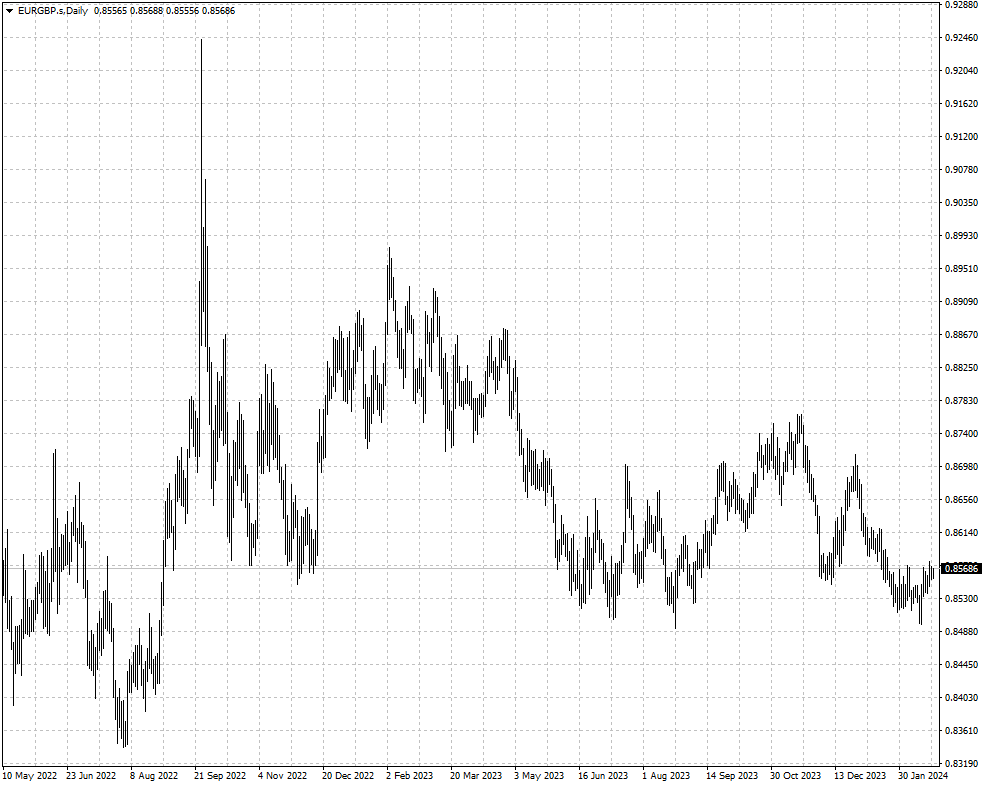

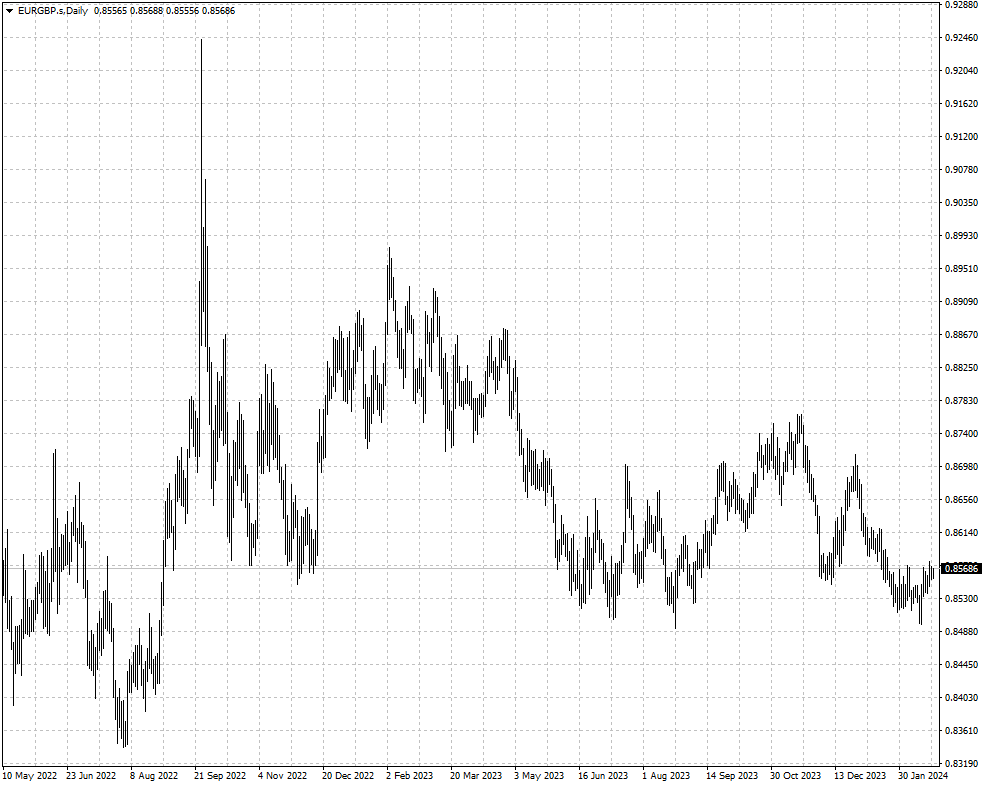

Sterling headed for its longest stretch of losses against the single currency

this year after the BOE governor said inflation did not need to return to target

to justify rate cuts.

But Andrew Bailey stressed there had been “encouraging signs” on the key

indicators in the jobs market and services prices. At a meeting earlier this

month, the central bank dropped its hawkish guidance.

Futures markets show traders expect around three rate cuts from the BOE this

year, compared with at least four from the ECB. Policymakers across the Channel

are yet to be convinced by waning inflation risks.

speculators lifted their bullish sterling position to a level just shy of

last July's nine-year high in the week to 13 Feb, according to CFTC. Leveraged

funds now hold their largest bet on a rising pound since October.

Three-month risk reversals in EURGBP edged down to their lowest level since

March 2022, a sign of traders’ willingness to pay a bigger premium for options

with lower strikes.

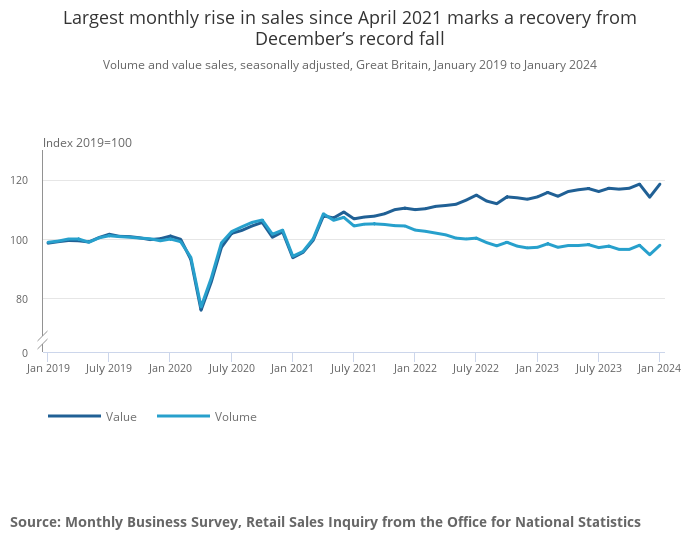

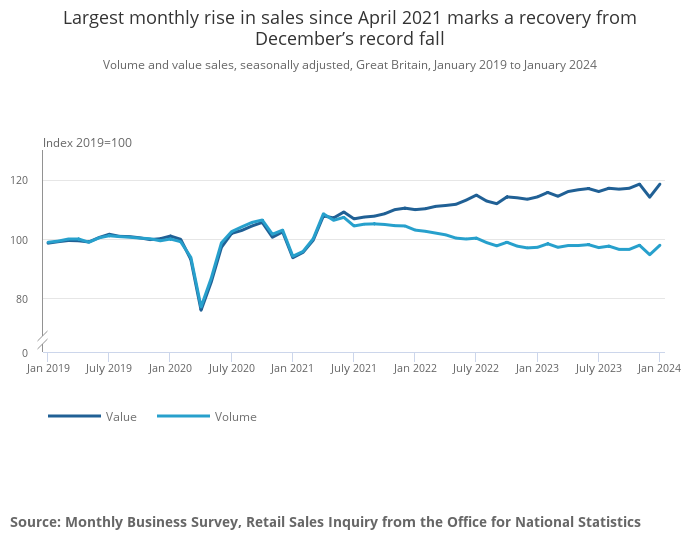

For the past few months, the allure of higher yields turned out to be

irresistible, pushing the pound higher. Economywise, retail sales saw the

biggest monthly increase since Apr 2021 in January following a slump in the

previous month.

Overtightening risk

The central bank risks deepening recession if it does not pivot to

interest-rate cuts soon, its former chief economist Andy Haldane warned. He was

one of its most hawkish voices in the MPC.

“For me the case for putting in place some upfront, early insurance on the

monetary policy side is strong and strengthening, and I’m fearful we leave that

insurance a little too late in the year,” he said.

The rate-setter Swati Dhingra said inflation is already on a “firm downward

path” and services prices are not a good measure of domestically generated

inflation. She voted for a rate cut in the latest policy meeting.

“The evidence to err on the side of overtightening is not compelling in my

view as it often comes with hard landings and scarring of supply capacity that

would weigh further on living standards.”

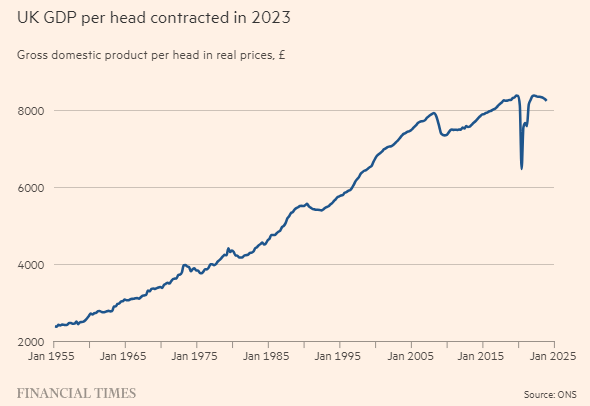

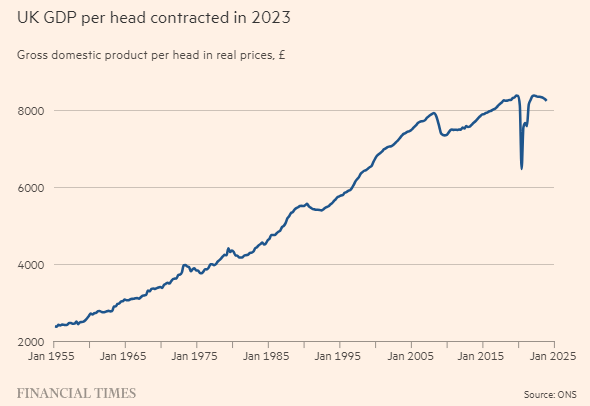

The UK economy grew only 0.1% in 2023, weaker than the 2.5% in the US and

0.5% in the eurozone. The BOE earlier this month upgraded its forecast for 2024

growth from zero to 0.25%.

PM Sunak has not delivered particularly if population is taken into account.

Output per head contracted 0.7% in 2023, falling in every quarter last year and

failing to grow since the start of 2022.

The ECB may have erred on the side of overtightening too - a boon for the

pound. The European Commission downgraded its forecasts for EU and eurozone

growth for 2024 to 0.8% last week.

Crowded bets

BofA has turned bullish on sterling and last week boosted its year-end target

for the pound to $1.37. That is contrary to its view less than two years ago of

an “existential” sterling crisis.

The bank predicts it will be among the best-performing major currencies in

2024 and EURGBP will weaken to 0.84 this year. So far the pound has gained

against all of its G10 peers except the dollar.

“The UK has become a low benchmark of sorts for everyone else in G10 with all

the problems the economy had to deal with in 2023,” said Valentin Marinov, a

currency strategy at Credit Agricole, “Despite that, the data hasn’t been all

terrible.”

Marinov sees the pound strengthening to 0.83 versus the euro, while MUFG Bank

recommended selling the euro to buy the pound late last month with a call for

0.8275.

The IMF declared the kingdom would be the slowest-growing economy among the

G7 nations months ago, but Germany’s fragility throws into question if the

eurozone economy can ride out energy quandary and China slowdown.

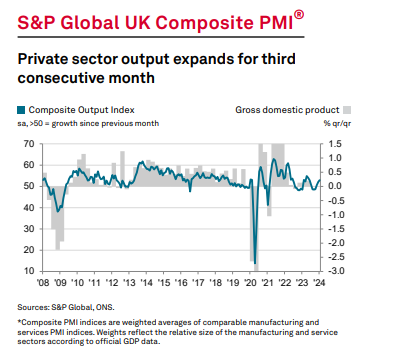

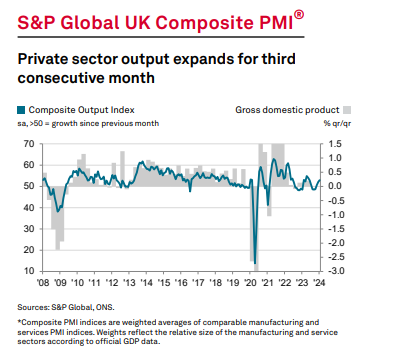

The preliminary February S&P Global/CIPS UK PMI rose to 53.3, the highest

in nine months, driven by a robust service sector, which beat comparable figures

for the eurozone and the US.

Chris Williamson, S&P Global Market Intelligence's Chief Business

Economist, said the survey pointed to the economy growing by 0.2% or 0.3% in Q1.

But he warned inflation may get stuck at the current 4%.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.