Recently, many friends plan to travel to Japan to grab cosmetics, and photos of Japanese scenery appear frequently in the circle of friends, and some people are even considering taking a plunge into real estate in Japan. The underlying reason for this phenomenon is simple: the yen has depreciated, making it cheaper to go to Japan and spend less on shopping. However, it is vital for investors to understand the real reason for the depreciation of the yen and the economic drivers behind it. This will help create the right investment mindset and avoid blindly following the crowd. In the next section, we will delve into the reasons for the yen's depreciation, its impact, and investment strategies to deal with it.

The Reasons for the Yen's Depreciation

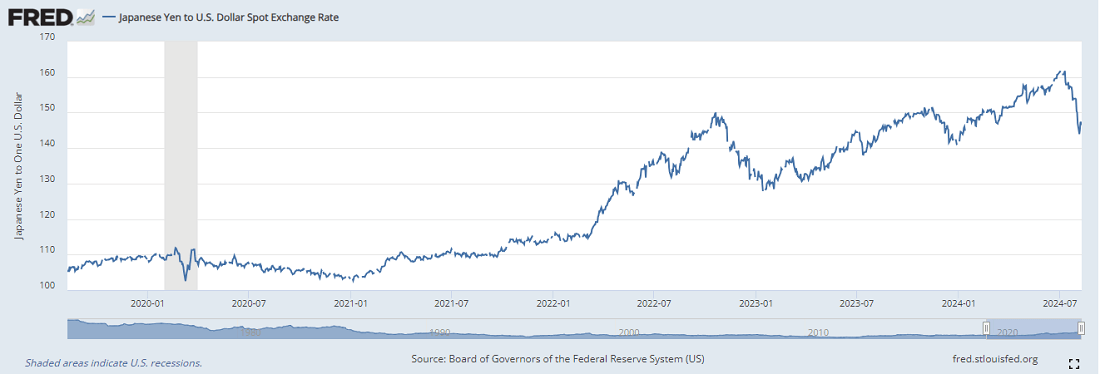

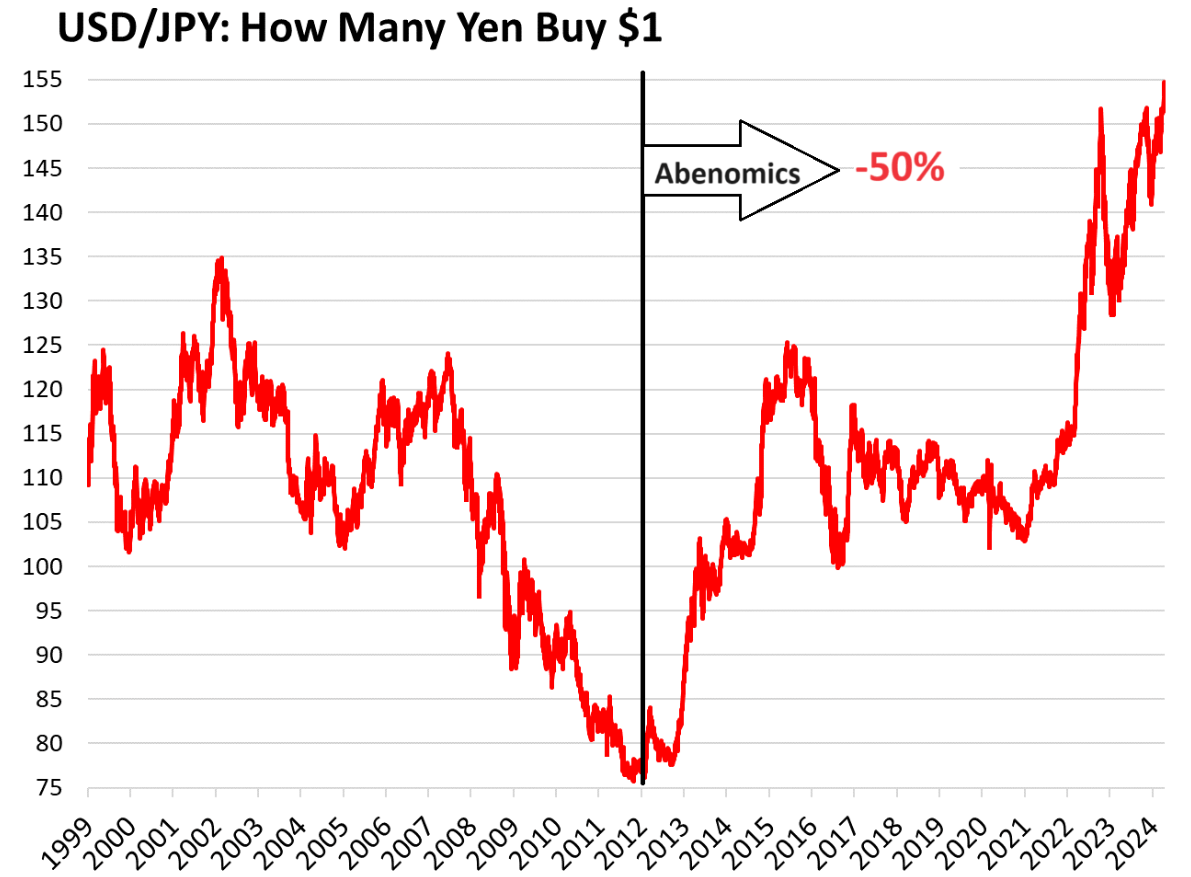

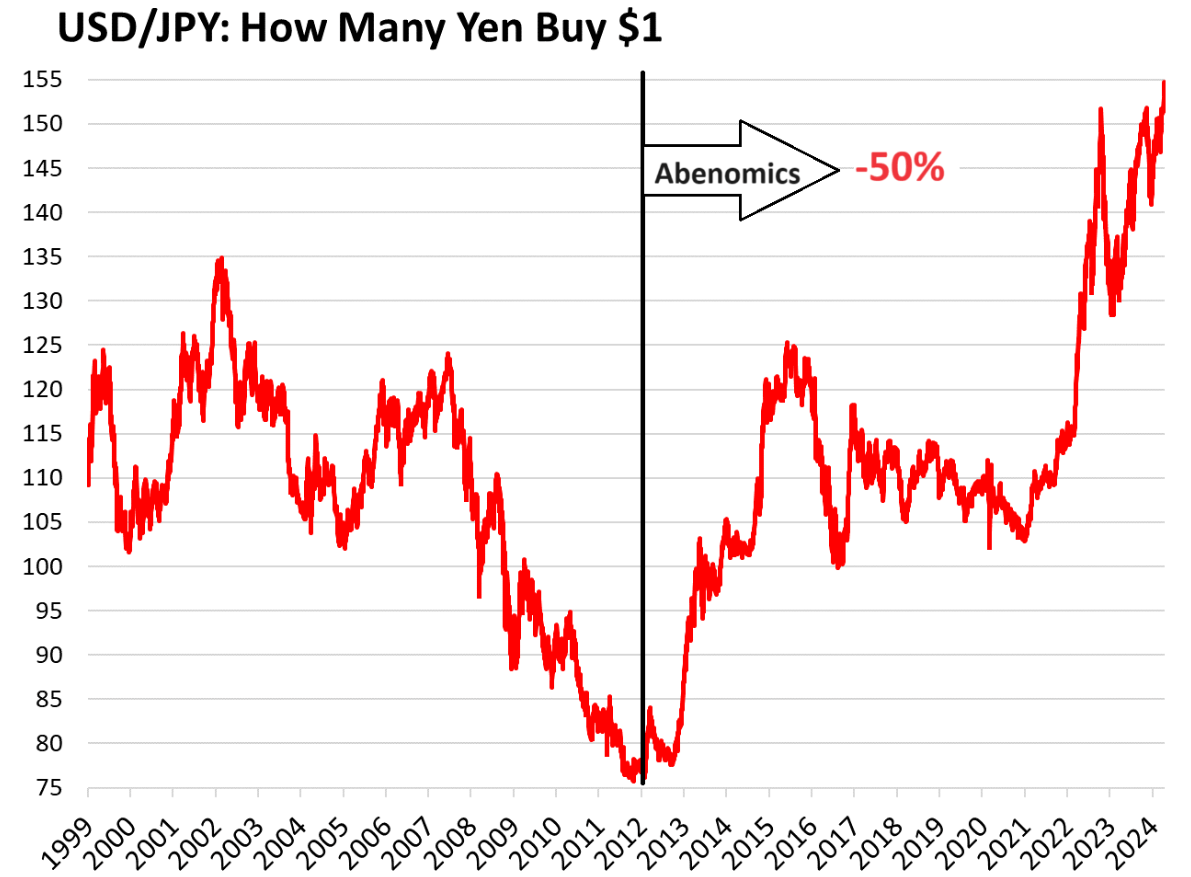

Just like stocks, the value of currencies goes through ups and downs. The yen has experienced significant depreciation several times in its history. For example, after the Asian Financial Crisis in 1997. the yen experienced sharp fluctuations against the US dollar, depreciating from about 90/USD to about 130/USD.

In 2012. Shinzo Abe became Prime Minister of Japan and implemented ‘AbeEconomics.'? Economics.'? One of the key measures is to promote the depreciation of the yen. As a result of his policies, the yen depreciated against the US dollar from around 80/US$ in 2012 to 120-125/US$ in 2015. This phase of yen depreciation is widely seen as a sign of policy success, significantly boosting Japan's export growth and positively impacting economic recovery.

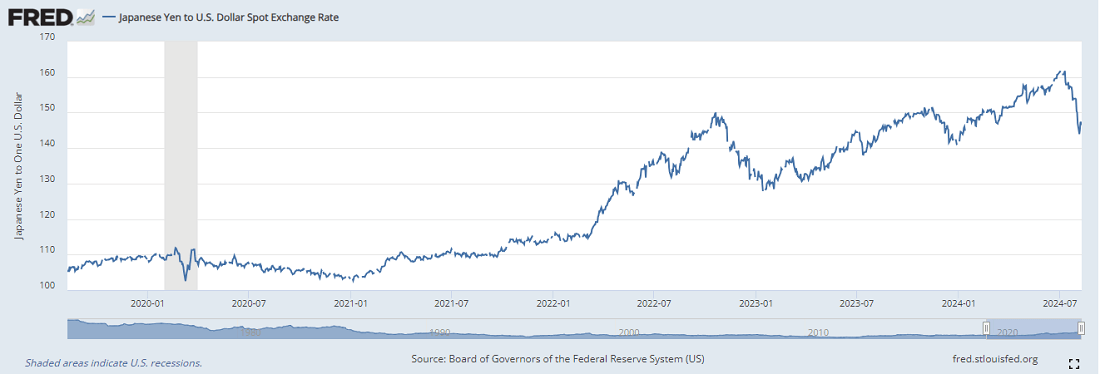

The COVID-19 outbreak brought global economic uncertainty and challenges to the Japanese economy. In response to the economic downturn, the Bank of Japan continued its accommodative monetary policy, which led to the depreciation of the yen against the US dollar to approximately 140/US$ in 2022 and 2023.

Subsequently, the yen has been in a prolonged state of depreciation, a trend that stems largely from a combination of multiple economic and policy factors. The Bank of Japan's continued accommodative monetary policy, coupled with a prolonged low interest rate environment, has led to a decline in the purchasing power of the yen. In addition, changes in the international economic situation, such as uncertainty about global economic growth and policy adjustments in major economies, have further intensified the pressure to depreciate the yen. All these factors have combined to make the yen persistently weaker over a longer period of time.

Keep in mind that Japan has long faced a trade deficit, meaning that imports have exceeded exports. Japan has run a trade deficit in each of the last three years or so. This situation has led to capital outflows from Japan, which has increased pressure on the yen to depreciate. Trade deficits indicate that Japan is not competitive enough in the international market and needs more foreign currency to pay for imports, which can lower the value of the yen.

And since 2016. the Bank of Japan has implemented a negative interest rate policy, initially set at -0.1%. The negative interest rate policy has resulted in very low returns on deposits and investments within Japan. In search of higher returns, investors and financial institutions borrowed yen and instead invested in foreign assets with higher interest rates, such as US or European Treasury bonds and real estate. Such arbitrage transactions have continued to increase the demand for foreign currencies while fueling the trend of yen depreciation.

Not only individuals and institutions, but even the Japanese government and large corporations have been involved in foreign exchange arbitrage. The Japanese government invested heavily in overseas bonds and gained income through spreads. This operation exacerbated the depreciation of the yen because they needed to exchange the yen for other currencies for investment. Corporations, in turn, may push the yen down further by repatriating profitable dollar or euro assets back to Japan.

Japan's government debt level is very high, exceeding 250% of GDP as of today. Under these circumstances, if the Bank of Japan were to stabilize the yen exchange rate by raising interest rates, it could trigger violent turmoil in the domestic financial market. The high debt level makes the Bank of Japan face a huge policy dilemma, limiting its options in monetary policy.

In addition, the Japanese government holds a large amount of U.S. Treasury. Treasury. If the Japanese government chooses to sell these Treasury bonds in order to support the yen's exchange rate, this will affect the market liquidity of U.S. Treasury bonds and may trigger the U.S. Treasury's dissatisfaction. The U.S. Treasury may take countermeasures against Japan, such as listing Japan as an exchange rate manipulator, which further increases the Japanese government's difficulty in exchange rate operations.

Moreover, the market is very sensitive to the policies and actions of the Bank of Japan. If the market believes that the BOJ is unable to effectively respond to the depreciation pressure on the yen, it may further shorten the yen and exacerbate its depreciation. This disconnect between market expectations and actual policies has led to a vicious circle of yen depreciation.

Since April 2024. the yen has continued to fall against the United States dollar, at one point extending its decline to 2 percent. By the end of June, the exchange rate had even fallen below the 1.160 yen mark, a 38-year low. Although the yen has recovered since then, the exchange rate has once again been on a downward trend recently.

The reason for this is that the Fed's interest rate hike policy has led to a widening of the interest rate differential between Japan and the U.S., which has led to capital outflows from Japan, resulting in a depreciation of the yen. Although most analysts now expect that the Fed may have 2-3 rate cuts before the end of the year, the Bank of Japan is likely to be very cautious in the pace of the next rate hike, given the weak state of the Japanese economy. As a result, the large spread between Japan and the U.S. still exists, and the general pattern of a strong dollar and a weak yen is difficult to change.

Overall, behind the depreciation of the yen is a combination of Japanese economic policy, market behavior, and multiple factors in the international economic environment. In order to cope with this depreciation trend, Japan needs to find a new balance between economic policy and market operations to avoid further economic and financial risks.

Impact of Yen Depreciation

Impact of Yen Depreciation

As a developed country, the depreciation of the yen has far-reaching implications. This currency depreciation has had a significant impact not only on Japan's domestic economy but also on other asian countries, with significant knock-on effects. In addition, the depreciation of the yen has had a wide-ranging impact on the global economy and financial markets.

For the Japanese economy, the impact of yen depreciation is two-sided. Firstly, the depreciation of the yen can significantly stimulate Japan's exports. Japanese-made goods are relatively less expensive in the international market, thus enhancing their competitiveness. This not only helps expand the overseas market share of Japanese companies but also attracts more foreign tourists to Japan, further boosting the growth of tourism. In addition, the increase in export revenue is a positive boost to the overall growth of the Japanese economy.

However, the other side of the coin is the jacking up of production costs for Japanese companies. With the depreciation of the yen, the cost of imported raw materials and energy has risen, which directly affects import-dependent firms, potentially leading to an increase in their production costs and compression of profit margins. In the long run, this cost pressure may weaken the competitiveness of Japanese firms in the international market and have a negative impact on the sustained and healthy development of the Japanese economy. Therefore, despite some economic benefits from the devaluation in the short term, its long-term effects need to be carefully assessed.

As in the case of the Japanese stock market, despite hitting new highs and breaking through the previous historical highs in the recent past, the real growth is limited when denominated in US dollars. The property market has performed similarly, with Tokyo house prices still failing to return to pre-bubble burst levels of the 1990s in US dollar terms, even though prices in Japanese terms have already exceeded their historical highs.

Thus, the continued depreciation of the yen not only reveals structural problems within the Japanese economy but may also foreshadow a number of difficulties for future economic development. While the depreciation has brought some benefits to the Japanese economy in the short term, such as stimulating exports and tourism, its long-term effects still need to be assessed with caution. A sustained depreciation could trigger deeper economic challenges, weaken market confidence, increase financial market volatility, and thus pose a potential threat to Japan's overall economic stability.

The depreciation of the yen has had a profound impact not only on the Japanese economy but also on the global economy, especially on Asian countries with which Japan has strong investment and economic and trade ties. It may trigger the risk of competitive devaluation in the market, which is unfavorable to the exports of countries such as China and Korea.

The depreciation of the yen has significantly increased the competitiveness of Japanese goods in the international market, especially in areas such as automobiles and electronics, which are in direct competition with China. As Japanese goods become cheaper, China's medium- and high-end manufacturing industries may face the risk of losing orders, which would weaken China's ability to export in these sectors.

This situation poses a potential threat to China's economy, especially in the current context where exports are the main engine of growth. If China's export competitiveness is weakened, overall economic growth could be adversely affected, exacerbating the current downturn in investment and consumption.

In addition, the depreciation of the yen could lead to an appreciation of the renminbi relative to the yen, which would have important implications for the trade and investment environment between China and Japan. As the price of Japanese goods becomes more attractive, Chinese exporters may face greater competitive pressure as Japanese goods become more price-competitive in international markets.

At the same time, the depreciation of the yen may attract more foreign investors to the Japanese market, thus enhancing Japan's attractiveness in the global investment market. However, it may also make it more expensive for Japanese investors to invest in the Chinese market and weaken their willingness to invest in China, thus affecting capital flows and economic cooperation between China and Japan.

The depreciation trend of the yen has revealed a lack of monetary policy coordination among the major global economies, and this lack of coordination has far-reaching implications for international capital flows, exchange rate volatility, and market investment decisions. Global investors and financial institutions have thus needed to adjust their strategies in response to this change. This policy divergence, transmitted through financial markets, further affected the global economy and posed a potential threat to the economic stability of certain countries.

All in all, the depreciation of the yen is a complex and multi-faceted phenomenon with far-reaching implications for the Japanese economy as well as the global economy. The continued depreciation of the yen has not only reshaped the regional economic landscape but has also posed important challenges to the stability of the global economy and market dynamics. This change has forced countries to be more cautious and coordinated in responding to fluctuations in the global economy and adjusting their internal policies in order to maintain sustained economic development and stability.

Investment Response Strategies to the Depreciation of the Japanese Yen

Investment Response Strategies to the Depreciation of the Japanese Yen

Currently, the yen is at a record low against the US dollar. In 2022. 10.000 yen could still be exchanged for about 85 U.S. dollars, but now it can only be exchanged for about 62 U.S. dollars. This means that if you hold US dollars to spend in Japan, you are essentially enjoying a discount of more than 25%. This is why a large number of tourists and surrogates have flocked to Japan, creating a shopping boom.

Experts predict that the yen is likely to continue to weaken as the Bank of Japan maintains its low interest rate policy. This not only increases the attractiveness of short-term spending but also provides opportunities to invest in Japanese assets at discounted prices. Buying Japanese stocks and properties or investing in Japanese companies with US dollars is equivalent to acquiring quality assets at a lower cost.

However, exchange rate volatility is a double-edged sword. While the depreciation of the yen in the short term provides investment opportunities, if the yen continues to depreciate, it may affect the return on investment. Assuming that the dollar to buy Japanese assets, the current exchange rate is a dollar to 150 yen, the future of the yen, and then fell to a dollar to 160 yen, even if the assets in yen-denominated no change in the value of the dollar back to the time of the reduction in the value of the dollar.

Japan has just experienced the ‘lost 30 years’, slow economic growth, and deflation is serious. In order to reverse this situation, the Japanese government and central bank took a series of measures, including lower interest rates and selling US debt. These funds were used for infrastructure construction, scientific and technological research and development, etc., with the intention of stimulating economic growth.

For example, by selling US bonds, Japan has obtained trillions of yen, which have been used to support high-speed rail and green energy projects, boosting the development of the relevant industrial chain. In addition, Japan has also supported enterprises to make innovations and enhance their competitiveness by setting up a fund for scientific and technological research and development.

Despite the positive measures taken by the Japanese government, it is still doubtful whether an economic rebound can really be achieved. Over the past 30 years, Japan has tried similar policies, but the results have not been significant. The current global economic environment is complex, and factors such as geopolitical risks and international trade disputes may also drag down Japan's economic recovery.

And in response to the yen's depreciation, Japan has announced plans to sell U.S. debt on a large scale from 2026 and implement a policy of interest rate hikes. These initiatives aim to stabilize the yen exchange rate, but they also increase market uncertainty. The negative impact of the interest rate hike on the market was further magnified by the fact that Japan's economic situation showed a serious burden. These policy moves further undermined market confidence in the Japanese economy and increased volatility in global markets.

Of course, if one invests in high-growth Japanese stocks, such as companies with annual returns of 20 percent, one's investment may still yield good returns even if the exchange rate depreciates. On the contrary, if investment returns are low, further depreciation of the exchange rate may exacerbate losses. Therefore, investing in Japanese assets should not only depend on the exchange rate but also carefully assess the potential of the assets invested in.

It is worth noting that Japanese technology companies are performing strongly in the semiconductor and new energy sectors, demonstrating strong competitiveness and innovation. If one is bullish on the long-term growth potential of these sectors, short-term exchange rate fluctuations may not have a significant impact on final returns. Investors should focus on the long-term trends of these sectors rather than short-term market fluctuations, especially against the backdrop of continued global demand for semiconductors and new energy sources, which are expected to be important growth areas in the future.

To summarize summarize, the depreciation of the yen does provide an opportunity for a short-term plunge into Japanese assets, but there is also a need to be wary of the risks associated with a sustained weakening of the exchange rate. For long-term investors, it is crucial to focus on the intrinsic value and long-term growth potential of the assets invested in rather than being swayed by short-term exchange rate fluctuations. By assessing the true value of assets, investors can find solid investment opportunities in volatile markets and ensure the sustainability of long-term returns.

Reasons, impacts, and investment strategies for yen depreciation.

| Reason |

Impact |

Investment strategies |

| Central bank easing, low rates |

Yen depreciation, stimulate exports |

Invest in export-focused firms |

| Wider Japan-US rate spread |

Yen drops faster from capital outflows. |

Buy yen assets |

| Rise in forex carry trades |

Increased market volatility |

Use hedging instruments |

| Long-term trade deficit |

Higher import costs, profits pressured |

Focus on exporters |

| High debt, limited policy space |

Tough rate hikes, weakened confidence |

Invest in safe-haven assets |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Impact of Yen Depreciation

Impact of Yen Depreciation Investment Response Strategies to the Depreciation of the Japanese Yen

Investment Response Strategies to the Depreciation of the Japanese Yen