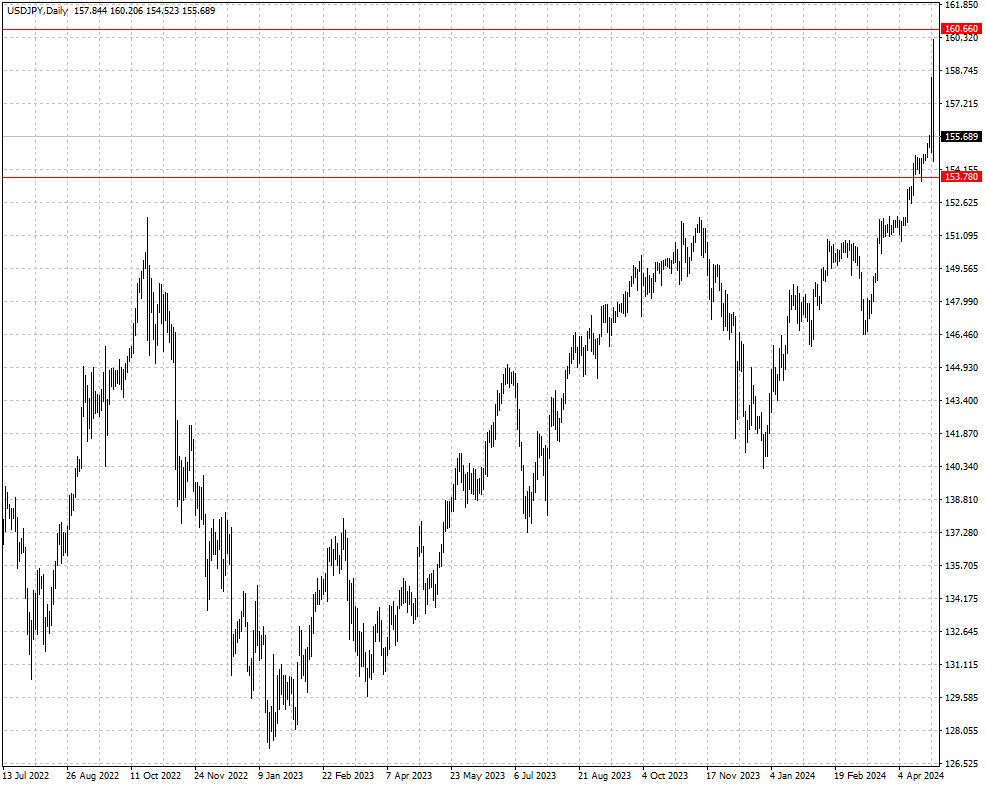

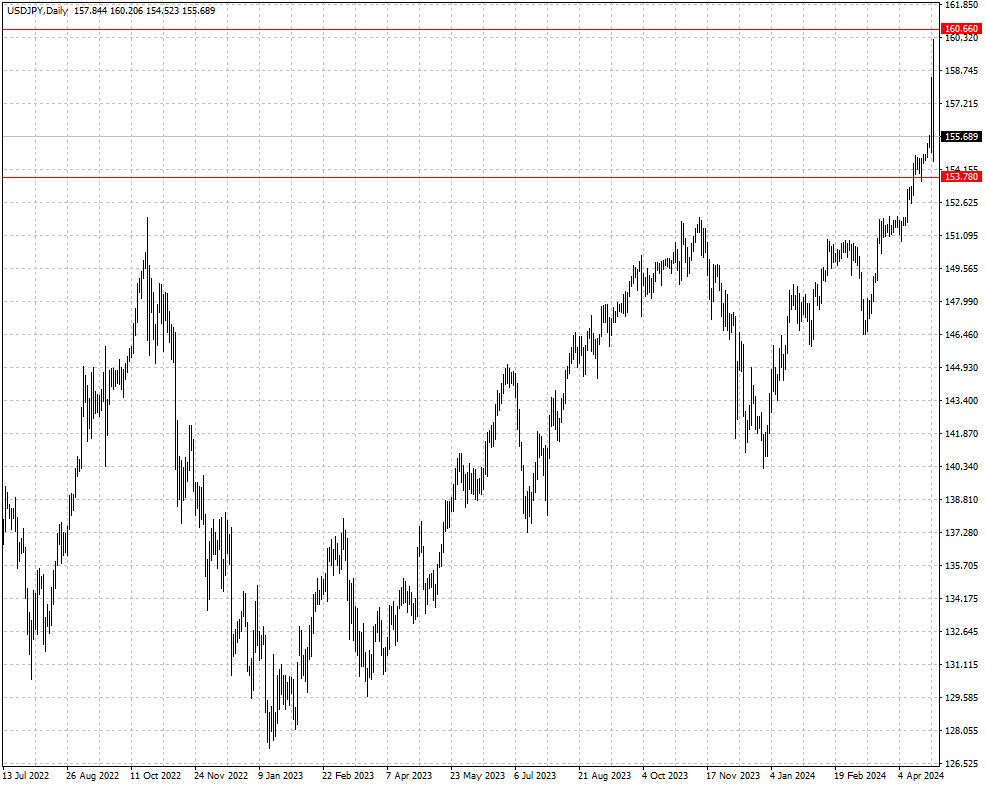

USD/JPY Jumps Unexpectedly on Monday

2024-04-29

Summary:

Summary:

USD/JPY Surged on Monday, Possibly Due to Japanese Intervention. Top Diplomat Masato Kanda Didn't Confirm or Deny Involvement.

EBC Forex Snapshot, 29 Apr 2024

On Monday, the USD/JPY saw a sudden surge, possibly indicating Japanese authorities' intervention. Masato Kanda, a key currency diplomat, remained tight-lipped about potential involvement.

While a weaker USD/JPY benefits Japanese exporters, it also drives up import costs, contributes to inflation, and strains household budgets. In real terms, the currency is currently at its weakest point since at least the 1970s.

Japan's central bank made a historic shift out of negative interest rates in

March. The move was so well advertised, leaving speculative traders comfortable

to add to short yen positions.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 22 Apr) |

HSBC (as of 29 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0600 |

1.0885 |

1.0566 |

1.0852 |

| GBP/USD |

1.2337 |

1.2709 |

1.2287 |

1.2700 |

| USD/CHF |

0.8999 |

0.9152 |

0.9049 |

0.9195 |

| AUD/USD |

0.6339 |

0.6668 |

0.6381 |

0.6665 |

| USD/CAD |

1.3478 |

1.3862 |

1.3527 |

1.3828 |

| USD/JPY |

150.88 |

155.00 |

153.78 |

160.66 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.