US stocks closed the first half of the year 14% above where they started the

year on Friday amid increasing concerns over the narrowness of a rally that was

predominantly driven just five stocks.

The rise in the benchmark S&P 500 ranks as one of the best performances

for the six months since the late-1990s dotcom bubble. That even followed a

24.2% increase last year –the highest since 2021.

However, almost 60% of the gain for the year to date was driven by Nvidia,

Microsoft, Amazon, Meta and Apple. Nvidia alone accounted for 31% on high hope

for the potential of generative AI.

That trend in recent months became more evident with Nvidia, Apple and

Microsoft driving more than 90% of the growth in Q2. There have been few signs

of broadening out as expected by analysts.

Still investors are hopeful that underperforming sectors will eventually

start to catch up - a pattern seen briefly in Q4 2023. Extended high interest

rates in the US typically favours value stocks.

Andrew Slimmon, a senior portfolio manager at Morgan Stanley Investment

Management, expressed his optimism that the upcoming earnings season would help

draw attention to fundamentally solid companies.

The current high level of concentration was inherently unstable, but

historically the market has stayed split for a very long time, said Denise

Chisholm, director of quantitative market strategy at Fidelity.

Economy Weighs

High valuations are another key point of contention. The S&P 500

Information Technology Index in June traded at 31 times expected profits in the

next 12 months, compared with a multiple of 21 for the S&P 500.

Big US companies generally seem to have the profits to back up their current

lofty valuations, unlike during the peak of the dot-com bubble of the late 1990s

and early 2000s, experts said.

The outsized sway of technology giants is likely to persist, absent a major

market rout along the lines of what investors endured in 2022, says JPMorgan

Asset Management's David Kelly.

Profit growth for the Big Tech is largely expected to slow, while the

remaining S&P 500 companies are poised to see earnings accelerate, in the

view of many forecasters.

Evercore ISI's research showed there were three equally expensive regimes in

the recent past — 1993 to 1995, 1998 to 2000 and 2020 to 2021 — and in each case

the market rallied until the economy faltered.

In a note to clients, BCA Research chief global strategist Peter Berezin

warned that, contrary to popular belief, the economy will fall into a recession

either this year or in early 2025.

Should that happen, the S&P 500 could tumble to 3,750, he warned. The

prediction hinges on the belief that the labour market will slow notably in

coming months, which will weigh on consumer spending.

Crying Bears

Corporate America faces the highest earnings bar in almost three years as it

prepares to report results, according to Goldman Sachs. Profits at S&P 500

firms are expected to rise 9% on average in Q2.

“The magnitude of EPS beats is likely to diminish as consensus forecasts set

a higher bar than in previous quarters,” the bank said, adding that stocks with

an upside surprise will be less rewarded.

While almost 80% of S&P 500 companies posted better-than-expected profits

in the last quarter, but the reporting season broadly got a muted response from

investors.

Stocks underperformed the index by about 12 bps on the day of their results,

according to the median reading of Bloomberg Intelligence data. Goldman's sentiment indicator is already at elevated levels.

Faced with a growing number of investment banks upgrading their year-end

forecasts, the few remaining bearish strategists say their contrarian views are

proving an increasingly difficult sell.

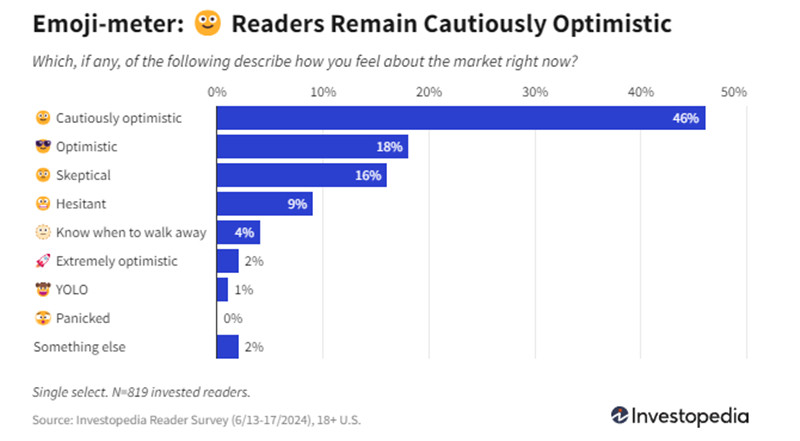

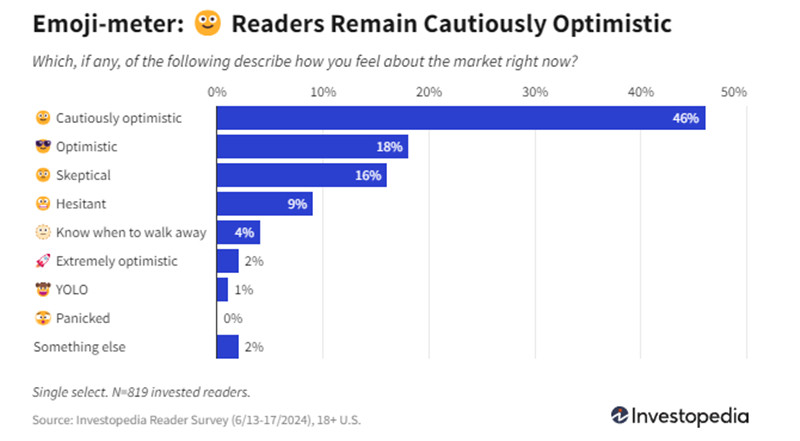

Individual investors were growing more optimistic about the stock market,

Investopedia's June survey found. Nearly two-thirds of respondents described

their sentiment as "cautiously optimistic" or "optimistic".

Likewise, the AAII Sentiment Survey was steady around 44% in the week ended

June 26, about 8% above its historical average. The respondents have stayed

bullish since late April.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.