Passive investing has become one of the most popular investment strategies in recent years. Whether you're a beginner or an experienced investor, this investing strategy offers an easy and cost-effective way to grow your wealth over time. But what exactly is passive investment, and how does it differ from active investment? In this article, we will explore the definition and meaning of this strategy, as well as compare it to the more traditional active investing approach.

Passive Investing's Definition

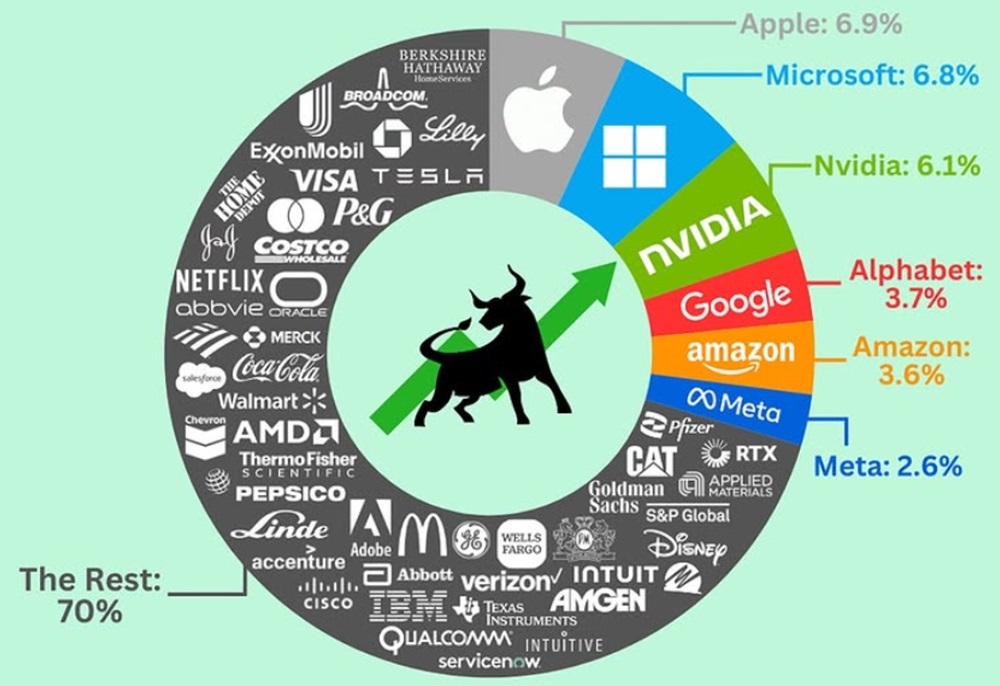

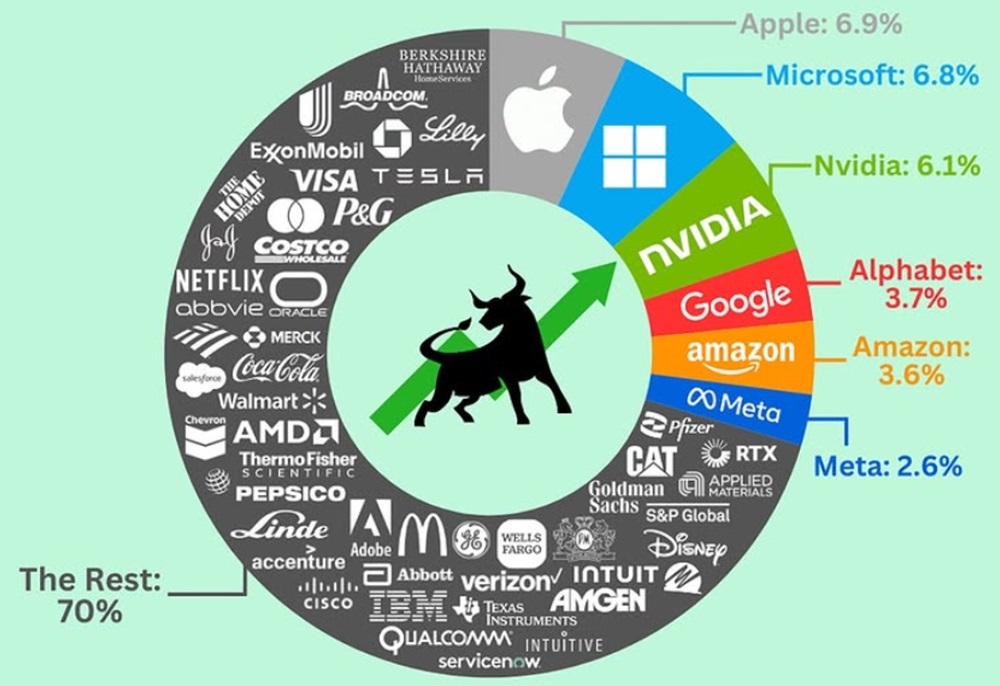

At its core, passive investing is a strategy that aims to replicate the performance of a specific market index or benchmark, rather than trying to beat the market through individual stock selection or frequent trading. The most common form of passive investment is through index funds or exchange-traded funds (ETFs), which track the performance of market indices such as the S&P 500. the Nasdaq-100. or the dow jones industrial average.

In passive investment, the goal is not to actively pick winning stocks or time the market but to mirror the broader market's performance. This strategy assumes that, over the long term, markets will grow in value, and the investor will benefit from this general upward trend. As a result, passive investors hold their investments for the long haul, making minimal changes to their portfolio.

As a more and more popular investing strategy, passive investing has several distinct characteristics that make it an increasingly appealing option for many investors:

Low Costs: Passive funds generally have much lower management fees compared to active funds. Since there's no need for active management or frequent trading, the overall costs of passive investment could be kept to a minimum.

Diversification: By investing in index funds that track broad market indices, passive investors gain immediate diversification. This helps spread risk across multiple companies and sectors, making it less likely that individual stock performance will significantly impact the portfolio.

Long-Term Focus: the passive strategy is centered on the idea of long-term growth. Investors typically hold their positions for years, if not decades, aiming to benefit from the market's overall performance.

Minimal Effort: Once an index fund or ETF is selected, there is little to no need for the investor to actively manage or adjust their portfolio. This makes passive investment strategy particularly attractive to those who prefer a hands-off approach.

Passive Investing's Risk Level

The risk level of passive investing is generally considered low to moderate, especially when compared to active investing. Since passive investors typically invest in broad market indices, they are exposed to a wide range of stocks, industries, and sectors. Its inherent diversification helps spread risk across different assets, which can reduce the impact of any single underperforming stock or sector on the overall portfolio. If one company or sector struggles, others within the index can help offset the losses.

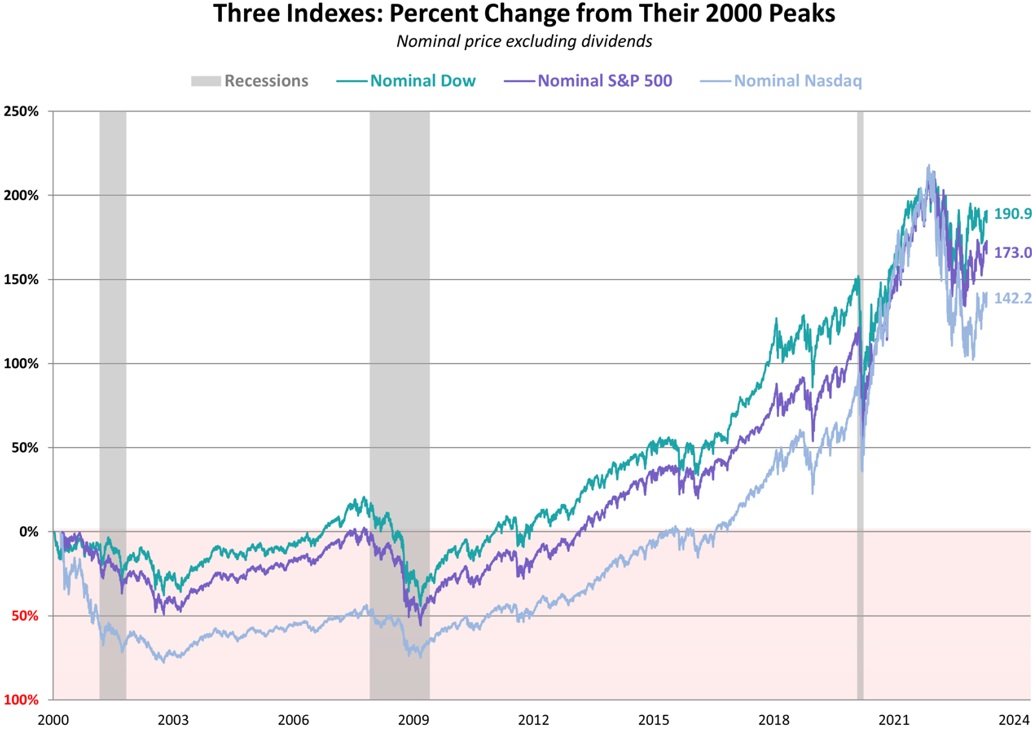

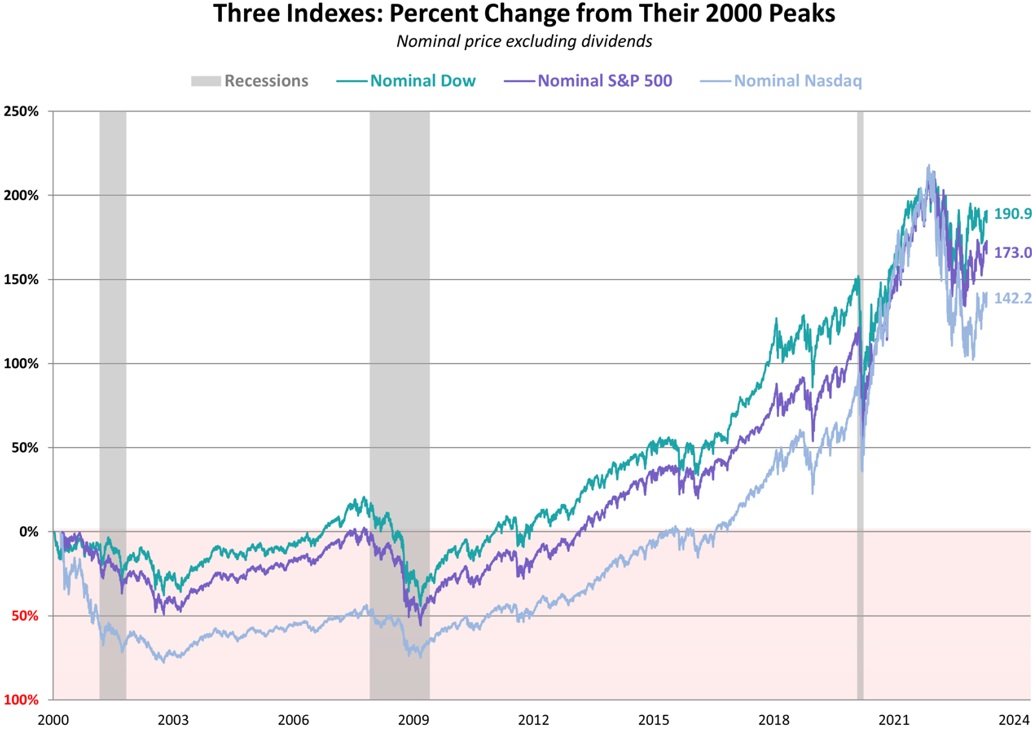

However, this strategy still carries market risk. If the overall market declines, the passive investor will likely experience similar losses. For example, during a market downturn, an S&P 500 Index Fund will generally reflect the downturn of the entire index. While passive investment offers lower risk than stock picking or market timing, it is still subject to broader market fluctuations.

The risk level can also vary depending on the type of index fund chosen. For an instance, funds that focus on more volatile sectors or stocks, such as technology or emerging markets, may carry higher risk than those that track broader, more stable indices like the S&P 500.

In a word, passive investing tends to have a lowto moderate risk level because it avoids the pitfalls of trying to time the market or pick individual stocks. However, it is not risk-free and is subject to the broad market movements and specific risks associated with the index it follows. Diversification, a key tenet of passive investment, helps reduce risks, but it can never completely eliminate them.

Passive Investing vs. Active Investing

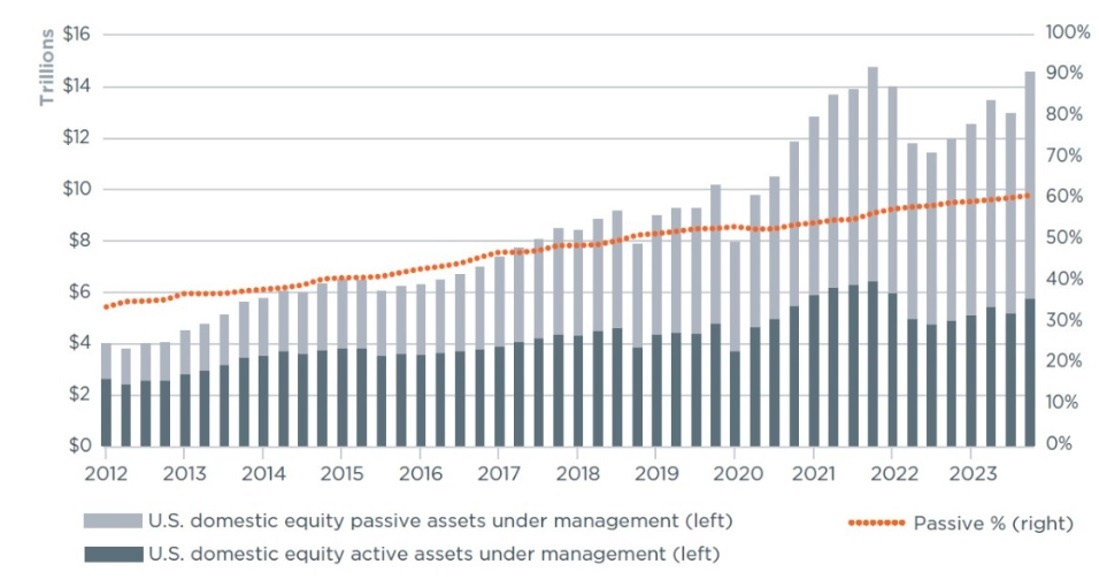

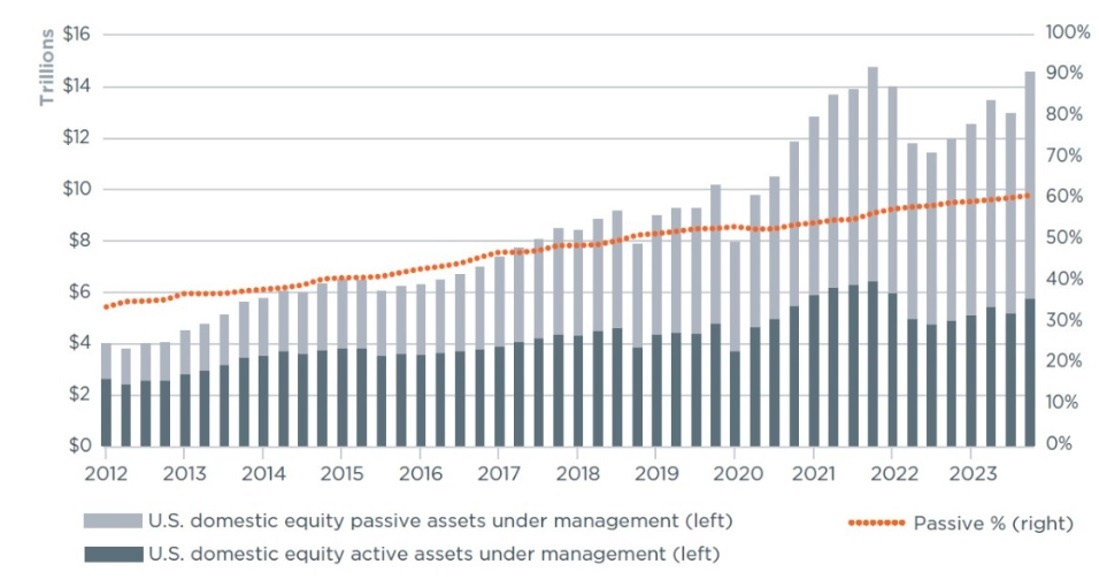

As is showed in the chart below, over the past decade or so, passive investing has gained traction, surpassing active strategies in total assets under management, and this trend has accelerated in recent years.

Passive and active investing both have their advantages, but their goals, methods, and outcomes are quite distinct. Here's a detailed comparison of these two strategies, which may also explain why passive investment has outgrown active investment in the past few years.

Objective:

The primary objective of passive investing is to match the performance of a market index, such as the S&P 500 or the Dow Jones Industrial Average. Investors are aiming to benefit from the overall market growth without trying to outperform the market. This approach is based on the belief that the market's long-term performance will deliver adequate returns.

In contrast, active investing aims to outperform the market or a specific benchmark. Active investors do this by selecting individual stocks or other securities they believe will outperform the market, based on research, analysis, or intuition.

Management Style:

Passive investing requires minimal intervention. Once an index fund or ETF is chosen, the fund automatically rebalances to reflect the changes in the index. There is little to no need for the investor to monitor or make decisions about specific stocks.

However, active investing involves ongoing analysis and decision-making. Investors or fund managers constantly assess market conditions, analyze individual securities, and adjust the portfolio by buying or selling assets based on predicted opportunities or risks.

Cost:

One of the biggest advantages of passive investing is its low cost. Since passive funds don't require active management, they have lower management fees and fewer transaction costs.

In comparison, active investing carries higher fees due to the costs of active management, research, and frequent trading. These fees can eat into returns over time, especially in funds that underperform the market.

Risk:

Passive investing is generally considered lower risk than active investment because of its diversified nature. By tracking an entire index, passive investors spread their risk across multiple sectors and companies. While market risk is still present, the exposure to individual stock volatility is reduced.

Active investing carries higher risk because it depends on the investor's ability to select stocks that outperform the market. Poor stock picks or market misjudgments can lead to significant losses, especially when compared to passive strategies that simply track the market.

Time Horizon:

Passive investing is typically a long-term strategy. Investors generally hold their positions for years, allowing their investments to grow along with the market. This long-term approach is suited to those who don’t need immediate returns and prefer to invest for future goals, like retirement.

Active investing can have a shorter or medium-term focus, depending on the investor's goals. Many active investors seek to profit from market fluctuations, often making decisions based on short-term trends or earnings reports.

Return Expectations:

Passive investors can expect returns that mirror the performance of the index they're tracking. Historically, the passive way of investing has been shown to deliver returns that are competitive with most actively managed funds, especially after accounting for lower fees.

Active investors, however, aim to beat the market. While the potential for higher returns exists, research shows that many active investors fail to consistently outperform the market, particularly after deducting higher management fees.

Passive Investing vs Active Investing

| Aspect |

Passive Investing |

Active Investing |

| Objective |

To mirror the performance of a market index. |

To outperform the market or a benchmark. |

| Management Style |

Minimal intervention; hands-off approach. |

Frequent buying and selling of stocks. |

| Cost |

Low management fees and transaction costs. |

Higher fees due to active management. |

| Risk |

Generally lower, thanks to diversification. |

Potentially higher risk, depending on stock selection. |

| Time Horizon |

Long-term focus, holding positions for years. |

Short-or medium-term, with frequent changes. |

| Return Expectations |

Matches the market's average returns. |

Aims to exceed the market's performance. |

To sum up, passive investing is a cost-effective strategy with low management fees and provides instant diversification, reducing risk. It offers consistent, long-term returns that mirror market performance, making it ideal for hands-off, long-term investors. However, it also has limitations, such as limited potential for outperformance and vulnerability to market downturns, as it follows the overall market. Whether to adopt a passive strategy on investing depends on an investor's willingness to accept risk, their investment horizon, and whether they value simplicity or are looking to actively manage their investments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.