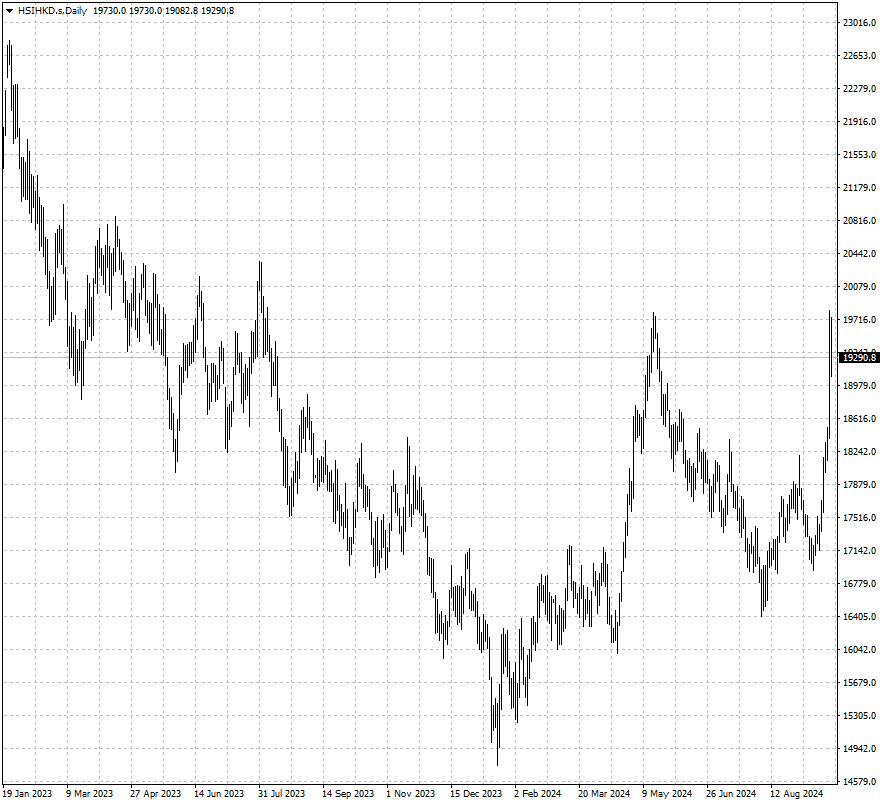

Hong Kong stocks surged to their highest in 18 months on Tuesday after Beijing announced a series of policy easing measures in a rare briefing by central bank governor Pan Gongsheng.

The central bank revealed a substantial fund to support the stock market, offering loans to asset managers, insurers, and brokers to purchase equities, and to listed companies to buy back their own shares.

The loan programs aimed at supporting shares were part of a broader stimulus package, which also included reductions in the benchmark interest rate, mortgage rates, and down payment requirements.

According to JPMorgan, the outsized gains may have been driven by short covering. The short sales ratio, as a percentage of total market turnover, dropped to one standard deviation below the average since 2016.

However, concerns persist about whether the rally is sustainable. After several false starts, "sizeable allocations will likely remain cautious, particularly ahead of the US presidential election," JPMorgan’s strategists noted.

In recent years, trade tensions between the US and China, along with globally high interest rates, have dampened foreign investors' enthusiasm for participating in Chinese equity capital markets.

Although Kamala Harris has consistently opposed full-blown trade wars, she supports a significant increase in tariffs on Chinese electric vehicles (EVs), raising them to 100%. She also advocates doubling the duties on semiconductors and solar cells to 50%.

Alibaba's Rebirth

Mainland China investors have been buying HK equities at a record pace, and

the inclusion of Alibaba Group Holding in the HK Stock Connect programme is

expected to quicken the capital outflows.

The tech group lately upgraded to a primary listing on the HK market. Morgan

Stanley estimated net inflows could be between $17 billion and $37 billion for

Alibaba from mainland investors over a 12-month period.

Alibaba Group's three-year process of "rectifying" its monopolistic practices

is over, the Chinese government said last month, signaling a more supportive

stance by the government toward the private sector.

China's SAMR unexpectedly suspended the $37 billion listing of Ant Group in

2020 and fined Alibaba 18.23 billion yuan in 2021 s as part of the efforts to

clamp down on "expansion in a disorderly fashion."

Analysts said the industry may have bottomed out after continuous scrutiny,

but warned they will have to juggle major policy signals, the AI rush, and a new

reality of price-sensitive consumption.

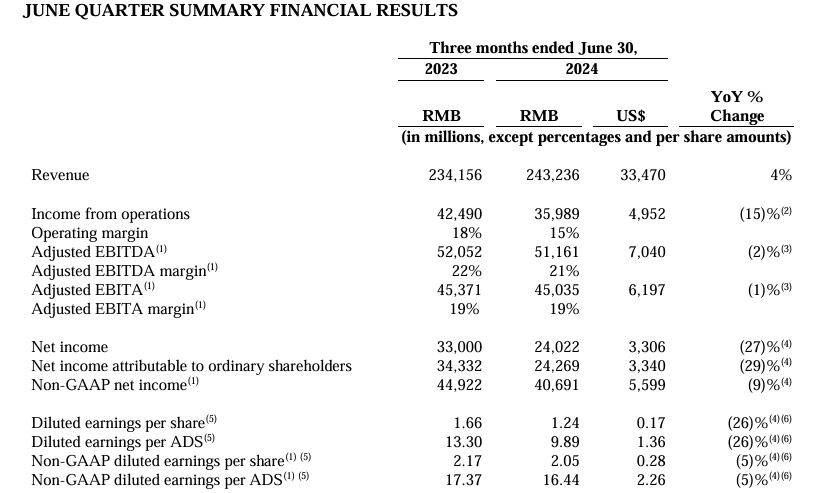

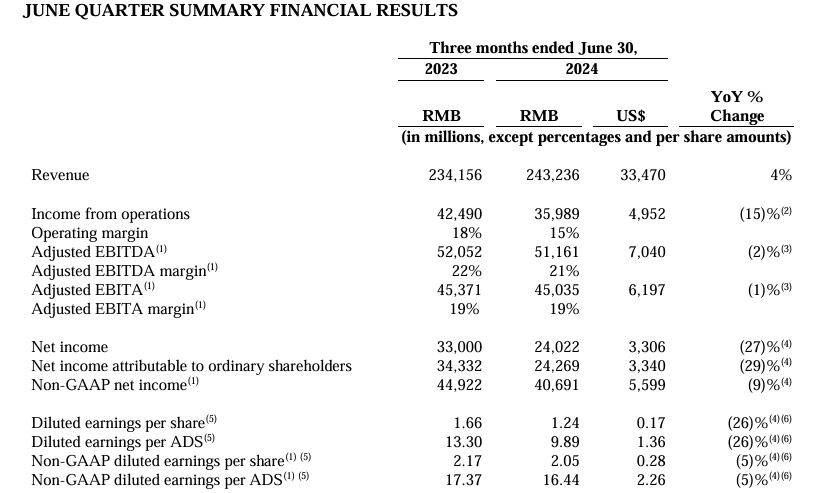

Q2 results were largely mixed. Tencent Holdings reported a

better-than-expected rise in earnings thanks to a turnaround in its core

video-game section and advertising business.

Worrisomely, NetEase posted a net income that fell 17% year-over-year and

missed expectations. Both Alibaba and JD saw lackluster sales growth while PDD

gave warning of slowing.

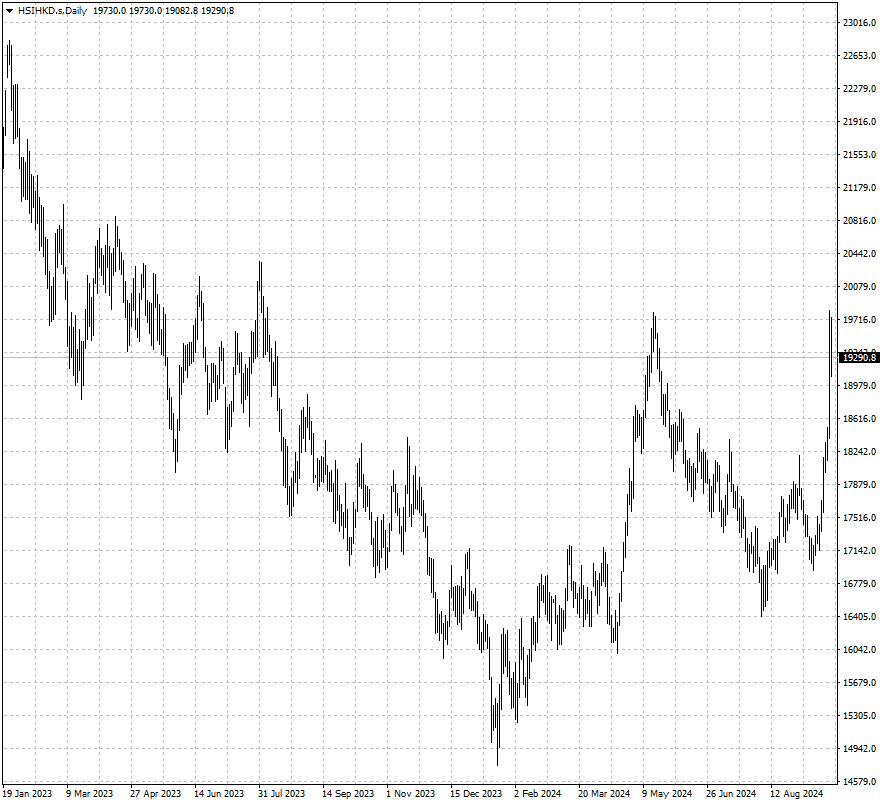

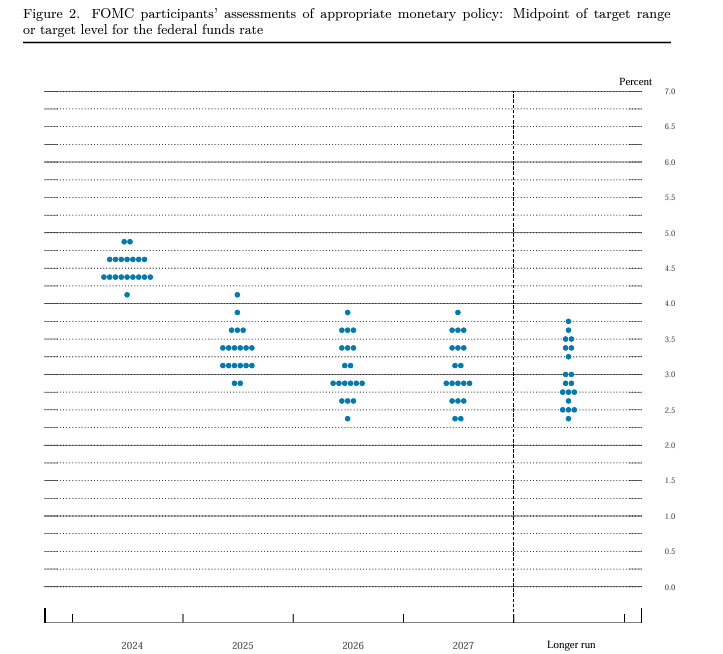

Fed Easing Scope

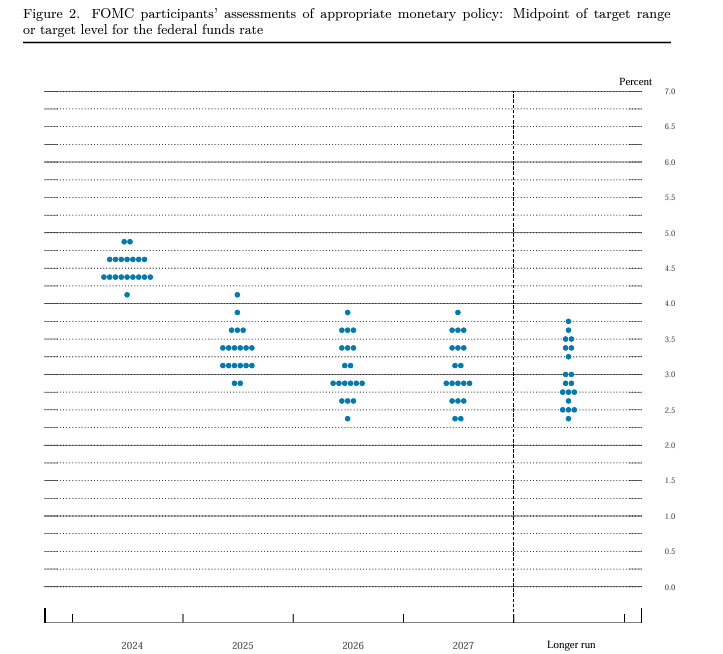

The market is now pricing in another 70 bps worth of rate reductions at the

Fed’s two remaining meetings this year, reflecting a far more aggressive stance

than policymakers.

The expectation could help drive steady inflows into emerging markets from

the US, quenching liquidity thirst in the shrivelling HK market which has fallen

for four years in a row.

"The fact that the dot plot is not suggesting more 50-bp moves further feeds

the narrative that this is a start — and proactive — rather than a trend," said

Nathan Thooft, a senior portfolio manager at MIM.

Economists at Goldman Sachs revised their forecast to show quarter-point

reductions at every meeting from November through next June – a view echoed by

Morgan Stanley.

The BofA predicts the Fed "will get pushed into deeper cuts" with 125 bps

next year, while Citigroup and TD Securities see 25 bps and 50 bps respectively

in 2025.

HKEX published a Consultation Paper on the proposed reduction of minimum

spreads in the HK securities market in June and the consultation period ended on

20 September.

In 2007 and 2019 when the Fed began an easing cycle, the Hang Seng index

registered strong gains within the two years. But the rally halted the following

year on both occasions, dragged lower by political tailwind.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.