Have you ever wondered why some investors seem to make money even when the market is down? Or how others manage to pick stocks that continue to grow in value over time? If so, you've probably come across the term value investing. But what does it actually mean? And how can it work in your favor?

Value investing is a strategy that has stood the test of time, popularized by legendary investors like Warren Buffett and Benjamin Graham. At its core, it's about finding stocks that are undervalued and holding onto them until the market recognizes their true worth. But how do you identify those hidden gems? And how does this strategy compare to other strategies, like growth investing?

In this article, we'll break down what value investment is all about, explore some famous examples, and highlight how it stacks up against other investment styles.

Value Investing's Meaning

Value investing is an investment strategy that focuses on buying stocks that are undervalued compared to their intrinsic value. In essence, it revolves around the idea that the stock market can, at times, overreact to news, market sentiment, or short-term challenges, causing stocks to be undervalued. This presents an opportunity for investors to buy these stocks at a discount, with the expectation that over time, the market will correct its pricing error. To identify these opportunities, value investors typically evaluate four key elements:

Earnings Power: The company's ability to generate consistent profits over time.

Financial Strength: A solid balance sheet with low debt and strong cash reserves.

Valuation: The price of the stock relative to its intrinsic value, often measured using metrics like the P/E or P/B ratios.

Dividend Yield and Shareholder Focus: The company's commitment to returning value to its investors through dividends or stock buybacks.

By focusing on these elements, value investors aim to minimize risk while positioning themselves for long-term growth as the market corrects the undervaluation.

Value Investing's Number One Rule

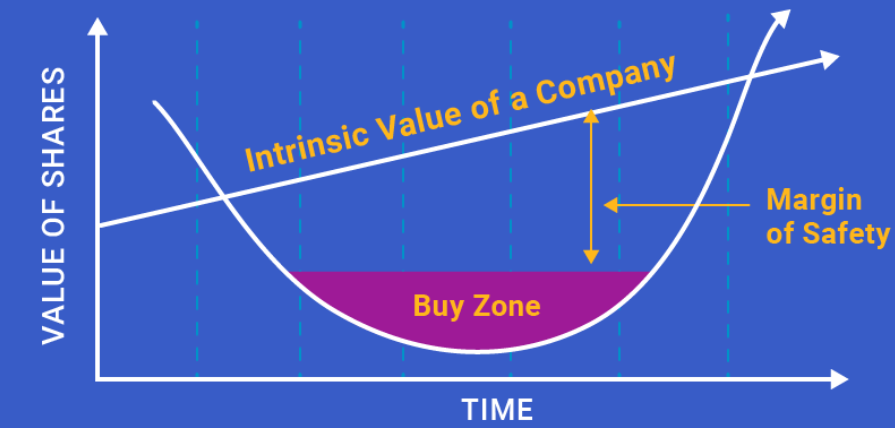

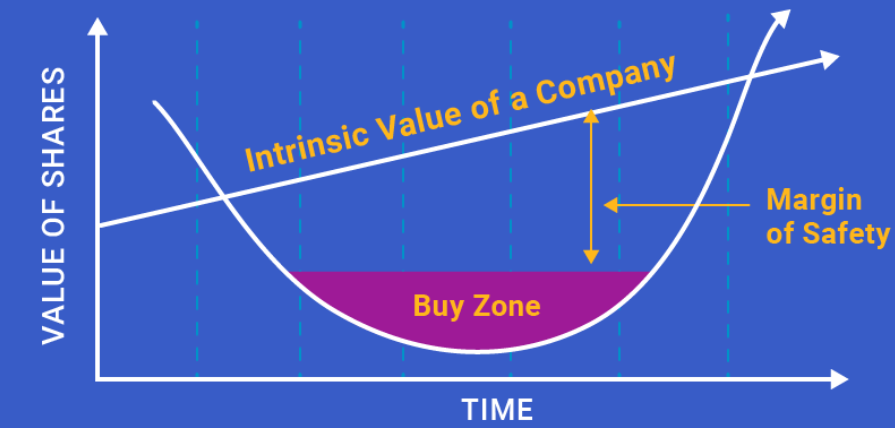

The number one rule in this strategy is often summed up by Benjamin Graham's famous maxim: "Margin of Safety". This principle emphasizes the importance of investing with a cushion to protect yourself from potential losses. The "margin of safety" is essentially the difference between the intrinsic value of a stock (what it's truly worth based on fundamental analysis) and its market price (what you pay for it).

In a nutshell, if you buy a stock at a significant discount to its intrinsic value, you're essentially creating a "buffer" that protects you from market fluctuations, company-specific risks, and even unforeseen events that could affect the stock price. The greater the margin of safety, the less risky the investment.

The importance of the "Margin of Safety" can be broken down into three key aspects:

Reduces Risk: By buying undervalued stocks, you're less exposed to the risk of overpaying. Even if the stock doesn't perform exactly as expected, the margin of safety can help mitigate potential losses.

Long-Term Focus: A strong margin of safety means you're less likely to panic during market downturns or short-term volatility because you've invested at a price that offers protection against downside risk.

Protects from Uncertainty: In the world of investing, nothing is certain. A margin of safety ensures that even if some of your assumptions about a company's performance are wrong, the price you paid for the stock still offers you a cushion.

In practical terms, this might mean looking for stocks with low P/E ratios, discounted prices relative to book value, or using discounted cash flow (DCF) analysis to estimate intrinsic value and buying when the market price is significantly lower than that.

Graham's philosophy has influenced generations of value investors, including Warren Buffett, who has made the margin of safety a cornerstone of his investing strategy.

Aside from the "Margin of Safety" rule, the 5% rule is another well-known principle in value investment, often associated with Warren Buffett. This rule advises investors to limit their investment in any single stock to no more than 5% of their total portfolio, unless they have a strong understanding of the company and are confident in its future prospects. The idea behind this rule is that investing in businesses you truly understand lowers the risk of making poor investment decisions, especially in unfamiliar or complex industries.

While the 5% rule suggests a cautious approach, it’s not a strict rule and can be adjusted based on individual circumstances. For companies within industries, you know well or have done extensive research on, you might feel comfortable allocating more than 5%. However, for businesses outside your area of expertise or in more volatile sectors, the rule serves as a safeguard, encouraging you to limit exposure. Critics argue that the 5% rule might be too conservative, especially for high-conviction investments, where an investor may feel justified in going beyond the 5% threshold. Ultimately, the rule serves as a flexible guideline that experienced investors can modify based on their own knowledge and risk tolerance.

Value Investing vs. Growth Investing

While value investment focuses on purchasing undervalued stocks with the expectation that the market will eventually recognize their true worth, growth investment takes a different approach. Growth investors seek companies that are expected to grow significantly in the future, even if their current valuations are high. Here’s a comparison between the two strategies:

Approach to Valuation: Value investment focuses on the price of the stock relative to its intrinsic value, while growth investment focuses on future earnings growth. Value investors may purchase stocks that appear cheap but are trading below their true value, while growth investors are willing to pay a premium for companies they believe will grow rapidly.

Risk Profile: Value investment generally carries less risk since it focuses on buying solid companies at discounted prices. In contrast, growth investment can be riskier, as investors are betting on the future success of companies that may be overvalued or may not meet their growth expectations.

Time Horizon: Value investment typically requires a longer time horizon since it relies on the market eventually recognizing the intrinsic value of a stock. Growth investors may take a shorter or medium-term approach, capitalizing on rapid price increases due to anticipated future growth.

Market Conditions: Value investment tends to outperform in market conditions where stocks are undervalued or where economic growth slows down. Growth investment, on the other hand, often outperforms during periods of economic expansion and when investors are willing to pay a premium for future growth potential.

Value Investing vs Growth Investing

| Aspect |

Value Investing |

Growth Investing |

| Investment Focus |

Undervalued companies with strong fundamentals |

Companies with high growth potential |

| Valuation |

Stocks are undervalued based on intrinsic value metrics (e.g., P/E, P/B) |

Stocks are often overvalued based on future growth prospects |

| Risk |

Lower risk, as the company is already undervalued and offers a margin of safety |

Higher risk, as high valuations can lead to losses if the growth doesn't materialize |

| Time Horizon |

Long-term, with an emphasis on holding through market fluctuations |

Can be medium or long-term, with a focus on capitalizing on future growth |

| Examples of Companies |

Mature companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble |

High-growth companies like Tesla, Amazon, and NVIDIA |

| Investor's Goal |

Buy low and hold until the market corrects its valuation |

Buy high-growth stocks with the expectation of rapid appreciation |

Value Investing's Notable Examples

Now that we've explored what value investment is and the principles that guide it, let's take a look at how this strategy works in the real world. Are there practical examples where this investing strategy has led to extraordinary returns? In this section, we’ll dive into a few standout examples where savvy investors turned undervalued stocks into gold mines. These stories not only highlight the power of buying undervalued stocks but also show how patience and a sharp eye for opportunity can lead to financial success over time.

Warren Buffett's classic value investments: One of the most well-known examples of value investing comes from Warren Buffett's purchase of Coca-Cola in 1988. Coca-Cola was a well-established brand, but its stock had been undervalued at the time. Buffett recognized the company's strong brand, global market dominance, consistent earnings, and potential for long-term growth, even though the stock was temporarily underpriced. His investment paid off massively as Coca-Cola's stock price grew significantly over the years, delivering substantial returns for Berkshire Hathaway.

Similarly, his investment in American Express, Geico, The Washington Post also paid off significantly. These are all very classic and notable instances of value investment.

However, for many current investors, they may feel a bit cliché and perhaps less relatable to modern investing trends, especially with the rise of new industries, technologies, and strategies. In that case, let’s take a look at some current and more relatable examples that may strike a chord with today's investors.

Lumen Technologies (Formerly CenturyLink): Lumen Technologies (formerly CenturyLink) represents a more recent example of a value investment. The company, operating in the telecommunications and fiber optics sectors, had struggled with its debt load and declining revenues in the early 2010s.However, savvy investors identified Lumen's undervalued stock due to its strong fiber optic infrastructure, its pivot towards high-margin enterprise services, and its relatively low market valuation compared to its assets. Over time, Lumen's transformation into a digital infrastructure company positioned it for growth despite earlier struggles.

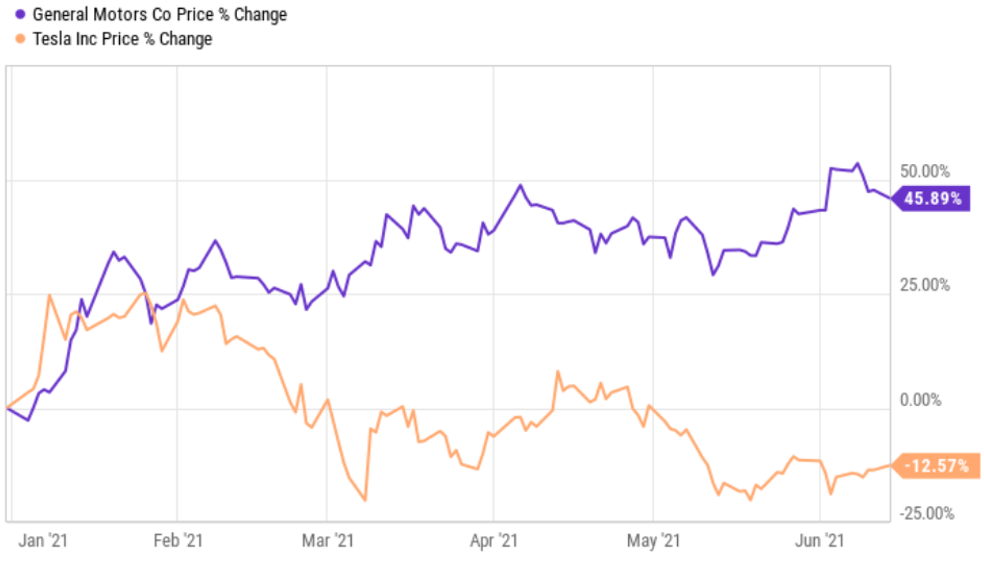

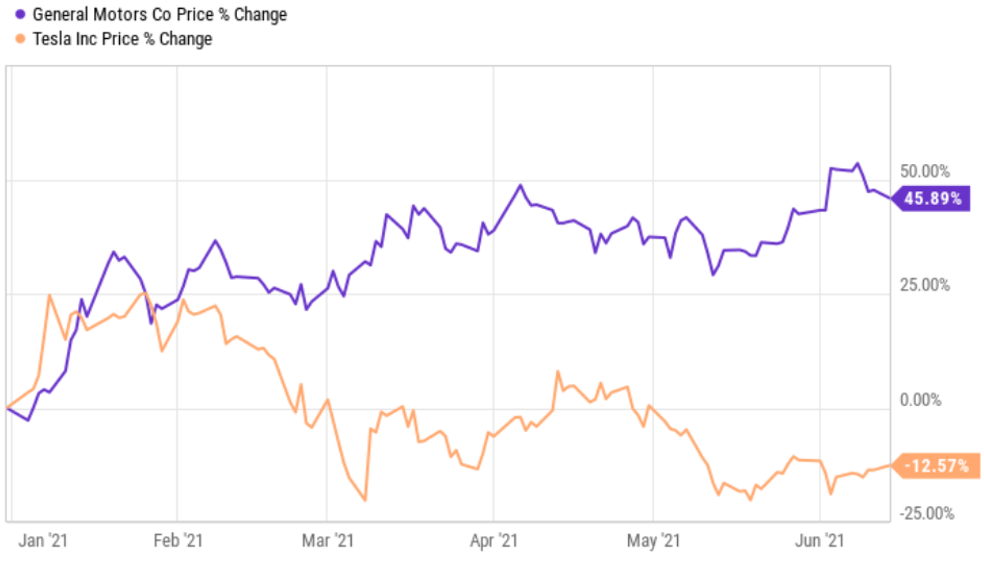

General Motors(GM) - Shift to EVs: General Motors (GM) is a strong recent example of value investment with a twist. In 2020. GM was still viewed by many as a traditional auto manufacturer struggling with an uncertain future in the wake of COVID-19 and the rise of electric vehicles (EVs). However, its announced commitment to transitioning to electric vehicles (EVs) and its massive investment in EV technology created an opportunity for value investors to buy the stock at a discount. With the rise of EV markets and GM’s strong brand, investors who bet on this transformation have seen significant gains as the company's potential in the green energy sector began to materialize.

In conclusion, value investing is a time-tested strategy that revolves around the principle of buying stocks that are undervalued by the market and holding them until their intrinsic value is recognized. While it can require patience and a long-term focus, the strategy has delivered solid returns for investors like Warren Buffett and Benjamin Graham over decades. By contrast, growth investing offers the potential for higher returns but comes with greater risks and higher volatility.

Ultimately, whether value investing or growth investing is the right strategy depends on your individual goals, risk tolerance, and investment timeline. Both strategies have their merits, and many investors choose to combine elements of both to build a diversified portfolio that balances risk and reward.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.