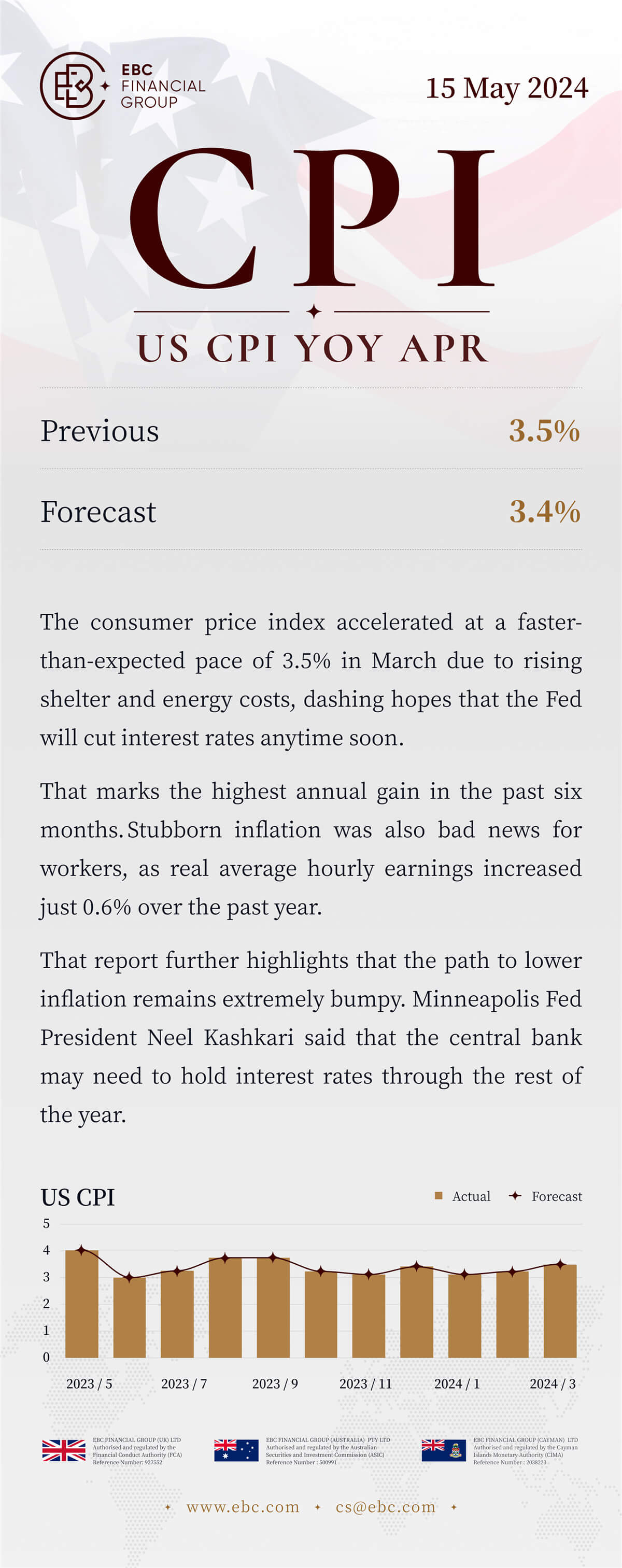

US CPI April, 15/5/2023 (Wed)

Previous: 3.5% Forecast: 3.4%

The consumer price index accelerated at a faster-than-expected pace of 3.5%

in March due to rising shelter and energy costs, dashing hopes that the Fed will

cut interest rates anytime soon.

That marks the highest annual gain in the past six months. Stubborn inflation

was also bad news for workers, as real average hourly earnings increased just

0.6% over the past year.

That report further highlights that the path to lower inflation remains

extremely bumpy. Minneapolis Fed President Neel Kashkari said that the central

bank may need to hold interest rates through the rest of the year.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.