Oil prices eked out a modest gain in the first week of 2024 as US-led

coalition strikes did not deter the Houthis from sporadic attacks in the Red Sea

in protest of Israel’s operation.

On Thursday Iran seized a tanker with Iraqi crude destined for Turkey in

retaliation for the confiscation last year of its oil by the US, complicating

the already intense situation.

Elsewhere Hassan Nasrallah, leader of Lebanese militant group Hizbollah,

vowed revenge against Israel over the killing of a Hamas’s deputy political

leader in an explosion in Beirut.

Cargo prices have surged in the wake of the disruptions. “It’s unclear to us

if we are talking about re-establishing safe passage into the Red Sea in a

matter of days, weeks or months,” said Maersk CEO Vincent Clerc.

Analysts say rising tensions in the region have not led to a problem in crude

supplies so far. Saudi slashed the price of Arab Light Crude for Asian customers

by $2 barrel earlier this week, reigniting oversupply jitters.

Excess supply

A steady growth in oil supplies from countries outside OPEC+ will likely keep

a lid on the price of crude despite simmering conflict in the Middle East.

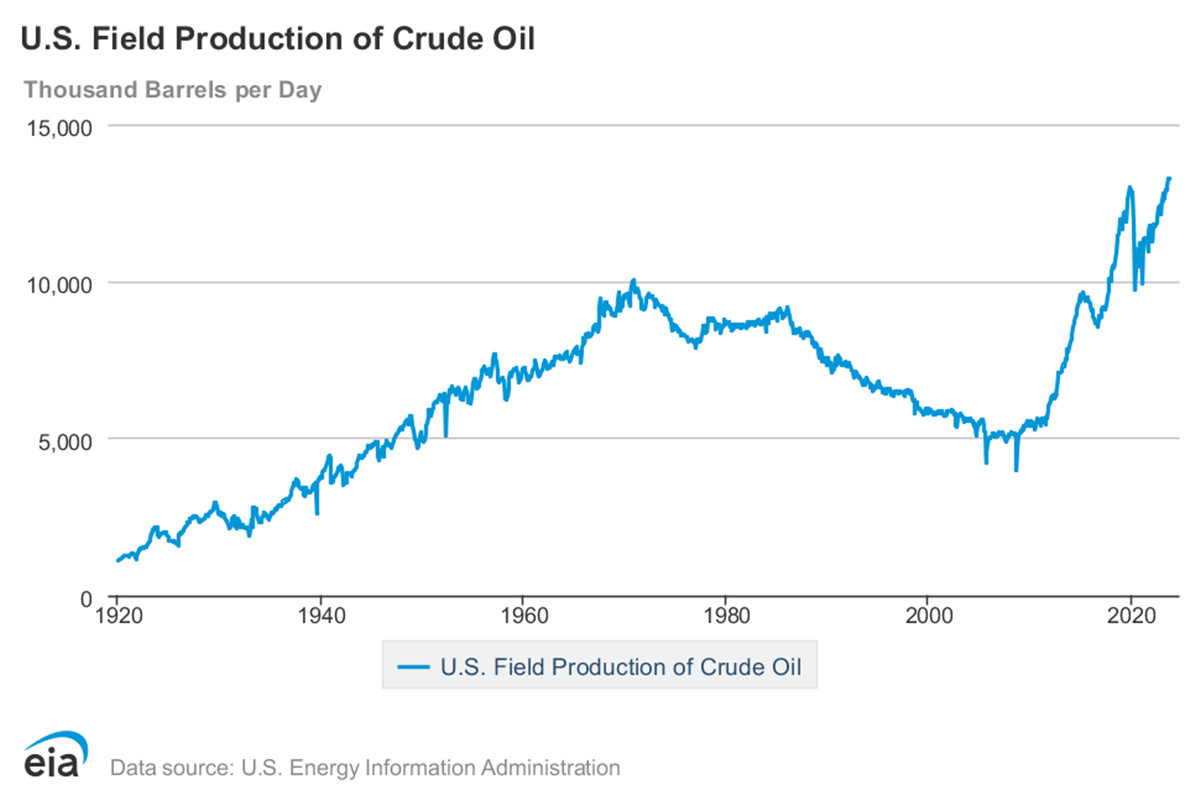

US Crude Oil and natural gas output is set to notch fresh records over the

next two years, the government has forecast. Production surged last year, taking

many industry players and analysts by surprise.

Yet the pace of oil production growth is set to slow in the coming years, as

efficiency gains offset a decline in rig activity. Biden might also place new

restrictions on drilling after inflation is in the rear-view mirror.

If US production continues to increase on a very strong note in 2024 on par

with 2023 then it will be much tougher for OPEC+ to support prices, said Bjarne

Schieldrop, chief commodities analyst at SEB.

Angola's exit will take the group’s production to below 27 million bpd which

is less than 27% of the total global supply. The market share was around 50%

back in the 1970s.

Even OPEC+ that includes some other major oil producers like Russia barely

controls half of global oil production. Its sway over the market could fall

further going forward.

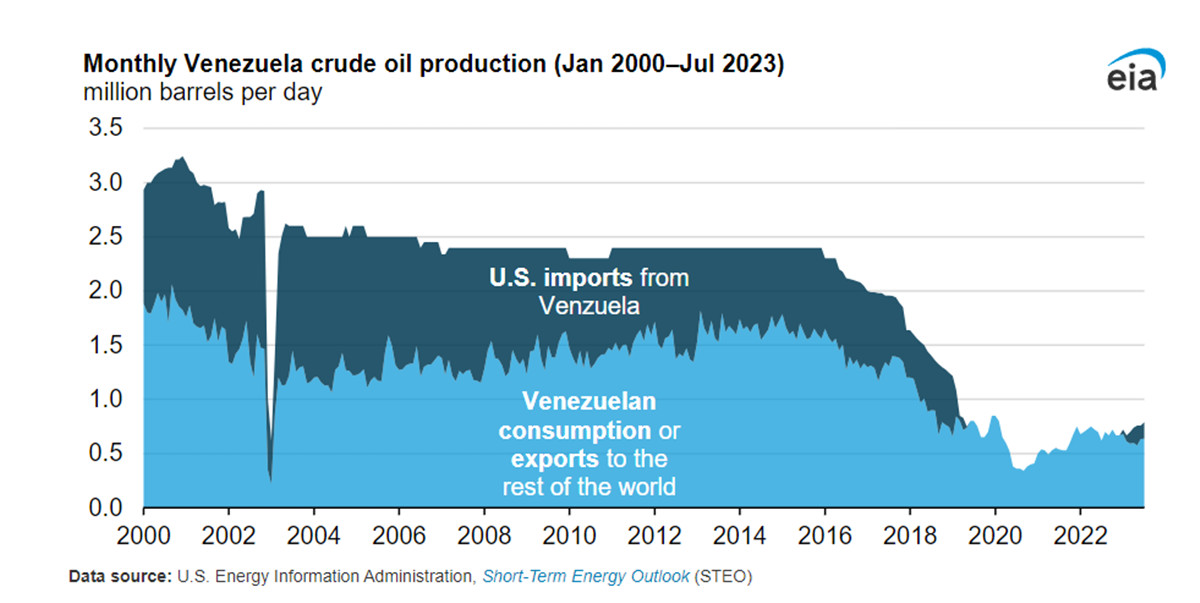

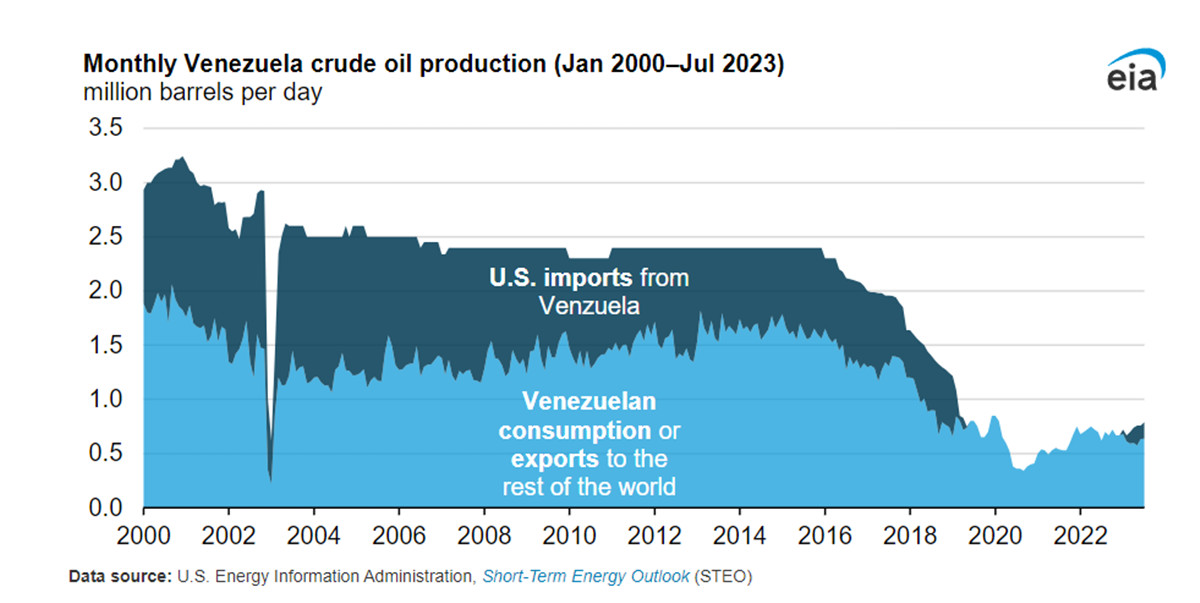

Another big unknown factor is the extent to which Venezuela will raise its

output after the US eased sanctions imposed on the country’s energy sector.

Analysts believe that its production cannot be ramped up in the short term due

to long-term underinvestment.

Subdued demand

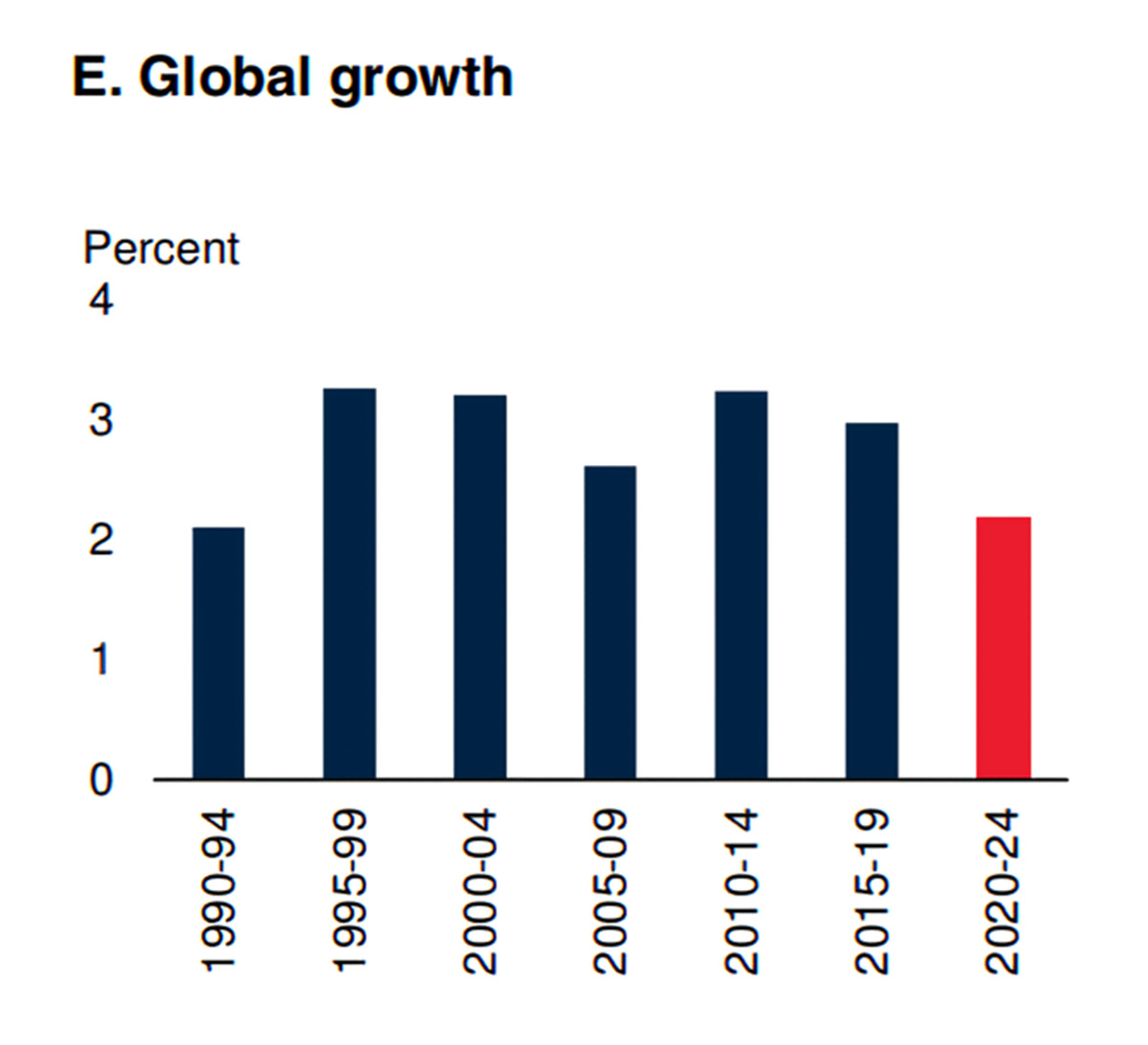

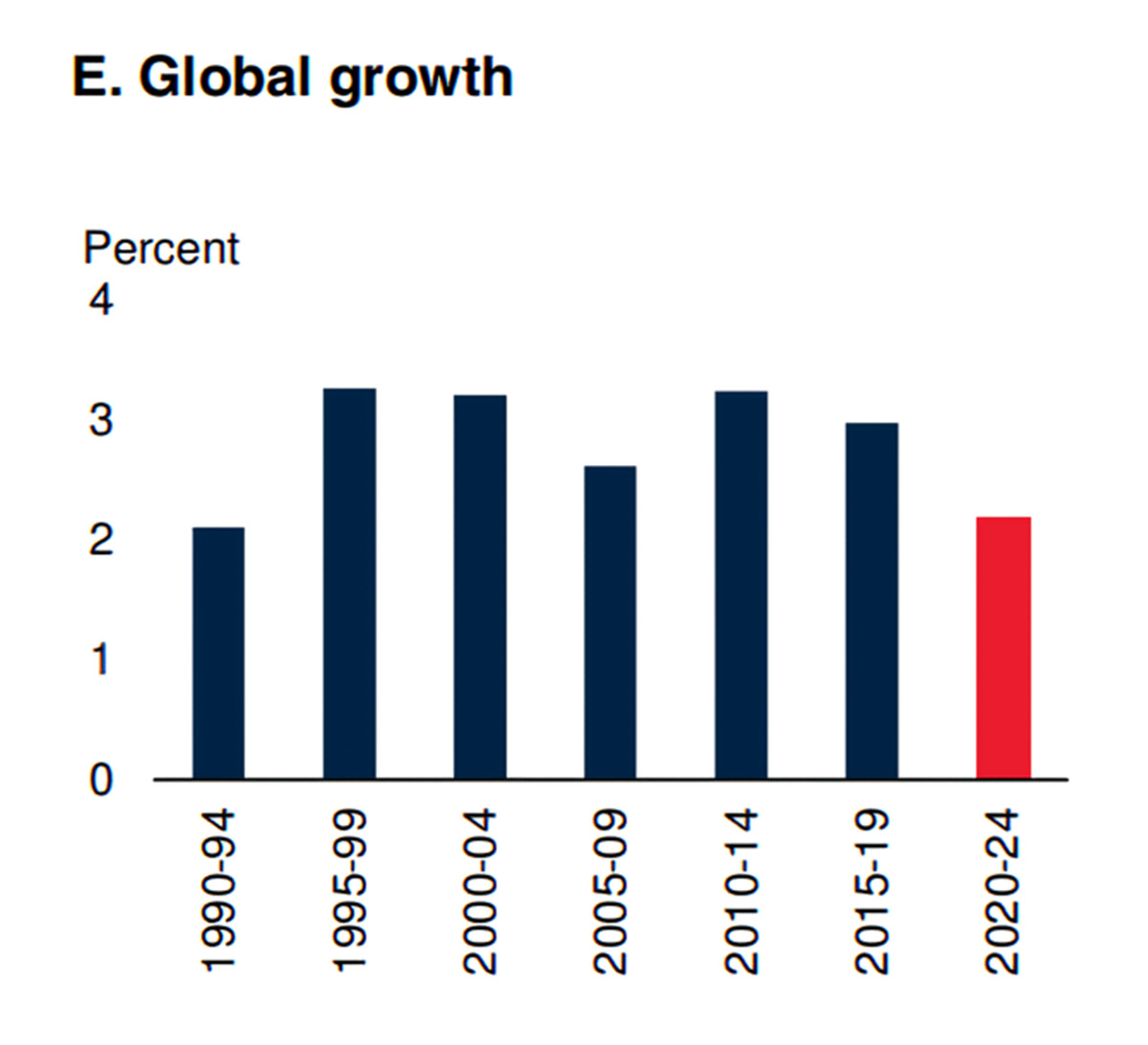

An uncertain economic outlook adds to downside pressure. The global economy

is on course to record its worst half decade of growth in 30 years, according to

the World Bank.

Global growth is forecast to slow for the third year in a row in 2024 in

which most economies are set to grow more slowly than they did in the previous

decade, the organisation said in a report.

Source: World Bank

On a regional basis, North America, Europe and Asia-Pacific will be the

hardest hit mainly due to China’s slowdown. Europe has been teetering on the

brink of a winter recession.

China's crude oil imports in Nov fell 9.2% year-on-year, its first annual

decline since April as high inventory levels, faltering factory activity and

sowing orders from independent refiners weakened demand.

Still imports by the world’s largest oil buyer increased 1.21% from the same

period a year earlier. China may have accounted for 80% of last year’s global

rise, according to the IEA.

The EIA said last month that evidence of softening demand is mounting and

consumption growth could halve to 1.1 million bpd in 2024, in stark contrast to

OPEC’s forecast for an increase of 2.25 million bpd.

The EIA on Tuesday lowered its 2024 crude price forecasts to $77.99 for WTI

and $82.49 for Brent, and the agency expects prices to fall further in 2025 as

production outpaces demand.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.