The passage of Trump's One Big Beautiful Bill Act marks a seismic shift in US economic policy, with sweeping changes to taxation, government spending, and social programmes.

As markets digest the implications, investors and analysts are focused on the bill's winners, losers, and the broader impact on growth, deficits, and sector performance.

8 Key Market Takeaways from the Big Beautiful Bill Act

1. Permanent Tax Cuts for Individuals and Corporations

The Act makes the 2017 tax cuts permanent for both individuals and businesses, preventing their scheduled expiry at the end of 2025. This includes:

-

Corporate tax rate: Maintained at 21%.

-

Individual tax rates: Lowered across most brackets, with the standard deduction for families increased to $31,500.

Child tax credit: Raised to $2,200, benefiting over 40 million families.

Impact:

The Tax Foundation estimates these changes will add $4 trillion in net tax cuts over the next decade, with the top 1% of earners in states like Texas and South Dakota seeing annual tax savings exceeding $10,000.

2. No Federal Tax on Tips and Overtime

Fulfilling a major campaign promise, the Act eliminates federal taxes on tips and overtime pay. This measure is expected to benefit millions of service and hourly workers, increasing take-home pay and supporting consumer spending.

3. SALT Deduction Cap Raised

The state and local tax (SALT) deduction cap rises from $10,000 to $40,000 for married couples earning up to $500,000. This change is particularly significant for high-tax states such as New York, California, and New Jersey.

4. Spending Shifts: Defence, Border, and Social Programmes

The bill enacts major spending reallocations:

-

Defence spending: Increased by $153 billion over 10 years.

-

Border security: Receives a $178 billion boost.

-

Fossil fuel incentives: Expanded, while clean energy and climate programmes are scaled back.

Medicaid and SNAP: Stricter work requirements and increased state contributions, with spending cut by up to 18% for Medicaid and 20% for SNAP.

5. Winners and Losers

Winners:

-

High-income households and corporations (tax cuts, SALT relief)

-

Seniors and hourly workers (higher deductions, no tax on tips/overtime)

Defence and fossil fuel sectors (increased spending and incentives)

Losers:

-

Low-income Americans (reduced Medicaid and SNAP support)

-

Clean energy sector (rollback of incentives)

States with high social spending (greater fiscal responsibility)

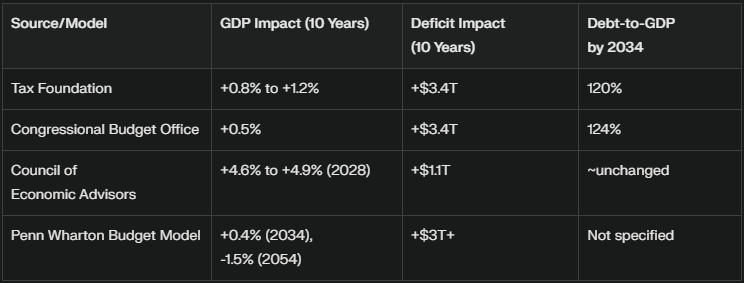

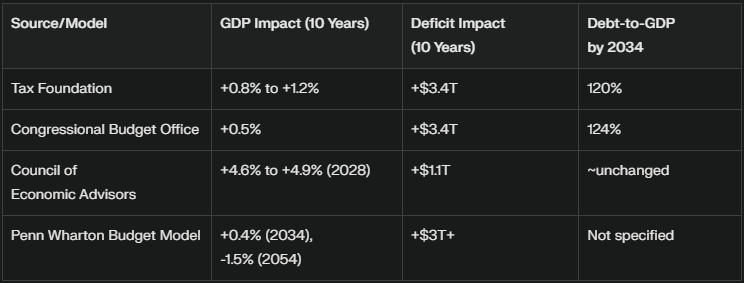

6. Economic and Fiscal Impact

-

Short-term growth: Most models predict a modest GDP boost (0.4%–1.2%) over the next decade, with the White House projecting higher gains.

-

Deficit and debt: The Act is expected to add $3.4 trillion to the federal deficit over 10 years, pushing the debt-to-GDP ratio to 120–124% by 2034.

Job creation: House estimates suggest up to 7.2 million jobs protected or created, with 1 million new jobs annually in small businesses.

7. Market and Sector Reactions

-

Equities: US stock indices initially rallied on news of permanent tax cuts and increased corporate profits, with the S&P 500 up 0.5% on the day of passage.

-

Defence and energy stocks: Rose sharply, reflecting new government spending and incentives.

-

Healthcare and social sector stocks: Underperformed amid concerns over reduced Medicaid and SNAP funding.

Municipal bonds: High-tax state bonds gained as investors anticipated increased demand due to the higher SALT cap.

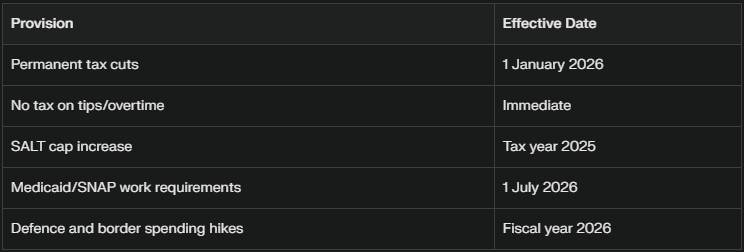

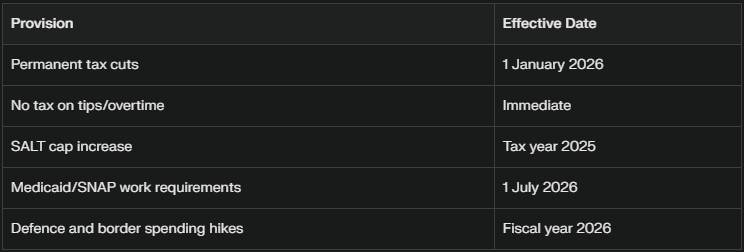

8. Timeline of Key Changes

Conclusion

Trump's One Big Beautiful Bill Act delivers sweeping tax relief, targeted spending increases, and major policy shifts that will reverberate through the US economy for years to come.

While the bill provides a near-term boost to growth and corporate earnings, it also raises long-term fiscal risks and deepens divides between winners and losers. As markets adjust to the new landscape, investors will be watching closely for the real-world effects on growth, inflation, and sector performance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.