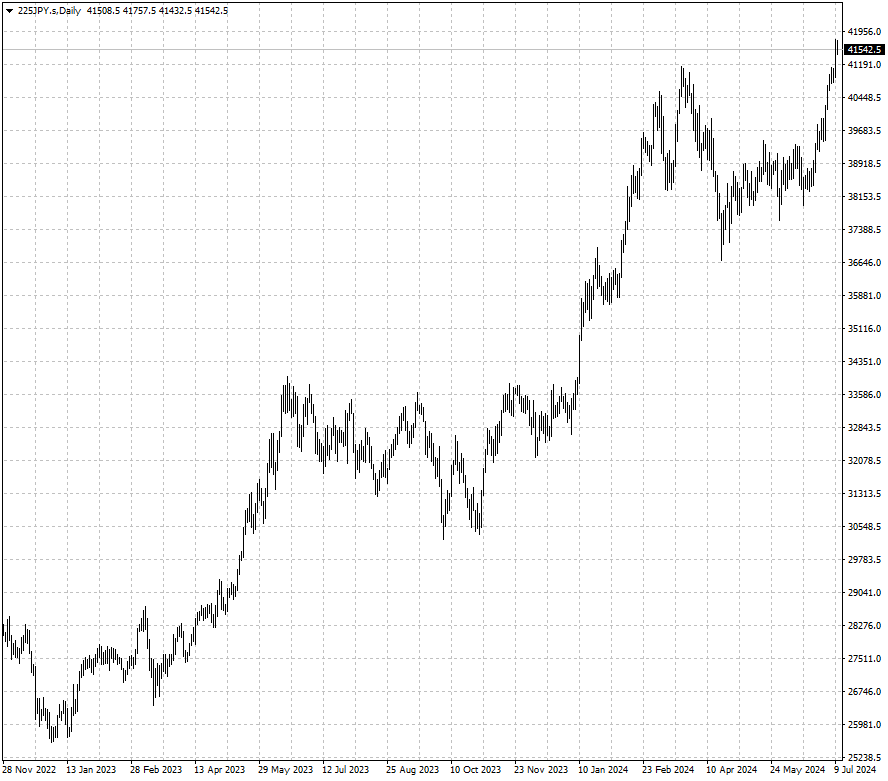

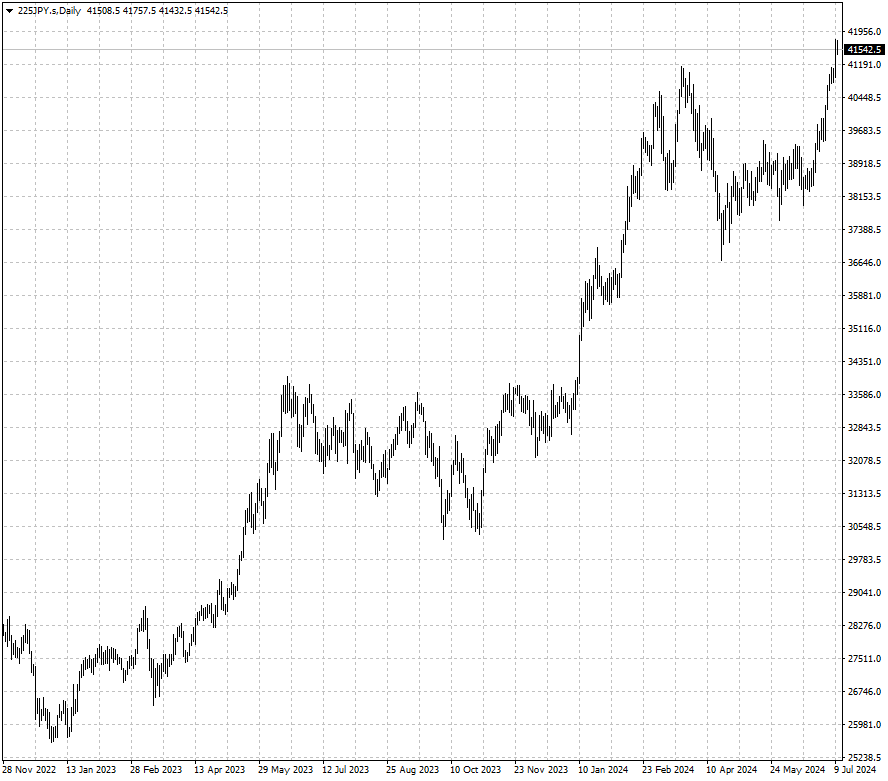

Japan's Nikkei 225 rose nearly 2% on Tuesday to log a fresh record high

close. Both foreign and domestic investors have piled into the Japan market

in recent months.

According to exchange data, cross-border investors snapped up Japan stocks

worth a net 604.93 billion yen in the week ending 28 June, marking their largest

weekly net purchase since mid-April.

Technology-related shares attracted strong demand. But some are growing

concerned about an overheating of the segment that could be in a bubble,

according to a japanese survey.

Respondents predicted that the Nikkei will trade at 40,020 by August, marking

the first time in the survey's history that the average one-month forecast

pegged the benchmark above 40,000.

Asked about key market factors for the next six months or so, 59% said they

are focusing on "economy and corporate earnings," while only 8% cited "foreign

exchange rates."

A large build-up of margin buying positions by individual traders is looming.

Those positions are near an 18-year peak with chipmakers at the centre of an

AI-inspired buying boom.

Many chip stocks, including Tokyo Electron, have turned listless after

hitting highs in March and April. Miki Securities believes unwinding of margin

position may have weighed on them.

Stumbling Block

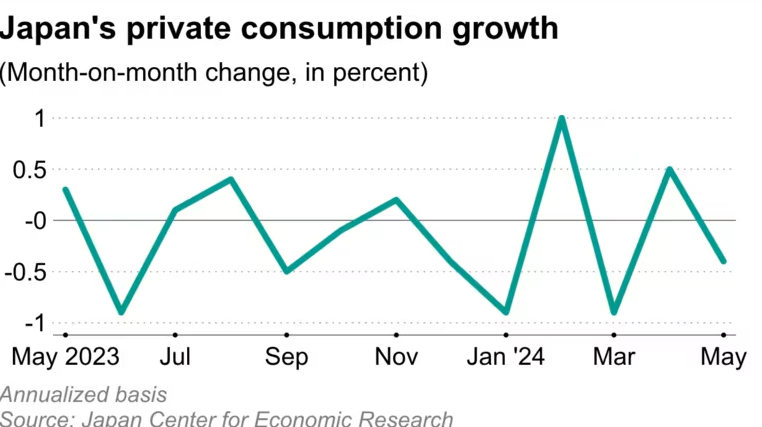

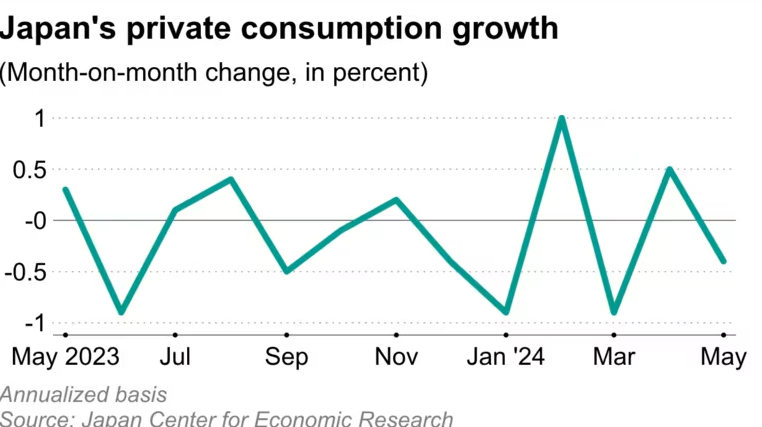

A survey by Japan Center for Economic Research released on Tuesday showed

economists expect GDP growth of 0.44% this fiscal year, down from a 0.62%

forecast made in the previous survey.

Economists at BNP Paribas and SMBC Nikko Securities slashed their growth

projections to predict 2024 will mark Japan’s first annual contraction since the

pandemic in 2020.

State Street Global Advisors said benign nominal growth story accompanies by

continued shift to structural inflation corporate reform and BOJ normalisation

are tailwinds to overall Japan equities.

Japan's core inflation rate rose for the first time in three months in May

due to higher electricity costs, staying well above 2%. That bolsters the case

for more rate hikes down the road.

The BlackRock Investment Institute is bullish on Japanese equities thanks to

support from the return of inflation, shareholder-friendly corporate reforms and

BOJ normalisation.

Goldman Sachs Asset Management views Japanese equities as particularly

attractive as plays on trends ranging from AI to addressing climate change,

adding corporate governance reforms also help.

The BOJ will likely hold fire this month and point to recent weak signs in

consumption. Household spending unexpectedly fell in May as higher prices

continued to squeeze purchasing power.

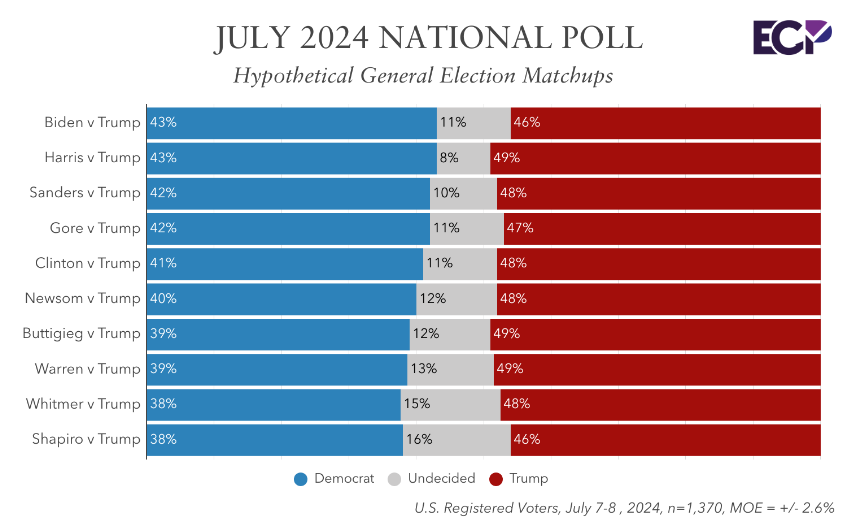

Trump Effect

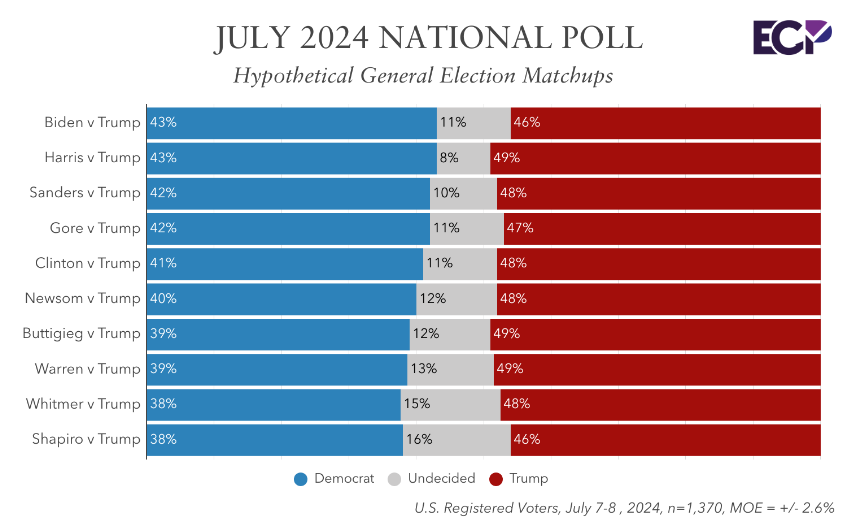

Donald Trump’s growing lead in the US presidential race has sparked a rush to

identify the key winning trades in global markets. History suggests that

Japanese stocks are a good bet.

According to the latest Emerson College Polling survey, Trump's support

remains at 46% - 3% higher than Biden's. When undecided voters are asked which

candidate they lean toward, 50% support Trump and 50% support Biden.

The Nikkei 225 mirrored the S&P 500 in gaining roughly 20% in 2017 – the

first year after the presidential election which Trump won. Meanwhile, the yen

was up 3.7% against the dollar.

Strategists say the boost from a weak yen will give Japan shares a leg up,

just as funds seek alternatives to Chinese equities in anticipation of a tougher

Trump stance toward Beijing.

To be clear, a win for Trump may not provide a blanket boost for Japan's

shares. Stocks with a substantial exposure to China are likely to take a hit if

tensions between Beijing and Washington intensify.

If the yen continues to weaken, the Trump administration could take actions

to force the yen to appreciate, which in return, could benefit Chinese equities,

according to RBC Wealth Management Asia.

Trump's victory could benefit most of ex-China Asian equity markets,

especially the Japanese equity market dominated by manufacturing firms, said

Invesco Asset Management Japan.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.