In today's competitive investment landscape, investors constantly seek ways to maximise portfolio returns. One lesser-known but effective method for generating extra income is stock lending.

In short, stock lending is a practice that allows investors to loan out their shares in exchange for a fee, creating additional revenue without necessarily having to sell their positions.

Thus, how does it generate income, and who can participate in the increasingly popular 2025 trend?

What Is Stock Lending

Stock lending, or securities lending, is where an investor loans their shares to another party, typically through a brokerage or intermediary. In return, the lender receives a fee, commonly called the lending fee or interest. The borrower, often a hedge fund or institutional trader, uses the borrowed shares for various purposes, such as short selling, hedging strategies, or arbitrage opportunities.

The original owner retains many of the economic rights of ownership, such as price appreciation or loss. However, certain rights, like voting rights during shareholder meetings, may temporarily transfer to the borrower for the duration of the loan.

Large institutions have traditionally dominated stock lending. But in recent years, many retail brokerages have opened stock lending programs to individual investors, democratising access to this income-generating strategy.

How Does Stock Lending Works, and Who Can Participate?

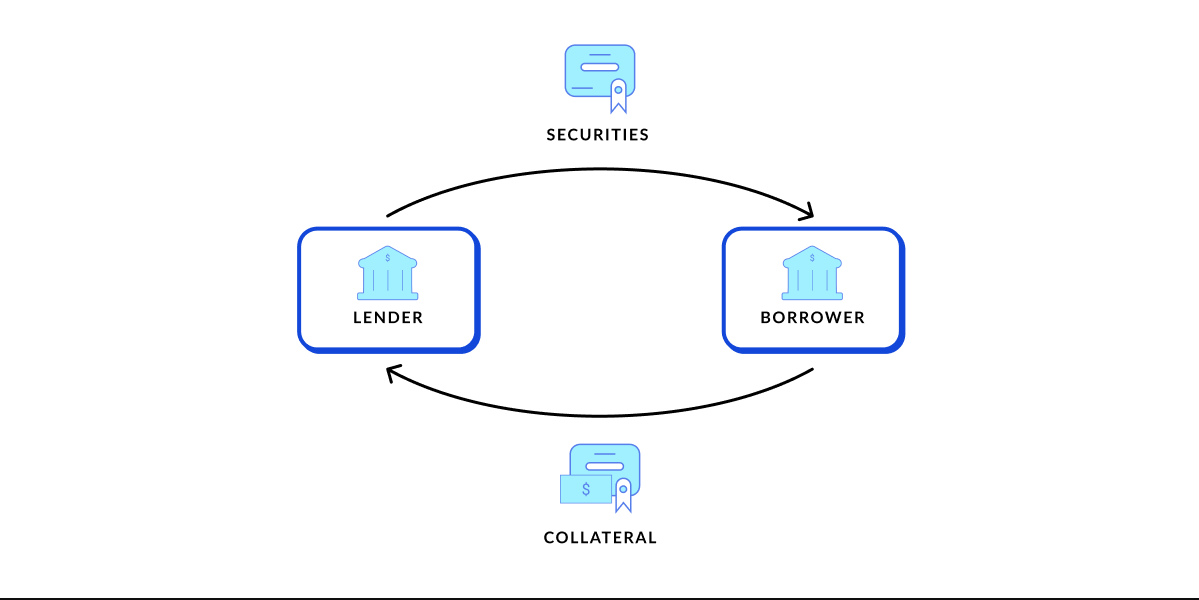

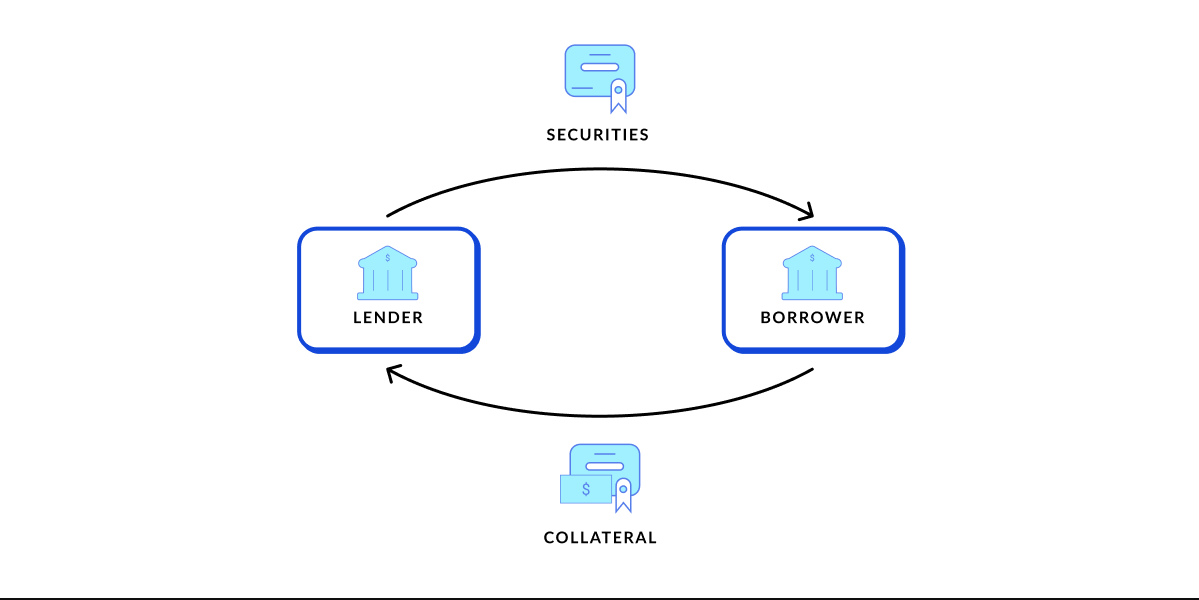

In a typical stock lending arrangement, several key steps occur:

The lender agrees to lend out specific shares to a borrower for a predetermined period or until either party decides to end the loan.

The borrower provides collateral worth more than the market value of the securities being borrowed, protecting against default risk.

The lender earns a fee for making the securities available.

The borrower uses the securities for their intended purpose, such as covering a short position.

At the end of the agreement, the borrower returns the borrowed securities to the lender, and the collateral is returned.

This process is often facilitated through custodians or brokerages that manage the operational and legal aspects, making it seamless for individual investors participating in stock lending programs.

As mentioned above, large institutional investors, such as pension funds, insurance companies, and mutual funds, dominated the stock lending market. However, retail investors now have increasing access to stock lending through brokerage firms.

Popular online brokerages such as Fidelity, Charles Schwab, Robinhood, and Interactive Brokers offer stock lending programs for individual investors. Participation typically requires agreeing to the broker's terms and conditions and understanding the specific program's structure regarding fee sharing and rights transfers.

How Stock Lending Generates Income

Stock lending generates income because borrowers are willing to pay fees to gain access to specific stocks. These fees vary depending on several factors:

Stock Demand: Hard-to-borrow stocks, often small-cap or heavily shorted companies, command higher lending fees.

Market Conditions: In volatile markets, demand for borrowing stocks can increase, raising lending fees.

Supply Constraints: If few shares are available for borrowing, fees may rise due to limited supply.

From the lender's perspective, this is a passive income opportunity. The investor still holds their position in the stock while earning additional revenue from the lending activity, enhancing overall portfolio returns.

Additionally, if the collateral is cash, lenders can invest that collateral in safe, short-term instruments and earn additional interest, boosting overall returns.

Current Trends in Stock Lending (2025)

In 2025, the stock lending market is still growing, fueled by increasing retail investor participation and broader adoption of alternative trading strategies.

Recent data shows that securities lending revenue globally reached over $10 billion in 2024, with technology and small-cap stocks being among the most in-demand assets. Hard-to-borrow stocks like GameStop and AMC Entertainment remain popular targets, often commanding lending fees over 10% annually.

Additionally, regulatory scrutiny has slightly increased, with stricter transparency requirements now imposed on brokers and financial institutions. It has led to more standardised reporting on lending activities and a better understanding of how retail investors utilise their shares.

Moreover, innovative financial products, such as tokenised securities and decentralised finance (DeFi) protocols, are beginning to offer alternative models for securities lending, though traditional brokers still dominate the space.

How to Start Stock Lending

Individual investors typically access stock lending opportunities through brokerage firms that offer lending programs. Participation usually involves the following steps:

Opt-In to the Program: Investors must agree to the broker's terms and conditions.

Selection of Eligible Securities: Not all securities may be eligible for lending. The brokerage selects based on liquidity and demand.

Collateral Handling: The broker typically manages the collection of collateral and ensures compliance with regulatory requirements.

Earning Lending Income: Investors receive lending fees, often credited monthly to their brokerage account.

Communication and Reports: Brokers provide detailed reporting so investors can track which securities are on loan, how much income they've earned, and other relevant information.

Some well-known brokerages that offer stock lending programs include Fidelity, Charles Schwab, Interactive Brokers, and Robinhood.

Benefits and Risks to Know

Stock lending offers several advantages for investors looking to optimise their portfolios:

Extra Income Stream: Stock lending provides returns beyond dividends and capital gains.

Portfolio Efficiency: It allows investors to earn passive income without selling shares or altering their investment strategy.

Enhanced Overall Returns: Over time, the incremental income from lending fees can contribute to better portfolio performance.

Accessibility: Many brokers handle all administrative tasks, making participation relatively effortless for the investor.

For long-term investors holding large positions, stock lending can generate "free" money from existing assets that would otherwise sit idle.

While stock lending presents compelling benefits, it is not without risks and trade-offs:

Loss of Voting Rights: Borrowers gain the right to vote on shareholder issues during the lending period, which can impact corporate governance if many shares are lent out.

Counterparty Risk: Though borrowers post collateral, there is always a minimal risk of borrower default or failure.

Manufactured Dividends: When a stock pays dividends while on loan, lenders typically receive a manufactured dividend, which could have different tax implications than qualified dividends.

Share Recall Risk: If a lender wishes to sell their shares or recalls them for any reason, it might take time to retrieve the loaned shares, potentially impacting liquidity.

Variable Lending Income: Lending fees are not fixed and may fluctuate based on market demand and supply dynamics.

Investors should weigh these risks carefully before participating and fully understand the terms of their brokerage’' stock lending program.

Conclusion

In conclusion, stock lending represents an exciting opportunity for investors to generate passive income from their portfolios.

However, it's crucial to understand the associated risks, including the temporary loss of voting rights, tax complications, and potential liquidity issues. Investors should carefully review their brokerage's lending program and consider their investment goals, risk tolerance, and tax situation before participating.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.