US stocks posted their biggest one-day gains in years on Wednesday, with the

S&P 500 recording its largest rise since 2008 on Wednesday after Trump

declared a temporary US pause on tariffs.

Treasury Secretary Scott Bessent later clarified that all countries except

China would return to the 10% baseline tariff rate, down from previously

announced higher rates, as negotiations take place.

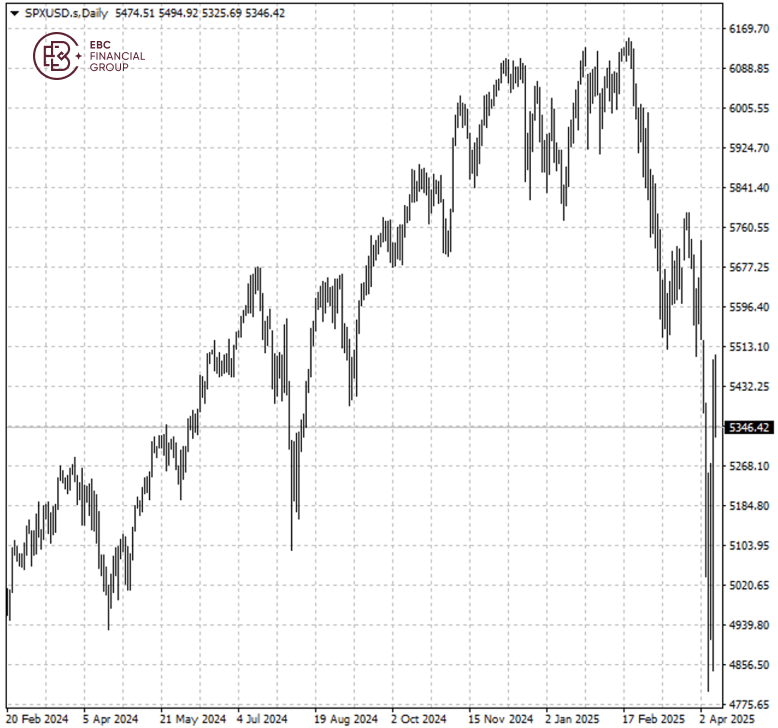

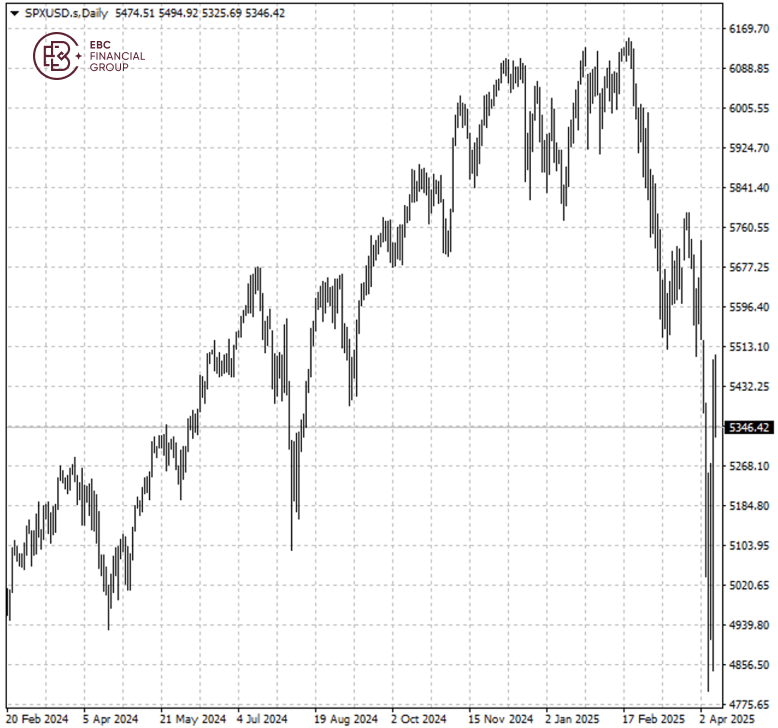

The selloff in US assets since Trump's announcement of sweeping tariffs on 2

April has been broad and deep. Deutsche Bank said the world was entering

uncharted territory in the global financial system.

BofA Global Research and Oppenheimer Asset Management on Monday became the

latest Wall Street research firms to cut their year-end targets for the S&P

500 index to below the 6,000 mark.

Oppenheimer reduced its target to 5,950 from 7,100 target but maintained its

"overweight" stance on US equities; BofA reduced to 5,600 from 6,666, making it

one of the lowest on Wall Street.

Likewise, BMO Capital on Wednesday cut its year-end target by 9% to 6,100

from the prior 6,700 which is still well above the current level, citing the

speed and severity of the recent selloff.

Last week, hedge funds underwent the largest selling on a net basis in almost

15 years on Thursday, while also turning the most bearish since 2011, according

to Goldman Sachs.

Recession fears

Goldman Sachs raised the odds of a US recession to 45% from 35%, the second

time it has increased its forecast in a week, amid a growing chorus of such

predictions by investment banks.

It has lowered its US growth outlook for 2025 to 1.3% from 1.5%, higher than

Wells Fargo Investment Institute's 1% forecast.

At least seven top investment banks have raised their recession risk

forecasts on fears that the tariffs will not only ignite US inflation but also

spark retaliatory measures from other countries.

|

US recession odds |

| JP Morgan |

60% |

| S&P Global |

30-35% |

| HSBC |

40% |

Inflation swaps are betting that Trump's tariffs will have a hefty short-term

impact on consumer prices that will recede in the next few years. March's

readings could be the last time that price pressures eased.

Core inflation has remained stubbornly elevated due to sticky costs for

shelter and services. Rising inflation expectations, coupled with rising fears

of a self-inflicted recession, has kept the Fed in "wait-and-see" mode.

The central bank could be forced to choose between fighting high inflation

and fighting high unemployment. Trump's ever-changing trade policies also help

complicate decision-making.

Richmond Fed President Thomas Barkin said, consumers could sharply slow

spending in the face of high prices after extra savings they had accumulated

during several rounds of pandemic-era stimulus are drained.

Gloomy scenarios

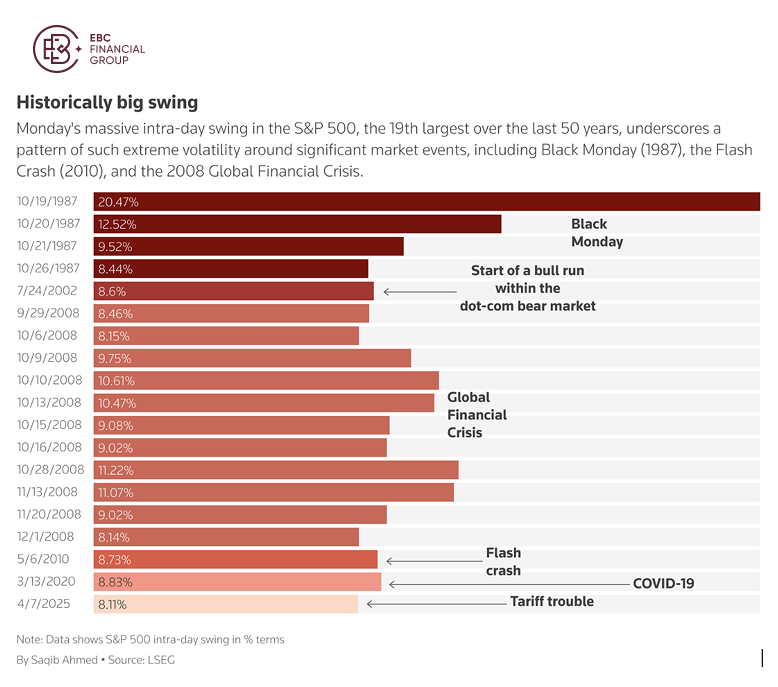

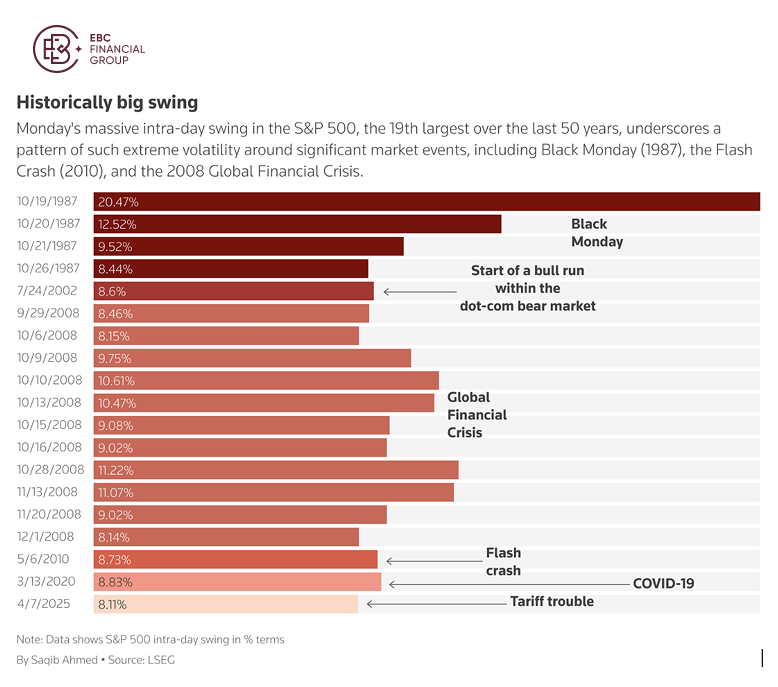

The recent drop has been one of the steepest concentrated selloffs for Wall

St, on par with the speed and intensity of drawdowns seen during the COVID-19

swoon in 2020 and the financial crisis slide in 2008.

The worst-case scenarios from some analysts saw the S&P 500 dropping as

much as roughly 50% from its all-time high, which would be akin to the aftermath

of the bursting of the dot-com bubble in 2000.

The forward PE ratio for the S&P 500 fell from 22.4 times expected

12-month earnings in February, to 18.4 as of last Friday, which is in line with

its average of the past 10 years, according to LSEG Datastream.

The indicator went down to 15.3 as recently as 2022, when the Fed was raising

interest rates to bring down spiking inflation. Furthermore, current valuations

are yet to reflect damage tariffs do to corporate profits.

S&P 500 earnings are expected to rise 6.8% in Q1 and 11.2% for the full

year, FactSet data shows. However, during recessions, earnings fall at an

average annual rate of 24%, according to Ned Davis Research.

Tariffs could have ripple effects across multiple aspects of American

companies' business models, from their supply chains to their labour costs to

their price structures to customer behaviour, noted Morningstar.

The bigger news coming out of the forthcoming earning season will more likely

be related to the outlook for the future. Some of US trading partners could

strike deals later, making business forecast more unlikely.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.