In the investment world, people are keen to look for "windfalls." In finance, traders should follow trends. There is a saying that the easiest way to make money is to follow the trend. But how to follow the trend depends on the trend analysis! In this article, we will come together to understand how to do trend analysis.

What is Trend Analysis?

Trend analysis is a method of identifying and understanding market trends and patterns by studying and analyzing data such as historical prices and volumes in trading markets. This analysis aims to reveal the relationship between market behavior, the psychology of market participants, and market forces so that investors and analysts can make more informed investment decisions.

Its objectives include identifying trends, determining buy and sell points, analyzing market sentiment, and developing investment strategies. It means revealing short-term and long-term trends in the market, including upward, downward, or sideways. And by identifying turning points in the trend, it determines the time to buy or sell. The sentiment and expectations of market participants are then analyzed by looking at indicators such as price movements and trading volumes. Finally, based on the analysis of the market trend, the appropriate investment strategy is formulated, including the selection of the underlying investment, setting stop-loss and take-profit points, and so on.

Simply put, in the financial market, whether it is foreign exchange, stocks, or futures, At first, investors will hold a critical eye to see, and when the price begins to rise, investors will start to get excited, and then all investors will begin to pay attention. This time, the participants in the market will begin to greed until the people who enter the market are finished. If there are no more people to buy, then this is the top of the market because there are no more people coming into the market to push the price higher.

And by this time, if the market suddenly gets bad news, investors will panic and sell. Those who can't get out in time will expect the market to rally, and eventually all of them will be desperate. At this time to get out of the market and all gone, there is no one to sell when this is the bottom of the market. At this time, whether the price is rebounding or starting to rise, investors will begin to excite the entry and start another trend cycle.

So for an investor to make money based on a trend, the first thing they need to do is discern whether it is an uptrend or a downtrend. Generally, price trends have a low and a high. When the price continues to make new highs and none of them fall below the previous lows, it means that it is in an uptrend. Generally, in an uptrend, it's all about going long. And in a downtrend, it's when the price keeps making new lows and the price highs can't break the previous highs. And then, when in a downtrend, it's generally looking for opportunities to go short.

It should be noted that the trend of trading also needs to pay attention to the cycle; Generally speaking, if the general trend is upward, you can find in the small cycle more trading opportunities. And in addition to rising and falling, there is a consolidation period; this time the price is like in the box up and down, left and right. Investors can go long or short, or you can also wait to break out of the box and then look for opportunities to enter the market.

Trend Analysis Terminology

|

Nouns

|

Interpretation

|

|

Trend analysis

|

Analyzing historical data to discern long-term trends and patterns. |

| Moving Average |

Calculate average prices over time to create smoother trend lines. |

| Technical Analysis |

Analyzing price and volume data with charts to predict market trends. |

| Fundamental Analysis |

Evaluating investment value through financial health and economic indicators. |

|

Time Series Analysis

|

Analyse patterns of data over time using time-dependent statistical methods. |

|

Trend Lines

|

A line or curve connecting data points to illustrate trend direction. |

|

Relative Strength Index

|

Relative performance indicator. |

|

Markov Chain

|

Transition probability model for time series analysis. |

|

Volatility

|

Volatility measure for risk assessment and derivatives pricing. |

|

Trend Reversal

|

An indication of a change in the direction of a market trend. |

Trend Analysis Methodology

It covers a variety of methods and techniques for understanding and predicting trends in the financial markets. Two of the main methods are technical analysis and fundamental analysis.

Technical analysis is an attempt to predict future price movements based on quantifiable data such as market prices and trading volumes by drawing charts using technical indicators and pattern recognition. Traders who emphasize technical analysis believe that all the information in the market is already reflected in the prices and therefore study the price movements to reveal the inner workings of the market.

Fundamental analysis, on the other hand, focuses on the intrinsic value of a financial asset and assesses the long-term potential of the asset by examining factors such as the financial position of the relevant company, economic indicators, and industry conditions. It focuses on the assumption that the market may underestimate or overestimate the true value of an asset during certain periods.

Technical analysis is a method of identifying and predicting market trends by analyzing chart data such as historical prices and trading volumes. Common methods of technical analysis include chart pattern analysis, moving averages, the Relative Strength Index (RSI), and Bollinger bands.

Predicting price trend reversals by looking at Chart Patterns such as head-and-shoulder tops and double-top bottoms. Smoothing price data using moving averages helps identify trend direction. Assess the overbought or oversold state of a market by measuring the relative magnitude of price movements. Demonstrates the volatility of price movements by calculating the standard deviation of prices, helping to determine whether the market is over- or under-valued.

Fundamental analysis looks at the fundamentals of the economy, companies, and industries and how they affect market trends. Common methods of fundamental analysis include financial statement analysis, macroeconomic analysis, and industry analysis.

Financial statement analysis analyzes a company's financial statements, including the income statement, balance sheet, and cash flow statement, to assess the health of the company. Macroeconomic analysis looks at the state of the overall economy, including factors such as GDP, inflation, and interest rates, in order to understand the macroeconomic impact on the market. Industry analysis examines the trends and dynamics of specific industries to identify investment opportunities and risks.

Quantitative analysis uses mathematical and statistical methods, as well as computer models, to analyze large amounts of financial data. This includes algorithmic trading, Statistical Arbitrage, volatility analysis, etc.

Algorithmic trading refers to the use of Automated Trading algorithms to execute trading strategies based on predefined rules and models. Statistical arbitrage is a strategy that exploits pricing differences in the market to make profits based on statistical models. Volatility is the degree of fluctuation in price movements in financial markets; analyzing it helps identify the level of uncertainty and risk in the market.

Event-driven analysis focuses on specific events in the market that may affect asset prices, such as corporate earnings reports, political events, etc. Unstructured data, such as social media and news reports, is used to analyze the sentiment state of the market and consider the emotions and behavior of market participants. Trend-following strategies attempt to capture and follow market trends, while trend-reversal strategies attempt to trade when a trend reverses.

These methods can be used individually or in combination, and the exact choice depends on the investor's or trader's preferences, risk tolerance, and market conditions.

Types of trends

Types of trends

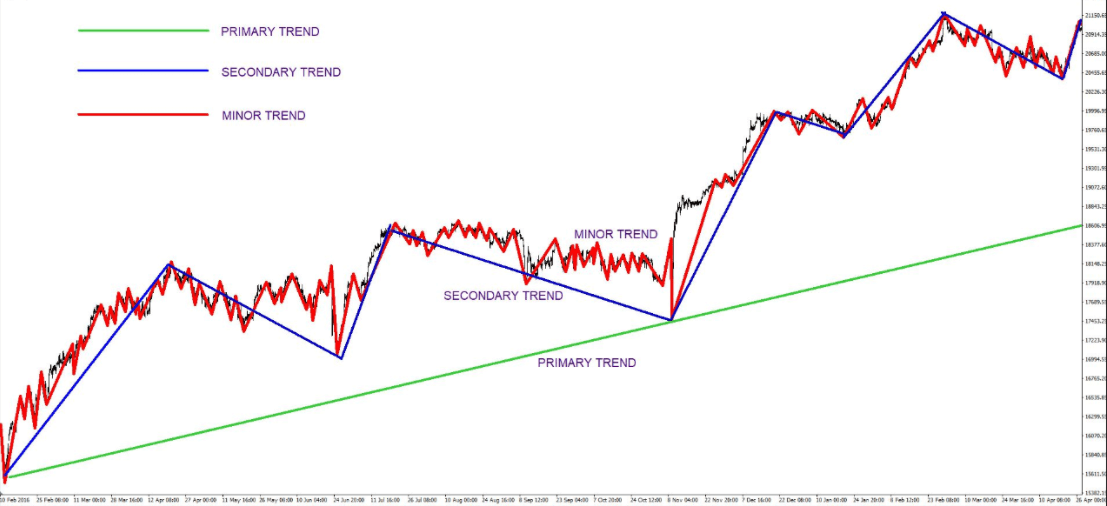

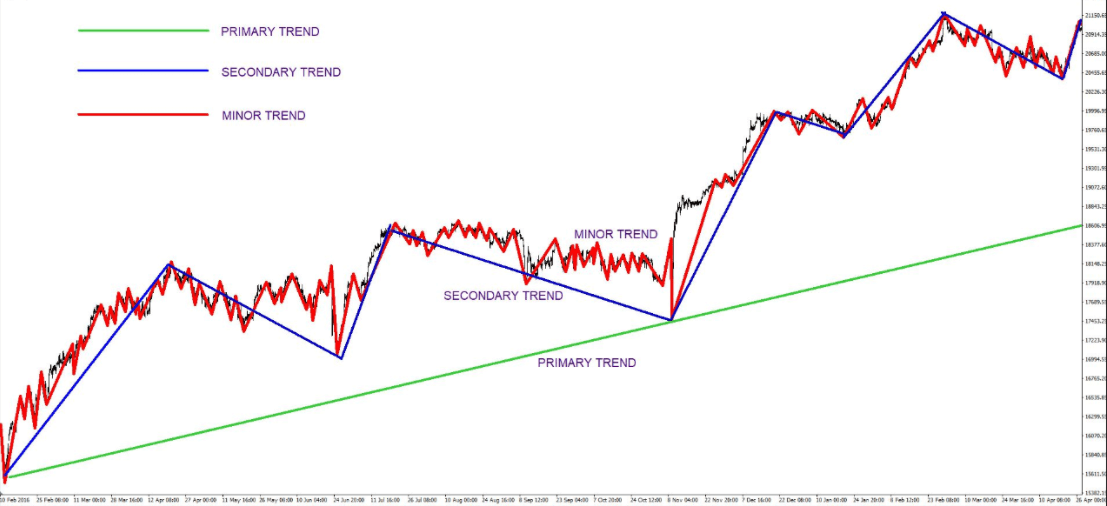

There are three types of trends: major, minor, and subtrends.

Major trends are extended upward or downward movements that last for a longer period of time, also known as uptrends and downtrends. It is also a series of higher highs and higher locations, and a series of lower lows and lower highs.

Secondary trends, also known as intermediate trends, are related corrections that interrupt the price evolution in the direction of the primary trend. In a primary uptrend, the secondary trend will be a downward move, also known as a retracement. In a major downtrend, the secondary trend will be an uptrend, also known as a rally.

Minor trends are short-term fluctuations of lesser importance. Such trends usually contain a lot of market noise, and it is generally not recommended to trade at this stage. And excessive focus on short-term fluctuations will detract from analyzing the major trend.

Creating a Trend Analysis Chart

It involves choosing the right type of chart, collating and entering financial data, adding trend lines, and other important elements. In the case of Forex, for example, technical analysis tools and chart patterns can be used to depict the price action of a currency pair, with the following general steps:.

First, select the currency pair of interest, such as EUR/USD (Euro/Dollar), USD/JPY (Dollar/Japanese yen), etc. The choice of currency pair usually depends on investment objectives and market concerns. Then decide on the time frame to be analyzed, e.g., a daily chart, a 4-hour chart, a 1-hour chart, etc. Different time frames are suitable for different Types of Traders and investors. Short-term traders may be more concerned with shorter time frames, while long-term investors may be more concerned with longer time frames.

Using a forex trading platform or charting software, real-time price data is obtained for the chosen currency pair, and the corresponding charts are generated. Then identify trends in the price action and add trendlines to the chart using the trendline tool. Trend lines should connect lows or highs on the price chart to show the direction of the trend.

Moving averages are added to smooth out price data and help identify the direction of the trend more clearly. Common moving averages include the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Or consider adding common technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), etc. to provide additional market signals and confirmation.

Label possible chart patterns such as head and shoulders tops, double tops/double bottoms, triangles, etc., which may provide clues about future price movements. And identify support and resistance levels on charts that may have an impact on price. Support and resistance levels are usually horizontal lines or zones that reflect key levels in the market.

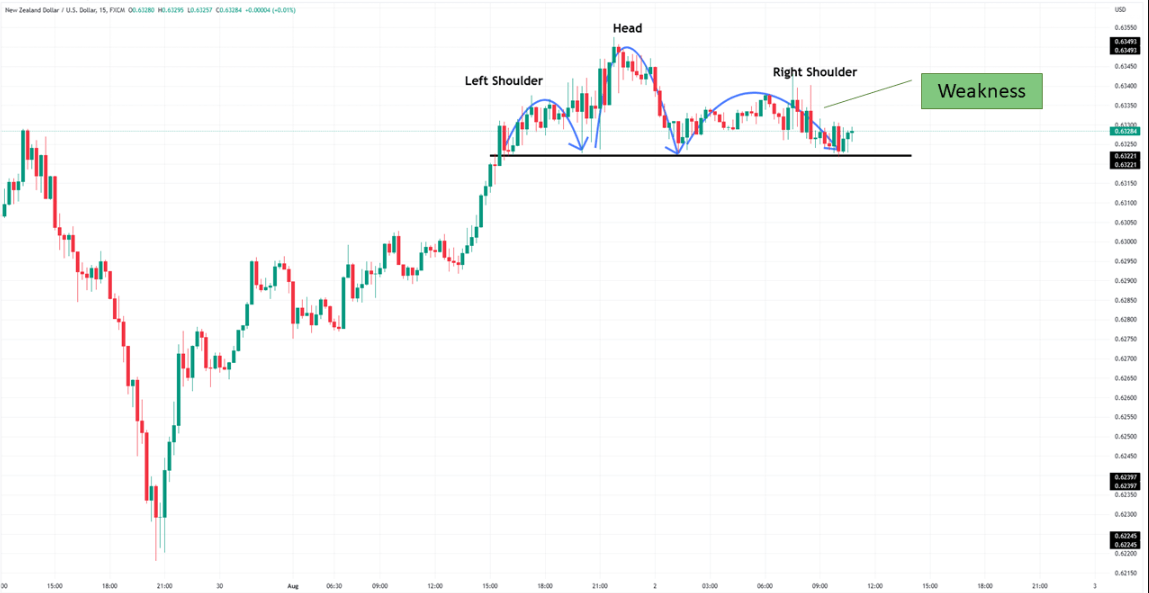

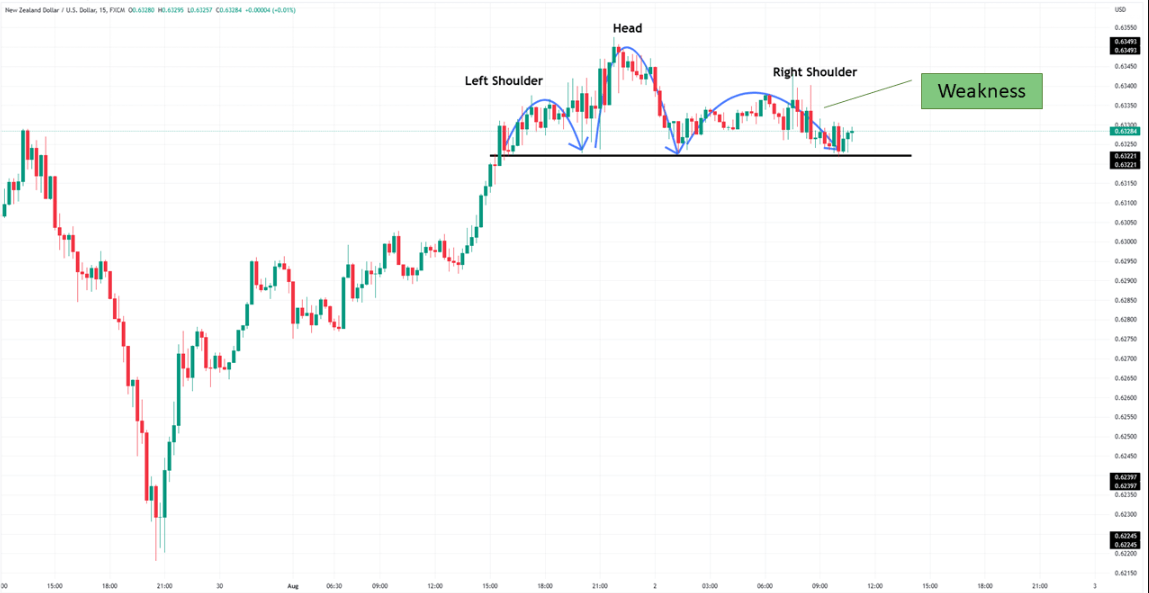

A typical head and shoulders top pattern is shown above; in this case, it is a trend exhaustion pattern. The market is in a mature uptrend and has been trending higher for a long time. From the left shoulder to the head, prices make higher highs. However, the distance between the two higher highs is very short and already indicates trend weakness.

From the head to the right shoulder, Price shows extreme weakness. The price is unable to make higher highs, and it is trading sideways for a longer period of time. These are not signals that indicate a high likelihood of the bullish trend continuing.

Update the charts regularly, and watch for changes in the trend and possible turning points. Adjust the analysis to accommodate changes in the market. Develop a trading strategy based on the results of the analysis and other market signals, including determining when to buy, sell, or hold.

Advantages of Trend Analysis

It has a number of advantages that have made it one of the most commonly used analytical tools in finance. Firstly, it provides insights into market behavior by analyzing historical price and volume data. This helps in understanding the balance of power between buyers and sellers in the market.

It can help identify long-term trends in the market, including upward, downward, or sideways movements. This is important for developing investment strategies and finding entry and exit points. And it helps to analyze market sentiment and expectations. Investors can determine the sentiment of market participants by looking at indicators such as price action and trading volume.

This is often done using simple and intuitive methods such as chart patterns and trend lines, making it relatively easy for investors to understand and apply this analytical tool. It is also often possible to generate Trading signals, such as trendline breakouts and moving average crossovers, to provide investors with a basis for buying or selling decisions.

As a relatively universal methodology, it is applicable to different types of financial markets, including the stock market, foreign exchange market, commodity market, etc., and can enable investors to better understand market risks and take appropriate risk management measures to avoid potential losses.

It can also be applied to different time frames, allowing investors to analyze the market from both short-term and long-term perspectives to gain a more comprehensive understanding of market conditions. For long-term investors, it provides tools to identify investment opportunities and market risks and helps develop long-term investment strategies.

In addition to these advantages, it has some limitations, including the handling of future uncertainty and sensitivity to unexpected events. Therefore, when using trend analysis, investors usually also need to incorporate other methods and consider global factors.

Trend analysis and forecasting

|

Distinctions

|

Trend Analysis

|

Prediction

|

|

Definition

|

Analyze past data for trends. |

Predict future trends or events. |

|

Timeframe

|

Analyzes past data for current and future trends. |

Predicts future events or trends. |

|

Methodology

|

Analyzes data with charts and moving averages. |

Spots trade opportunities via trend analysis. |

|

Purpose

|

Identify market trends for strategic investments. |

Forecasting for decision-making and planning. |

|

Examples

|

Spots trade opportunities via trend analysis. |

Predicting earnings growth for stock investment. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Types of trends

Types of trends