EBC Forex Snapshot, 28 Feb 2024

The dollar inched up on Wednesday despite data showing that orders for

durable goods fell more than expected in the US last month. Markets have largely

priced out a Fed’s cut before June.

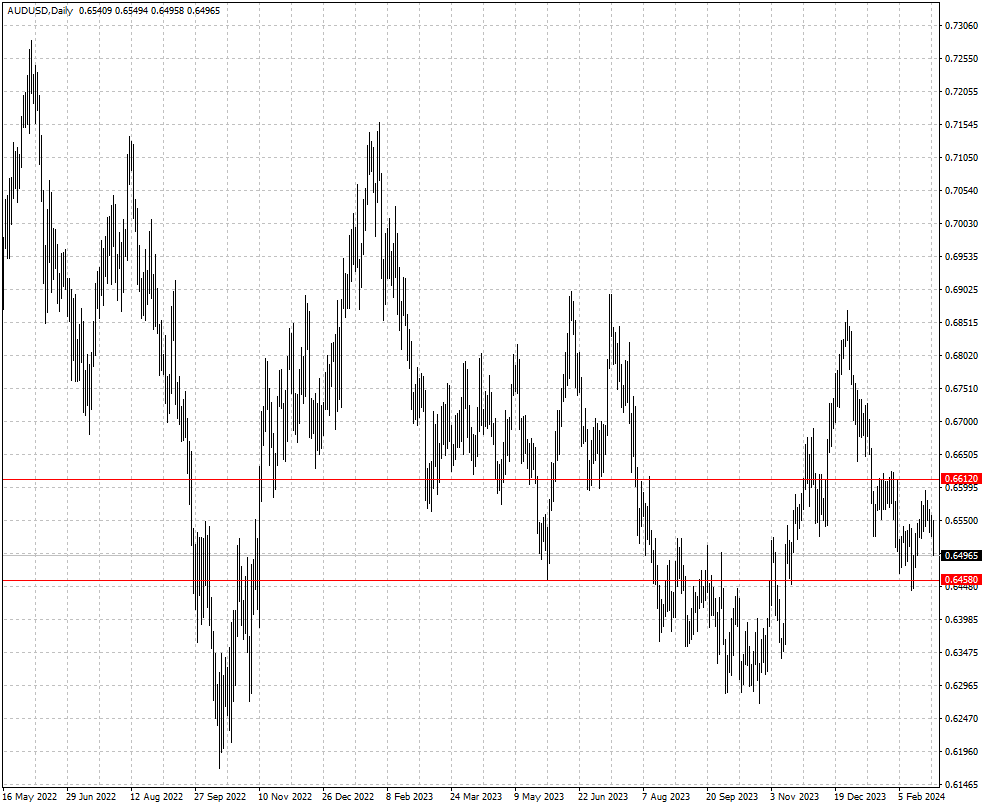

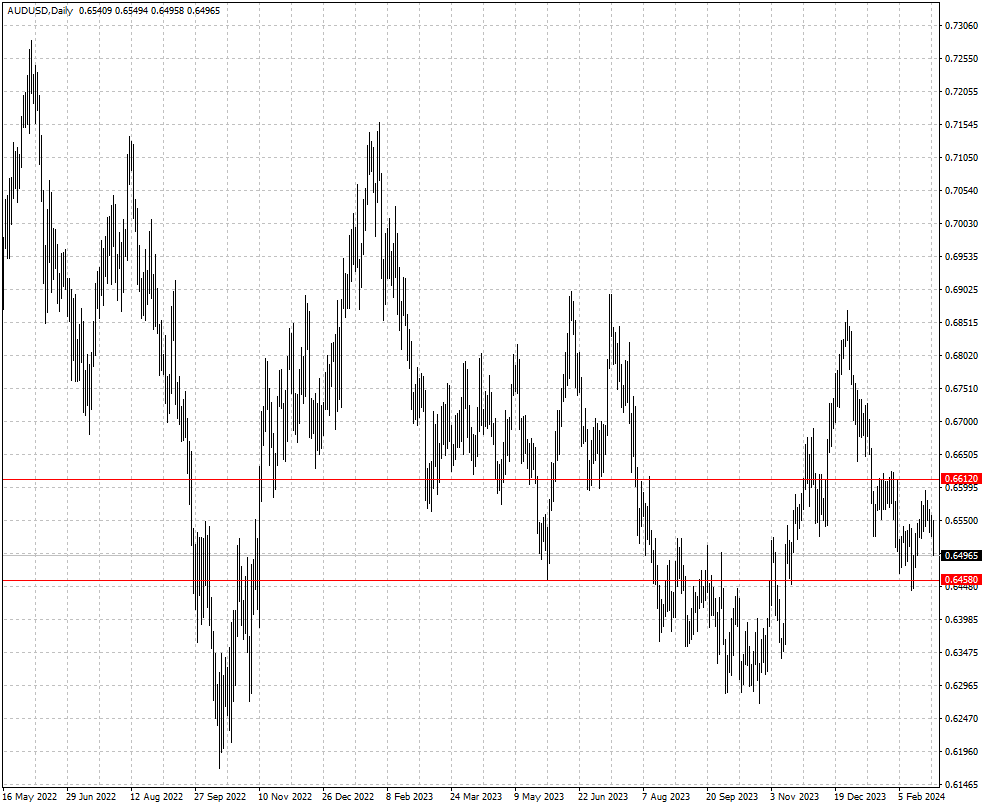

The australian dollar was hanging near its lowest in over a week. Australia's

monthly CPI held at a two-year low, reinforcing expectations that interest rates

are unlikely to increase further.

Iron ore futures tumbled this week to their lowest level in four months as

higher inventories in key buyer China and slower construction activity due to

unfavourable weather raised demand concerns.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 19 Feb) |

HSBC (as of 28 Feb) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0694 |

1.1017 |

1.0729 |

1.0924 |

| GBP/USD |

1.2476 |

1.2827 |

1.2574 |

1.2751 |

| USD/CHF |

0.8551 |

0.9013 |

0.8708 |

0.8871 |

| AUD/USD |

0.6443 |

0.6624 |

0.6458 |

0.6612 |

| USD/CAD |

1.3379 |

1.3586 |

1.3430 |

1.3605 |

| USD/JPY |

146.09 |

151.91 |

148.65 |

151.61 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.