In today's stock market, it is widely recognized that tech stocks are the justly hot windfall. Just looking at the top 10 companies by market capitalization shows that the biggest companies, no matter who is up or down, are tech companies. And among these top tech companies, there is one company that is particularly strange. It's been on the market for 20 years and has lost money every year, but when you look at it all together, it's the company that has given investors the highest rate of return. Now let's take a good look at this strange US stock, Amazon's business model, and investment analysis.

What is Amazon?

Amazon is a global e-commerce and cloud computing giant founded by Jeff Bezos in Seattle, USA, in 1994. It started as an online bookstore, selling books as its main business. And now its business has covered a variety of fields, including but not limited to online retail, cloud computing services, digital streaming media, artificial intelligence, and artificial intelligence assistants.

Though Amazon is known for its comprehensive online shopping platform that sells a wide range of goods, including books, electronics, home furnishings, apparel, food, and other items, making it one of the largest online retailers in the world, its business goes far beyond that. It also has numerous investments, the most notable of which include Whole Foods, an organic supermarket, and AWS, a fast-growing cloud computing service.

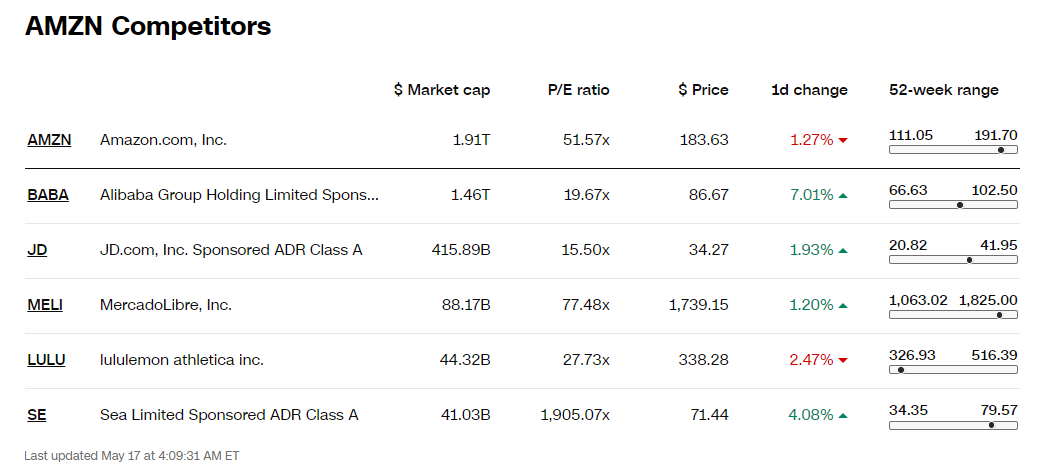

As a result, it is no longer just an e-commerce company but a tech giant with a huge cloud computing business. Its cloud computing service, AWS, has become a major component of the company's market capitalization, accounting for a significant percentage, and that percentage continues to grow. As a result, it has completely transformed itself into a cloud computing company.

As an investor, you cannot habitually think of it as an e-commerce company and ignore its huge cloud computing business (AWS). In fact, Amazon has become one of the largest cloud computing service providers in the world, and the AWS business accounts for a significant percentage of its overall valuation.

Its AWS business will continue to play an important role as the cloud computing industry continues to grow and expand. While the e-commerce business remains its main source of revenue, the growth potential and profit contribution of AWS cannot be ignored. Therefore, investors need to fully consider the impact of its cloud computing business, not just its e-commerce business, when assessing its value.

This is because its e-commerce business, though high in revenue, has in the past relied heavily on traditional online sales revenue, which is not profitable. Of course, by successfully introducing prime subscription services and advertising businesses, Amazon has also found new ways to monetize its e-commerce business.

In terms of Prime subscription services, it has achieved scale with 200 million subscribers globally and is bringing in net profit for every additional Prime subscriber. Prime revenues have grown rapidly over the past few years, at an average rate of 30%, and the recent annual fee hike has further boosted future profits.

Meanwhile, its advertising business has also shown phenomenal growth, averaging 57% over the past two years, making it one of the main sources of future profit growth. Although the margins of its advertising business have not been disclosed, it can be expected to be a significant source of profit as well, with reference to Google and Facebook's high gross and net profit margins on their advertising businesses.

However, while the company has realized growth in its Prime subscription service and advertising business, its e-commerce business still has a low operating margin of 1.5%. Even after taking into account the contribution of these two major money-making machines, the margins of the e-commerce business have not improved. This one is due to the increase in capital expenditure, and the other is due to its continued increase in debt size.

Its capex has nearly quadrupled from the data, showing a surge. And most of that capex went into the e-commerce business, not higher-margin projects like AWS. This high level of capex has led to increased depreciation costs, which has put pressure on the margins of the e-commerce business. While the e-commerce business remains Amazon's main source of revenue, its margins have suffered to some extent due to increased capital expenditure.

Also, the size of its debt has continued to increase, especially during the epidemic. Its long-term debt nearly doubled from $63 billion to $116.4 billion. And, as a percentage of debt, this ratio has also been increasing, suggesting that it shows that it is dependent on debt to support its expansion and operations.

Because it has taken advantage of the very low interest rate environment, it has benefited from a 0.35% interest rate and has invested the funds in massive expansion and business growth. And despite difficulties such as the epidemic, it has continued to hire and expand massively over the past two years, doubling its workforce and purchasing a large number of airplanes to reduce its reliance on third-party shipping while reducing average delivery times.

Amazon's unique business model and operational strategy, while delivering significant market share and influence, have also led to a long history of losses for the company. Despite its phenomenal growth over the past two decades or so, the company has been losing money for a long time due to high operating costs and constant investment spending.

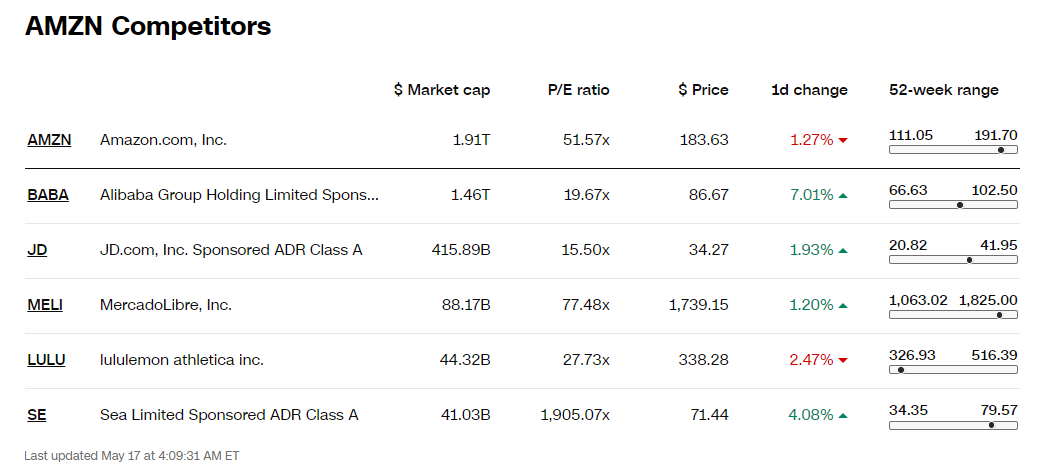

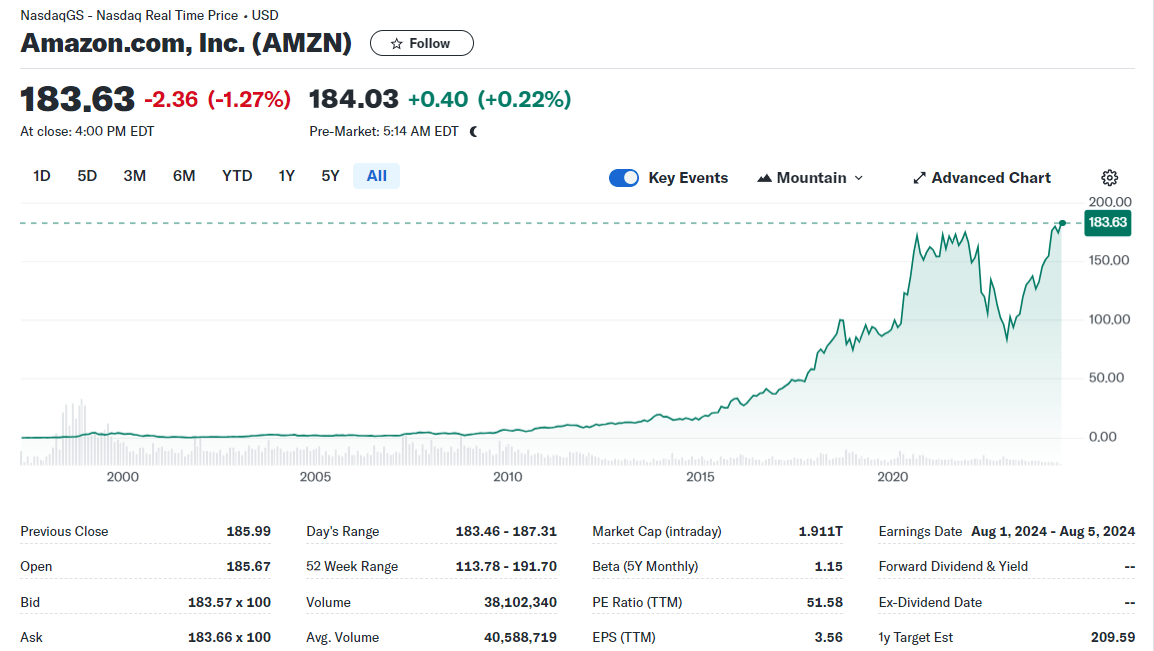

It wasn't until after 2015 that it started making larger profits. In 2018. it became one of the companies with the highest market capitalization. And according to its latest earnings report, its total revenue for the first quarter of 2024 amounted to $143.31 billion, with particularly strong performances in cloud computing and advertising. But facing pressure from competitors, Amazon needs to show investors how to stay competitive.

What Power Amazon's Success

In terms of performance earnings, Amazon was in the red until 2014. This is because the company's core strategy is not primarily focused on profitability but rather on maximizing cash flow. This means that while it has been poorly profitable, this is not by accident or inability; it is intentional.

The first reason is that it has a longer payment cycle compared to other retail industry giants, waiting an average of 28 days before paying its suppliers for their goods. This operation allows it to have more cash available for capital operations, which boosts the company's growth.

The second reason is that Amazon tends to invest the money it earns into new research and development projects to continue its growth. The company is used to investing its profits into new projects at the first opportunity, such as the cloud computing service AWS, which tends to require a large capital investment but also brings long-term benefits to the company.

The company's management is adept at utilizing the cash on hand to invest in new technologies and use the profits wisely for growth and expansion. This strategy has enabled the company to make sustained R&D investments in e-commerce and cloud computing. With the profitability of its cloud computing business, the company started to become profitable, and the size of its earnings continued to grow. Overall, the company's turnover has grown steadily each year, despite the fact that it incurred a loss in 2017 due to the failure of some of its investment projects.

This core strategy has been established thanks to the company's founder, Bezos, who has a deep understanding of capital and a vision far beyond that of other tech company founders. Bezos understands that in order to ensure Amazon's success, it must continue to generate long-term excess returns for its shareholders. Therefore, three years after its founding, the company clearly defined its direction to maximize cash flow as its ultimate goal, aggressively set financial targets, and implemented effective capital management strategies.

By implementing the strategy of maximizing cash flow as the ultimate goal, the company gained a long-term competitive advantage in the industry, and its stock price was recognized by Wall Street analysts and continued to climb. This initiative not only met investor expectations but also quickly converted cash flow into R&D funding, which fueled the company's rapid growth. The steady growth of its stock price over the years has been closely linked to Bezos' vision and execution of his strategy for the company.

And understanding this characteristic of Amazon can be of great benefit to the average investor. Not only can it help investors assess the company's value more comprehensively, but it can also help them avoid making bad investment decisions because of the wrong metrics. After all, the average investor is particularly jubilant about data related to net income, such as price-to-earnings ratios and earnings per share.

But for this company, traditional P/E metrics may not accurately reflect the company's value because they may deliberately depress net profits or use them for other purposes. Therefore, understanding more appropriate metrics, such as cash flow per share, can help investors more accurately assess a company's performance and potential value.

Overall, it is important to understand these lesser-known characteristics of Amazon in order to develop a more informed investment strategy. This is because, unlike other tech companies, its core strategy is aimed at maximizing cash flow rather than just pursuing profits. Understanding these characteristics will help investors more fully assess the company's value and future potential, so that they can develop a smarter investment strategy and better capitalize on investment opportunities.

Amazon Stock Investment Analysis

Amazon Stock Investment Analysis

As a tech giant with a huge presence in e-commerce, cloud computing, and other areas, the company's stock is an investment target for many. And after understanding the company's operational characteristics, it is clear that an investment strategy should focus on long-term growth and cash flow prioritization.

This is because, unlike tech companies like Apple and Microsoft, investing in the company's stock should be based on the continued growth and development of its profitability. This is because the company aims to maximize its cash flow by investing its profits in research and development and expansion in areas such as e-commerce and cloud computing, as well as managing its capital flexibly to respond to market changes.

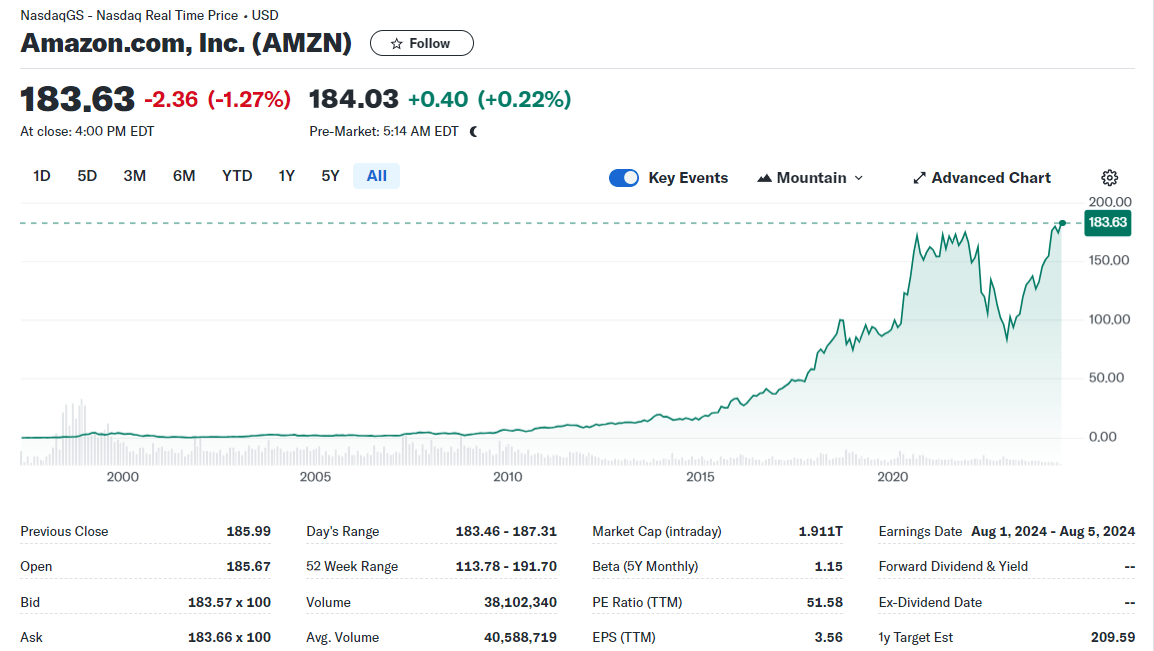

And as can be seen from its stock price trend, it has shown a steady upward trend over time, which partly reflects investors' confidence in its business model and long-term growth potential. As such, the focus on investment areas and emphasis on future potential mining has enabled SUN to sustain its competitive advantage and is something investors should keep an eye on over the long term.

Historical data on the share price shows that there are different stages of its profitability before and after 2017. Before 2017. its profitability was generally low, while after 2018. profitability improved. And compared to 2021. in 2022 it experienced a significant decline in profitability and growth, and therefore a significant drop in share price as a result.

By 2023. profitability will have largely recovered, but growth will still not be at normal levels. In normal times, Amazon's revenue growth rate usually stays around 20%, whereas in 2023. that figure is only 11%. However, some key metrics of profitability, such as net margins, ROA, and ROE, have returned to pre-2017 levels in 2023.

Profitability that is beginning to recover provides a good base for investment. And the recovery of its growth and the potential of its AWS cloud business are the main drivers of future share price gains. It's important to note, of course, that the three main business areas have had different growth rates over the past few years.

In North American business, for example, growth rates are expected to likely remain low or even decline slightly due to lower growth expectations in the US. For international business, on the other hand, it is expected that the growth rate may increase due to higher economic growth expectations in countries such as Europe. As for the AWS cloud business, although the current growth rate is lower than before, its base is smaller and it is in the dividend period of the AI era, so its growth is still considerable.

Therefore, the international business and AWS cloud business have more room for growth and will play a key role in driving the company's overall growth. In particular, the AWS cloud business is expected to be the main engine of growth going forward, bringing long-term sustainable earnings growth to the company due to its low base and AI-era dividend.

Amazon's stock price has risen more than 1.100% over the past 10 years, a notable performance, especially when compared to other tech giants such as Alibaba, which has fallen 28% over the same period. While some in-house executives and large investment organizations have reduced their holdings over the past year, it's also possible that they're doing so to cash out, and not necessarily because they've lost confidence in the company's long-term prospects. In fact, investment institutions have increased their holdings in the company's stock over the past year, suggesting that they are optimistic about its future growth.

And depending on how its profitability recovers, investors may consider keeping their position between 10% and 20%, and if profitability improves further, they can increase their position to more than 20% as appropriate. And when buying, it is advisable to choose to enter on pullbacks rather than buying at all-time highs, which can help minimize risk and yield better investment returns.

It is important to note that it is advisable to hold Amazon stock for longer than a year, as it takes time for such a large company to show its full growth potential. Short-term investors may consider looking for more volatile small-cap stocks to trade rather than opting for relatively less volatile large-cap stocks like it, as returns may be more limited in the short term.

These are the investment preferences analyzed from the fundamentals, and based on the analysis of the company's weekly K-chart, the current share price is at an all-time high and at a key pressure level, so it is not appropriate to enter directly here. Considering that the broader market has recently begun to pull back, its share price may also retrace, and an appropriate entry point would be on a pullback to around $168. If the stock continues to fall, the lower support level would be around $145. but this would need to be further analyzed on a case-by-case basis.

Amazon's Business Model and Investment Analysis

| Characteristics |

Advantages |

| Business model focuses on cash flow |

Leading global e-commerce platform with extensive user base |

| Focus on long-term growth, cash flow. |

Strong cloud computing business (AWS) |

| Adapt capital flexibly to market changes. |

Continuous expansion and innovation, huge brand influence |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Amazon Stock Investment Analysis

Amazon Stock Investment Analysis