australian dollar Near Six-Month Highs Ahead of China Data

The Australian dollar held near six-month peaks on Friday, with two Fed rate cuts already priced in. However, upcoming economic data from China may challenge the currency's strength.

GDP likely grew at a slower rate of 5.1% in Q2 due to sluggish consumer demand. A Reuters poll expects growth to slow further to 4.8% and 4.7% in the next two quarters.

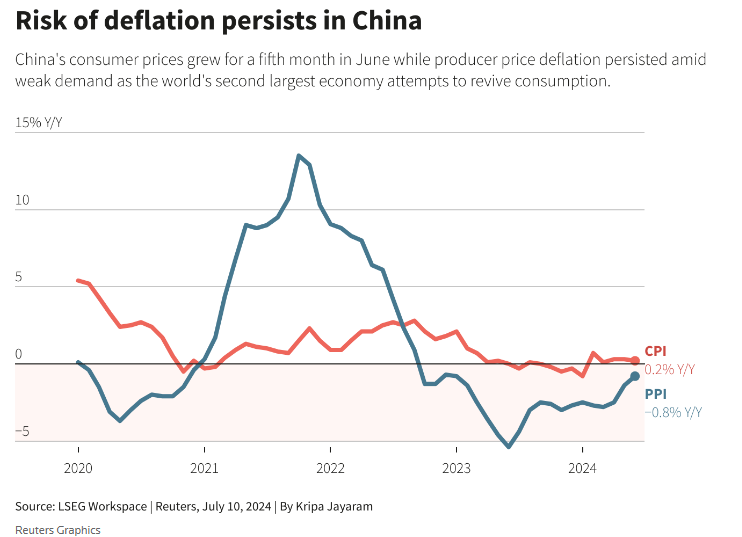

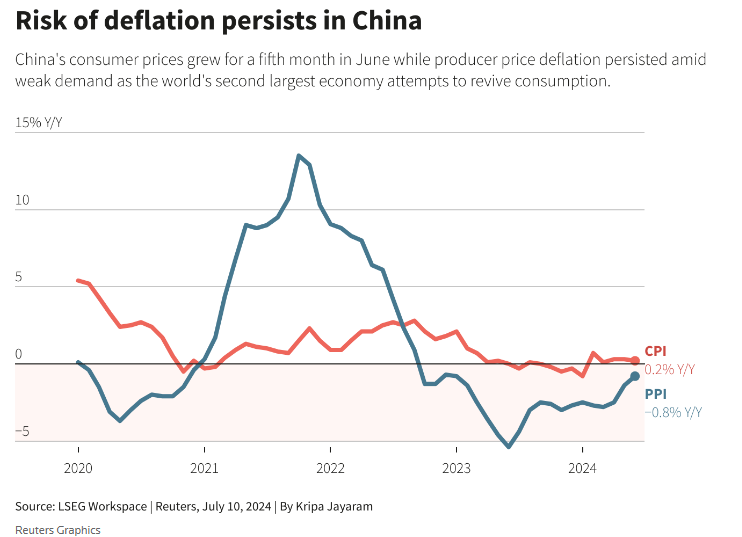

Consumer inflation in June fell short of expectations, indicating persistent deflationary risks. Analysts estimate a 0.6% rise in consumer prices this year, well below the official forecast.

Investors Eye Key Policy Meeting Amid Economic Challenges

Investors are closely watching next week's key party leaders' gathering for hints on policies to address economic challenges beyond industrial upgrades. However, the chances of significant changes seem slim.

Last month, the PBOC pledged to maintain a supportive monetary policy stance and stated it would flexibly use policy tools, including interest rates, to support economic development.

Despite this pledge, the central bank may be cautious about further rate cuts. Aggressive easing could trigger more capital outflows from the world's second-largest economy, putting pressure on the yuan.

Australia's foreign trade balance fell more than expected on a monthly basis. Commodity exports, particularly iron ore, remained weak, contributing to the decline.

Ire Ore Woes: Prices Likely to Remain High in 2024

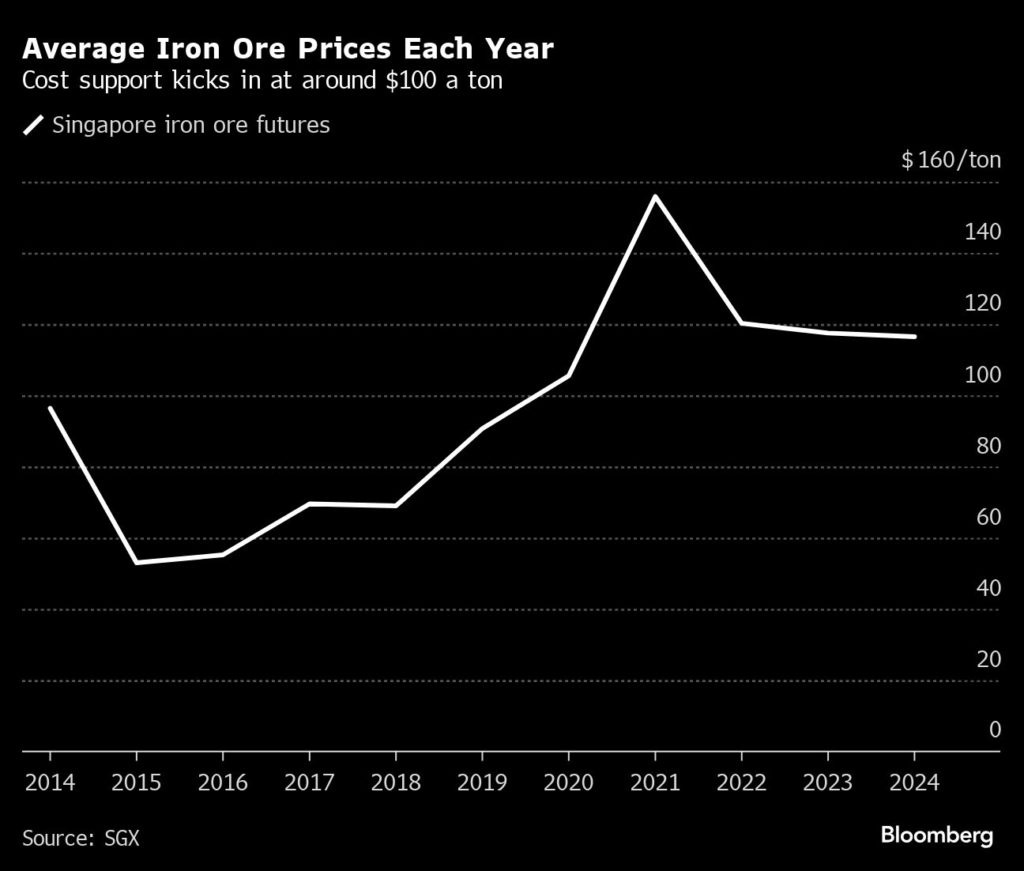

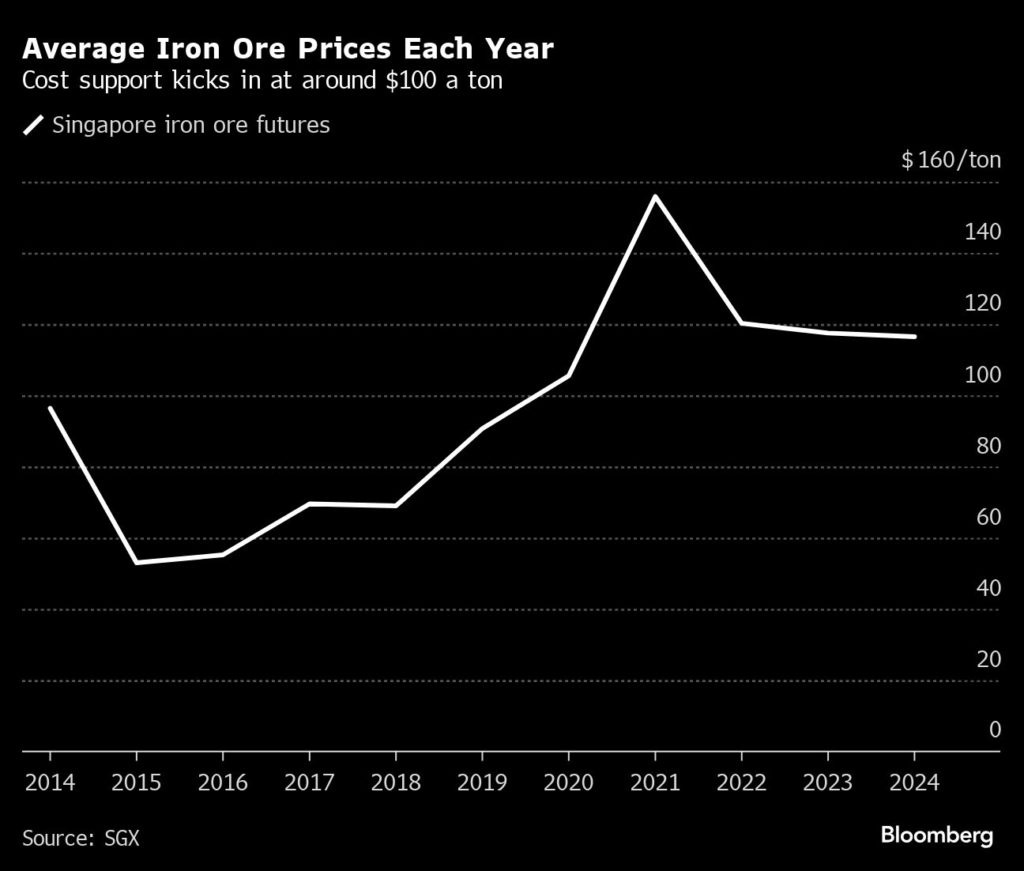

Iron ore prices are expected to stay in the three-digit range for the rest of 2024. Despite a decline in steel production, cost support around $100 per ton is likely to keep prices insulated.

Twice in recent months, the Singapore contract has breached $100 only to

swiftly rebound due to the threat that higher-cost miners would be forced to

curtail production if prices stayed below that level.

Rio Tinto, BHP, and Fortescue dominate the lower end of the cost curve, producing ore at between $18 and $24 per ton, excluding processing and transportation costs.

However, this dynamic may change next year as a wave of cheap supply from West Africa starts to build, lowering the industry’s average costs and forcing prices to better reflect the long-term equilibrium.

The Simandou project in Guinea will deliver 1.6 billion tons of iron ore annually. This initiative is part of China’s efforts to raise its high-grade iron ore self-sufficiency to 45% by 2025.

Chinese buyers are well supplied this year as overseas production gains momentum. Port inventories have expanded to their highest levels in over two years.

China is trying to cap steel production at or below the previous year’s levels to reduce overcapacity. Additionally, a less carbon-intensive industry that recycles existing steel increases downside risks.

Australian Dollar Strengthens Amid RBA's Unique Stance

The Australian dollar has been gaining strength since late June, as the Reserve Bank of Australia (RBA) stands out in the global easing cycle. Swaps traders are pricing in roughly a one-third chance of a rate hike in August.

While the consensus among economists is that the central bank will hold rates steady this year, some believe a rate hike cannot be ruled out, especially if the second-quarter inflation report surprises to the upside.

The minutes from the RBA’s June board meeting indicated that policymakers are "closely monitoring" longer-term inflation expectations, noting that a drift higher would necessitate "significantly higher interest rates."Josh Williamson, an economist at Citigroup, stated that Australian households "will need to grapple with another interest rate hike," which could dampen consumer sentiment in the second half of the year.

Home prices have been rising since February 2023, with Sydney reaching record highs. This trend supports the RBA’s conclusion that aggregate demand continues to exceed supply capacity. The Australian dollar is poised to continue benefiting from a growing appetite for risk and policy divergence, unless signs emerge that tailwinds are starting to impact business activity.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.