The US dollar was slightly lower on Thursday

2024-04-25

Summary:

Summary:

The US dollar dipped on Thursday as European currencies strengthened. US business activity slowed in April, signaling a global economic shift.

EBC Forex Snapshot, 25 Apr 2024

The US dollar was slightly lower on Thursday on strengthening European

currencies. US business activity cooled in April to a four-month low due to

weaker demand, signalling a global economic confluence.

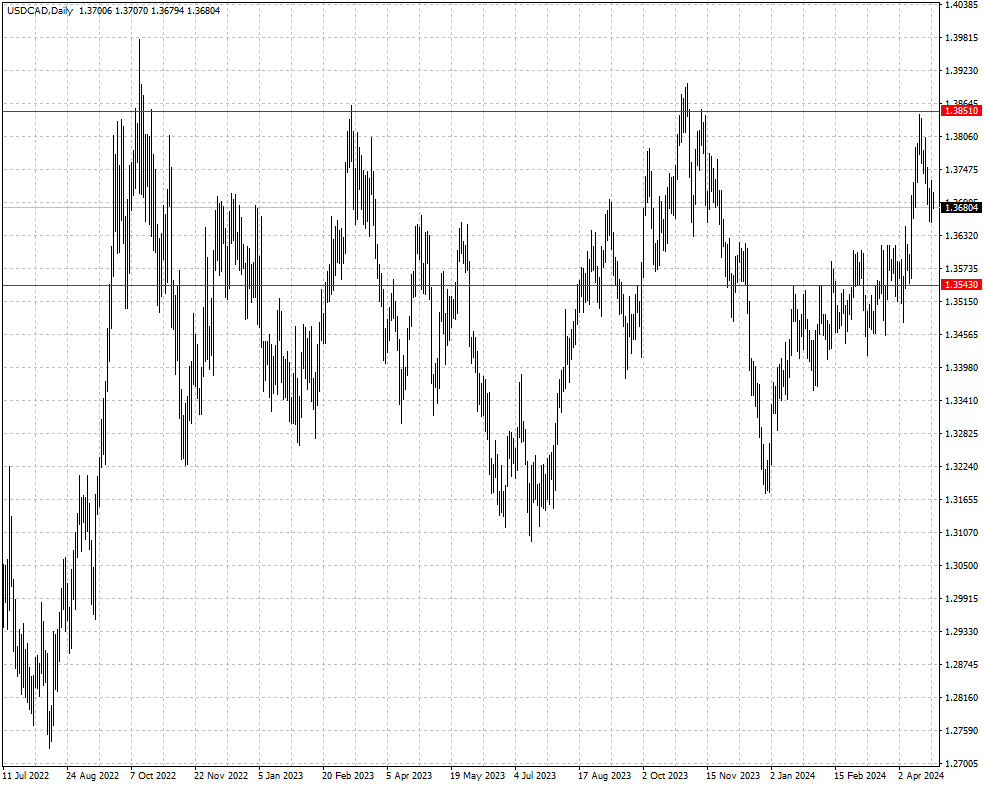

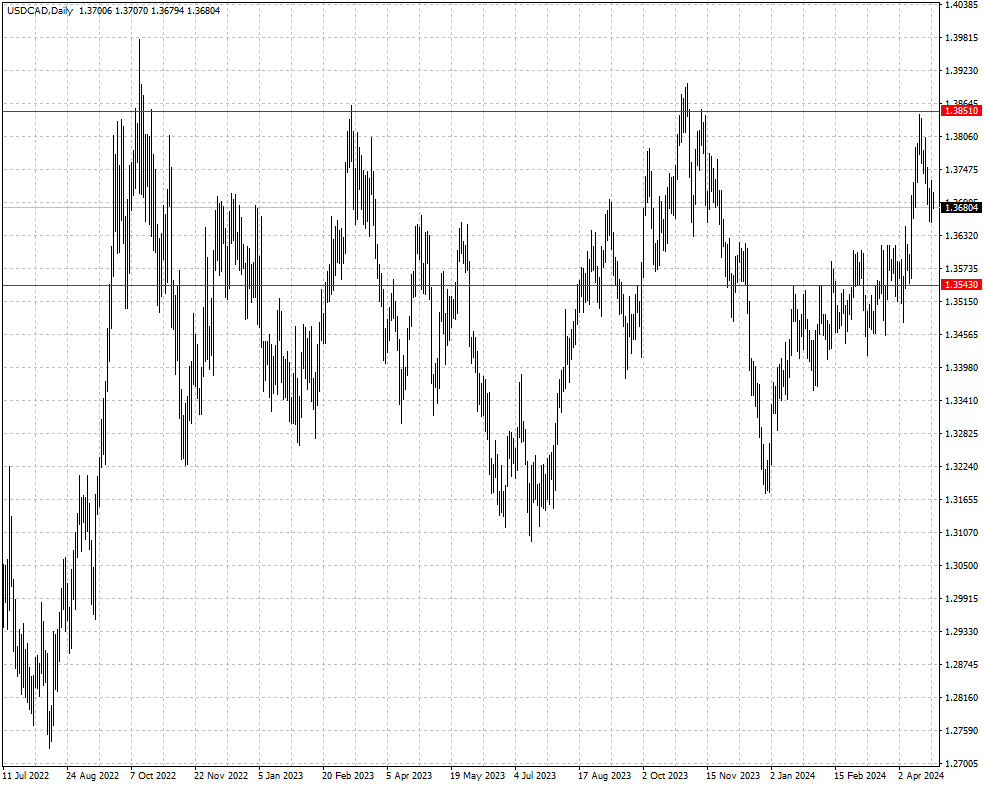

The Canadian dollar rose along with oil prices. Standard Chartered estimates

that global oil demand will pick strongly in May and June and the OPEC+ is

unlikely to increase output in the near term.

Retail sales decreased 0.1% in February, led by a drop in sales at gasoline

stations and fuel vendors. Money markets are betting that the BOC will begin

easing ahead of the Fed.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 22 Apr) |

HSBC (as of 25 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0600 |

1.0885 |

1.0569 |

1.0855 |

| GBP/USD |

1.2337 |

1.2709 |

1.2268 |

1.2681 |

| USD/CHF |

0.8999 |

0.9152 |

0.9046 |

0.9203 |

| AUD/USD |

0.6339 |

0.6668 |

0.6357 |

0.6641 |

| USD/CAD |

1.3478 |

1.3862 |

1.3543 |

1.3851 |

| USD/JPY |

150.88 |

155.00 |

152.29 |

156.90 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.