The collapse of Silicon Valley Bank had caused a furor, as no one before that time had expected such a large bank to fail. However, it was not the size or history of the bank that was at the center of this tragedy, but rather the bank's ability to cope with liquidity challenges. So in this article, let's take a good deep dive into the concept of bank liquidity and its risk assessment.

What does Bank Liquidity Mean?

It refers to the ability of a bank's assets, especially cash and cash equivalents, to meet its payments and debt service. In other words, bank liquidity refers to the ability of a bank to liquidate its assets quickly to meet the various payments and funding needs it faces.

It is a very important part of a bank's operations because banks need to readily handle deposit withdrawals, loan disbursements, interest payments, and various other fund flow activities from their customers. Good bank liquidity management can help to avoid delays in payments or failure to meet commitments due to a shortage of funds, thus preserving its credibility and stable operations.

To reduce payment risk and uncertainty in the flow of funds, banks must ensure that they have sufficient liquidity to process transactions such as customer deposit withdrawals, checks, and electronic payments. This means that banks need to have sufficient cash or easily realizable assets on hand at all times to meet the funding needs of their customers while maintaining the efficient operation of their payment services. In addition, banks need to be actively involved in payment systems and clearing systems that ensure that funds can arrive and settle efficiently and in a timely manner, thus maintaining the smoothness and security of their daily operations.

Adequate bank liquidity is the basis for ensuring that banks are able to meet their obligations as they fall due in a timely manner under a variety of circumstances. This includes not only customer deposits and the bank's own borrowings but also a wide range of other financial instruments. Banks must ensure that the stability of their operations is maintained in the face of market volatility, uncertainty, and unexpected events.

This liquidity protection enables banks to cope with large-scale deposit withdrawals, payment demands, and funding pressures arising from market changes, thereby avoiding the risk of delayed payments or failure to meet commitments due to a shortage of funds. By maintaining adequate liquidity, banks can ensure their credibility and sound financial position, increase their resilience to risk, and maintain competitiveness and trust in the financial markets.

Banks can obtain and maintain liquidity in a number of ways to ensure that they are able to respond to a variety of payment and funding needs. Customer deposits are one of the most important sources of funding for banks and an important source of liquidity. Banks rely on deposits for their lending operations and other investments to generate income and profits. The size and stability of deposits have a direct impact on a bank's liquidity and ability to operate.

Therefore, banks usually take measures to attract and retain customer deposits, such as offering competitive interest rates, convenient withdrawal services, and quality customer service, to maintain and increase the size of their deposits and to ensure sufficient liquidity to respond to various funding needs and market changes.

Banks may apply for loans from the central bank or participate in reverse repurchase operations to obtain temporary liquidity support. The central bank is usually the executor of the country's monetary policy and is responsible for regulating and managing liquidity in the financial markets. When banks face a shortage of funds or need additional liquidity, they can apply for short-term loans from the central bank. These loans, which are usually provided at lower interest rates, help banks address temporary funding needs and ensure their normal operations and ability to make payments.

In addition, banks can also participate in the Central Bank's reverse repo operations. A reverse repo is a short-term debt financing instrument in which banks sell their holdings (usually highly liquid securities such as government bonds) to the central bank with an agreement to repurchase them back after a certain period of time in the future. Reverse repo operations provide banks with an easy way to obtain liquidity and quick access to funds to deal with peaks in demand for funds or unexpected situations.

Banks can enhance their liquidity by holding a variety of more liquid assets. These assets include government bonds, as they are generally considered to be among the safest and most liquid assets. In addition, banks can hold highly liquid stocks, i.e., stocks that are actively traded in the market and easily liquidated.

In addition, other easily realizable securities are important assets that banks use to respond to liquidity needs because they are relatively liquid in the marketplace and can be quickly liquidated to meet payments and other funding needs. By holding these assets, banks can manage their liquidity risk more flexibly and reliably in the face of deposit withdrawals and other payment needs.

Banks can effectively manage their liquidity risk and increase liquidity through a variety of market operations, including buying and selling bonds to adjust their asset portfolios, hedging with derivatives such as interest rate swaps or futures contracts, and packaging assets into securities for issuance through asset securitization. These operations enable banks to respond flexibly to market changes and customer needs, thereby effectively managing liquidity risk and increasing liquidity levels.

Good bank liquidity management is essential to helping banks protect themselves against various risks, such as market risk, credit risk, and operational risk. By ensuring adequate liquidity, banks can minimize the loss of funds due to unforeseen events, maintain sufficient funds, and respond quickly to market changes and customer needs when needed. By effectively managing liquidity, banks can reduce the risk of capital outflows in the face of unpredictable events or market volatility, thereby maintaining their financial stability and reputation.

In summary, bank liquidity refers to the ability of a bank's assets, especially cash and cash equivalents, to be quickly realized to meet payment and debt service needs. Good liquidity management is essential for banks to handle deposit withdrawals, loan disbursements, interest payments, and other liquidity activities and helps to avoid bank liquidity risk.

What is Bank Liquidity Risk?

Bank liquidity risk refers to the vulnerability of a financial institution to not acquiring sufficient funds promptly to fulfill its obligations. This risk stems from various factors, including large-scale deposit withdrawals, market volatility, and imbalances within the bank's balance sheet.

Specifically, it involves the challenge of securing funds swiftly and at reasonable costs to meet short-term liabilities and other financial obligations. When a bank encounters a deficit in available funds relative to its needs, it may struggle to fulfill deposit withdrawals, loan repayments, and other essential disbursements in a timely manner. This shortfall can disrupt normal operations and pose significant challenges.

The primary causes of liquidity issues typically revolve around mismatches between a bank's assets and liabilities, or its inability to liquidate assets promptly during unfavorable market conditions. These scenarios can precipitate scenarios where banks experience heightened customer withdrawals or insufficient funds upon loan maturity.

A mismatch between a bank's assets and liabilities may lead to an imbalance between disbursements and funding needs, increasing the bank's liquidity risk. First, this situation may expose banks to challenges in repaying deposit withdrawals, loan principal and interest, or other liabilities in a timely manner. For example, if a bank's short-term liabilities exceed immediately realizable assets, it may need to liquidate assets quickly on unfavorable terms to meet payment needs, increasing asset liquidity risk.

Second, asset-liability mismatches may also weaken a bank's capital adequacy and soundness, particularly if the bank relies on short-term financing to support long-term assets, which may make it difficult to meet long-term commitments in times of market volatility or funding constraints, further exacerbating liquidity problems.

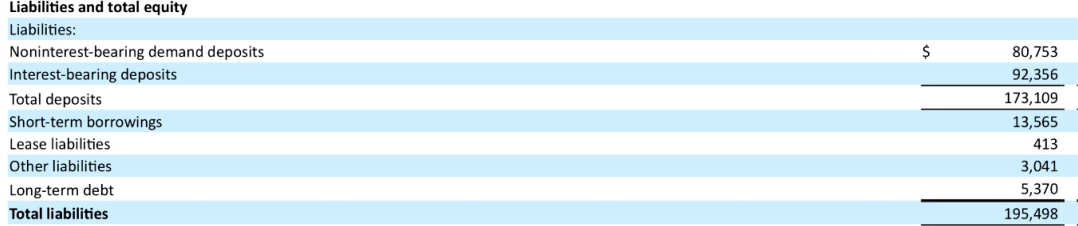

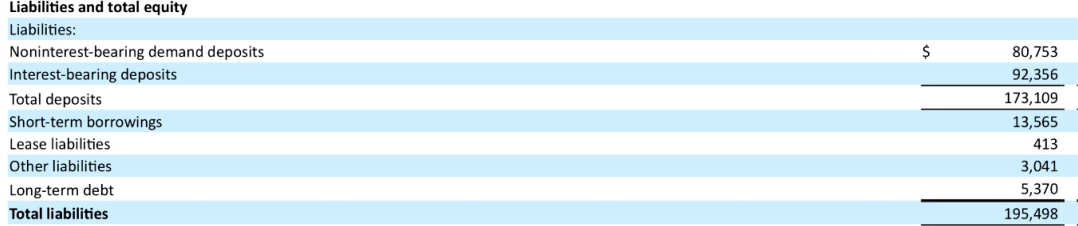

The failure of Silicon Valley Bank in 2023 was a case of bank liquidity risk due to a mismatch between assets and liabilities. As shown in the chart below, the bank's balance sheet shows a maturity mismatch (a mismatch between the maturity of the asset side and the maturity of the liability side) caused by "borrowing short and lending long" (i.e., short-term source of funds and long-term use of funds). At the end of December 2022. Silicon Valley Bank's deposits were $173.1 billion, or 89 percent of total liabilities. Of this amount, $92.3 billion were interest-bearing deposits.

There is also the possibility that banks may need to raise funds at a higher cost in times of market tightness or when the bank's credit is impaired, which could have an impact on its profitability. Tight markets usually mean a reduction in the supply of funds or an increase in the cost of funds, resulting in banks facing higher borrowing rates or other financing costs in obtaining funds. These additional costs can increase a bank's operating expenses and compress its net profit margin.

In addition, damage to a bank's credit rating may lead to reduced investor trust in it, which in turn may make the cost of borrowing further higher or funding more difficult to obtain. In this case, banks may face less efficient use of capital as well as limited business expansion. Because of increased investor concern about a bank's credit rating, banks may need to pay higher interest rates to attract funds or face stricter borrowing restrictions, which may have a negative impact on the bank's financial position and future growth.

Payment and clearing systems are critical to the normal operations of banks, as they ensure the timely arrival and settlement of funds and support banks in processing customer transactions and debt repayment. If liquidity problems at other financial institutions affect the normal operation of these systems, banks may need to take additional measures to cope with fluctuations in funding liquidity, such as mitigating risks by adjusting their fund management strategies or finding alternative means of payment and clearing.

There are also times when there is an economic downturn, a financial market shock, or a major credit event, for example, which may lead to higher pressure on banks to withdraw deposits or depreciation of their assets, which in turn may exacerbate their liquidity risk. During an economic downturn, customers may make large-scale withdrawals of deposits, leading to funding constraints for banks. At the same time, shocks in financial markets and major credit events may cause the value of assets held by banks to fall, making it more difficult to liquidate these assets or only possible to sell them at a discount, further exacerbating bank liquidity problems.

Bank liquidity risk may not only expose a bank to insolvency but may even be the trigger for a financial crisis. The existence of such risk therefore requires banks to adopt effective liquidity management measures to ensure that adequate levels of liquidity are maintained under various market conditions.

How bank liquidity is assessed

To assess the health of a bank's liquidity, one can look at a number of aspects and use various indicators and methods to get a comprehensive picture of its liquidity position. For example, it is possible to conduct daily liquidity management, which is a series of measures implemented by banks by monitoring cash flows, assessing maturity matching of assets and liabilities, and ensuring diversification of funding sources. Banks anticipate and respond to possible funding needs by regularly monitoring and analyzing cash inflows and outflows, as well as the liquidity characteristics of their assets.

In addition, banks reduce liquidity risk by maintaining a reasonable maturity profile of assets and liabilities and ensuring that short-term liabilities can be used to support the settlement and repayment of short-term assets. Diversification of funding sources is also one of the important strategies, whereby banks maintain liquidity stability through different sources of funding such as deposits, market financing, and central bank support to meet the challenges of various market and economic environments and to ensure the smoothness and stability of day-to-day operations.

For example, a bank's balance sheet can be analyzed with particular attention to the liquidity characteristics of its assets and the maturity profile of its liabilities. Focus on assets such as cash, deposits, short-term bonds, and highly liquid securities held by the bank, as well as the composition and maturity of short-term deposits, borrowings, and other short-term liabilities.

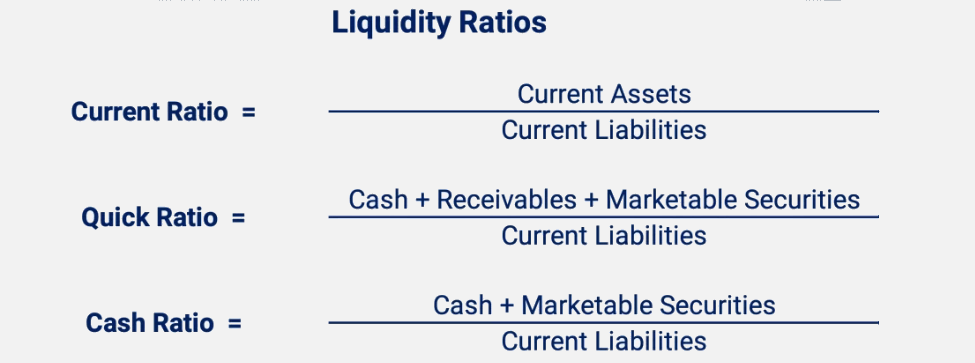

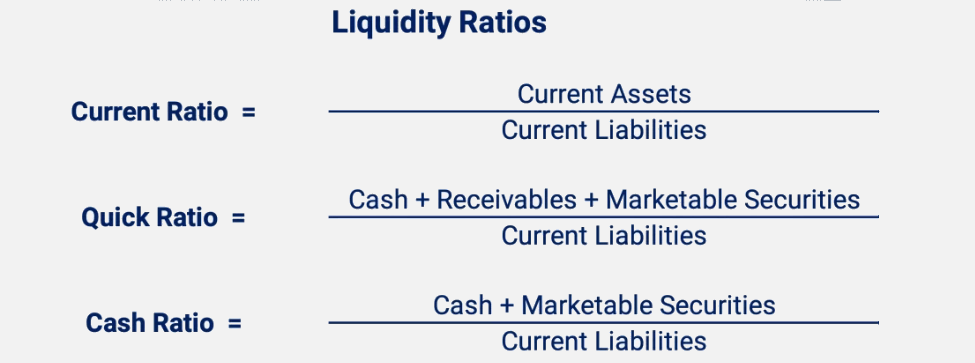

Then various liquidity indicators and ratios can be used to quantify a bank's liquidity risk, such as the liquidity coverage ratio, the ratio of liquid assets to liquid liabilities, and cash flow projection analysis. These indicators can help in assessing whether a bank has sufficient funds to meet its short-term and long-term liability commitments.

Liquidity Coverage Ratio (LCR) is an important indicator of whether a bank's holdings of high-quality liquid assets are sufficient to cover its net cash outflows when faced with a 30-day stress scenario. The value of the LCR is usually required to be no less than 100%. This means that banks must hold at least enough high-quality liquid assets to cover possible cash outflow scenarios and ensure that they can meet their payment obligations in the short term without relying on external sources of funding.

The calculation of LCR is based on the ratio of highly liquid assets held by the bank (e.g., cash, government bonds, etc.) to the projected net cash outflows. A high LCR indicates a bank's ability to handle unexpected funding needs in the short term and is therefore considered a healthy and robust indicator of liquidity management in regulatory and market assessments. By maintaining an adequate liquidity coverage ratio (LCR), banks are able to reduce their exposure to liquidity risk and enhance their ability to withstand unfavorable market conditions and stressful situations.

The cash ratio is a measure of the ratio of cash held by the bank to total deposits and is used to reflect the bank's ability to respond to short-term deposit withdrawal needs. This ratio directly affects a bank's liquidity management and risk control strategies. A high cash ratio means that the bank is able to meet its customers' cash withdrawal requests more easily in the short term, thus reducing the risk of liquidity challenges.

Typically, cash ratios should not be too high because cash does not generate interest income, which may affect the bank's profitability. However, a cash ratio that is too low may result in the bank being unable to respond to large-scale deposit withdrawal requests in a timely manner, thereby increasing liquidity risk. Therefore, banks need to set and manage their cash ratios appropriately, taking into account their business model, customer needs, and market conditions, to ensure that a balance is found between maintaining liquidity and profitability.

The Net Stable Funding Ratio (NSFR) is an indicator that assesses a bank's long-term soundness and liquidity risk by measuring the proportion of a bank's assets that are adequately supported by stable sources of funding under a one-year stress scenario.The NSFR requires that a bank hold sufficient stable funding that is capable of supporting the bank on an ongoing basis during periods of stress to ensure that its business operates in a sound manner.

NSFR requires banks to consider the expected stability of various assets and liabilities in aggregate to ensure that funding sources are sufficient to support the long-term nature of their assets. For example, long-term deposits, long-term loans, and various capital instruments are considered stable sources of funding, while funding dependent on short-term market financing is not considered stable. This comprehensive assessment helps banks better manage their asset and liability structures, reduce liquidity risk, and improve their overall soundness and resilience to risk.

The reserve requirement ratio, on the other hand, is the percentage of deposits that the central bank requires commercial banks to keep as reserves and not use for lending or other investments. This ratio is set to ensure that banks maintain sufficient cash reserves to meet customer needs in the face of possible large-scale deposit withdrawals. Such a requirement helps to maintain the stability of the financial system and prevent systemic risks arising from banks' illiquidity.

It may also examine whether banks can rely on liquidity support provided by the central bank, such as by applying for loans from the central bank or participating in reverse repurchase operations. In addition, analyze whether banks have strategies to use market operations to manage and increase liquidity, such as buying and selling bonds and conducting asset securitization.

Meanwhile, conducting stress tests in contingency situations is an important methodology for assessing banks' liquidity performance and ability to cope under different market conditions. Such tests simulate a variety of unfavorable market environments, such as large-scale deposit withdrawals, asset market volatility, and other situations that could lead to liquidity constraints.

Stress testing allows banks to comprehensively assess their liquidity position under stress scenarios and identify possible risk points and weaknesses. This analysis helps banks formulate effective liquidity management strategies and measures to ensure that they can take timely and appropriate countermeasures in the face of unforeseen circumstances to safeguard the safety and stability of their funds.

Through the use of the above indicators and methods, banks and regulators can comprehensively assess the status of bank liquidity, identify potential liquidity risks, and take appropriate management measures. This not only contributes to the stable operation of the bank itself but also helps to maintain the stability of the financial system as a whole.

| Aspects |

Description. |

Risk factors |

Valuation Methodology |

| Definition |

A bank's liquidity is its ability to convert assets into cash quickly. |

Asset Liquidity |

Cash flow testing ensures rapid asset realization under stress. |

| Role |

Ensures solvency, boosts reputation, and manages risk efficiently. |

Liability Liquidity |

Analyzing liability maturity ensures short-term debt repayment. |

| Risks |

The bank risks asset conversion and timely liability repayment. |

Liquidity buffer |

Manage liquidity amid market volatility for stable operations. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.