Europe 600 Index is calculated using a market capitalization weighting methodology, which means that the extent to which each company comprising the index contributes to the index depends on the size of its market capitalization. Specifically, a company's market capitalization is the result of multiplying its share price by the number of shares outstanding, so the larger the market capitalization, the more weight a company has in the index.

This approach ensures that the index accurately reflects the relative importance of individual companies in the market, allowing the performance of larger companies to have a more significant impact on the index and smaller companies to have a relatively smaller impact. In this way, the Stoke 600 Index reflects not only the overall market trend but also the actual performance of the major companies in the market.

Widely regarded as an important benchmark for the European market, the Stoke 600 Index serves to measure the overall performance of stock markets across Europe. It provides a comprehensive view of the market, enabling investors to gain insight into the overall health of the European stock market. The index is widely regarded as an important tool for analyzing and tracking European stock market trends, whether for long-term investing or short-term trading.

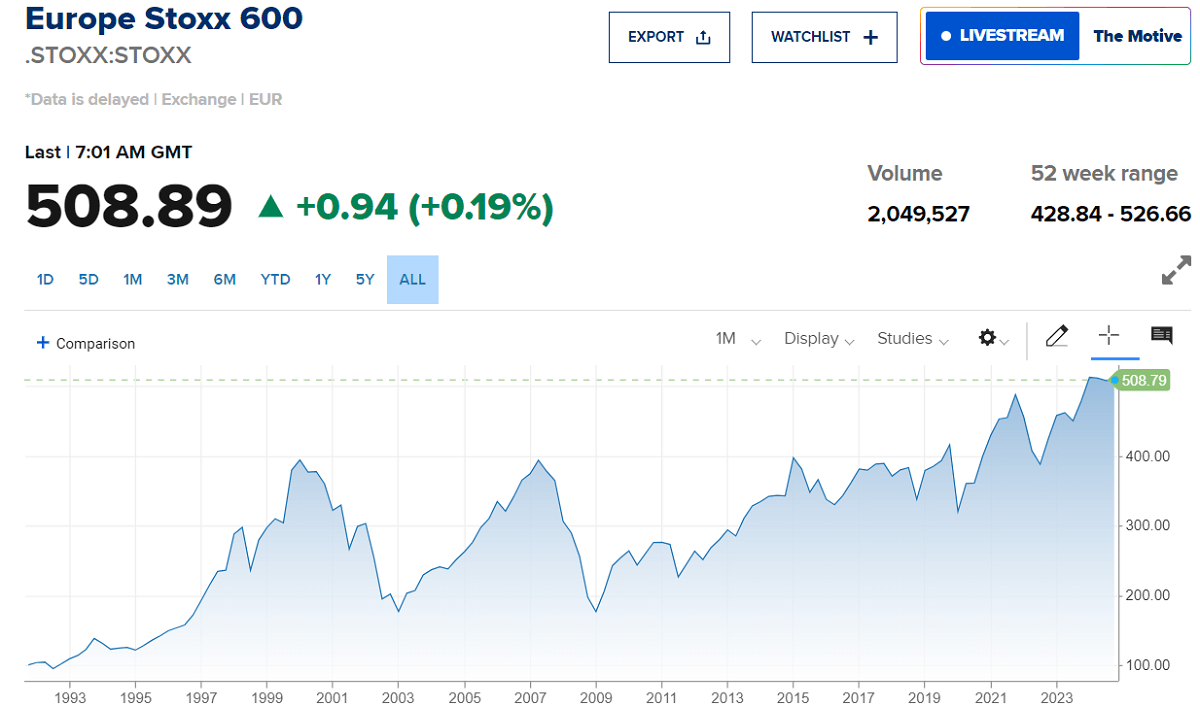

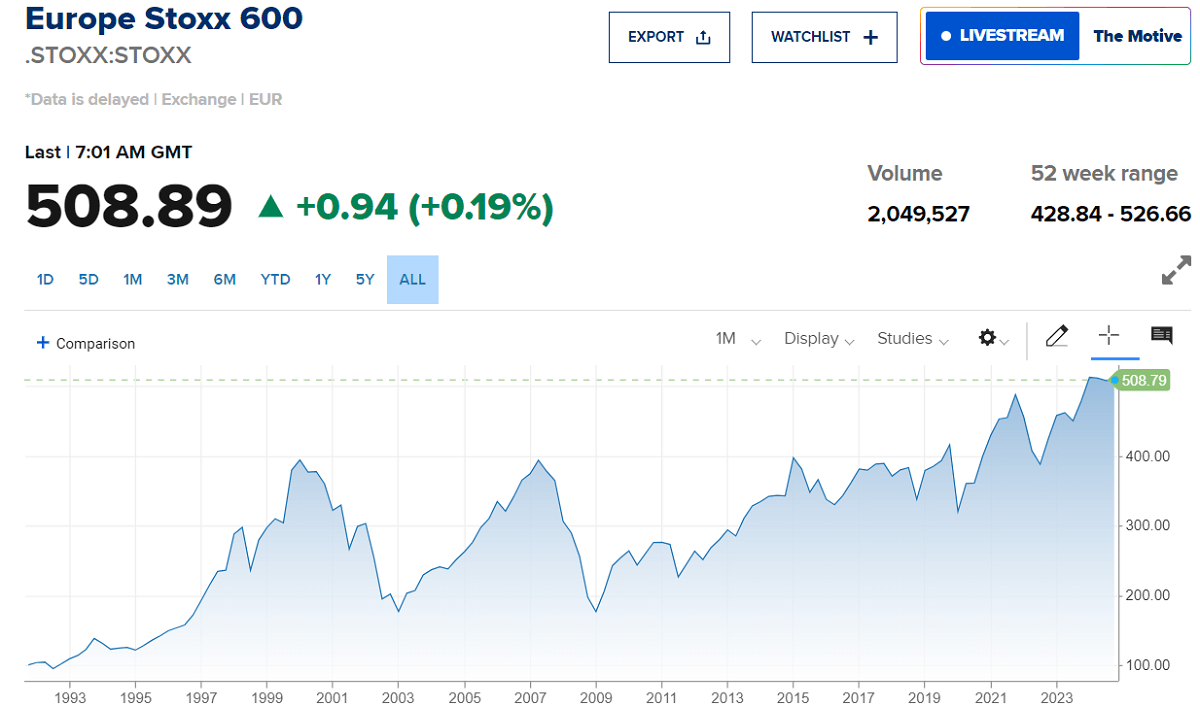

The index has reached new highs on several occasions in its history, and these highs not only reflect the strong performance of the European markets but also signify a significant market recovery. Most recently, the Stoxx Europe 600 reached another all-time intraday high, highlighting the resilience of the European economy and the rebound in markets. These all-time highs show that despite all the economic challenges and market volatility, European markets continue to show strong growth momentum.

And its recent record highs are likely to lift market sentiment and drive other European stock markets higher, reflecting investor confidence in the economic outlook. Especially against the backdrop of strong performance in key sectors such as technology and financials, such optimism may attract more international capital flows into the European market, further fueling stock market gains. As a result, many investors are increasingly concerned.

The Stoxx Europe 600 is more than just a stock market index; it also provides investors with valuable information about the health of the European economy. By analyzing the performance of the index, investors can gain insight into the economic trends and market dynamics of various sectors in Europe. At the same time, its volatility and performance can help investors assess the strength of the European economy as a whole, as well as the development of individual sectors, so that they can make more strategic investment decisions.

The role of the Stoxx Europe 600 Index

The role of the Stoxx Europe 600 Index

The Stoxx Europe 600 Index (Euro STOXX 600) plays a crucial role in the financial markets and enjoys a high level of interest, especially among global investors, as an important tool for assessing the health of the European economy and the performance of the stock markets. As a broad market benchmark, the index not only represents the stock markets of Europe's major economies but also provides a comprehensive picture of economic conditions in different countries and sectors.

International investors typically analyze the movements and changes in the Stoxx Europe 600 Index to gain insight into the overall movement of the European markets, identify investment opportunities, and assess the potential risks and growth prospects of the European economy. This makes the index an important reference point for global financial markets, with far-reaching implications for international capital flows and investment decisions.

The index is also used as a benchmark for a wide range of financial products, including funds and exchange-traded funds (ETFs), as well as other investment vehicles. Its broad market coverage and representativeness make it an ideal benchmark for measuring the performance of financial products, helping investors to assess the performance of these products in relation to the market as a whole.

Fund managers and investment consultants often use the Stoxx Europe 600 Index as a reference indicator for their portfolios and strategies to ensure that their investment choices are in line with the overall trend of the European markets. By comparing the index, investors can get a clearer picture of the relative performance of their investments and adjust their strategies in response to market changes.

This benchmarking role has made the Stoxx Europe 600 Index a key player among global investors and financial markets. Its broad market coverage and diverse constituents make it a key tool for assessing the health of European equity markets, helping investors to determine whether their investments are keeping pace with market trends and providing an important reference for adjusting and optimizing investment strategies.

By analyzing the Stoxx Europe 600 Index, investors are also able to gain insight into the overall trend of the European economy and markets. The index's broad coverage and diverse constituents make it a powerful tool for assessing the health of the European economy. Analyzing the index not only reveals the performance of different sectors but also reflects economic trends and changes in the European market.

For example, the sector distribution and company market capitalization movements in the index can help investors identify hot areas of economic growth or potential risks. At the same time, by observing the volatility and long-term performance of the index, investors can obtain valuable information about the overall stability and direction of the European market and thus make more accurate investment decisions.

Investing in the Stoxx Europe 600 Index can be an effective risk management tool as it provides broad market exposure. As the index covers 600 companies from a wide range of industries and countries, its diversified nature helps investors reduce their reliance on a single stock or sector, thereby reducing the risk associated with fluctuations in individual companies or sectors.

This broad sector and regional distribution allows investors to maintain relatively stable returns through different economic cycles, avoiding overexposure to market-specific risks. At the same time, the market capitalization-weighted approach of the index helps spread risk across a number of companies, further enhancing the portfolio's resilience to risk.

Overall, the Stoxx Europe 600 Index plays a key role in investment decision-making, market analysis, and risk management. It provides insight into the performance of the European market as a whole, helping investors to make accurate decisions and reduce the risk of single stocks or sectors through its diversification characteristics. As such, it is an important tool for understanding and participating in the European markets.

How can I invest using the Stoxx Europe 600 Index?

How can I invest using the Stoxx Europe 600 Index?

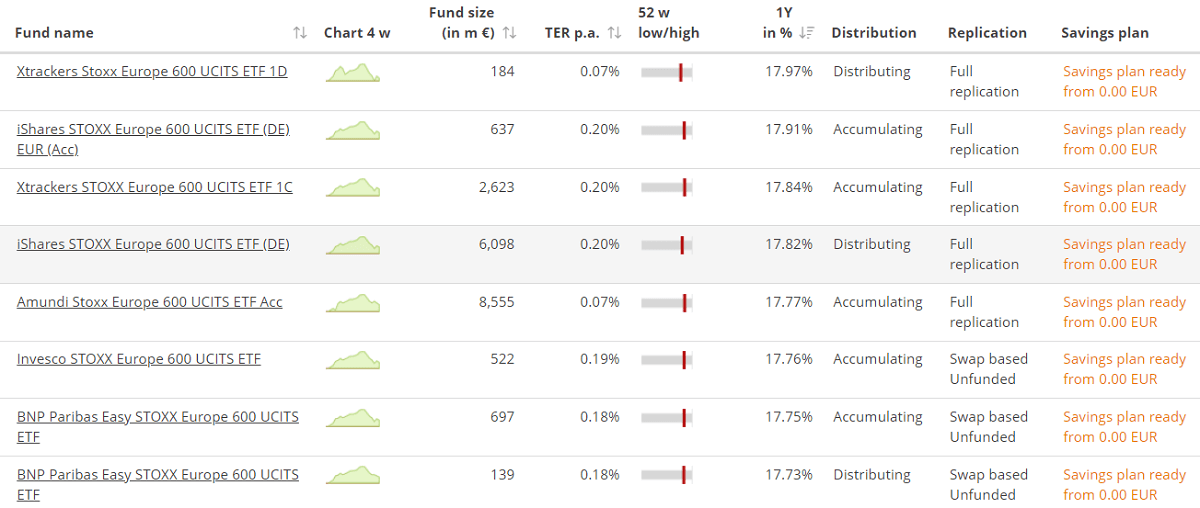

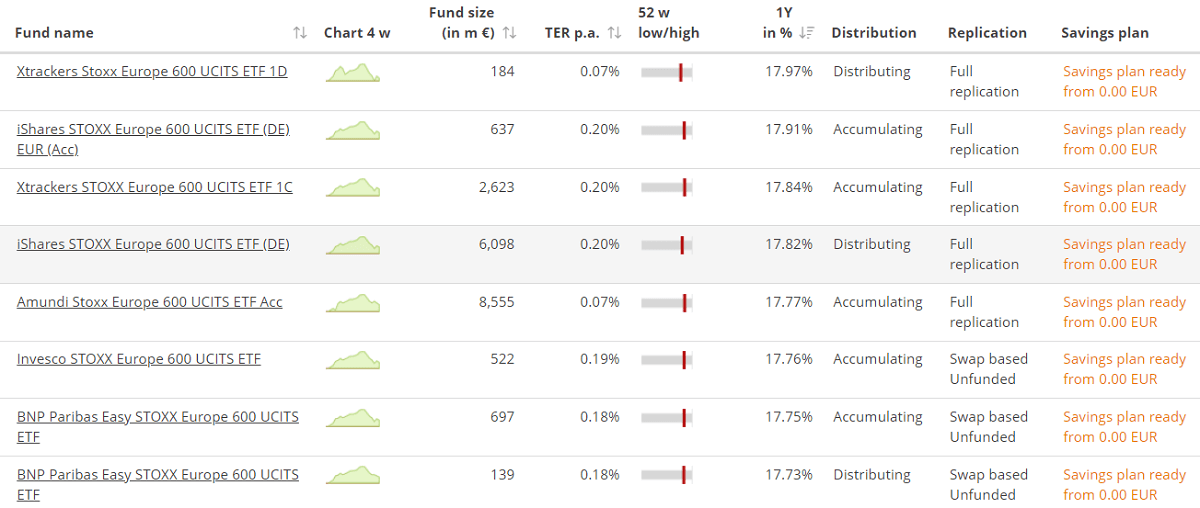

As a key indicator of the performance of European stock markets, the Stoxx Europe 600 Index offers a variety of investment options. Investors can choose to buy ETFs based on the index, such as the iShares STOXX Europe 600 UCITS ETF and Xtrackers STOXX Europe 600 UCITS ETF, which are widely recognized options in the market. By purchasing these ETFs, investors can indirectly hold all the constituent stocks in the index and gain broad coverage of the European market.

The main advantages of this type of investment are convenience and market exposure. Investors can easily achieve exposure to the entire index through ETFs, thereby gaining good diversification and reducing exposure to individual stocks or sectors.ETFs provide a convenient way for investors to achieve returns in line with the performance of the Stoxx Europe 600 Index at a relatively low cost.

In addition, the liquidity and expense ratio of ETFs are also one of their significant advantages. Investors can buy and sell ETFs on the Exchange in real time, providing flexibility in responding to market fluctuations while typically enjoying a low expense ratio. This high liquidity allows quick access to the market, while the low fees help reduce the overall investment cost, thus enhancing the economic efficiency of investment.

index funds that track the Stoxx Europe 600 Index are another convenient way to invest. These index funds usually adopt a passive management strategy and aim to reflect the performance of the index as accurately as possible. By purchasing these funds, investors indirectly hold all the constituent stocks in the index, thus realizing an investment in the whole index.

The main advantages of index funds are their simplicity and low fees. Investors can gain full exposure to the Stoxx Europe 600 Index simply by putting money into the fund. As these funds usually adopt a passive management strategy, their management fees are relatively low, providing investors with a cost-effective investment option.

For more experienced investors, futures and options contracts on the Stoxx Europe 600 Index offer additional investment opportunities. These financial instruments allow investors to hedge market risk or engage in speculative trading. Futures contracts can be used to lock in a future price, while options contracts offer the right to buy or sell under certain conditions, both of which provide flexibility in response to market movements.

The main advantage of futures and options is their high degree of flexibility and leverage, which allows for greater market exposure with a smaller capital investment. However, this also means that investors are exposed to higher risks. Therefore, when using these instruments, investors should have adequate market knowledge and risk management strategies to ensure that potential risks are effectively controlled.

There is also the option of buying individual stocks in the Stoke 600 Index directly, an approach that allows them to invest based on having a particular interest or view of a particular sector or company. In this way, investors can concentrate on stocks that they believe have growth potential or companies that have a unique view of certain sectors, allowing for a more precise investment strategy.

The main advantage of investing directly in constituent stocks is the ability to make choices based on individual market forecasts and investment strategies. Investors can select stocks that best meet their investment objectives based on in-depth financial analyses and market outlook assessments. However, this also requires investors to conduct detailed research on the financial position of individual companies, market dynamics, and industry trends in order to make informed investment decisions.

By investing in the Stoxx Europe 600 Index, investors are able to achieve broad market diversification and reduce their exposure to a single stock or sector. As the index covers 600 companies from a wide range of countries and industries, investors are able to diversify across different sectors and markets, thereby mitigating the impact of individual stock fluctuations on the overall portfolio.

It is important to note, however, that while this index provides a more stable investment option, investors still need to be mindful of the macroeconomic factors affecting the market. For example, factors such as the European Central Bank's monetary policy, the international trade situation, and geopolitical risks can have a significant impact on the market. Staying on top of these macroeconomic variables can help investors better understand market trends and adjust their investment strategies in response to potential market volatility.

Overall, the Stoxx Europe 600 Index offers diversified investment options as a benchmark with broad coverage of the European markets. Investors can invest in the index indirectly through ETFs and index funds, trade flexibly using futures and options contracts, or invest directly in index constituents. Its broad market coverage and sector diversity make it an important tool for assessing the overall performance of European stock markets, helping investors to effectively understand and participate in European markets.

Stoxx Europe 600's Definition, Role, and Invest Strategy

| Definition |

Role |

Investment Strategies |

| Benchmark of 600 European companies. |

To gauge European market health. |

Invest in ETFs, funds , futures. |

| Covers multiple industries in 18 countries. |

Show European economic diversity. |

Diversify and reduce risk. |

| Managed by STOXX. |

Measure country and industry. |

Grasp market opportunities. |

|

market cap-weighted with varying weights. |

Provide European market trend data. |

Choose suitable investment tools. |

| Strengths: broad coverage, low volatility. |

Benchmark and assess performance. |

Adjust strategy based on trends. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is the meaning of the STOXX 600 Europe Index?

What is the meaning of the STOXX 600 Europe Index? The role of the Stoxx Europe 600 Index

The role of the Stoxx Europe 600 Index How can I invest using the Stoxx Europe 600 Index?

How can I invest using the Stoxx Europe 600 Index?