The RBA held interest rates steady on Tuesday as expected, while reiterating

that it was not ruling anything in or out to control inflation, a result that

led markets to slightly pare back the chance of a November rate cut.

"Inflation in underlying terms remains too high, and the latest projections

show that it will be some time yet before inflation is sustainably in the target

range," the central bank said in a statement.

Markets had wagered heavily on the decision due to unexpectedly deceleration

in core inflation last quarter, while recent wild swings in global markets

argued for a cautious policy stance.

The antipodean country is still haunted by the stickiest price pressures

among major economies. While the Fed is almost certain to cut rates this year,

the RBA is leaving traders in the dark.

Debate over whether delivering a late-cycle policy tightening is necessary

should go on as the figures gave few clues on how long the interest rates should

stay at the current level.

With strong fiscal support, the price report came on the heels of

higher-than-forecast jobs growth and strong retail sales, while measures of

business surveys remain resilient.

Australian states' deficits are among the highest in the developed world,

S&P Global Ratings said. It expects the debt to top A$600 billion by

late-2024, more than double pre-pandemic levels.

Unfavourable Conditions

The central bank has raised rates by less than global counterparts as it

sought to hold onto employment gains while worrying about the capacity of

heavily-indebted households to cope.

Cooling inflation also raises the prospect of the centre-left government

calling an early election this year. Opposition parties have earlier threatened

to block a flagship housing bill for a second time.

Housing affordability will continue to deteriorate with a shortfall in

supply, according to the government's own expert council. Rents were up 35%

since 2020 and 8% in 2023 amid rising interest rates.

On top of that, the economy barely grew in Q1 with the 1.1% annual pace the

slowest since Q1 1991, excluding the Covid lockdown era. The growth forecast for

2024 has been revised down to 1.7%.

The risk-sensitive Australian dollar has been among the worst performing

major developed market currencies this year as fresh US and China slowdown fears

are weighing on investor sentiment.

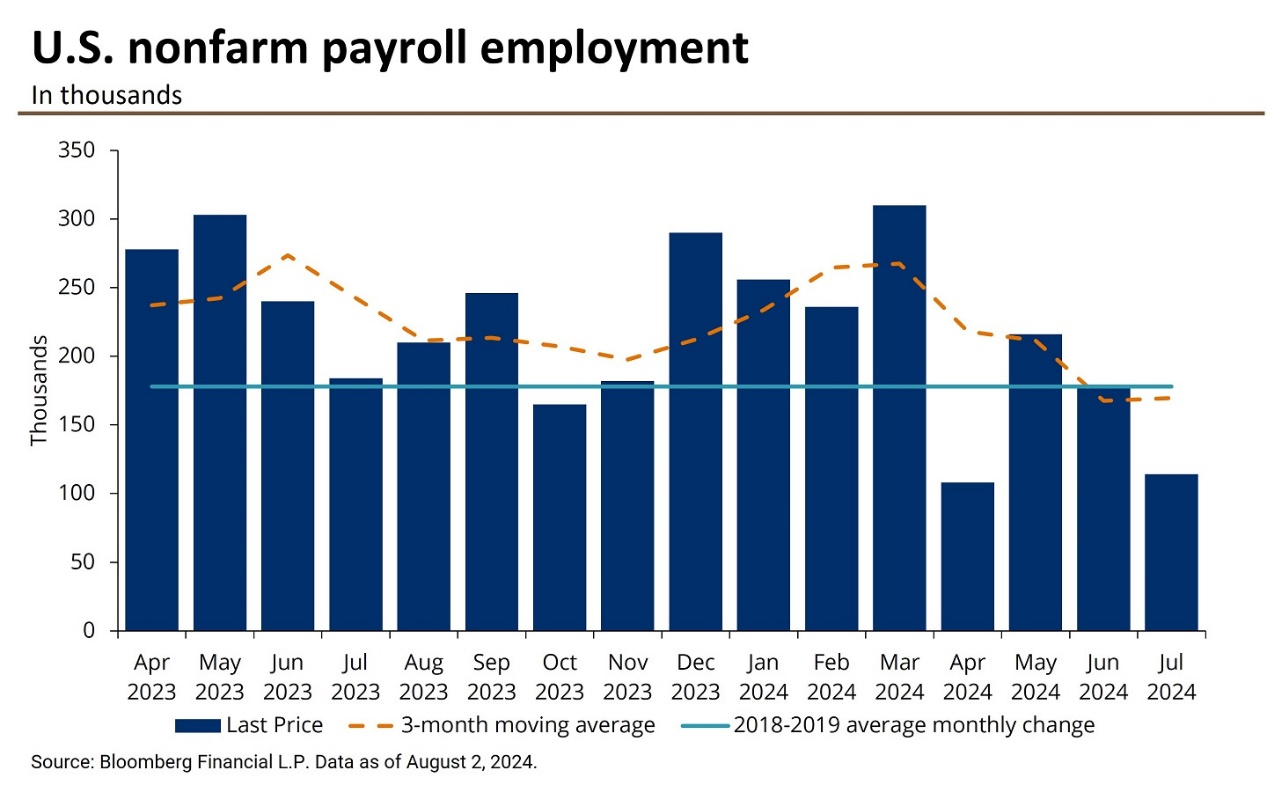

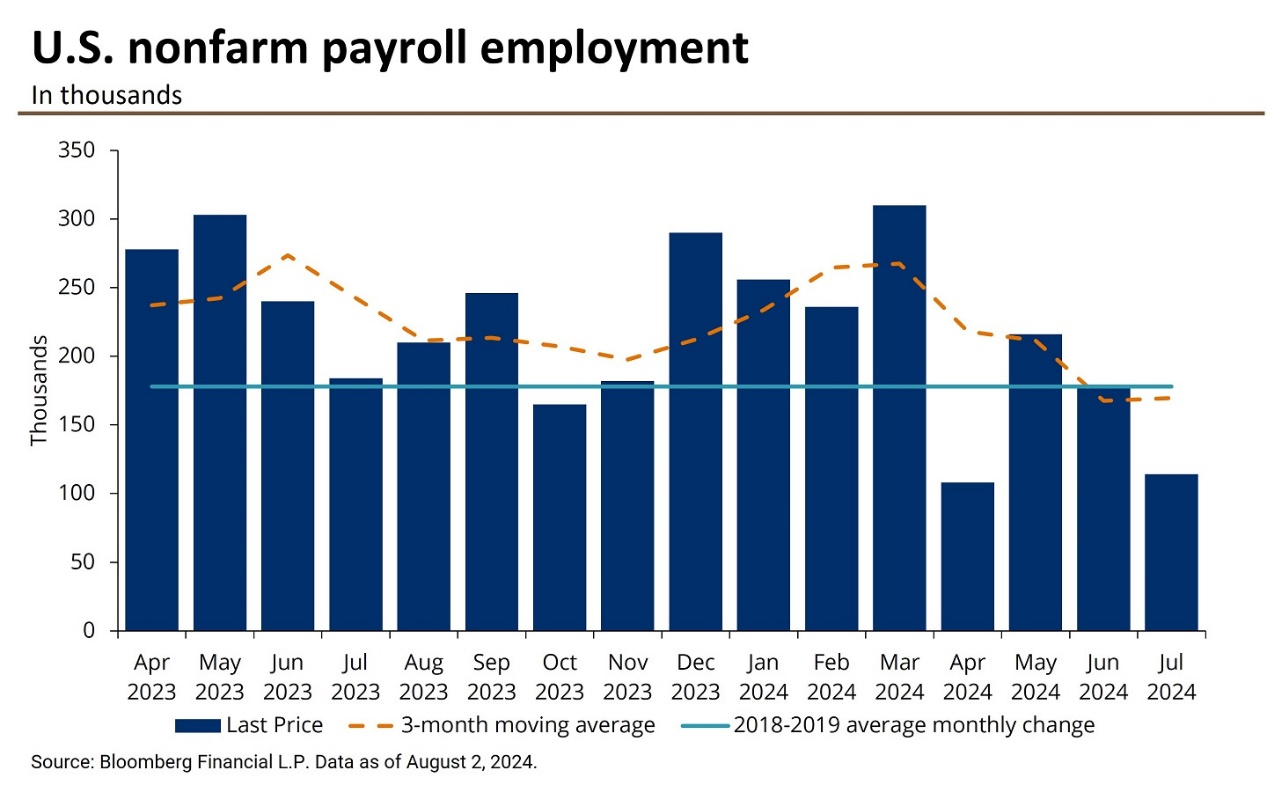

"Once you see the unemployment rate rise, in past economic cycles, that's always been the stage when you begin to see temporary lay-offs become permanent

ones," said Andrew Hollenhorst at Citi.

Meanwhile, China's export growth came in well below forecasts last month.

That followed a slow retail sales growth of 2%, raising doubts about reaching

the full-year GDP target.

Financial Contagion

China's iron ore imports rose back above 100 million tons in July, despite

bulging stockpiles and weak steel prices that point to a heavily oversupplied

market.

Rio Tinto, the world's second-largest miner, highlighted the depth of China's property market slump when it said that steel demand from that sector was down

by as much as 30% from its peak in 2020.

"We expect hot metal output to see more significant drops this week as more

mills suffered losses … and the iron ore market has not yet to enter the cycle

of destocking," analysts at Galaxy Futures said.

Experts see few price changes from now to the year end. banks HSBC Holdings

expects the commodity to reach $100 per tonne in 2024 and Capital Economics

predicts a range from $99-100.

Commodity markets begin to tumble and flagging Chinese demand prompt fund

managers to cut around $41bn of bullish bets on natural resources. Iron ore saw

a sharp fall in late July.

Other Australia-mined base metals such as copper and lithium have followed

suit. Copper was particular hit, down close to 20 % from its record high in May

above $11,000 per tonne.

The widespread sell-off marks a sharp reversal from just over two months ago

when some commodities reached record highs. The assets are seen as a tool to

hedge an inflationary environment.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.