Today, the financial market buzz is focused on artificial intelligence, driving a surge in technology stocks, particularly semiconductor companies. However, some high-quality leading stocks in traditionally defensive sectors are still showing strong investment value. UnitedHealth is a prime example of a company that not only delivers great returns but also plays an active role in the health sector. Next, let's take a deeper look at UnitedHealth's financial performance and investment opportunities.

UnitedHealth Company Profile

It is a leading global health insurance and healthcare services company headquartered in Minnesota, USA. Its businesses include health insurance, health management, information technology services, and pharmacy benefit management, aiming to provide customers with high-quality, low-cost healthcare products and services through the integration of healthcare services and health management specifications.

In the absence of a universal health care system in the United States, people need to purchase their own health insurance to meet their medical needs. As a result, in 1973. the U.S. Congress passed a bill that allowed commercial insurance companies to contract with independent physicians to provide medical and health services. This bill laid the groundwork for the formation of UnitedHealth Group.

In 1974. Charter Mat Incorporated, the predecessor of UnitedHealth Group, was founded in Minnesota. Three years later, in 1977. the company was founded by Richard Burke, a successful entrepreneur and longtime member of the company's board of directors, and Paul Elward, one of the founders of Health Maintenance Organizations (HMOs) and a key contributor to the reform of the U.S. health care system.

In 1984. UnitedHealth went public and quickly became a constituent of the S&P 500. solidifying its position as a major player in the healthcare industry. Despite a severe business restructuring and financial crisis between 1987 and 1989. the company managed to turn the corner with effective strategies and management improvements in the face of market uncertainty and internal reorganization, restoring financial stability and laying a solid foundation for future growth.

The company's subsequent growth was marked by significant achievements. In 1996. UnitedHealth launched the industry-breaking JAS Pro system, which enhanced the precision and efficiency of insurance administration, optimized data processing and service quality, and gained widespread industry recognition. The company also acquired Metra Health and Pacificare Health Systems in 1995 and 2005. respectively, expanding the scale of the business and doubling revenues, and further optimized its business structure and service offerings in 2011 through the establishment of Optum, which consolidated its health services business under the Optum brand.

Today, UnitedHealth has two core divisions: insurance and health management. The insurance business unit is responsible for offering a wide range of health insurance plans covering the needs of multiple populations, while the health management unit focuses on leveraging advanced technology and data analytics to design personalized health programs and improve the effectiveness and quality of care. This dual business model enables it to comprehensively address the health needs of its customers and lead the industry.

UnitedHealthcare is the leading health insurance provider in the U.S., offering health insurance to 50 million people, including government-backed supplemental health insurance. The company offers a broad range of insurance programs covering individual, family, and business customers, from basic coverage to comprehensive health management. UnitedHealthcare helps customers manage their health risks and ensures the delivery of high-quality care through innovative insurance products and services. Supplemental options, such as dental and vision coverage, are also available to meet customers' overall health needs.

Optum is a wholly owned subsidiary of UnitedHealthcare and accounts for approximately 40 percent of the company's revenue. Founded in 2011. Optum provides integrated healthcare services, including pharmacies, clinics, emergency rooms, and surgery centers. It provides healthcare services, data analytics, and prescription drug services through OptumHealth, OptumInsight, and OptumRx and is expanding its business through acquisitions (e.g., LHC Group in 2023), particularly in home healthcare.

UnitedHealth Group is committed to technology innovation, establishing a $250 million venture fund in 2017 to support health tech advancements. 2018 saw the launch of Health Savings Accounts and the introduction of Apple Pay, as well as the exploration of blockchain technology to improve the accuracy and transparency of healthcare delivery. These initiatives highlight the company's leadership in digital health and technology innovation.

While continuing to innovate, the group has faced a number of challenges. In 2022. the US Department of Justice blocked its planned acquisition of Change Healthcare. The failure of the 2024 rate resolution to increase government subsidies to insurers has impacted the revenues of insurers, including United Health. In particular, about one-third of the company's revenue comes from its Medicare and Retirement business, and this policy change has had a significant impact on its financial position.

In addition, it recently suffered a cyberattack that crippled its systems, affecting customers and hospitals and potentially harming the company's performance and reputation. At the same time, increased competition in the industry is also putting pressure on the company. 2024 In February, the U.S. Department of Justice opened an antitrust investigation into the company, which could have a further impact on future business operations. This investigation, which focuses on the company's market behavior and competitive strategies, could lead to regulatory challenges and strategic adjustments that could affect the company's long-term growth and financial performance.

UnitedHealth Group is not only a leading U.S. health insurer; it is also at the forefront of technological innovation. Its success is due to continued technological innovation and strategic acquisitions. Despite challenges such as regulatory restrictions, policy changes, and cyberattacks, it remains a company to watch for investors with its strong business foundation and forward-looking strategy.

UnitedHealth Financial Results Analysis

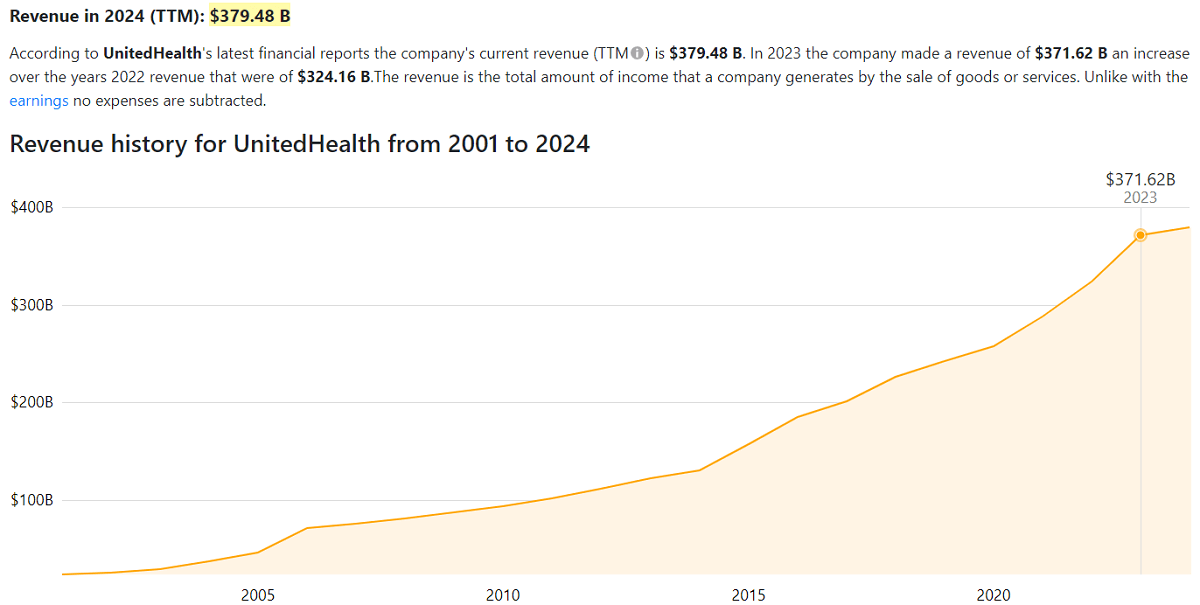

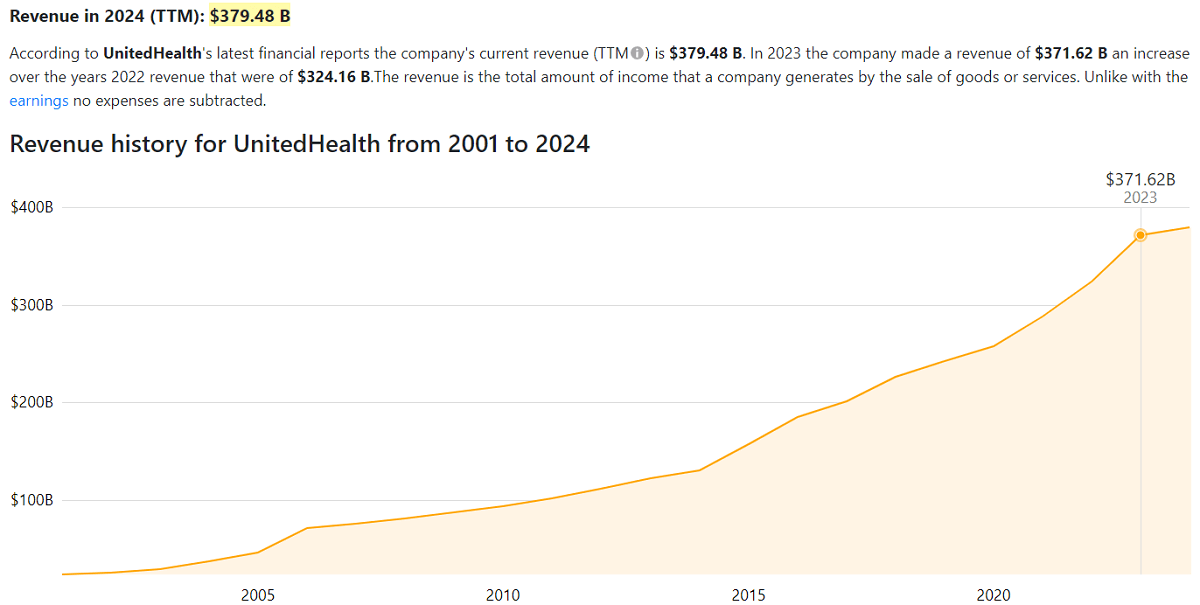

As of July 2024. UnitedHealth Group had a market capitalization of $515.12 billion, ranking 17th globally. According to the latest financial report, the company's current total revenue (TTM) is $379.48 billion, which is up from $371.62 billion in 2023 and also shows significant improvement compared to $324.16 billion in 2022.

UnitedHealthcare's revenue and earnings per share (EPS) performance has continued to be strong from 2021 to date. In 2022. the company's earnings per share (EPS) reached $21.48. a significant increase from $18.32 in 2021. While in 2023. EPS was boosted to $23.33 until today, the current EPS is $23.86. This is an increase of 12.66% compared to last year and 397.28% from the previous quarter. This growth demonstrates the company's continued improvement and strong performance in terms of profitability, reflecting the company's successful strategy to optimize operations, improve efficiencies, and achieve revenue growth.

According to the latest financial results, UnitedHealth Group (UnitedHealth) demonstrated strong financial performance in the second quarter of 2024. with total revenues reaching $98.855 billion, up 14.1% from $91.9 billion in the same period last year. Net income was $4.22 billion, up 11.24% from the same period last year and 399.22% from the previous quarter. In addition, the company reported operating income of $8.5 billion, an increase of 13.33% from the same period last year.

During the second quarter of 2024. UnitedHealth Group experienced several key factors that significantly impacted financial performance. Losses on exchange rate fluctuations due to the sale of the Brazilian business and additional costs associated with the cyberattack contributed to the net loss for the quarter. In particular, the subsidiary Change Healthcare suffered significant financial losses due to the cyberattack, totaling $1.41 billion, which contributed to a significant increase in the group's net loss, which amounted to $1.53 per share. The financial impact of this event was particularly significant and is expected to be between $1.15 and $1.35 per share for the full year.

In addition, the healthcare cost ratio for the quarter was 84.3%, which included a 40 basis point impact from the cyber attack. These challenges have weakened the company's financial health to some extent, reflecting the challenges to the company's financial soundness in response to unexpected events and external pressures.

Despite cyberattacks and other challenges, UnitedHealthcare continues to show strong performance in the Medicare and health services sectors. In the second quarter of 2024. both of the company's major business segments performed well. The Optum segment reported revenues of $61.1 billion, an increase of 12.9% year-over-year, a growth that was largely attributable to notable revenue improvement in the Patient Care and Pharmacy segments.

Meanwhile, the UnitedHealthcare segment reported revenue of $75.4 billion, up 6.9% year-over-year. This growth was primarily driven by an increase in the number of people served, which totaled 2 million in the second quarter. These performance metrics reflect not only the company's resilience in dealing with challenges but also its successful strategy in driving business growth and improving service quality.

The company continues to optimize its business operations and respond to external pressures to achieve significant revenue growth. These performance metrics not only reflect the company's strong position in the industry but also demonstrate its exceptional ability to continuously improve service quality and drive business growth. In the face of these challenges, UnitedHealth Group has updated its full-year net income expectations, adjusting its projected earnings per share range to $17.60 to $18.20.

In summary, despite some challenges, UnitedHealth Group's financial performance remained very strong, with growth across all key metrics. The company has raised its full-year net income estimates, further demonstrating confidence in its future growth. As such, investing in the company remains worthwhile.

UnitedHealth Stock Investment Opportunities

As one of the largest health insurers in the U.S., UnitedHealth Group's stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol UNH.The company encompasses a wide range of health insurance and healthcare services businesses, which supports its solid performance in the industry and has made its stock appealing to a large number of investors. The company is in an uptrend.

In an uptrend, the stock price rose 19.3% in 2020 and soared 43.2% in 2021. Despite entering a sideways swing after reaching a new high of $548.97 in 2022. the stock hit another new high of $553 in 2023. while it climbed further strongly in 2024 to its latest high of $581.5.

Analysis of the financial results shows that the company has continued to grow its revenues steadily, highlighting the strength of its economic moat. UnitedHealth's low costs and strong network provide it with a leading position in the industry, a moat that effectively protects market share and continues to create value for investors.

The company's average annual growth rate typically ranges from 12% to 15%, demonstrating its solid growth trend and favorable market performance. Looking ahead to the next four years, analysts expect earnings per share (EPS) to grow by approximately 13%, further validating the company's strong position in the industry and long-term profitability. This steady growth expectation provides investors with strong confidence that the company still has significant growth potential while maintaining stable financial performance.

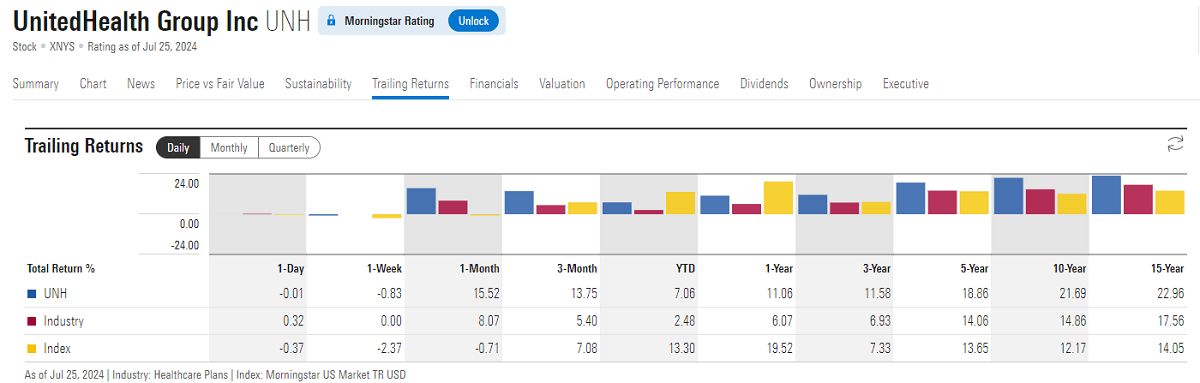

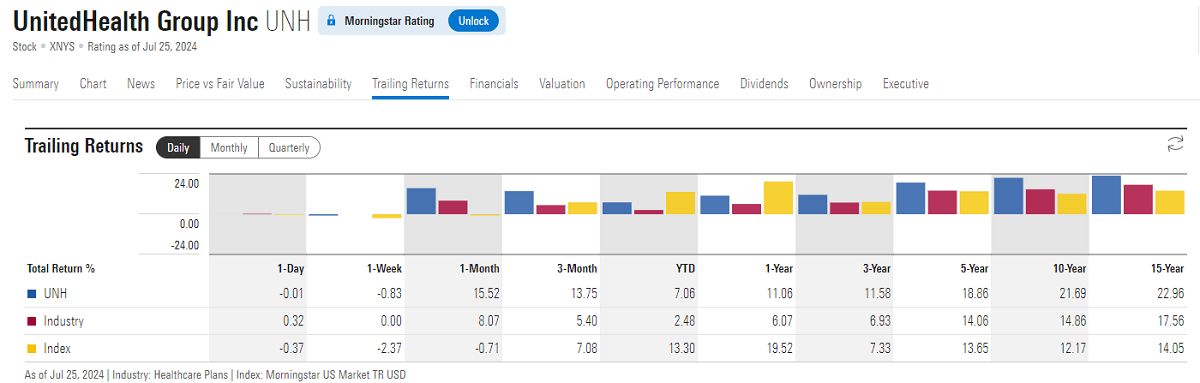

Over the past decade, UnitedHealth (UNH) shares have returned an average of 22% annually, compared to 16% over the past three years. Even with the significant declines in the Nasdaq and S&P 500 in 2022. UNH's stock price has risen 16%. UNH's stock price has consistently outperformed the broader market over the past five years, has maintained an uptrend over the long term, and continues to grow.

Despite the recent significant share price gains, the current share value may be high for investors. It is advisable to wait until the stock price has digested its valuation, especially when the forward P/E ratio has come down to about 17 times and the adaptive growth rate (PEG ratio) is close to 1.5 before considering an investment. If the stock falls back to the $440-450 range, it will offer a more attractive investment opportunity.

Therefore, for investors, it is advisable to focus on defense stocks in the current market, as these stocks are likely to continue to move sideways. For short-term strategies, consider investing in the broad market index on a regular basis, on a monthly basis, to capitalize on the market's long-term growth potential. Meanwhile, when the broad market retraces its 30-day SMA, you can add to your positions in related ETFs and stocks to capture buying opportunities in market pullbacks.

Additionally, investors should keep an eye on traditional quality stocks like UnitedHealth. During market volatility, the prices of these stocks may pull back to a more attractive range, at which point one can consider adding to their positions to capitalize on the stability and long-term appreciation potential of these stocks amidst market volatility. Traditional-quality stocks usually have a solid business foundation and stable financial performance that can provide reliable investment opportunities in uncertain market environments.

In the medium to long term, UnitedHealth's health insurance business is performing solidly, and the Optum division has further strengthened its market position by expanding its business through ongoing acquisitions. The global aging trend is driving growth in healthcare demand, which is expected to benefit the company's performance and share price to continue its positive upward trend.

In addition, the health insurance industry is inherently stable and unaffected by economic fluctuations, as health insurance is a necessity and users are highly dependent on health insurance companies. The group, with its large business scale and market share, is difficult to replace, while the health insurance market continues to offer significant growth potential. Based on these factors, the long-term investment outlook of UnitedHealth is well worth watching.

UnitedHealth's financial performance and investment opportunities

| Financial Performance |

Investment Opportunities |

| UnitedHealth’s market cap ranks it among the top. |

The stock has long-term outperformed the market. |

| The company has strong financials and revenue growth. |

Analysts expect steady growth in the coming years. |

| EPS has risen steadily, and profitability is improving. |

Optum has grown and solidified its market position. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.