EBC Forex Snapshot

12 Jan 2024

The dollar held steady on Friday, as investors weighed an ambiguous inflation

reading against market bets that the Fed will cut rates soon. Still, traders are

pricing in a 73.2% chance of rate cuts in March.

On a 12-month basis, the CPI closed 2023 up 3.4%. Economists surveyed by Dow

Jones had forecast a rise of 3.2%. The year-over-year core reading was the

lowest since May 2021.

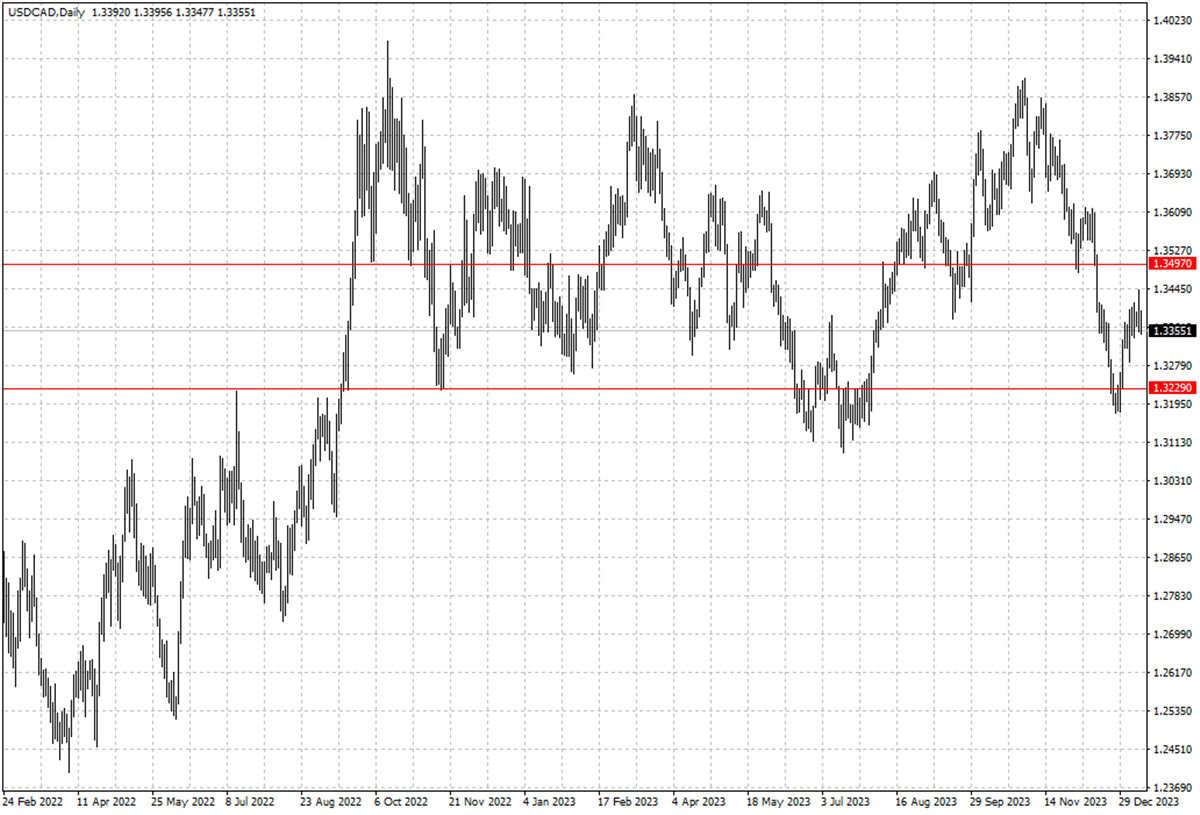

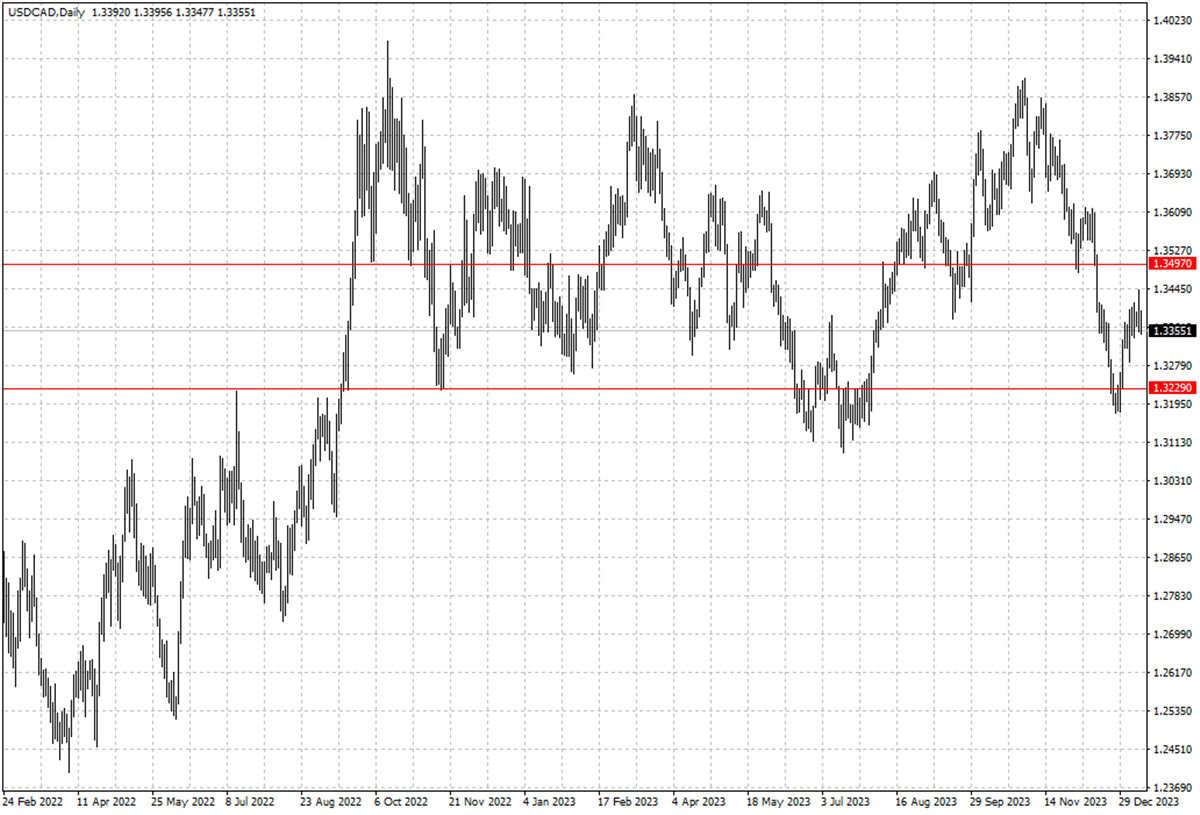

The canadian dollar strengthened after touching its four-week low on

Thursday. The price of oil, one of Canada's major exports got a boost after Iran

seized an oil tanker off the coast of Oman.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 2 Jan) |

HSBC (as of 12 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0833 |

1.1150 |

1.0850 |

1.1114 |

| GBP/USD |

1.2527 |

1.2848 |

1.2636 |

1.2856 |

| USD/CHF |

0.8333 |

0.8667 |

0.8373 |

0.8622 |

| AUD/USD |

0.6691 |

0.6900 |

0.6594 |

0.6826 |

| USD/CAD |

1.3114 |

1.3387 |

1.3229 |

1.3497 |

| USD/JPY |

139.48 |

144.94 |

141.54 |

147.71 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.