People always talk about money management, which you might think is about being dissatisfied with your own wealth and wanting to make it better. But the truth is that it is nothing more than a way to avoid depreciation of the wealth in hand. The root of the problem is inflation. People know it, worry about it, but do not necessarily know the reason why it appears. Now let's explore the causes of inflation and how to deal with it. We hope that while we understand it, we will also be able to find the right way to deal with it.

What is Inflation?

In fact, it refers to a general increase in the general price level over a certain period of time, resulting in a decrease in the purchasing power of the same amount of money. Where inflation stands for currency in circulation and inflation stands for an increase in quantity, the combination means an increase in the quantity of money. It is a reflection of the devaluation of money, i.e., it loses some of its value in terms of purchasing power. To put it in more common parlance, it means that money is becoming less valuable.

That is, inflation causes fewer goods and services to be purchased with the same amount of money. People need to pay more money for the same goods because the price of the goods has increased. It is also a situation where the supply of money exceeds the actual demand, leading to a depreciation of the currency and an increase in prices.

There is a special formula in economics called MV equals PT. m is the total amount of money, v is the speed at which money circulates, p is the price level, and t is the total exchange, which is the total output in the economy.

Typically speaking, the state starts to print more money, the monetary aggregate m increases, and the velocity of money in circulation v increases. To drive the equals sign, the price level p and total output t on the right-hand side rise. The simple understanding is that the water rises, but so does the relationship between inflation and price increases.

A common measure of inflation is the Consumer Price Index (CPI), which is a measure of the price trend of goods and services we normally use, reflecting the total cost paid by consumers.The CPI is a reflection of the whole of society's residential price consumption, and its growth rate is also directly and simply regarded as the rate of inflation by most people.

It also comes in many different types, including moderate, hyperinflationary, and deflationary. Generally, moderate inflation is considered to help promote economic growth, but excessive inflation can lead to instability.

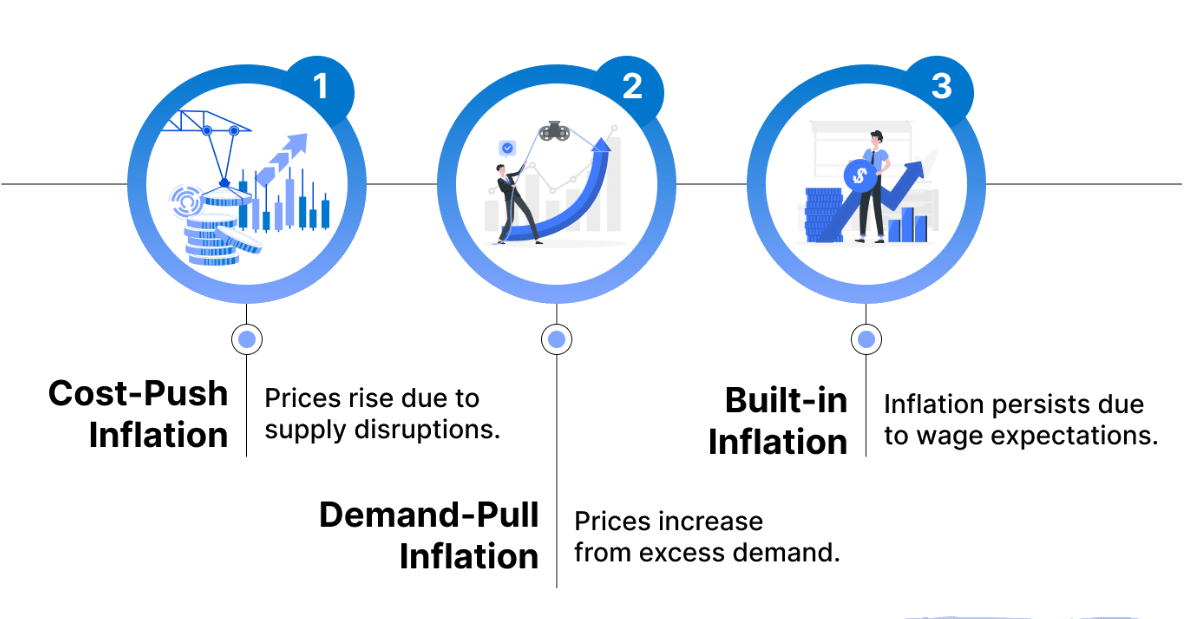

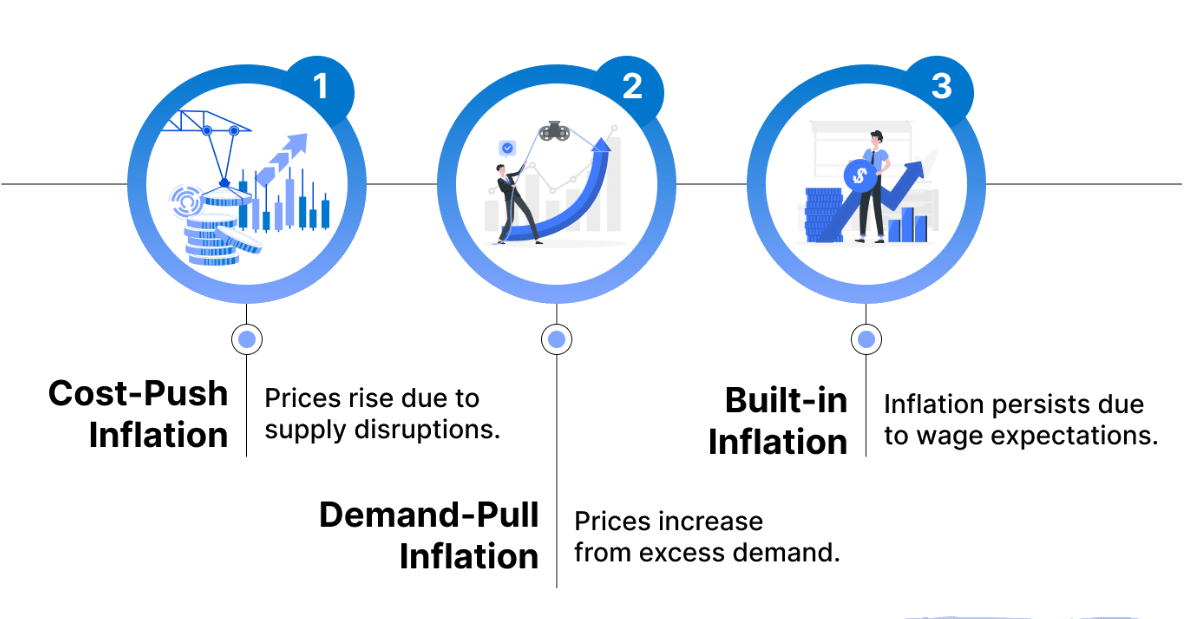

And different types of inflation may have different causes and effects. The causes can be manifold, including overheated demand, cost-push, and increased money supply. Overheated demand may be due to rapid economic growth and the inability of supply to keep up with demand. Cost-push can be due to rising production costs, which firms pass on to consumers.

And the effects are far-reaching and wide-ranging, with multiple implications not only for individuals and businesses but also for governments. The impacts are specifically a decline in purchasing power, changes in interest rates, investment decisions, and financial planning. They may also lead to a redistribution of wealth, affecting different segments of the population to varying degrees.

For consumers, a fall in purchasing power may lead to a rise in the cost of living. For businesses, costs may rise as they may have to pay higher wages and raw material costs. For the government, once inflation moves towards a vicious cycle, it will cause the overall economic system to collapse.

Therefore, governments and central banks can take a range of measures to deal with it, including tightening monetary policy, Fiscal Policy adjustments, and regulatory measures. The central banks of many countries have set target Inflation rates and adopted monetary policies to maintain their stable levels. When the level of inflation is too high or too low, central banks adjust interest rates and other monetary policy tools to reach the target level.

Inflation is an important concept in economics that has far-reaching implications for the lives of individuals and societies. Therefore, economists and policymakers usually keep a close watch on its trend and adopt appropriate policies to maintain the balance of the economy.

Difference between inflation and deflation

|

Characteristics

|

Inflation

|

Deflation

|

|

Definition

|

Rising prices, shrinking purchasing power. |

Prices down, purchasing power up. |

|

Price Trend

|

Persistent annual price increases. |

Persistent annual price decreases. |

|

Causes

|

Demand, money increase, cost pressures. |

Low demand, less money, credit crunch. |

|

Economic Impact

|

Growth may increase inequality. |

Less output, financial stress, job losses. |

|

Interest rates

|

Usually accompanied by rising interest rates |

Usually accompanied by a fall in interest rates |

What Causes Inflation?

When the amount of money circulating in an economy exceeds the size of the economy, too much money chases too few goods, and prices naturally rise. The causes of this usually involve factors such as supply and demand, cost pressure, money supply, and expectations.

This means that when the economy is over-booming and demand exceeds supply, it can lead to higher prices. High demand can spur companies to raise prices because consumers are willing to pay higher prices to get the goods and services they need. Simply put, this is demand-pull inflation. When aggregate demand exceeds the economy's ability to produce aggregate output, inflation results from excess demand pushing firms to raise prices.

For example, governments stimulate the economy and increase spending, leading consumers and businesses to increase their purchasing power and driving up aggregate demand. This occurred in the aftermath of the financial crisis, when some countries adopted large-scale fiscal stimulus measures, increasing infrastructure investment and social welfare spending, which drove up aggregate demand.

Cost-push inflation is caused by rising production costs, including increases in the cost of raw materials, labor costs, and energy costs. When production costs rise, firms may choose to pass these costs on to consumers, resulting in higher prices for goods and services.

Rising production costs such as raw materials, labor, and energy drive enterprises to raise the prices of their products. For example, the rise in Crude Oil prices in recent years has led to an increase in energy costs. Enterprises have had to raise production costs to maintain profits, and prices of goods have risen, which has sparked fears of inflation.

It is also the case if wages rise faster than productivity growth and firms raise the price of their products to pay higher wages. Factors such as wars and natural disasters can also drive up prices; for example, in Russia, the price of imported goods has risen by 30 percent because of the war. Add to this the fact that many high-tech products cannot be imported because of Western sanctions, and supply falls off a cliff. A decrease in supply and a rise in prices trigger cost-push inflation.

An increased money supply is also a major cause of inflation. When the supply of goods and services is relatively stable and the money supply is excessive. Prices will naturally rise, and inflation will occur. This is mostly caused by excessive printing of money by the government or the central bank or the implementation of loose monetary policy. For example, the over-issuance of money by the government of a certain country during the crisis period led to inflation, the rapid depreciation of the currency in the market, and soaring prices.

Another important reason is that too many expectations can also lead to inflation. If people expect inflation to come, they may act accordingly. For example, they may increase their consumption on their own, or they may even want to overspend and stock up on things because they may be more expensive afterwards.

If everyone in the economy thinks this way, then money stays in everyone's hands for a shorter period of time, which actually increases the velocity of money circulation. And when the velocity of money increases, then the amount of money in circulation increases while the total amount of money remains the same. So the cycle goes on and on; even if the central bank doesn't print a single cent, inflation will happen on its own.

There is also the fact that when a currency is devalued, the price of imported goods rises, which can also cause inflation to occur. This is because the purchasing power of the national currency declines relative to other currencies. There are also some cases of inflation that are caused by international factors, such as fluctuations in the prices of raw materials, exchange rate movements, and geopolitical events, which are external factors that can directly or indirectly affect a country's price level.

These multiple causes are usually intertwined, and inflation in an economy may be affected by a number of factors at the same time. The government and the central bank need to take different factors into account when dealing with inflation and adopt appropriate monetary and fiscal policies to maintain inflationary stability. It is important to note that the impact of inflation varies from country to country, region to region, and period to period.

What are the Consequences of Inflation?

What are the Consequences of Inflation?

Inflation can lead to a wide range of economic and social consequences, the severity and nature of which depend on the extent of inflation and the particular circumstances of an economy.

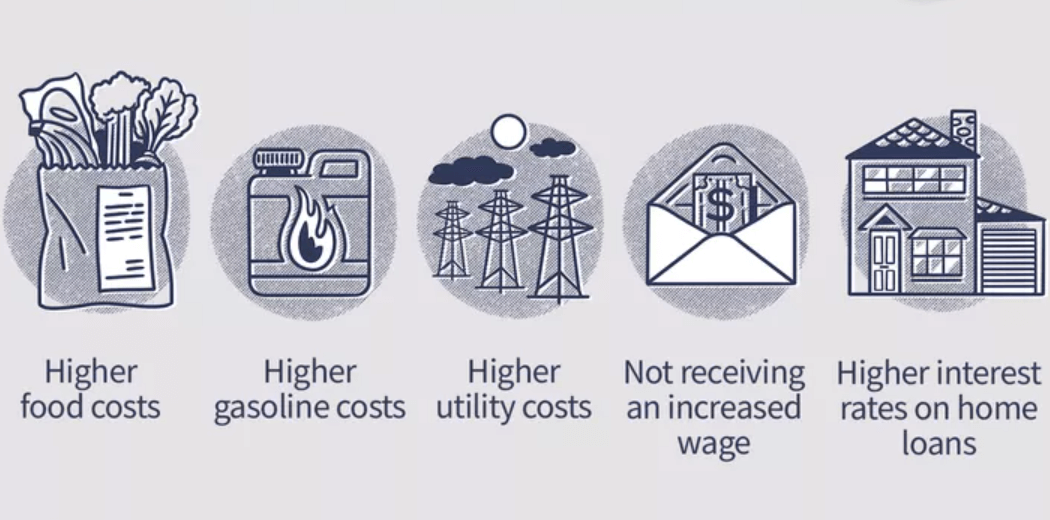

It can lead to a reduction in the purchasing power of the same amount of money, with people needing to pay more money for the same amount of goods and services. This can affect the standard of living of individuals and families, especially for those on fixed or low incomes.

As more and more currencies appear in this world, it makes the currency itself less and less valuable. Let's say that originally, a bowl of beef noodles cost $50. and you had $100 in hand to eat two bowls. Now, because of price increases, beef noodles have become a bowl of 100 yuan. Now,? the hand of 100 yuan is only enough to eat a bowl. Your loss of one bowl of beef noodles is the best proof of cash devaluation, which can also be referred to as a decrease in purchasing power.

High inflation rates can lead to increased uncertainty as people find it difficult to predict future price levels. This may affect the investment decisions of companies, causing them to postpone investments or adjust their business strategies. In order to curb inflation, central banks may adopt a tight monetary policy and increase interest rates. This will increase the cost of borrowing and affect lending and investment by businesses and individuals.

Inflation can have a particularly large impact on those who rely on fixed incomes. This is because their incomes do not usually rise in line with the level of inflation or do not rise at the same level as inflation. Income rises do not keep pace with price increases, and they become poorer by comparison.

Let's say the monthly income is $30.000. and this year the boss adjusts the salary to $31.500. looking at the rise in income. As a result, when you buy dinner, you find that the sesame noodles have risen from $40 to $50 a bowl, and this is an increase of 25 percent, but your salary has only risen by 5 percent. It is useless to increase salaries when prices are rising due to inflation.

And this still refers to those whose income has risen. If their income has not risen, it is tantamount to a pay cut in disguise by society. The more fixed and unchanging the income is, the less growth there is, and the more it will be hurt by inflation. This will in turn lead to a widening of the gap between the rich and the poor, as those who own assets may be more likely to preserve their value in inflation.

Inflation may lead to higher asset prices, including in the property and stock markets. This may make investors more willing to invest their money in real assets as a hedge against inflation. If inflation is higher than in other countries, the country's currency may depreciate, causing exports to become more expensive, which reduces the country's competitiveness in the international market.

Most people keep cash savings in their hands, and such people will be greatly affected once inflation occurs. Because the world's money will only increase and not decrease, holding cash is like holding a popsicle in your hand that will slowly melt over time. Inflation is like the sun; the hotter it gets, the faster the popsicle will melt. So determining how much cash should be kept on hand is a dilemma that every investor needs to pay close attention to.

Overall, the consequences of inflation depend on a number of factors and can have an impact both at the macroeconomic level and at the individual level. So what is the usual response of governments and central banks to ensure balanced and sustainable economic growth?

Effective Responese to Inflation

Inflation is usually dealt with by the government or central bank, usually through a combination of monetary, fiscal, and structural policies. For example, central banks can tighten the money supply by raising interest rates. Higher interest rates usually reduce borrowing and spending, thus dampening overheated demand and having a dampening effect on inflation.

Governments can take fiscal measures to curb inflation. This may include reducing government spending, raising taxes, or some structural fiscal reforms to balance the finances. The demand for private sector borrowing can be reduced by raising interest rates on government bonds to attract investors. This helps to reduce consumption and investment, thereby slowing down inflation.

By improving market regulation and increasing competition in the market, the government can reduce the likelihood of firms abusing their dominant market position, which can help curb price increases. By implementing policies to increase the value of the currency, it can reduce the price of imported goods, thereby curbing inflation.

By investing in technological innovation, education, and training, productivity can be increased, thereby moderating the cost drivers of inflation. Ensure that wage negotiations match productivity growth to avoid excessive increases in labor costs. In some cases, governments may adopt price control measures to limit price increases for certain goods and services. However, this is usually considered a short-term and unsustainable instrument.

What are the ways in which individuals can cope in times of inflation? The first option is to raise income. For example, endeavoring to improve one's skills and career in order to increase one's income. In an inflationary environment, having a higher level of income can help you cope with the rising cost of living. At the same time, you can make reasonable budgets and spending plans and be smart about your spending to avoid unnecessary expenses in order to keep your finances sound.

The next option is to protect your assets. This can be divided into two areas: saving and investing. For savings, you can put your money into low-risk items with stable returns, such as fixed deposits and bonds. One can also own physical assets such as real estate, gold, or other Precious metals, which usually retain or increase in value during inflation and can act as a hedge against it.

Investments can be made in assets that have the ability to preserve value during inflation, such as some sectors in equities (e.g., raw materials, energy), bonds, or some commodities. And consider diversifying your investments into different asset classes, such as equities, bonds, property, and commodities. Diversification reduces risk and helps protect against the impact of inflation on specific assets.

There is also a need to gain a deeper understanding of the impact of inflation on the economy and personal finances and to maintain sensitivity to the financial market and economic trends to make better investment and financial decisions. And, in anticipation, adjust the portfolio to better suit the inflationary environment. For example, increase the proportion of inflation-sensitive assets, such as equities, and reduce the proportion of bonds.

Inflation and unemployment

|

Characteristics

|

Inflation

|

Unemployment

|

|

Definition

|

Prices up, purchasing power down. |

Not enough jobs, significant workforce idle. |

|

Economic Impact

|

Production up, inequality, spending impact. |

Slow growth: Lower income, weaker spending. |

|

Causes

|

Demand, money increase, cost pressures. |

recession, tech change, structural issues. |

|

Interest Rate

|

Usually accompanied by rising interest rates |

Usually brings lower interest rates. |

|

Social Impact

|

Widens rich-poor gap, impacts fixed incomes. |

Social turmoil: Inequality, tension. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What are the Consequences of Inflation?

What are the Consequences of Inflation?