In 2025, the exchange rate between the U.S. dollar (USD) and the Colombian peso (COP) has experienced significant volatility, influenced by global economic shifts, domestic political developments, and commodity price fluctuations.

As of April 16, 2025, the Dollar vs Colombian Peso exchange rate is at approximately 4,329.90, reflecting a dynamic interplay of factors affecting both currencies.

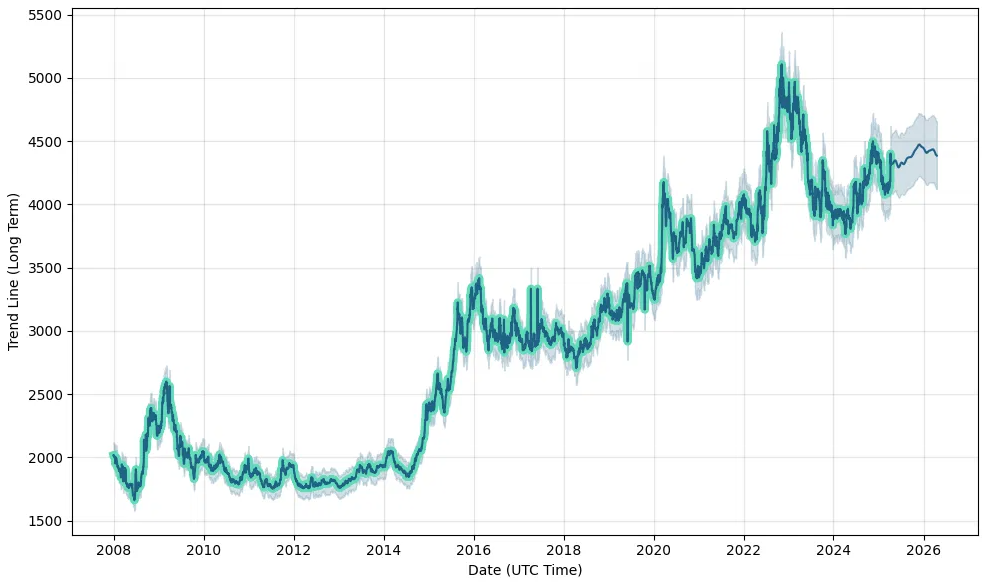

Dollar vs Colombian Peso History

For decades, the Colombian peso has generally depreciated against the U.S. dollar, reflecting broader trends seen in many emerging market currencies due to inflation differentials, capital outflows, and shifts in investor sentiment.

In the early 2000s, the exchange rate hovered around 2,000 COP per USD. As global oil prices surged, Colombia's peso experienced moderate appreciation, particularly between 2003 and 2014, benefiting from increased revenues from oil exports. However, this trend reversed sharply in 2014–2015 when crude oil prices collapsed globally. As Colombia is a significant oil exporter, the drop in oil revenues weakened the country's trade balance and fiscal stability, causing the peso to slide rapidly against the dollar.

The COVID-19 pandemic in 2020 triggered another wave of peso depreciation, with the USD/COP rate reaching record highs near 4,200 COP as risk aversion drove capital to safe-haven assets like the U.S. dollar. Subsequent inflationary pressures and interest rate hikes in the United States further strengthened the dollar globally, putting additional downward pressure on the peso.

Since 2022, the Colombian peso has experienced sharp fluctuations due to a combination of factors, including domestic political uncertainty, reforms introduced by the Petro administration, and volatility in global oil markets. Despite some short-term rebounds due to improved oil prices or strong investor interest in emerging markets, the peso's long-term trajectory has generally been one of devaluation relative to the dollar.

In 2025, the exchange rate remains sensitive to shifts in U.S. monetary policy, Colombian central bank actions, and the country's political environment. The peso's historical volatility serves as a reminder of how interconnected Colombia's economy is with global financial flows and commodity markets, particularly oil, which remains a cornerstone of the country's export profile.

Recent Dollar vs Colombian Peso Exchange Rate Trends

As mentioned above, the USD/COP exchange rate has seen notable fluctuations in recent months. In early April, the rate reached a high of 4,456 COP per USD, influenced by global trade tensions and shifts in commodity prices.

Subsequently, the rate declined, reaching a low of 4,066.70 COP per USD in late February. Moreover, the rate fluctuated between a high of 4,470 COP on April 9 and a low of 4,257.79 COP on April 14, indicating a dynamic and responsive currency market.

The average exchange rate for 2025 stands at approximately 4,201.87 COP per USD. These movements underscore the Colombian peso's sensitivity to international and domestic economic developments.

Factors Influencing the Exchange Rate

Several key factors have contributed to the volatility of the USD/COP exchange rate in 2025.

Firstly, global trade dynamics have played a significant role. United States' implementation of new tariffs, including a 10% tariff on Colombian exports, has impacted investor sentiment and trade flows, leading to fluctuations in the exchange rate.

Secondly, commodity prices, particularly oil, have influenced the Colombian peso. As oil constitutes a substantial portion of Colombia's exports, changes in oil prices directly affect the country's trade balance and, consequently, its currency value.

Thirdly, domestic political developments have added to the uncertainty. The resignation of Colombia's finance minister and challenges in passing the national budget have raised concerns about fiscal stability, contributing to currency volatility.

Economic Indicators and Monetary Policy

Colombia's economic indicators provide additional context for the exchange rate movements. Inflation has been on a downward trend, with the annual rate decreasing to 5.41% in October 2024, down from 10.48% the previous year. This decline suggests price stabilisation, which can influence monetary policy decisions.

The central bank's interest rate policy also affects the exchange rate. Projections indicate a gradual reduction in the policy interest rate to 7.75% by the end of 2025. Lower interest rates can lead to currency depreciation, as they may reduce foreign investment inflows seeking higher returns.

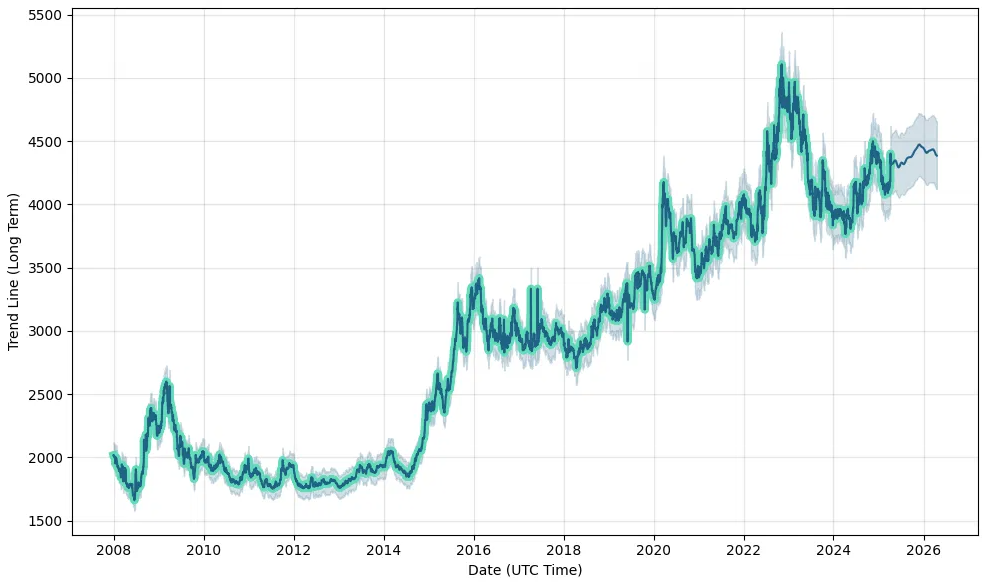

Forecasts and Future Outlook

Looking forward, various forecasts provide insights into the potential trajectory of the USD/COP exchange rate. Some analysts project that the exchange rate could reach approximately 4,350 COP per USD by the end of 2025, with further depreciation to around 4,230 COP per USD by December 2026. These projections are based on expectations of continued economic adjustments and stabilisation efforts.

However, other forecasts suggest a potential for further depreciation of the Colombian peso. For example, ongoing fiscal challenges, political uncertainty, and external economic pressures could contribute to a weaker currency. In this scenario, the exchange rate may exceed 4,500 COP per USD, depending on the severity of these influencing factors.

Conclusion

In conclusion, the USD/COP exchange rate 2025 reflects a complex interplay of global economic conditions, domestic political developments, and commodity price fluctuations.

While efforts to stabilise the economy and reduce inflation are underway, remaining challenges could still influence the currency's value. Investors and policymakers must closely monitor these factors to navigate the evolving economic landscape and make informed trade, investment, and monetary policy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.