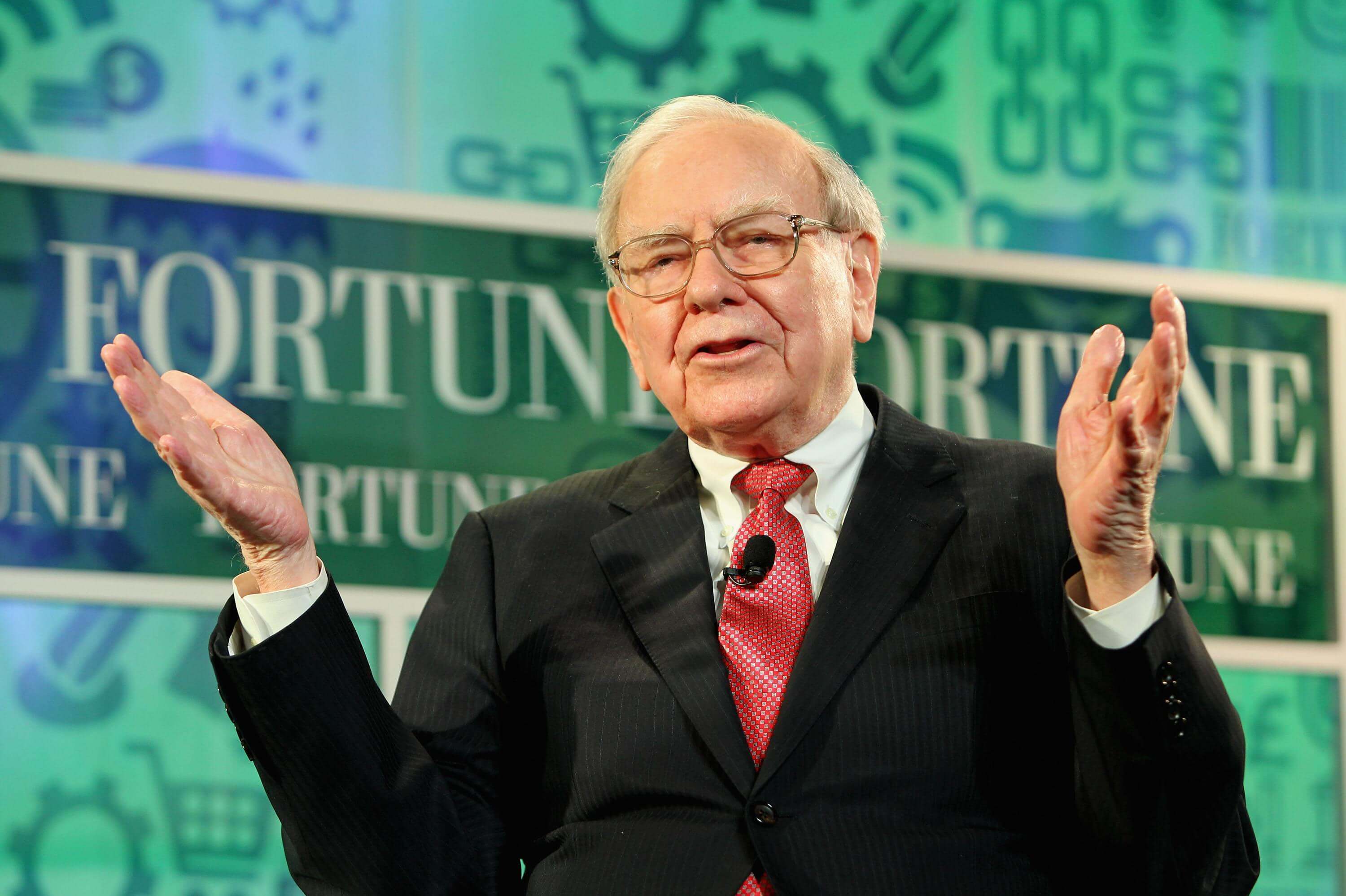

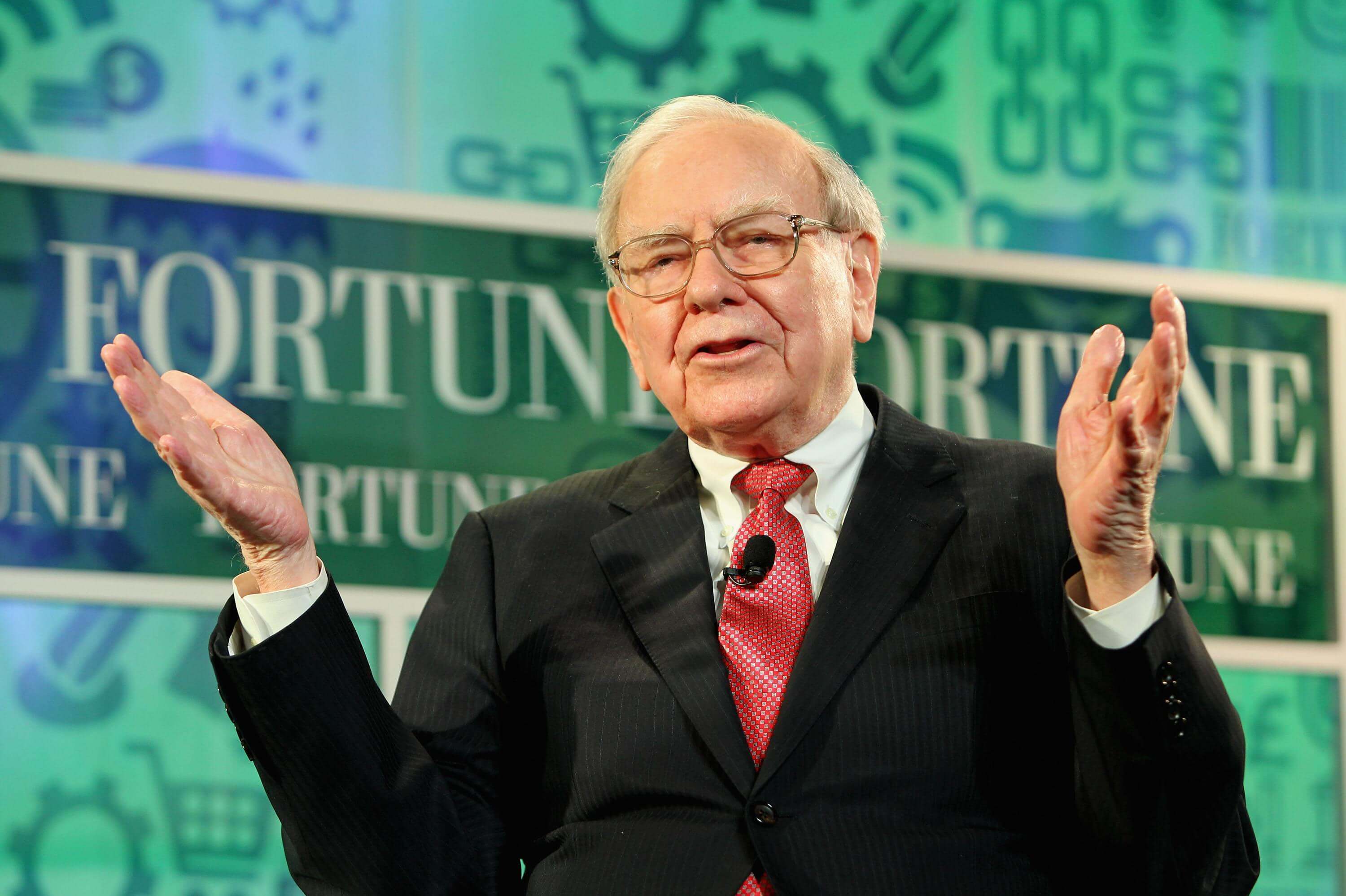

In 2007, Buffett launched a million-dollar challenge on the famous online

bingo website. Starting January 1, 2008, the returns of the S&P 500 Index

will compete with the net return performance of the parent fund ten years later.

The master fund is a fund that invests in various types of hedge funds, which is

Buffett's challenge to all hedge funds, or the collision between passive

investment and active investment. He believes that the returns of short-term,

one-year, or two-year investment managers may beat the market, but if the time

is extended, the market will eventually win.

After Buffett proposed this million-dollar challenge, although his views were

opposed by many famous investment managers, no one dared to truly confront them.

After a long wait, a fund manager named Sades finally accepted the challenge and

chose five master funds as his investment portfolio to compete with Buffett's

Index Fund.

Mercedes did not disclose which five funds it chose, while Buffett chose the

S&P 500 index of the Vanguard Fund. The fund code is VFIA, which is almost

identical to the VO we previously introduced, except that VO is an ETF, while

VFIA is a mutual fund.

In the blink of an eye, in 2017, who won?

Shortly after the challenge of Buffett and Sades began, the US stock market

faced one of the most severe economic crises in modern history, the 2008

subprime mortgage crisis. The index fund chosen by Buffett lost 37% of its value

that year, while the hedge fund benefited from a risk-hedging loss of only

23.9%, which means that the index fund alone fell behind by more than 10% in its

first year of return. At that time, many people thought that Buffett was going

to lose this time, but what they didn't expect was that every year after that,

Buffett's index funds defeated the five fund portfolios chosen by Cedes and

finally achieved a comeback in 2015, and the gap has widened ever since.

In 2016, index funds received a return of 11.9%, while Sades' investment

portfolio returned only 0.9%. In the end, Sades surrendered his investment

portfolio ten years in advance, with an annualized return of only 2.2% and a

profit of $220,000. Buffett's index fund achieved an annualized return of 7.1%,

earning $850000.

For the success of this challenge, Buffett attributed it to two reasons.

Firstly, in the long run, even the most powerful professional investors cannot

defeat the market. Perhaps one year, an investor will be lucky enough to choose

the right investment target and make a profit as a result. But if we stretch our

horizons, it is almost impossible to complete the task. So as long-term

investors, what we should think about is not how to defeat the market but how to

grow together with the market.

The second reason is that fund managers receive management fees. Hedge fund

managers often charge fees in accordance with industry practice, which is a 2%

management fee plus a 20% profit commission. Buffett chose an index fund with a

management fee of only 0.04%. Don't underestimate the percentage difference. If

we prolong the time, the compound interest effect will create a several-fold

difference.

Do you remember the challenge we just mentioned? The annualized returns of

7.1% and 2.2% may not seem much different, but after ten years, the profit

difference has quadrupled, which is only ten years away. What if we extend the

time dimension to twenty or thirty years? This is the biggest difference between

long-term thinking and short-term thinking. Under the influence of the compound

interest effect, small differences will be amplified.

The two golden rules of long-term investment—growth with the market and low

management fees—perfectly match index funds, which may be the most suitable

financial product for most ordinary people.

What is an index fund? Simply put, it means buying all the companies in an

index at once and putting them into a portfolio. For example, in this challenge,

Buffett chose S&P from the Vanguard Fund.

500 Index Fund. The S&P 500 almost covers the world's top 500 companies,

with the largest proportion being well-known ones such as Apple, Microsoft,

Amazon, and so on. The founder of Pioneer Fund, Johann Berg, was the inventor of

index funds and launched this revolutionary investment product in 1976. His

friend Buffett once said of him, 'Berg is the person I know who creates the most

value for ordinary investors.'.

Why do you say that? Buffett mentioned more than once in Berkshire's

shareholder letter that, for most ordinary people, investing in index funds is

the simplest and most effective way to accumulate wealth. He and his wife said

that if I were gone, you would buy 10% of the US Treasury bond bonds and the

remaining 90% of the S&P 500 index funds.

What kind of charm does this index fund have that made Warren Buffett, the

stock god, give up investing in individual stocks? The answer to this question

can be found in the book of index fund inventor Berg, who has a series of works

to elaborate on his investment philosophy. Here, Charlie briefly introduces two

points to everyone.

The first reason why individual investors cannot defeat the market in the

long term, as we just mentioned, is a concept called mean regression. In his

book, Berg believes that the most important aspect of investing is not how to

read financial reports or the need to understand economics, but rather a clear

understanding of the concept of mean regression. The meaning of mean regression

is that whether the price of a stock is too high or too low, it is likely to

approach the median.

Berg listed eight investment managers who had performed well in the book, but

they all ended up returning to the mean without exception. We often hear that an

investor has been very strong in recent years, and then they start copying their

homework. However, if he has been strong in the past, he is likely to return to

the mean and perform mediocrely in the future. This iron law is no exception to

the ancient Buffett. Buffett's investment performance over the past few decades

has been too good, so he has also started to return to the mean in the past few

years. Berkshire's stock price did not actually outperform the market.

So if we know that in the long run, investment returns will return to the

mean, how should we improve our investment returns? We know that profit equals

revenue minus costs. Since revenue will average back, we need to find ways to

reduce costs. What are the costs of the fund? Firstly, there is the management

fee for the fund manager. The common group rule in the industry is that fund

managers charge a 2% management fee as compensation, and there is also a 20%

profit commission. The more they earn, the higher the share. This sounds quite

reasonable. Let's rephrase it in a different way. If you go to a restaurant and

the waiter tells you that a steak costs 20 yuan, regardless of whether the steak

is good or not, you still have to pay me so much money, even if the steak is

fried. And if it's cooked well, you'll have to pay an additional 100 yuan.

Do

you know how to order this steak? I believe many people will feel that this is a

bullying restaurant. The vast majority of transactions we encounter in our lives

involve paying a fixed fee, receiving a fixed value, and delivering the goods

with one hand. For example, when I order a steak, I expect it to be a delicious

steak, not a burnt or spoiled one. The more I pay, the higher my expectations

and requirements for this steak will be. Alternatively, in another trading mode,

for some larger transactions, we only pay commissions to intermediaries. For

example, a real estate agent can only receive commissions after the house is

sold. Although the income is not so fixed, if done well, you can receive excess

returns. And the investment manager only took advantage of the benefits of both

trading modes, including fixed management fees and profit commissions.

This is only a superficial fee, and most funds also have many hidden fees,

which are the cost of adjusting positions. Since the investment manager has

collected management fees, they need to actively manage their positions on a

regular basis, thus incurring turnover costs. Berg has a simple calculation

method for this, which is to multiply the fund's turnover rate by one percent to

obtain the fund's turnover cost. For example, a fund with a turnover rate of

100% has a turnover cost of 1%, which includes trading spreads, commission

effects on market prices, and so on. Before inventing index funds, the sum of

these costs, both explicit and implicit, adds up to a final fee of approximately

3% to 4% per year for investors.

It may not seem high, but it is actually a huge cost. Berg calculated an

account for us, assuming we save 10,000 yuan and invest it in the stock market.

With an annualized return of 8%, it will grow to 470000 yuan in fifty years. If

used as retirement pension money, this is really a good level of income. But if

we add 2.5% of the cost, guess what the 10,000 yuan we invested will become?

This number may surprise you: only 1.45 million, up to a full 3.25 million,

which is only 2.5% of the cost. If it were an average cost of 3.4%, this number

would be even worse. Einstein once said that compound interest is the eighth

wonder in the world, and its power is astonishing. However, if it is the

compound interest on expenses, the effect will also surprise you.

When we invest, we often care about which stock has risen significantly and

how much growth potential there is in the future, forgetting another variable in

the formula. To increase returns, it's not just about looking at which stocks

can rise more, but also about how to save costs.

Which task is easier: selecting stocks that have skyrocketed or saving costs?

Personally, I think it's the latter. If we choose a stock, we may choose a

tenfold stock, but most of us dare not put our eggs in one basket. We need to

diversify our risk and buy more different stocks. If we choose more times, the

probability of choosing a good stock will naturally return to the mean, similar

to the overall market. John Berg said this: Don't look for a needle in the

haystack; you should buy the entire haystack. That is to say, we should buy the

entire market instead of thinking about which stock can beat the market. Anyway,

if we can't beat the market, we should join it. Buy the market, enjoy the

compound interest effect brought by time, and avoid more impulsive trading.

The million-dollar challenge between Buffett and Sades is not only a gamble

but also a profound education. He told us that investing is not a short-term

game but a long-term marathon. Successful investment is not about who can earn

the most in a certain year or years, but about who can persist for decades,

avoid excessive trading, reduce unnecessary costs, and use the power of compound

interest to create wealth.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.