In the financial world, people are always watching the specifics of the economy and the markets. And whether it's the ups and downs of the stock market or the rise and fall of interest rates, they all seem to be related to Treasury yields. In this article, we will interpret the signals of Treasury bond yields in detail and understand these market signals in detail so that you can not only protect your assets but also seize investment opportunities.

How to Calculate Treasury Yield

How to Calculate Treasury Yield

As the name suggests, the national debt is the country's commitment to borrow money from the public and to pay interest within a certain period of time to repay the principal at maturity. U.S. bonds are bonds issued by the U.S. government; the money lent to the U.S. government will get an IOU. Since the U.S. is backed by the U.S. government and the U.S. dollar is the world's common currency, The U.S. government also has a high degree of credibility and will certainly not renege on its debts. Therefore, US Treasury bonds are considered a risk-free asset.

U.S. bonds are issued with different borrowing periods, ranging from one month to 30 years. Short-term U.S. debt is vulnerable to policy and market fluctuations are more frequent; too long-term U.S. debt uncertainty is too much, and liquidity is not high. The 10-year U.S. debt has the highest liquidity of all maturities, so the 10-year U.S. bond yield is widely recognized as a risk-free rate of return.

In layman's terms, the interest rate of any money in circulation is based on the return of Treasury bonds. Investment in other assets to obtain at least this level of return is good; otherwise, investors directly buy U.S. bonds. As a risk-free rate, the 10-year U.S. bond yield is also the basis for bank credit rates, including mortgages.

It is calculated slightly differently depending on the factors considered. Generally, the real interest rate, unadjusted for inflation or deflation, is also known as the nominal yield when stated on the bond. It is the annualized rate of interest specified on the bond contract at the time the investor purchases the bond and does not take into account the effects of inflation or currency depreciation.

The nominal yield includes the bond's coupon rate, which is a fixed rate determined at the time of issuance. For example, if a bond has a face value of $1.000 and a coupon rate of 5%, then its nominal yield is 5%. The exact formula is: nominal yield = coupon rate ÷ face value of the bond x 100. In this formula, the coupon rate is the annual interest payment, and the face value of the bond is the initial value of the bond.

And to take inflation into account, it can be subtracted so that you are able to get the real rate of return, which reflects the change in the real purchasing power of the investment. The specific formula is: real yield = nominal yield minus Inflation rate.

There is also a yield to maturity, which is the annualized rate of return that an investor receives when he buys a bond and holds it to maturity. The calculation of YTM involves factors such as the face value of the bond, the purchase price, the maturity period, and the frequency of interest payments. The specific formula is: YTM=(M-Pb)/(Pb*N)*100%

Where M is the amount of one debt service payment at maturity, Pb is the market bid price, and n is the number of years remaining from purchase to holding to maturity. The yield to maturity takes into account the global return on the Treasury bond, including interest and principal, and gives the investor's expected rate of return when the bond is held to maturity.

What rising and falling Treasury yields tell us

| Characteristics |

What the Rise Says |

What the decline means |

| Economic conditions |

Economic optimism boosts return demand. |

Worried investors seek safer assets. |

| Inflation Expectations |

Inflation rises, investors chase higher returns. |

Inflation falls, lower investor returns. |

| central bank Policy |

Tightened policy, higher short-term rates. |

Easy policy, lower short-term rates. |

| Investor Risk Appetite |

Higher returns, willingness for riskier assets. |

Conservative, favors low-risk assets. |

| Currency Liquidity |

Markets fret over short-term bond liquidity. |

Short-term bond liquidity improves. |

| Global Economic Uncertainty |

Risk aversion, short-term assets favored. |

Stable global economy, leans long-term. |

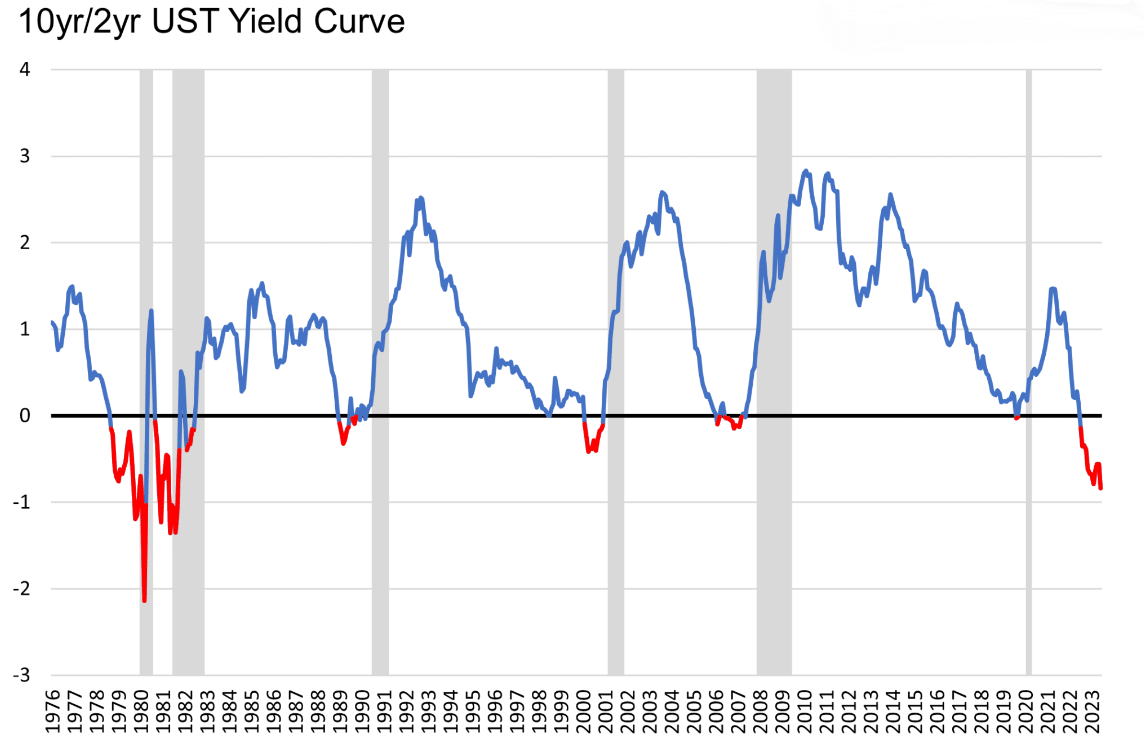

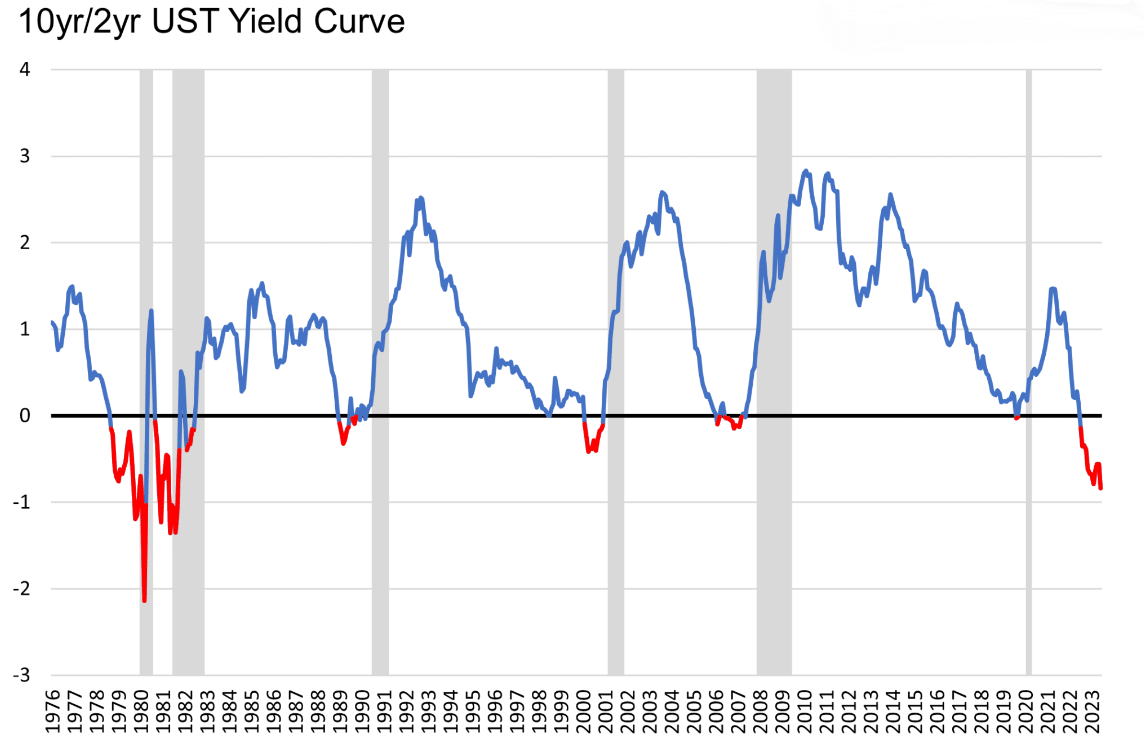

Treasury yields are inverted

This refers to the fact that the yields on short-term bonds are higher than the yields on long-term bonds. This is often considered a bond market anomaly because, in general, long-term investments should yield higher returns than short-term investments.

This brings us to several characteristics of treasuries, one of which is that the yields on short-term and long-term treasuries move in the same direction, and if the yields on short-term treasuries rise, the yields on long-term treasuries will rise as well. The second is that the price and yield of Treasury bonds are negatively correlated, with the higher the price, the lower the yield. If a bond's popularity increases with market demand, it will cause its price to increase and its yield to decrease.

Third, Treasury bonds are considered a safe-haven asset. In the case of U.S. long-term Treasury bonds, for example, if investors are not optimistic about future market expectations, they will withdraw their investments from stocks or other high-risk investments and purchase 10-year Treasury bonds as a hedge.

When inversion occurs, it is seen as a precursor to a recession. This is because investors may be more willing to buy long-term Treasury bonds to avoid a possible future economic downturn. This may indicate that the market has concerns about the future economic outlook, leaving investors interested in assets with lower short-term risk. In the US, for example, historical data suggests that almost every time this so-called inversion occurs, a recession occurs in the US. For example, an inversion of yields occurred in the U.S. in 2008. before the subprime mortgage crisis.

To see if an inversion will occur, you can look at the Treasury yield curve. You can also use the yield of the 10-year Treasury bond minus the yield of the 2-year Treasury bond to get a difference that is greater than 0. This means that long-term yields are greater than short-term yields, which is relatively normal. If the difference is less than 0. It means that the yield of long-term Treasury bonds is smaller than the yield of short-term Treasury bonds, which is the phenomenon of yield inversion.

This phenomenon can happen mainly because investors expect a recession; it is not that the inversion is causing an economic crisis. It is more of a signal that is the result of a collective vote by the majority of investors on what the market expects.

And the interest rate on Treasury bonds

And the interest rate on Treasury bonds

They are two related but different concepts that are commonly used to describe different aspects of the Treasury market. Treasury yield is the annual rate of return on Treasury Securities, which is the rate of return an investor receives from holding Treasury securities. It is calculated based on the current market price of Treasury bonds and the face value of the bond, usually expressed as a percentage. The calculation involves the annual interest payments on the bond and the current price of the bond.

It is a dynamic metric that fluctuates with changes in the Treasury market. If the market price of Treasury securities rises, the yield falls; conversely, if the price falls, the yield rises.

The interest rate on a Treasury bond usually refers to the coupon rate on the bond, which is the annual rate of interest promised to be paid when the bond is issued. It is set at the time the bond is issued and remains constant. For example, if a Treasury bond has a coupon rate of 5 percent, then 5 percent interest will be paid annually.

The interest rate on a Treasury bond is a static indicator; it does not change with fluctuations in market prices. The Treasury bond interest rate remains constant regardless of the current market price of the bond.

As an example, a U.S. bond with a one-year maturity has a coupon rate of 2%, which means that it is able to earn two points when purchased and held to maturity. Let's say Zhang San buys a $100 U.S. bond and is able to get $2 in interest after one year. So the interest rate on U.S. bonds is fixed from the time of purchase, written into the contract, and the loan agreement will not change with future changes in the situation.

However, the yield on U.S. bonds changes every moment, and there exists a secondary market where investors can buy and sell their holdings of U.S. bonds. Still in the example just given, suppose Zhang San suddenly needs money urgently after six months of holding U.S. bonds and sells all of them to Li Si on the secondary market at a price of $98.

After half a year, Li Si will be able to get the principal and interest from the U.S. government, that is, the U.S. bond coupon rate of 2% interest on two U.S. dollars plus the principal of $100. A total of $102 can be obtained. Li bought the U.S. debt for $98. and after maturity, he will get the principal and interest of $102. a profit of $4. Then its yield to maturity is 4.08%.

In other words, Treasury yields are more focused on describing the actual rate of return that investors receive under current market conditions, while Treasury interest rates are more focused on describing the fixed rate of interest determined at the time of the issuance of a Treasury bond.

and the price of Treasury bonds

There is an inverse relationship between the two, which is due to the basic pricing principle of bonds. That is, when the yield on Treasury bonds rises, the price of Treasury bonds falls, and vice versa. When the market rate of interest on bonds rises, new issues offer higher interest rates, so older bonds have relatively lower fixed interest rates, causing their market prices to fall. Conversely, when market interest rates fall, the fixed rates of older bonds are relatively more attractive, and their prices rise.

As you can see from the above example, US bond yields follow the price of US bonds. The higher the price at which U.S. bonds are traded, the lower the yield on U.S. bonds. The lower the traded price, the higher the yield. So the yield on US bonds can be calculated based on the current trading price of US bonds.

For example, the current 10-year U.S. bond price is 88.2969. with a coupon value of 100 and a coupon rate of 2.75%. Show that if this bond is purchased at that price and held to maturity for one year, with two interest payments and an interest income of 1.375 per period, and redeemed at maturity at the coupon price, the annual yield would be 4.219 percent.

U.S. bond yields and U.S. bond prices are inversely proportional; when investors scramble to buy U.S. bonds, they will push up the price of U.S. bonds, resulting in lower U.S. bond yields. On the contrary, if investors are not bullish on U.S. bonds and sell more people than buy more people, U.S. bond prices will fall and yields will rise.

For example, since March this year, the Federal Reserve has been raising interest rates, and this has led to a sharp rise in U.S. bond yields. So investors have begun to sell U.S. bonds and put their money in the bank. There are more people selling U.S. bonds than buying them in the market, and the price of U.S. bonds will fall while U.S. bond yields will rise.

Meanwhile, longer-term bonds are more sensitive to changes in market interest rates. Long-term bonds are relatively more volatile, so their prices fall more when market interest rates rise and rise more when market interest rates fall.

So investors should make a good trade-off between price and yield when investing in Treasury securities. When market interest rates fluctuate, bond prices and yields adjust back accordingly, thus affecting investors' returns and investment strategies.

Treasury yields and the federal funds rate Since 2007

| Instrument |

High |

LOW |

Current |

Basis Points From LOW |

| 30 Year |

5.35% |

0.99% |

3.85% |

286 |

| 20 Year |

5.44% |

0.87% |

4.06% |

319 |

| 10 Year |

5.26% |

0.52% |

3.81% |

329 |

| 5 Year |

5.18% |

0.19% |

4.13% |

394 |

| 2Year |

5.10% |

0.09% |

4.87% |

478 |

| 3 Month |

5.55% |

0.00% |

5.43% |

543 |

| FFR |

5.41% |

0.04% |

5.07% |

503 |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

How to Calculate Treasury Yield

How to Calculate Treasury Yield And the interest rate on Treasury bonds

And the interest rate on Treasury bonds