The Japanese yen jumped higher after a sharp decline to 160.00 per dollar at

the end of April, but the rally only last for less than a week, raising the

prospect of another bout of weakness in the currency.

Japanese officials declined to confirm if they had acted. A Bloomberg

analysis of the current account suggests the nation probably entered the market

twice in the first week of this month.

Japan's forex reserves decreased to $1.14 trillion in April, largely on the

back of drop in the holdings of foreign securities. Hedge funds turned

increasingly bearish despite the sign of interventions.

Leveraged fund was re-entering bets the yen will slump back toward 160

through one-to three-month reverse knock-out call-option contracts, according to

option traders.

"The market is betting that USD/JPY is now stuck in a range with topside

capped at 160 by the authorities," said Ruchir Sharma, global head of FX option

trading at Nomura International Plc.

He sees the currency pair's downside being limited to around 152 by onshore

demand for the greenback from retail investors and importers with real dollar

needs.

More hikes

Vanguard Group and PIMCO see three quarter-point hikes by the BOJ in the

cards this year, suggesting the market's pricing is too conservative. Goldman

Sachs expects interest rates rising to 1.5% by 2027.

"We think markets are underpricing the BOJ," Ales Koutny at Vanguard said. "They understand that the only way to really get out of that is for Japan to

send a fairly hawkish message."

He also said the currency will only manage a "continuous bullish move" towards 100 per dollar if the global economy sees a significant slowdown,

prompting Japanese investors to reduce their foreign asset exposure.

A BofA survey published showed more than half of respondents see the yen

heading back to 160 or higher. Just under one third see it stabilising at around

155, while none foresee a reversal to 150.

Yue Bamba, head of Japan active investments at BlackRock, believes the yen

may gradually weaken to the 170 range without Fed’s rate cuts while a level of

130 to 135 is “entirely conceivable” the other way round.

The yen's fair value is "much higher" than the current levels and "easily in

the 130s." If the yen strengthens past 150, overseas investors will feel

comfortable coming back to the market, he said.

The BOJ offered to purchase a smaller amount of JGBs in a regular operation

on Monday than it did on 24 April. Bamba expects the central bank to potentially

hike in July or October after reducing bond purchases.

Little leeway

Japan's government and central bank should start targeting the level of

120-130 per dollar to give businesses greater operational flexibility, according

to Ken Kobayashi, chairman of the Japan Chamber of Commerce and Industry.

"Small and medium-sized companies are already in a very tough spot with the

yen sticking around 150 to the dollar," he said, citing small businesses' struggle to pass labour costs onto customers.

But he added, it would be difficult for the BOJ to make a sharp move anytime

soon considering companies' financing issues and the potential impact on the

economy.

BofA strategist Alex Cohen sees potentially coordinate efforts that involve

the US warranted only if there's "excessive volatility or disorderly and

illiquid conditions in markets."

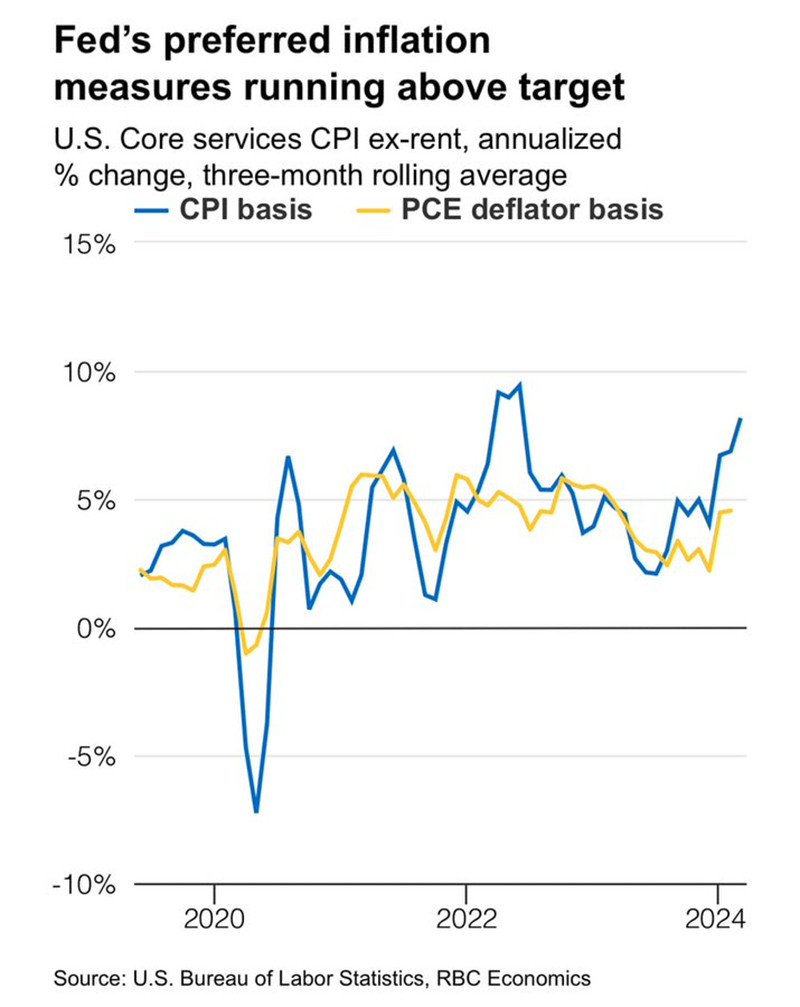

The tacit approval of Japan's unilateral activity seems to be the most the

US Treasury is willing to concede at present as a weaker dollar could stand in

the way of the Fed's inflation fight.

The finance ministers of the US, Japan and South Korea agreed a month ago

that the countries will step up efforts to consult closely on forex market

developments at their first such trilateral meeting.

Still Treasury Secretary Janet Yellen on Monday expressed her mild

disapproval of government intervention in the market. "We believe that it should

happen very rarely," she said.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.