An army of retail traders appears to be reloading bets for a rebound in the

broken yen as the currency’s slide increases the chances of Tokyo intervening in

the market again.

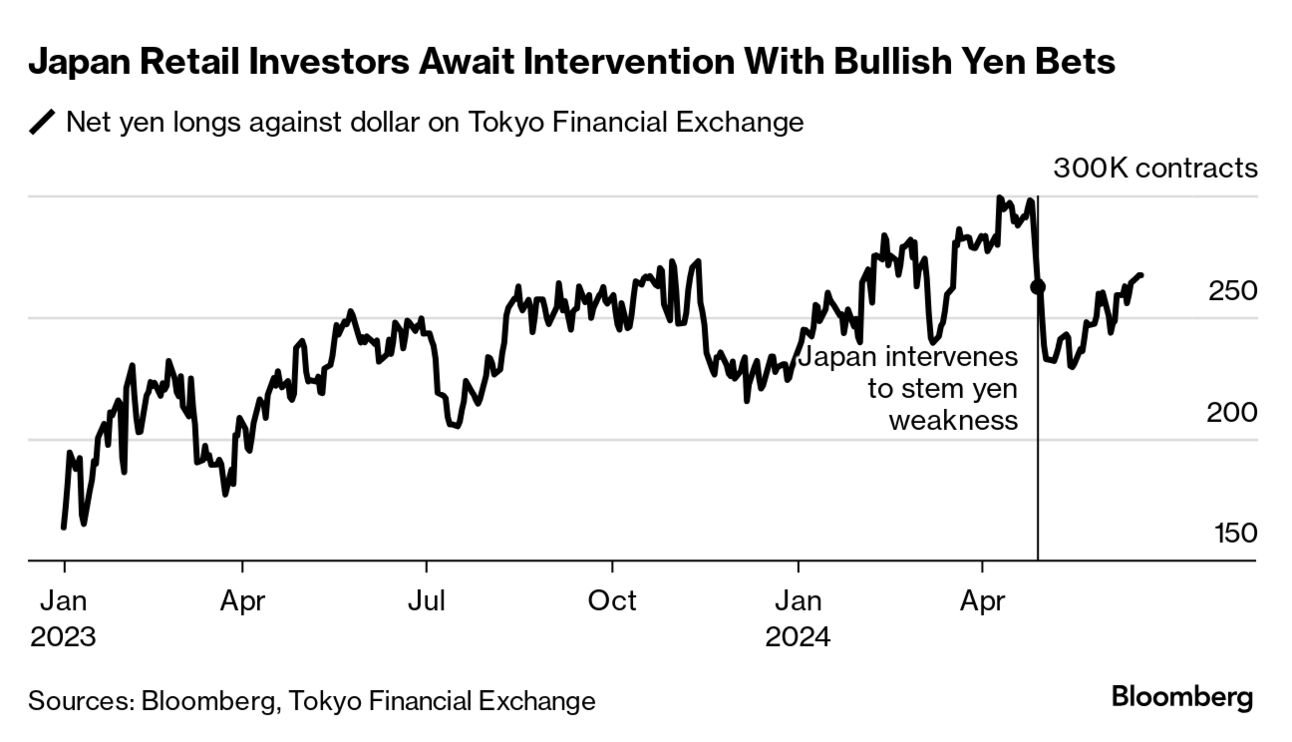

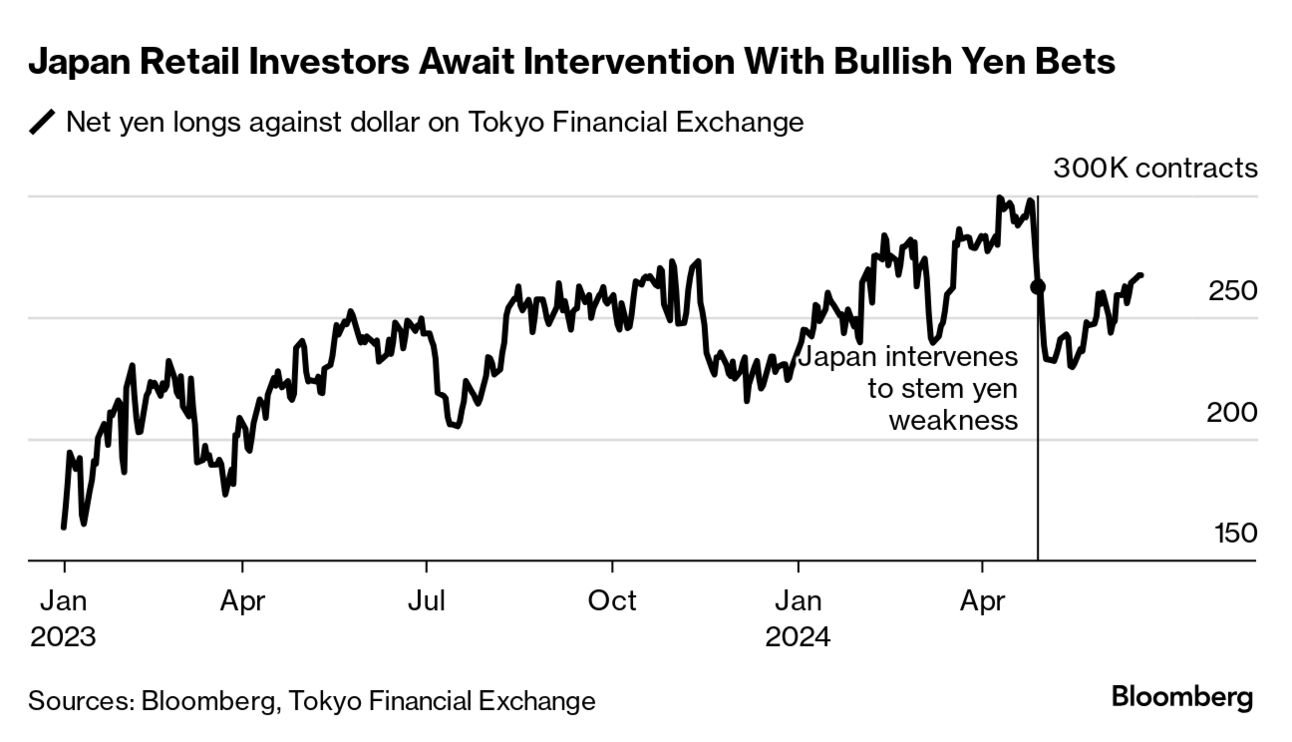

Bullish positions on the yen against the dollar have been building since

mid-May via futures contracts that cater to individual investors, according to

data from Tokyo Financial Exchange.

It is a risky strategy to play the guessing game. Those who positioned

themselves well ahead of one that happened in late April or did not lock in

profits in time saw painful losses.

A gauge of active trader positioning in the yen from Citigroup has fallen to

the most negative since 2022, suggesting there are plenty of positions that may

need to be quickly unwound in the case of a sharp rebound.

Japanese investors sold the amount of foreign debt in the week through June

7, the most since April 2015, amid a shift in global central bank policy,

preliminary figures from Ministry of Finance showed.

That contrasts with their monthly purchase of foreign bonds in May hitting

the highest level since January. That the yields rose in the second half of the

month was viewed as a chance to buy the dip.

Is a July Rate Hike Coming?

Investors will be closely watching whether the Bank Of Japan pushes ahead with its

second interest-rate hike in July. Swap rates are signalling that the odds of

that have dropped to below 30%.

Board members discussed the case for another hike as upside risks to

inflation become “more noticeable,” according to the latest meeting minutes. But

some among them remained cautious.

“While private consumption lacks momentum, there have been successive

unexpected suspensions of shipments at some automakers,” one member in favour of

the current rate level said.

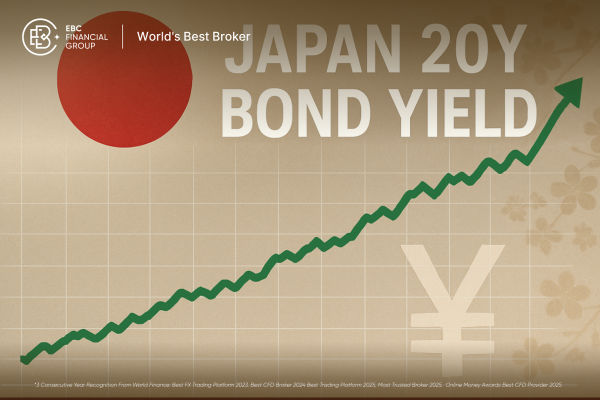

The BOJ said it will specify plans at the end of next month for cutting bond

buying in its first step towards quantitative tightening and will hold meetings

with market participants next month.

Ueda has said the reduction will be “sizable,” prompting many in the market

to speculate on the likely size of the cuts. The central bank still buys roughly

¥6 trillion of government bonds each month.

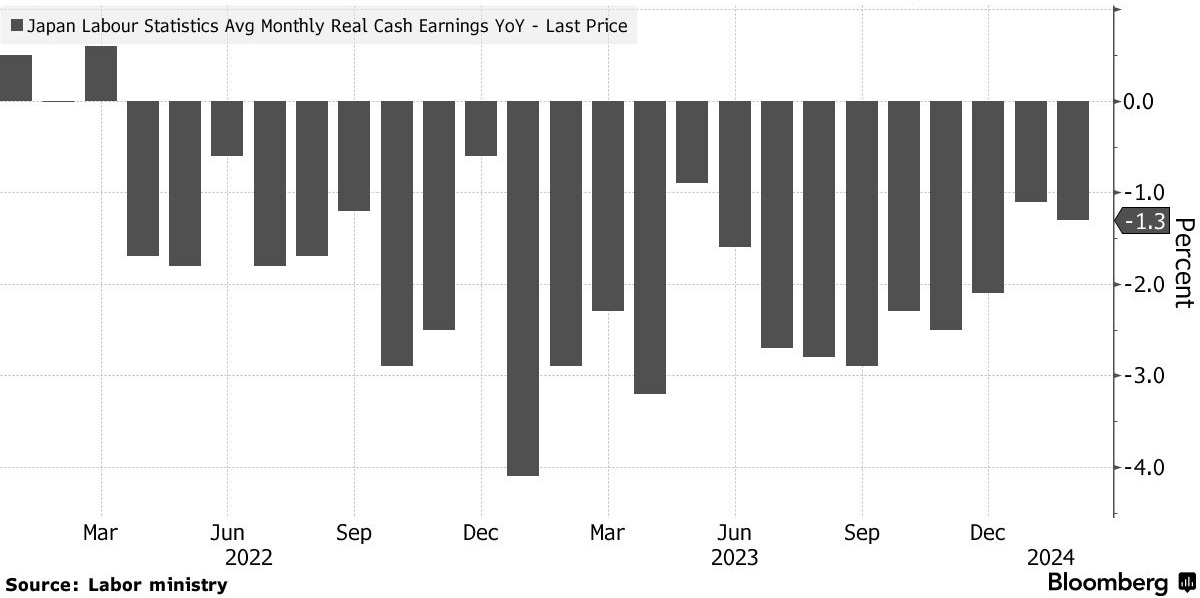

Japanese households are bearing the brunt of slow policy normalisation, which

is giving investors a perfect excuse to push down the yen, said Izuru Kato,

chief economist at Totan Research.

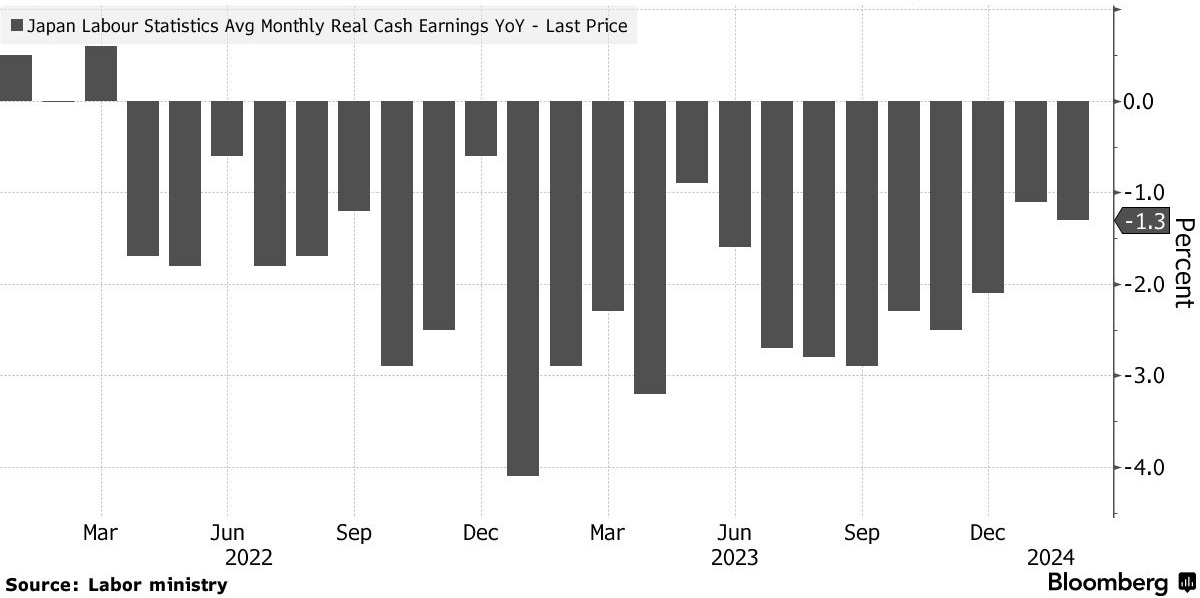

Real wages fell in April, extending a record streak of 25 consecutive monthly

declines as higher living costs outweighed pay raises. They may turn positive

during this fiscal year, said some economists.

Divergent views

Hedge funds and asset managers collectively held bearish yen wagers worth

about $14 billion as of June 18, marking the most bearish in data going back to

2006, according to CFTC data.

A slump as far as 170 per dollar is possible amid continued selling of the

currency to fund the higher-yielding greenback, according to Sumitomo Mitsui DS

Asset Management Co. and Mizuho Bank Ltd.

Investors see few catalysts right now, including potential yen purchases by

Japan, that would be powerful enough to reverse the momentum. The path of least

resistance appears to the downside.

Japan’s currency may strengthen beyond 150 per dollar should officials

intervene, but “in the long term, the yen will continue to weaken toward 170,”

said Sumitomo Mitsui DS Asset Management.

Taro Kimura, senior Japan economist for Bloomberg Economics, wrote that “the

yen is more likely to strengthen than to weaken in coming months as yield

differentials turn more favourable.

Macquarie Group argued yen may strengthen to around 120 per dollar and this

outcome will depend heavily on the Fed slashing interest rates to bolster demand

in the event of a huge scare in the US.

The forecast is significantly more optimistic than the median Bloomberg

analyst consensus for Japan’s currency to trade at around 140 by the end of

2025, and 138 by late 2026.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.