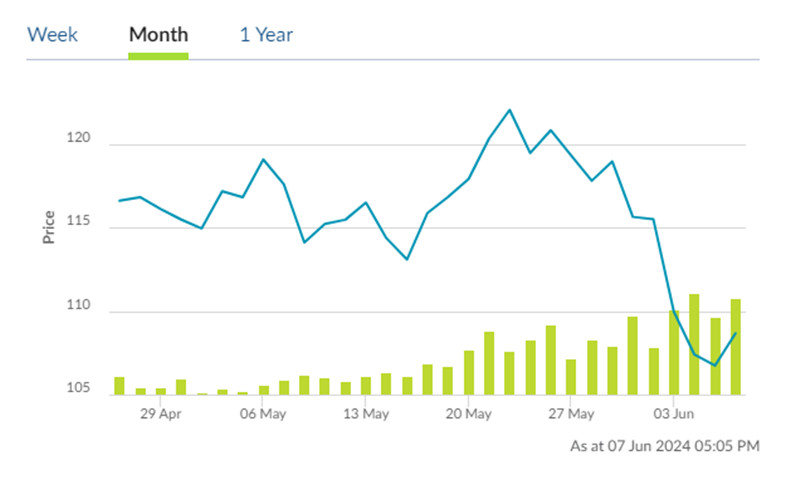

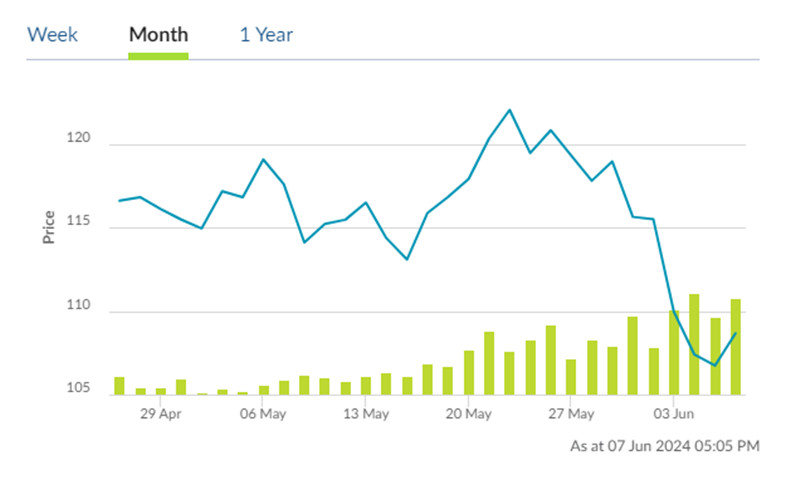

The australian dollar has made headway over the past month after a brutal

start to the year, in line with our forecast. But lacklustre economic growth is

acting as a drag on the currency.

Australia's GDP all-but stalled in the first three months of the year as

elevated interest rates and cost of living pressures weighed heavily on

households and broader activity.

The increase of 0.1% from the prior quarter missed estimates. Furthermore,

the annual reading was the worst after the pandemic ended with essential

spending outpacing discretionary consumption.

Australia's surplus on trade goods rebounded in April due to declining

imports, data showed. Exports fell to the lowest since late 2021 as prices and

volumes of iron ore and coal both eased.

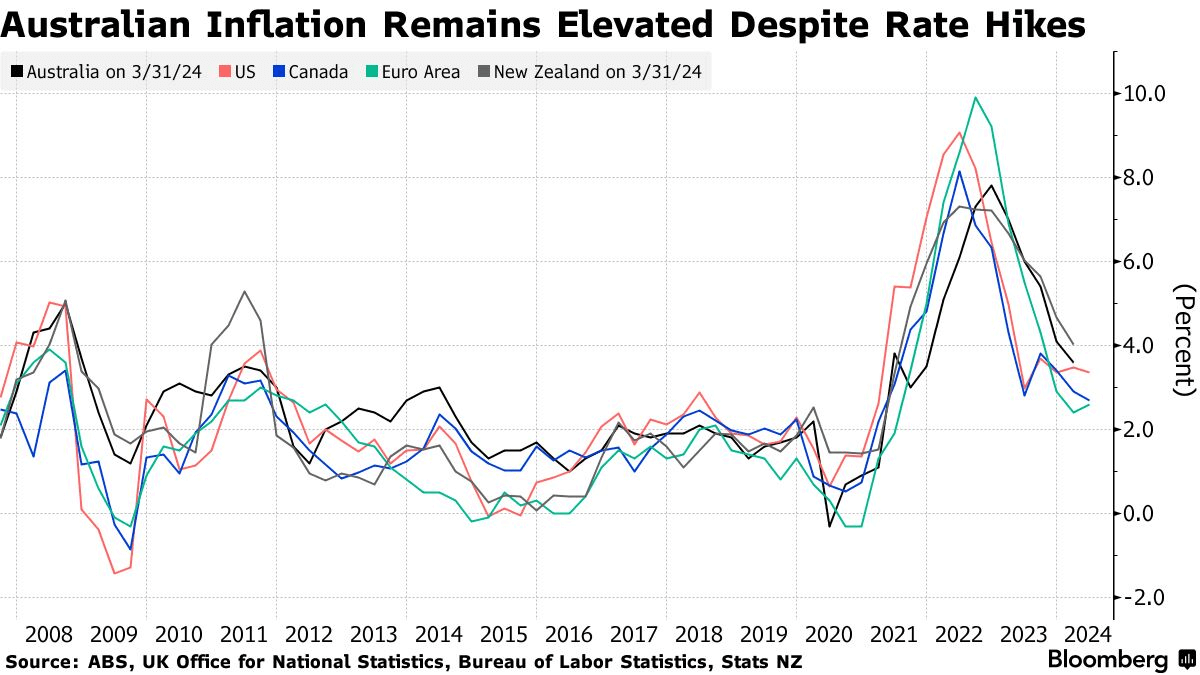

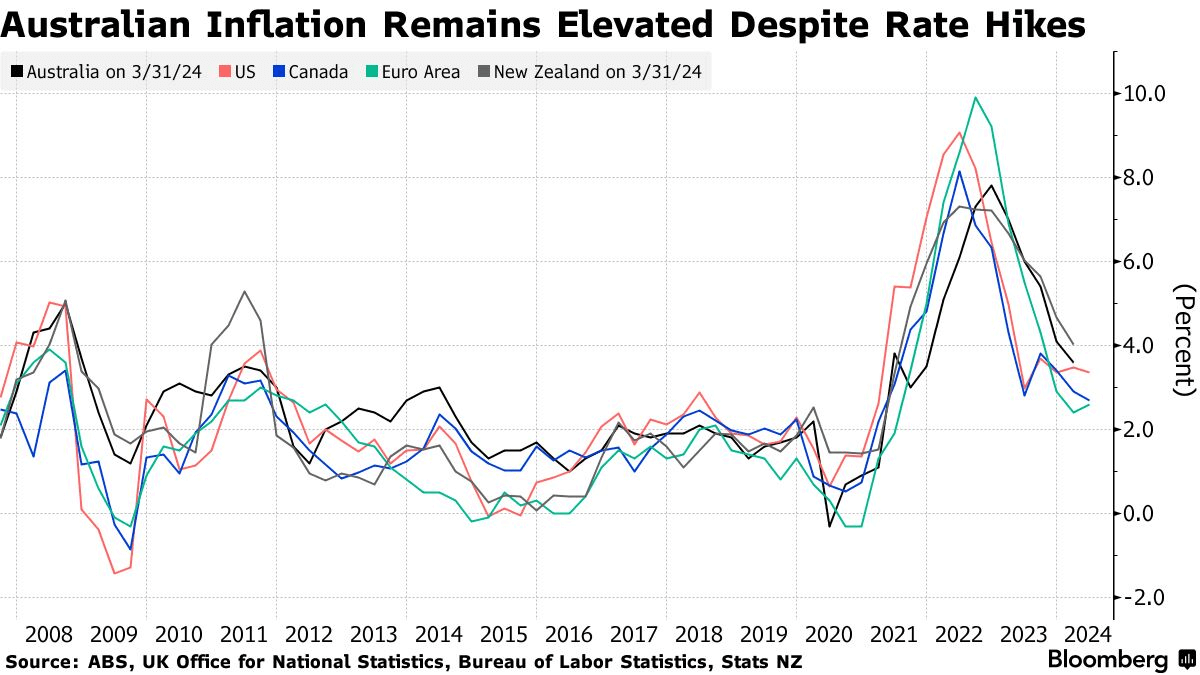

The slowdown comes as inflationary pressures remained stubbornly high.

Consumer price index rose to a five-month high of 3.6% year-on-year in April,

greater than the 3.4% gain forecast.

The report was heavily skewed towards goods and did not capture price changes

for a range of services. Australia still suffers the highest inflation rate

among the world's largest advanced economies.

The RBA expects headline inflation to pick up to 3.8% by June this year, but

the hope is that the new relief from the government would help ease the

cost-of-living pressures in the second half.

After UK

The RBA may have no choice but to resume raising interest rates this year,

according to money markets, setting it up as a potential outlier to a

post-pandemic global tightening cycle that has ended.

Traders have trimmed bets on a rate cut this year to a 25% chance from a

one-in-three probability prior to the GDP release. A cut is not fully priced in

until the first half of 2025.

Policymakers have kept the benchmark rate on hold for six months. Their

patience most economists anticipate that the will keep rates higher for longer,

rather than hike again.

Governor Michele Bullock reiterated she had not ruled anything out. Deputy

Governor Andrew Hauser said that cooling price pressures was the "first and

predominant challenge."

Hauser was the executive director of markets at the BOE. Coincidentally, the

central bank also grappled with signs of stagflation earlier and then navigated

the predicament by just sitting around.

However, it is not a given that the RBA will worm its way out of that

effortlessly like its British peer. China's housing slump is into its third

year, raising the question of steel demand.

Iron ore future hit a seven-week trough this week. The consumption shrank

along with falling hot metal output, while portside stocks continued to pile up,

analysts at Huatai Futures said in a note.

King dollar

The greenback's relentless strength in the recent past will make way for

minor weakness over the next 12 months, according to FX strategists in a Reuters

poll, who generally agreed the dollar was overvalued.

Much of that resilience is down to interest rates staying higher for longer.

At the beginning of the year, forecasters and financial markets had predicted

the Fed would have cut rates soon.

A separate Reuters poll showed inflation averaging above the Fed's target at

least until late 2025, suggesting the risk was the dollar would remain strong

for an extended period.

"When the Fed starts to cut, the dollar is likely to remain relatively firm.

It's not going to give back an awful lot of this year's gains and it's going to

remain overvalued," said Jane Foley, head of FX strategy at Rabobank.

The number of central banks seeking to increase their exposure to the

currency has increased sharply this year against the dedollarisation trend,

according to a OMFIF's report.

The survey said short-term factors seemed to be driving the renewed demand

for dollars, including expected higher returns from the US, where rates are

forecast to remain higher than other major economies.

That could pose another challenge to the Australian dollar which is under

pressure of the sore spot in China's recovery. The currency could hardly power

forward until the Fed's rate cuts are convincing.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.