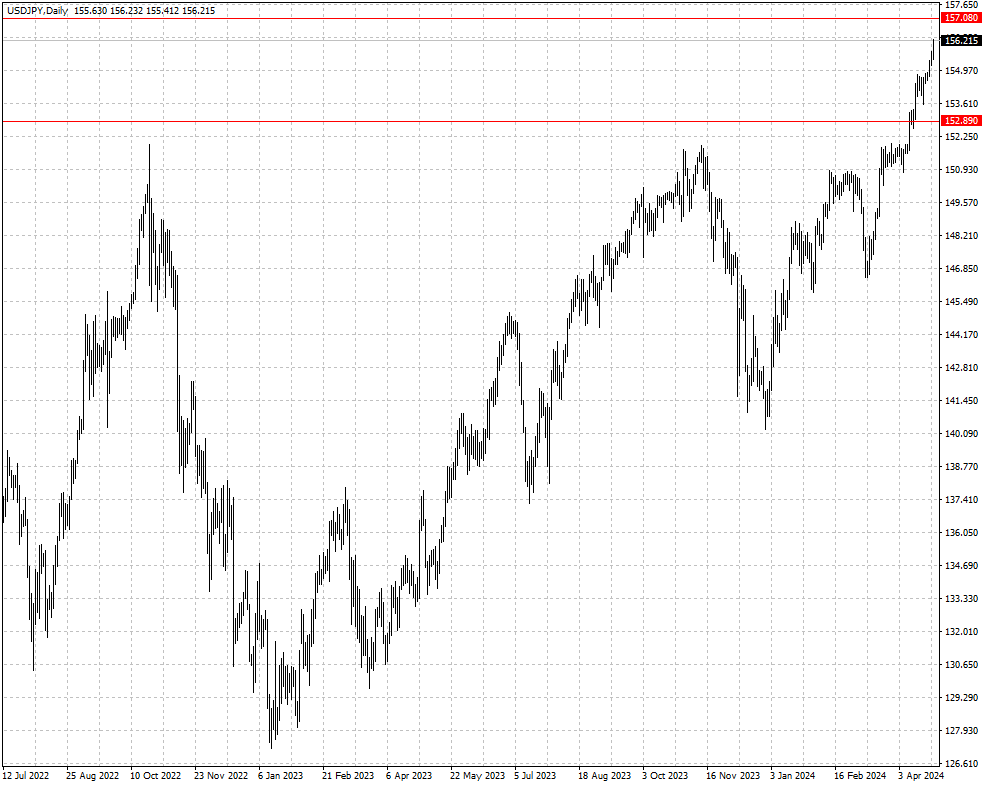

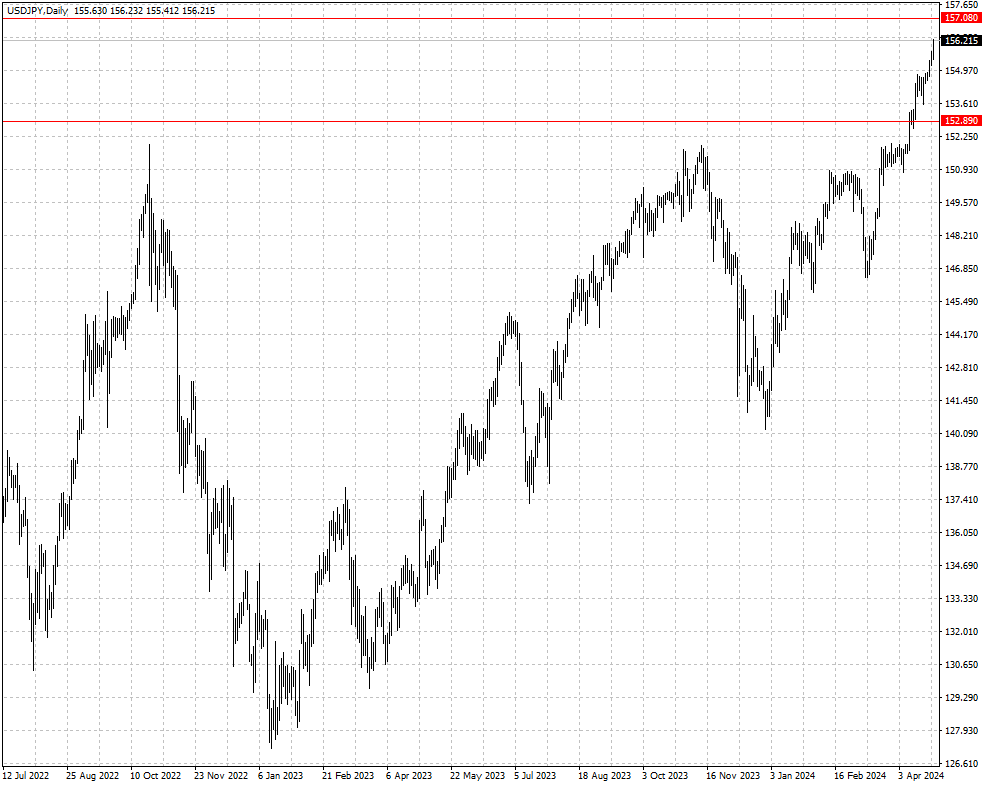

The yen hit its weakest level in three decades

2024-04-26

Summary:

Summary:

The yen hit a 30-year low against the dollar after the BOJ kept rates steady. The dollar stayed stable despite weak US growth last quarter.

EBC Forex Snapshot, 26 Apr 2024

The yen hit its weakest level in three decades against the dollar after the

BOJ held interest rates steady on Friday. The dollar steadied though US economic

growth disappointed in the last quarter.

The central bank did not provide a clear guidance on the future rate hike

path. In its quarterly outlook report, core consumer inflation is expected to

hit 2.8% in the year that began in April.

Finance Minister Shunichi Suzuki again threatened to intervene in the market.

Still, traders figure there is not much Tokyo can do to reverse the yen's slide

as interest rates will unlikely rise soon.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 22 Apr) |

HSBC (as of 26 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0600 |

1.0885 |

1.0590 |

1.0876 |

| GBP/USD |

1.2337 |

1.2709 |

1.2303 |

1.2716 |

| USD/CHF |

0.8999 |

0.9152 |

0.9032 |

0.9182 |

| AUD/USD |

0.6339 |

0.6668 |

0.6357 |

0.6641 |

| USD/CAD |

1.3478 |

1.3862 |

1.3518 |

1.3819 |

| USD/JPY |

150.88 |

155.00 |

152.89 |

157.08 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.