The Australian Dollar Rises on Inflation

2024-06-26

Summary:

Summary:

On Wednesday, the dollar edged up as Fed officials signaled no rush for rate cuts. The Aussie dollar rose on inflation hitting a six-month high.

EBC Forex Snapshot, 26 Jun 2024

The dollar inched higher on Wednesday as Fed officials continue to signal

they are in no rush to kick off a rate cut cycle. A jump in inflation to a

six-month high sent the Aussie dollar higher.

Consumer prices rose 4% last month from a year earlier in Australia, compared

with the 3.8% rate expected for May by economists. That was propelled in part by

automotive fuel price.

The RBA has said it won’t hesitate to raise its key interest rate if it loses

confidence that inflation can fall back within its 2%-3% target by the end of

next year.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 17 Jun) |

HSBC (as of 26 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0688 |

1.0981 |

1.0619 |

1.0854 |

| GBP/USD |

1.2612 |

1.2860 |

1.2582 |

1.2822 |

| USD/CHF |

0.8885 |

0.9158 |

0.8849 |

0.9018 |

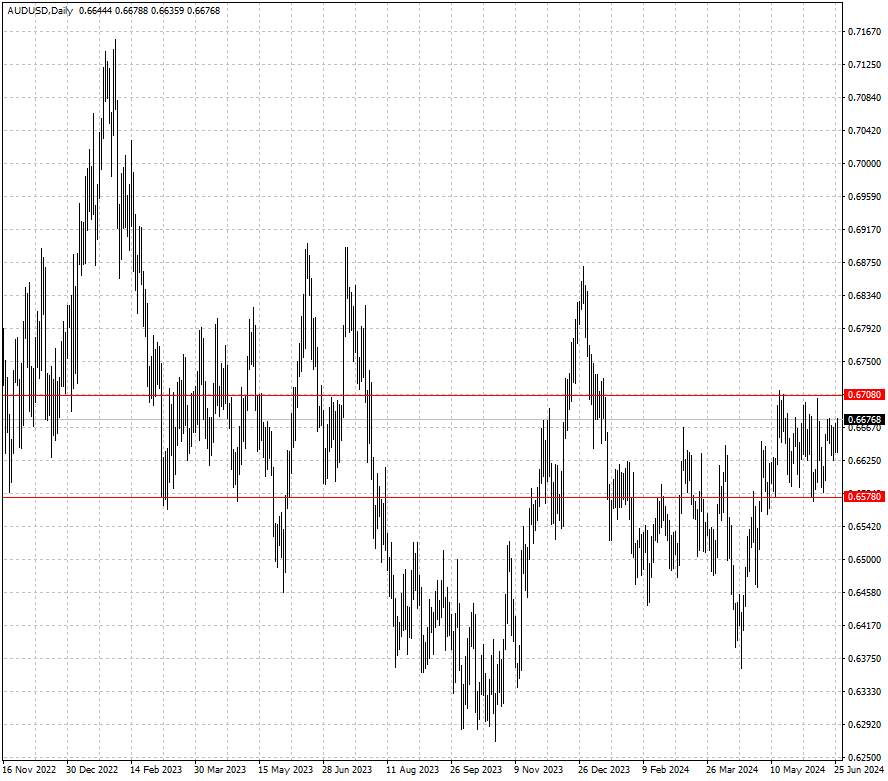

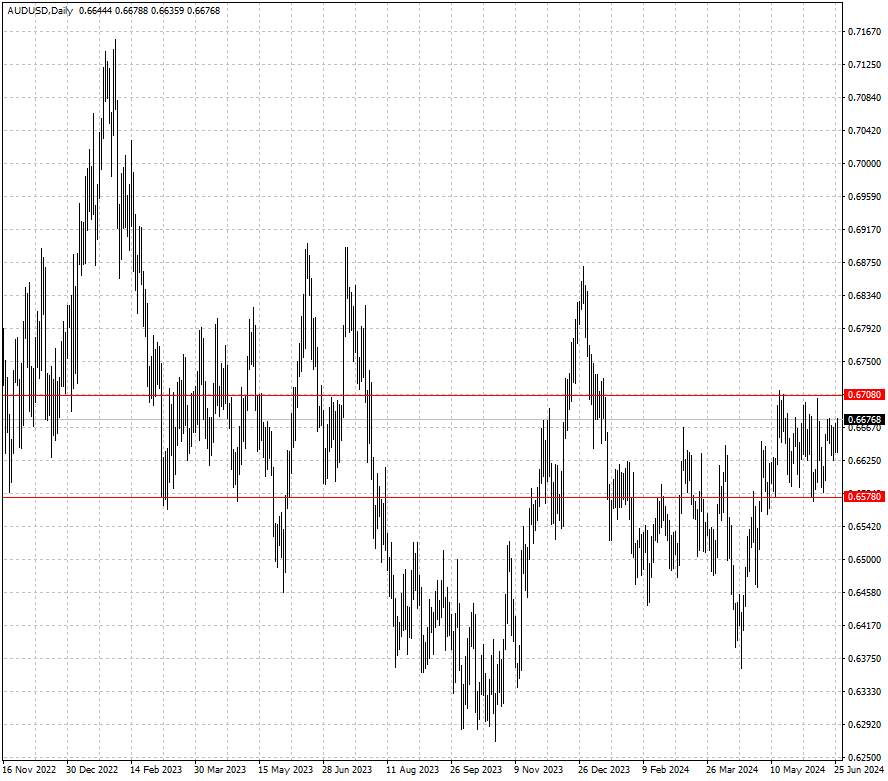

| AUD/USD |

0.6564 |

0.6729 |

0.6578 |

0.6708 |

| USD/CAD |

1.3577 |

1.3846 |

1.3590 |

1.3755 |

| USD/JPY |

151.86 |

158.26 |

156.55 |

161.37 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.