The prospects of US gas prices still look very bearish after a mild winter,

swelling stocks and excess production have pushed a benchmark contact to its

lowest in over 3 years.

Hedge funds and other money managers sold the equivalent of nearly 400 bcf in

the two major futures and options contracts linked to prices at Henry Hub over

the seven days ending on 20 Feb.

They have been net sellers in each of the most recent five weeks. Short

positions have only ever been greater in the first quarter of 2020, when the

coronavirus devastated the global economy.

Technically that may represent a rare opportunity for shrewd traders to bet

on a short-covering rally, but those dip buyers failed to identify the turning

point three times in the last twelve months.

Meanwhile, the price of European gas has fallen to a level last seen before

Russia started curtailing supplies in 2021, triggering coal-to-gas switch in

some countries such as Germany.

Mild winter

Strong El Niño conditions in the central-eastern Pacific this winter directed

warmer air into the northern US and ensured temperatures have been much milder

than usual.

Lower 48 population-weighted heating degree days were below the long-term

average on 98 of 137 days between 1 Oct and 14 Feb. NOAA warned that ice cover

in the Great Lakes has fallen to a historical low for this time of year.

Based on available data to date, analysts reckon the latest

December-to-February winter period will be the warmest since reliable tracking

equipment was installed in US airports in the 1950s.

Heating demand has fallen 11% so far during winter 2023/24 in the US.

December was especially mild with the smallest seasonal draw since Dec 2015.

Moreover, data released this month showed the average global temperature for

the first time breaching the benchmark of 1.5C above pre-industrial levels over

a 12-month period.

Swelling stocks

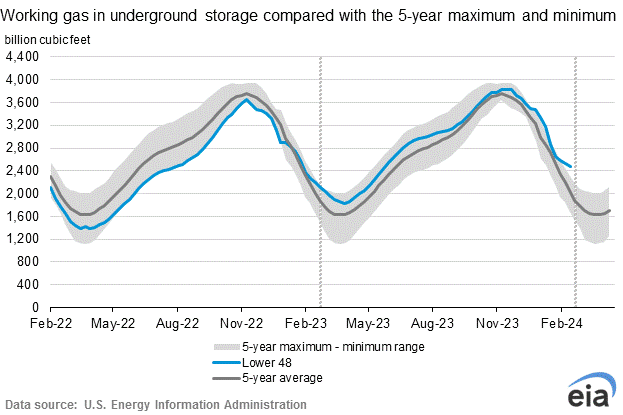

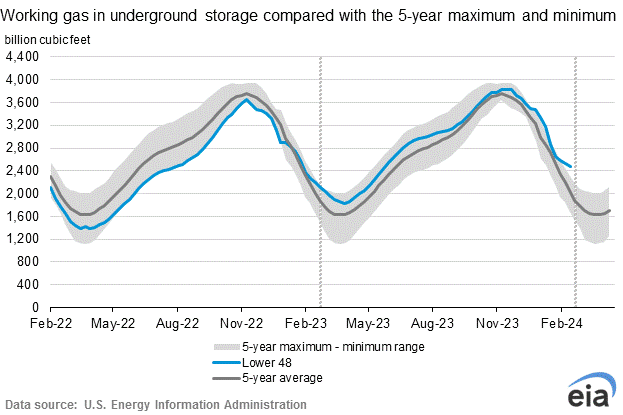

Working gas stocks stood at 2,535 bcf on 9 Feb, the highest for the time of

year since 2016 and 11 % higher than a year ago, according to data from the

EIA.

Prices for gas delivered in March have already slipped 7 cents below April,

having begun the winter at a premium of 21 cents. Prices will have to fall low

enough for long enough to purge excess inventory.

Many analysts now expect the rebalancing to be postponed until the winter of

2024/25 with options markets suggesting little chance of a significant US price

improvement in the near term.

Gas stocks in Europe and Japan are also bloated. “I think the market has

really written off 2024 in terms of any sustained upside rally,” said Charlie

Macnamara, head of commodities at US Bank.

But Tom Marzec-Manser, head of global gas analytics at ICIS, said until new

LNG production comes online from Qatar and the US in 2026, global gas demand was

likely to continue to outstrip supply.

Excess production

The rig count for gas has increased since Sep 2023 as producers have been

unresponsive to falling prices until the last few weeks. More associated gas is

being produced as a co-product of drilling for oil.

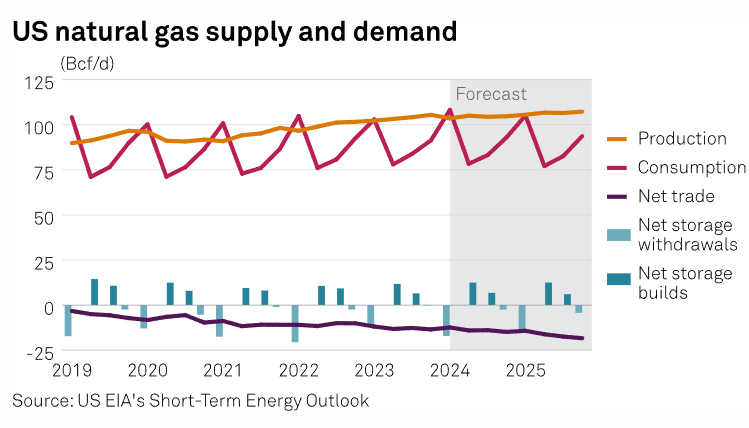

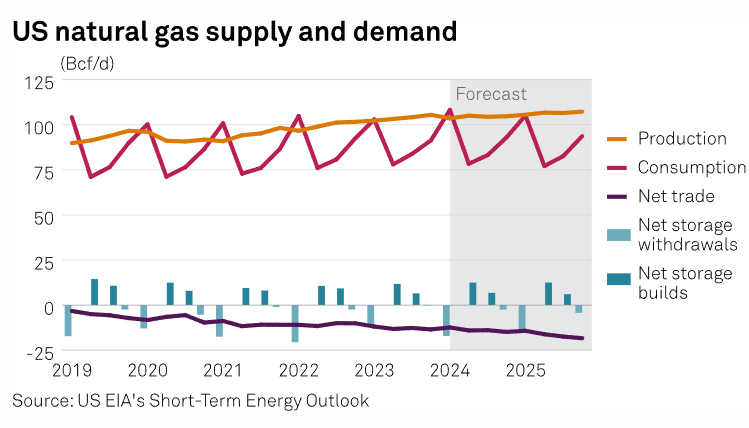

S&P Global Commodity Insights estimates that US gas output rose to a

record of more than 105 bcf per day in December. Production stayed around that

level early this month.

Production in the first eleven months of 2023 was up 4% compared with the

same period in 2022. Total exports of pipeline and liquefied gas also increased

marginally, according to the EIA.

As a result, several gas producers have announced plans to curtail drilling

programmes as weak prices put pressure on their profit margins. EQT cautioned

that “activity reduction is going to be a big thing.”

Elsewhere, Qatar has announced new plans to expand output from the world’s

biggest natural gas field, saying it will boost capacity to 142 million tonnes

per annum before 2030.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.