As long as you are in the financial industry, you will not be able to get around Wall Street, and you will be very familiar with the word investment banking. The first thing that strikes the average person when they talk about it is that the industry reeks of money. Whether it's the employees inside or the clients, it exudes money. But to say that it is specifically what it does and what the difference is between ordinary banks, I believe that many people cannot give a reason. To this end, this article will focus on the "investment banking is to do what" topic for you to do a comprehensive mystery.

What Investment Banking does?

It is also called an investment bank; in English, it is called an investment bank. Its main business is to help enterprises issue stocks and bonds and complete the process of financing in the capital market. To put it simply, it is an intermediary that helps enterprises raise funds. If you want to buy or sell a house, it is almost the same as looking for a real estate agent to find a suitable buyer or seller.

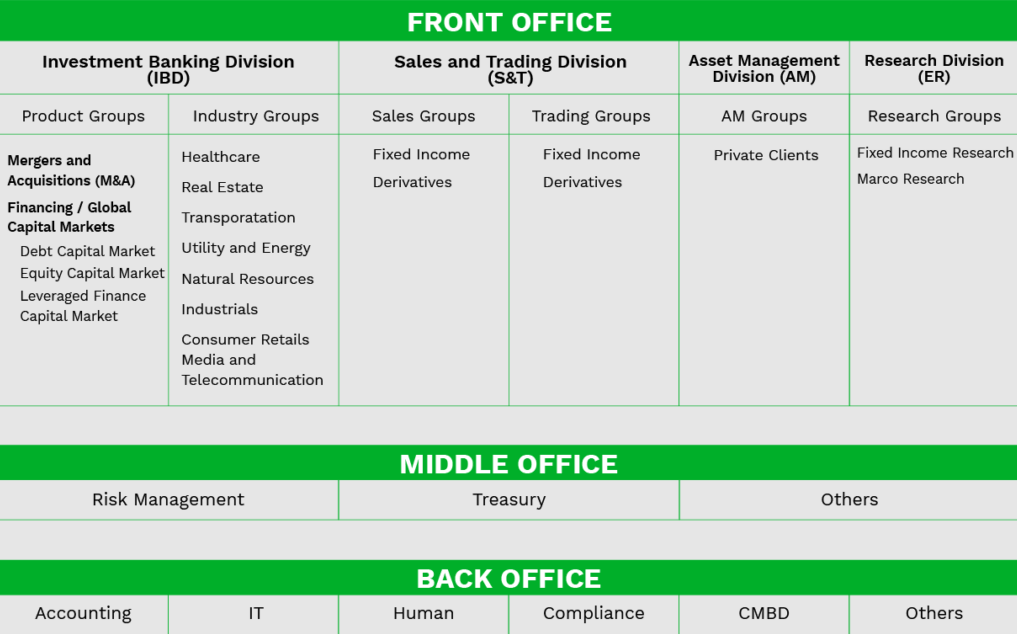

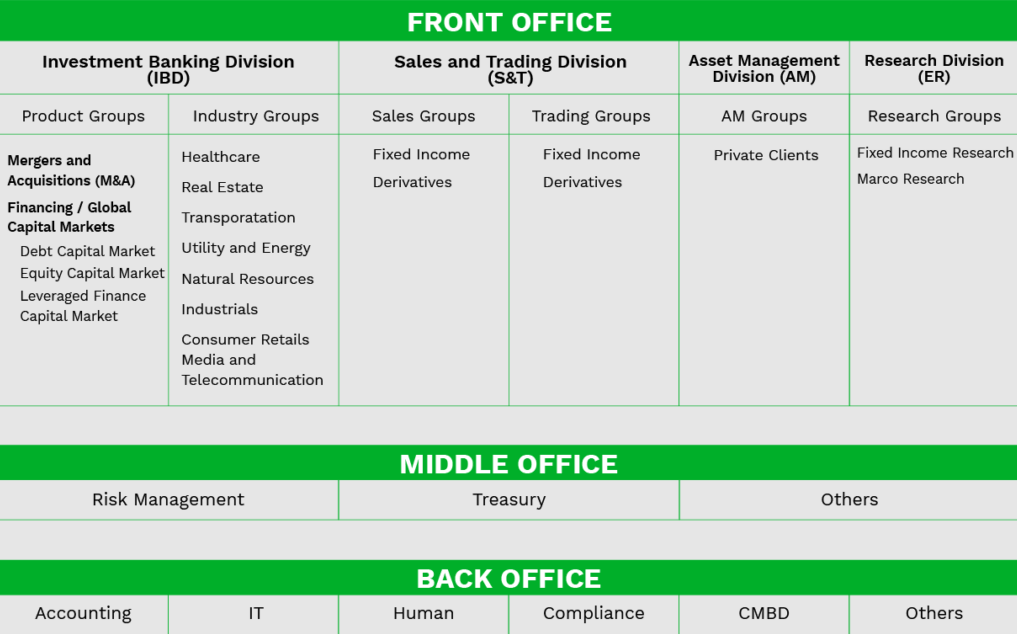

It began in the United States in the middle of the 19th century, when the U.S. economy was developing rapidly and traditional commercial banks could no longer meet the financing needs of the government and companies. With its emergence in this situation, it began to provide a variety of services for these organizations with financing needs. It has two divisions: the investment banking division and the marketing division.

The Investment Banking Division, or IBD for short, is responsible for the core business, which is the services related to the primary market. It is responsible for the core business, which is to provide services in the primary market, such as IPOs for corporations or government contractors, providing advice on offering prices and related information, or providing advisory services for asset restructuring and compatible mergers and acquisitions.

Some smaller investment banks specialize in just one or a few primary market-related services, such as the familiar Rothschild Family Investment Bank, which focuses on M&A advisory services.

The services of the market sector are all centered around secondary market transactions. The secondary market is the market for equity Securities and other derivatives, and the commodities traded in it originate in the primary market. Financing is achieved when a company issues new shares on the primary market, and the subsequent trading of the shares has no impact on the amount of money raised by the company.

Commodities on the secondary market are traded in this sector, in addition to the traditional bonds and equities and foreign exchange, as well as a large number of complex derivatives and risk-avoidance products created in accordance with the needs of clients.

The positions of the salespersons in this department are categorized as front, middle, and back office. Positions close to clients are in the front office, such as traders and sales of financial products. Also, departments that provide pricing and analysis for trading are often classified as front-office traders. As well as departments that provide ancillary support to sales, they are referred to as the middle or back office. This includes everything from risk control, risk analysis, product control, and so on.

In order to prevent conflicts of interest between the primary and secondary markets, there is a firewall between the two. This means that analysts in the secondary market do not have access to the analytical reports of analysts in the primary market. The business of the primary market and the secondary market combined is the investment banking business in a broad sense. Some of the most familiar large investment banks are involved in the primary and secondary markets, such as JP Morgan, Stanley, Goldman Sachs, and so on.

Investment Banking Job Levels and Salaries

|

Position

|

Promotion Timeline

|

Base Salary (USD)

|

Total Compensation (USD)

|

|

Analyst

|

2 -3 years |

80K – 100K |

150K – 200K |

|

Associate

|

2 – 3 years |

150K – 180K |

250K – 400K |

|

Vice President

|

5 years with a strong performance |

200K – 300K |

500K – 700K |

|

Director/Principal/Senior Vice President

|

5 – 10 years |

250K – 350K |

500K – 1000K |

|

Managing Director

|

|

450K – 600K |

1000K+ |

Investment Banking Business

If a privately owned company wants to do an IPO to go public, investment banking comes in the form of a financial advisor. It helps the company get listed on the stock exchange by ringing the bell and issuing securities to raise funds. In this process, the investment bank assists the company in making an IPO, introducing the privately owned company to the stock market.

And in this process, its company is to provide advice. For example, the investment bank has to help the company decide how many shares it wants to issue. If the company wants to raise, say, $3.3 billion, the investment bank needs to help analyze roughly how many shares to issue, how much to price each share, and so on.

Or if the company wants to go public, the investment bank can also act as an underwriter. Underwriters are called underwriters, which means that the investment bank participates in the process of issuing new shares or bonds by assuming a certain number of securities and is responsible for introducing them into the market.

That is to say, the issuer enters into an agreement with the underwriter, and then the underwriter will help the issuer to assist in the public offering of these securities throughout the entire process of issuing securities or bond stocks, in which the investment bank has to be involved in every small step of the process.

In addition to public offerings of securities to help finance companies, it can also do private placements. A private placement means that instead of publicly offering the company's stock to raise money, it chooses to sell it privately to some large organization. For example, going directly to large corporations like Alibaba or Facebook and having them invest in the company to become major shareholders in the company.

The advantage of a private placement over an IPO is that you don't have to be subject to a lot of restrictions, i.e., you don't have to go out to the public. Naturally, you don't have to make your financial statements public or constantly disclose legal documents. Since it is only financing for a private company, the information only needs to be sent to the important investors. Comparatively speaking, IPOs are more strictly regulated.

Apart from financing, investment banks can also go for mergers and acquisitions, which means merging two or more companies into one. There are actually two types under this concept, which are mergers and acquisitions. Mergers generally refer to the integration of two larger companies or two companies in different industries, which then form a more complete industrial chain. Whether horizontally or vertically, the two companies can gain more market share when they merge.

There is another situation where a larger group and a newly developed or smaller company. But the larger company appreciates the business philosophy of the smaller company more, and then the larger company buys the smaller company, which is called an acquisition. After the acquisition is completed, the small company is equivalent to no more, and after that, only the big company appears.

The Differences with Investment Banks anf Traditional Banks

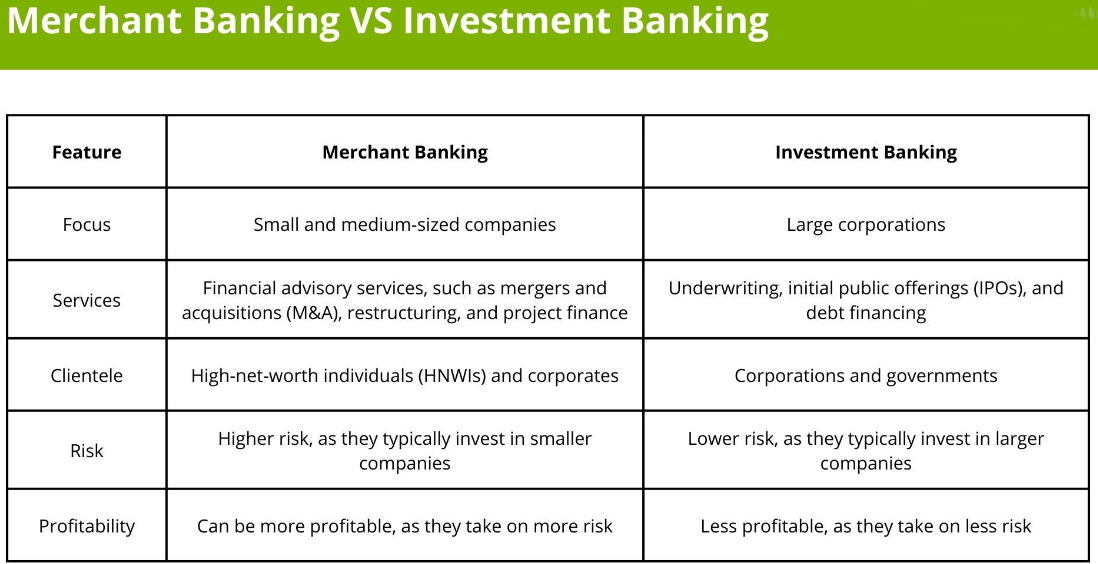

There are two different types of organizations in the financial system, and there are some obvious differences in their functions, business models, and service targets.

Among them, commercial banks mainly provide traditional banking services, including deposits, loans, credit cards, payment services, and so on. Their main business is to receive deposits, provide loans to customers, and offer a variety of payment and savings products. Investment banks are mainly engaged in advanced financial services related to the capital market, including securities underwriting, corporate finance, mergers and acquisitions, restructuring, and asset management. Their operations are more complex and usually involve large transactions and high-risk financial activities.

Commercial banks serve a wide range of social groups through the provision of retail banking services, mainly to individuals, households, and small to medium-sized enterprises. Investment banks, on the other hand, serve large corporations, government agencies, and institutional investors and provide services to clients who require sophisticated financial services and advice.

The business model of commercial banks relies heavily on deposit-taking and loan-granting, earning profits through the spread between deposits and loans. In addition, commercial banks earn fees by providing other financial services, such as credit cards and payment services. The business model of investment banks is much more diversified, including securities underwriting, trading, and asset management. Their source of profit is to earn commissions and spread them through underwriting, trading, and providing advanced financial services.

The business of commercial banks is relatively more traditional, with the main risks coming from credit risk and market risk. Its loan portfolio and deposit business are relatively stable. The business of investment banking is more complex and usually involves a higher level of risk. These include market risk, credit risk, operational risk, etc., and are particularly high when participating in the block trade and derivatives markets.

Commercial banks are subject to relatively stricter and more robust regulation, with regulators typically overseeing their capital levels, risk management, and compliance. Investment banks are also regulated, but the regulatory requirements can be relatively more complex. This is because they need to meet higher capital requirements and face more stringent regulatory requirements to ensure their sound operations.

That is, commercial banks are primarily engaged in traditional retail banking services, while investment banks focus on providing advanced financial services and participating in capital market activities. In some financial institutions, the functions of the two may intersect, but they largely maintain their distinctive characteristics.

Differences between Investment Banks and Brokerage Firms

They are two entities with different functions and operations in the financial sector, and while they may overlap in some respects, they are also distinctly different in many respects. The main differences between them are in their functions, client base, business focus, sources of revenue, and regulatory requirements.

Investment banks are intermediaries for the capital market activities of corporations and governments, providing fundraising, trading, and investment services. The main function of a brokerage firm is to act as an intermediary in trading by providing services to clients in the purchase and sale of financial instruments such as stocks, bonds, and derivatives. Brokerage firms may also provide research reports, investment advice, and other related services.

The main service targets of investment banks are large corporations, government agencies, and institutional investors, and they deal more with large clients in underwriting securities, mergers and acquisitions, and other businesses. Brokerage firms serve individual investors, institutional investors, corporations, and other brokerage firms, and they serve a wide range of client groups by providing them with trading platforms and investment services.

Investment banks focus on advanced financial services such as capital markets, corporate finance, and mergers and acquisitions, with a greater emphasis on the provision of specialized financial advice and complex transaction services. The business of brokerage firms focuses on securities trading, including the purchase and sale of stocks, bonds, and futures.

The main sources of income for investment banks include underwriting fees, advisory fees, trading spreads, asset management fees, etc. It is usually able to earn higher service fees when providing advanced financial services to its clients. The main sources of income for brokerage firms include trading commissions, management fees, interest spreads, etc. It earns income by providing trading services and asset management services to its clients.

In terms of regulatory intensity, investment banks will be subject to stricter regulation due to the complex financial transactions and operations in which they are involved. Regulators typically require them to meet higher capital requirements and transparency standards. Brokerage firms are also regulated, but their regulatory requirements are likely to be more flexible because they are primarily engaged in relatively traditional financial activities such as securities trading.

That is, investment banks are more focused on advanced financial services, whereas broker-dealers are more focused on providing securities trading services to a broad range of clients.

Top 10 Investment Banking Firms

|

Best Investment Bank

|

Bank of America Securities

|

|

Best Equity Bank

|

CITIC Securities |

|

Best Debt Bank

|

J.P. Morgan |

|

Best M&A Bank

|

Morgan Stanley |

|

Best Bank for IPOs

|

Citi |

|

Best in Emerging Markets

|

Bradesco BBI |

|

Best in Frontier Markets

|

Absa |

|

Best Investment Bank for Sustainable Financing

|

Societe Generale |

|

Best Multilateral Finance Institution

|

African Development Bank |

|

Best Bank for Client Facing Technology

|

Nedbank |

|

Best Bank for New Financial Products

|

BTG P actual |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.