For many people, real estate investing falls into the category of being a high barrier to entry. Whether it is a young person who has just started working with a low salary or a middle-aged breadwinner with a heavy family burden, it is difficult to come up with a large down payment to enter the real estate market at one time. For these situations, real estate investment trusts (REITs) are undoubtedly an ideal choice. As a low-barrier, low-risk investment vehicle, it allows investors to participate in the real estate market with a small amount of capital and enjoy stable returns. Next, we will delve into the pros and cons of REITs and a guide to choosing one.

What are REITs?

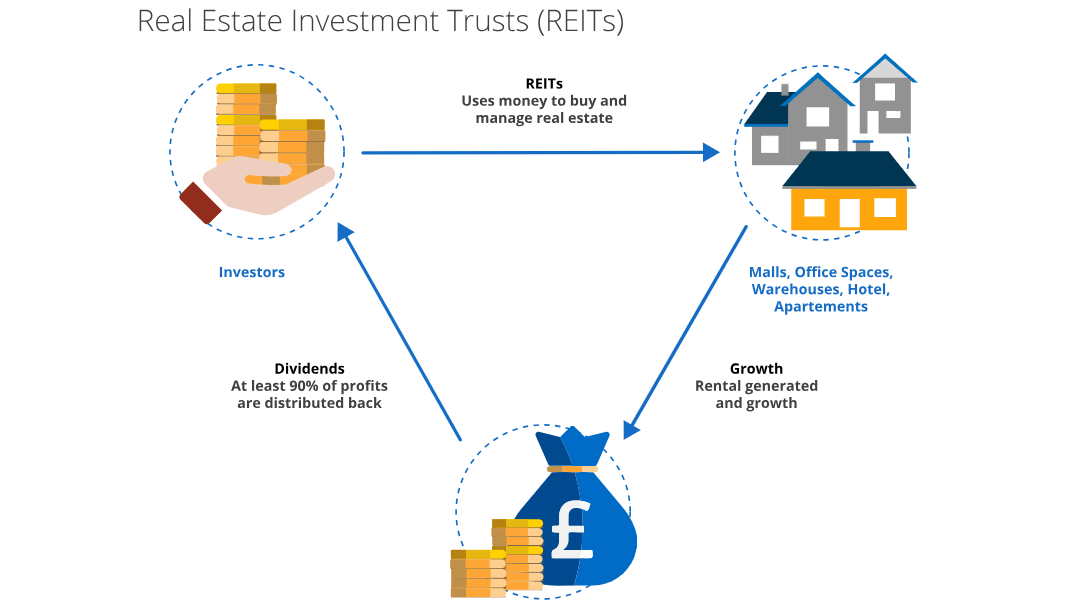

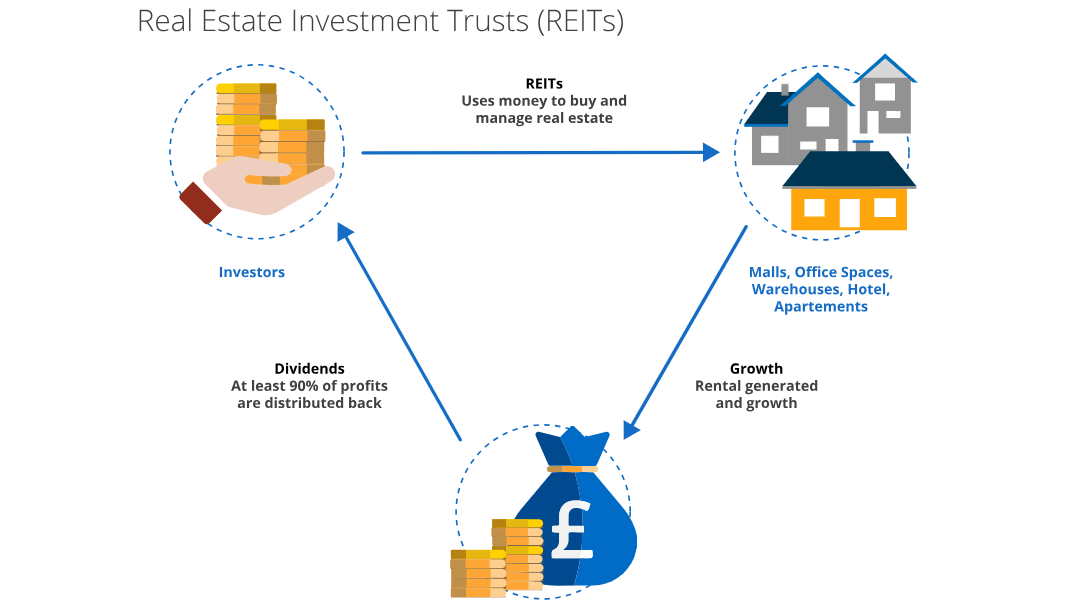

REITs, known as Real Estate Investment Trusts in Chinese, are companies that invest in real estate assets and distribute rental income to shareholders. Simply put, REITs are publicly traded companies that focus on owning, managing, and operating various types of real estate assets, such as hotels, shopping centers, office buildings, condominiums, factories, and medical centers.

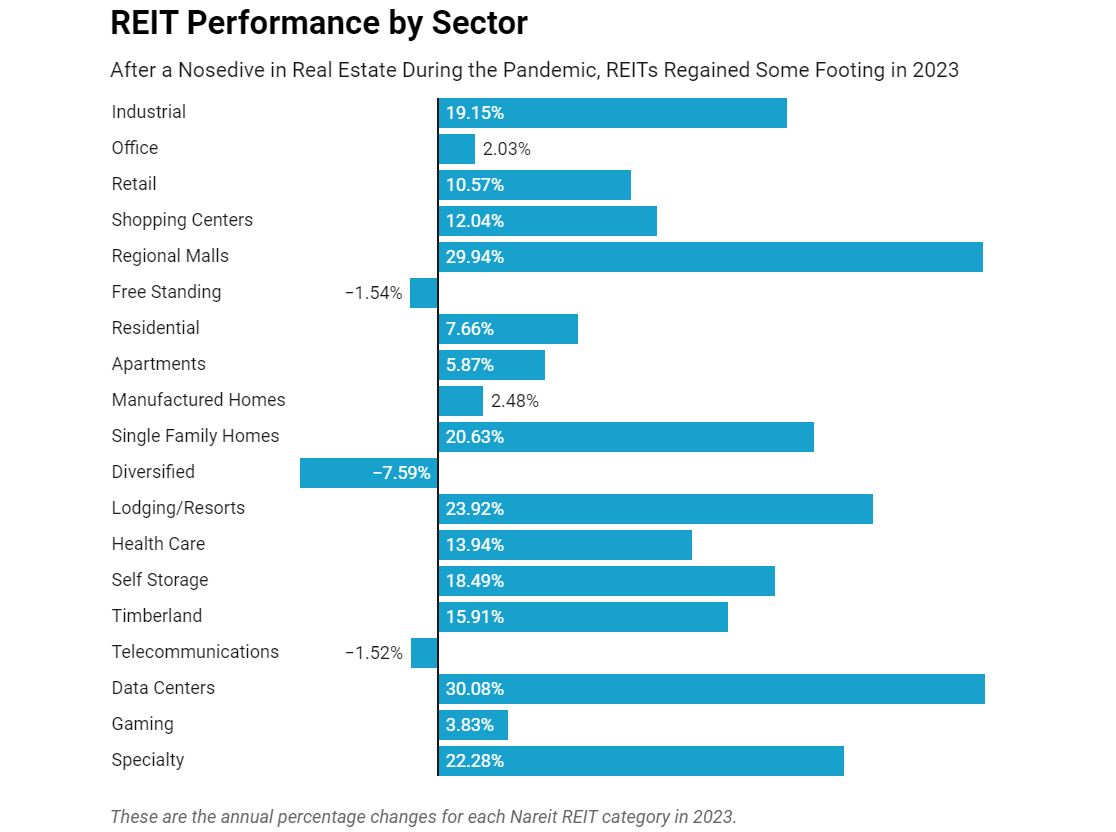

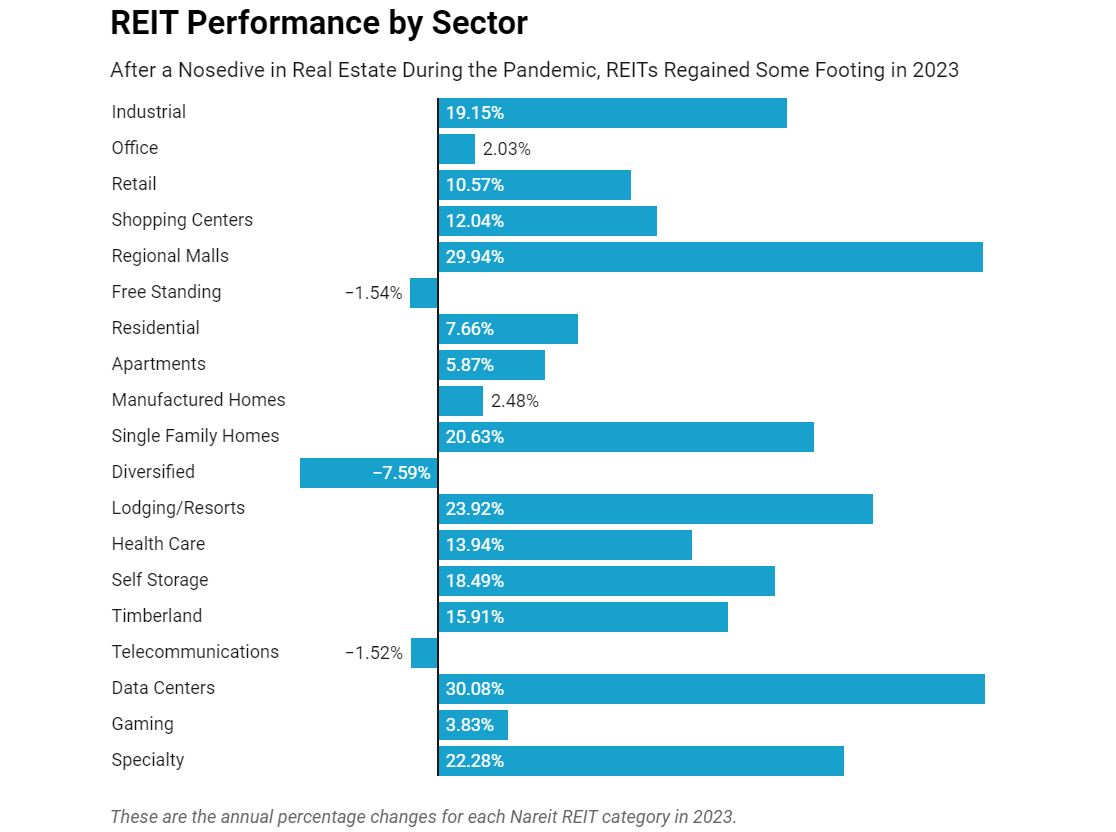

REITs (real estate investment trusts) were created by the U.S. Congress in 1960. and as of 2021. REITs have been established in at least 39 countries around the world.The system has gone through several phases of regulatory evolution since its creation, including initial regulation from the 1970s to the 1980s, adjustments to tax and investment rules in the 1990s, diversification in the 2000s, and the 2020s' focus on market adaptation and ESG standards.

It is similar to a mutual fund, but its investment focus concentrates on real estate assets. Operated as a trust, it is treated as a corporation under the U.S. Internal Revenue Code and is subject to specific tax requirements, including distributing a large portion of its income to shareholders in the form of dividends. The trust structure makes it possible to avoid double taxation while providing investors with a stable source of income.

By holding shares in a REIT, investors are able to share in income from real estate investments, such as rent or mortgage interest, without having to be directly involved in the actual transaction of the real estate. This structure provides a convenient way for the average investor to benefit from diversified real estate investments while avoiding the complexity and high barriers of actual real estate investments.

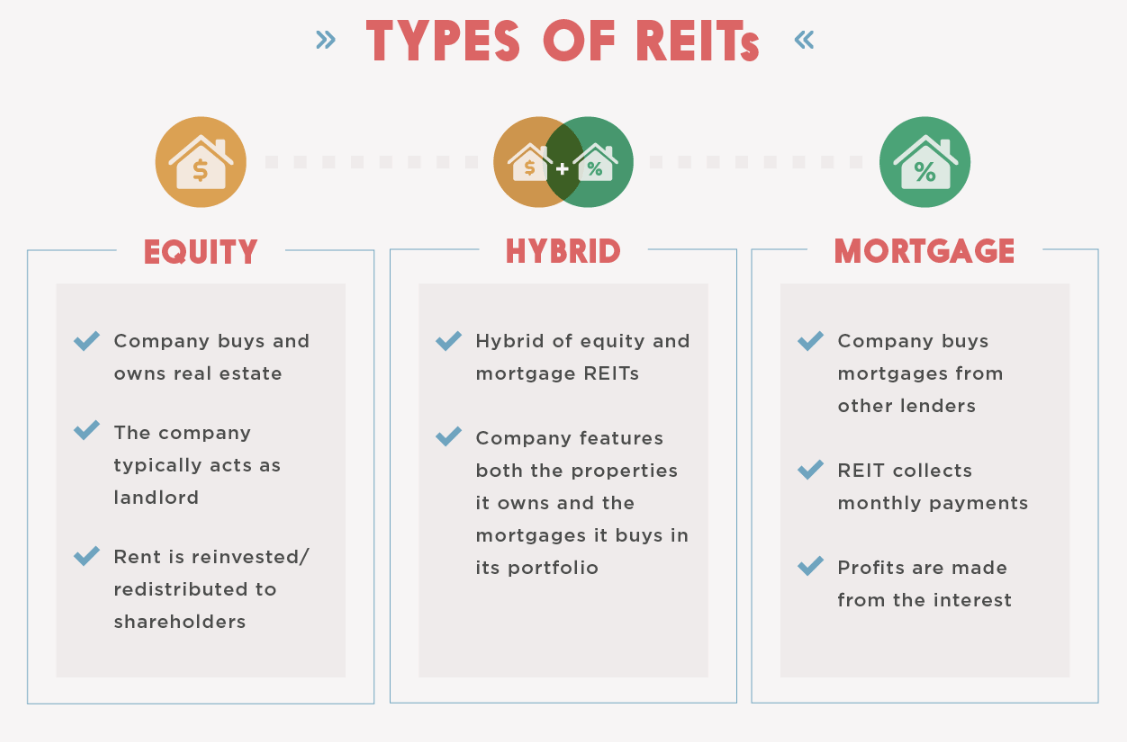

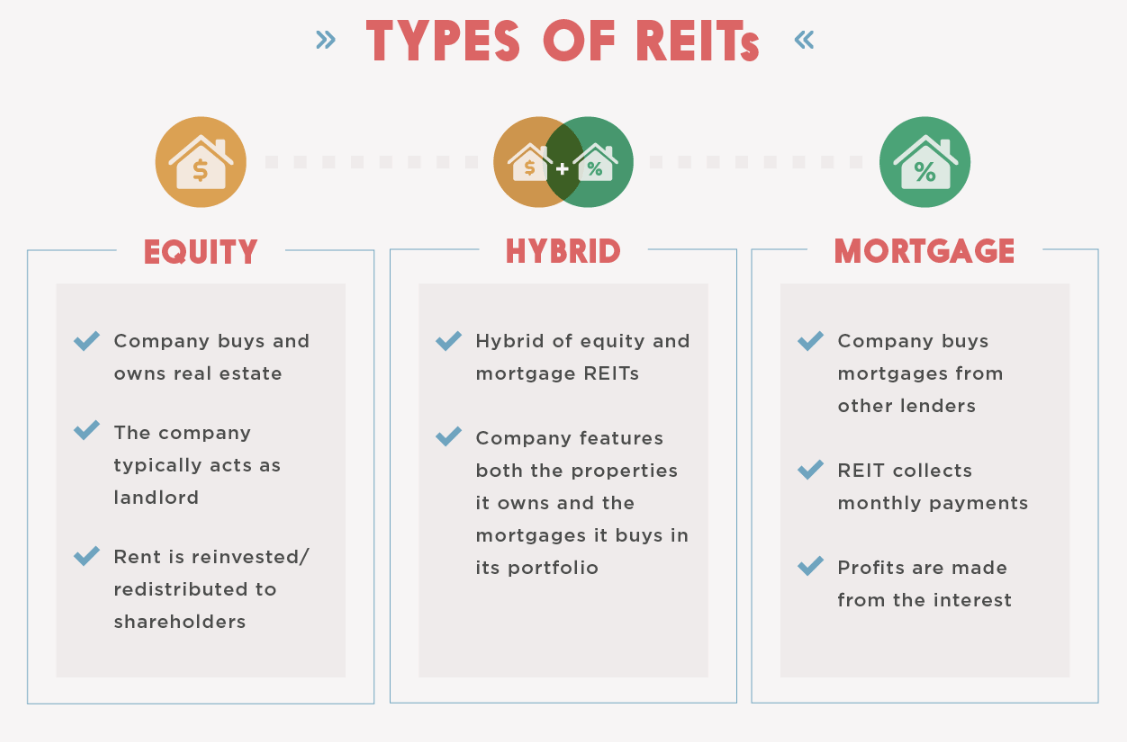

It can be categorized into two types: equity and mortgage. Equity REITs focus on owning and operating a wide range of real estate assets, such as office buildings, shopping centers, hotels, and apartments. They generate revenue primarily through rental income from the properties they hold. By leasing these properties to tenants, it is able to generate stable rental income and distribute a large portion of the income to shareholders in the form of dividends, thus creating a stable dividend return mechanism.

Mortgage REITs invest primarily in residential or commercial real estate mortgages and related mortgage-backed securities. Their source of income is primarily interest income generated through these mortgages or securities. Unlike equity, a mortgage does not directly own the property but earns interest income by making loans to real estate borrowers or purchasing mortgage-backed securities. This investment model makes it possible to realize a profit through interest spreads and distribute most of the income to shareholders.

There are three main types of REITs: publicly traded, unlisted, and private. Of these, publicly traded REITs are listed on stock exchanges where investors can buy and sell them like ordinary stocks, are more liquid, and are usually registered with the U.S. Securities and Exchange Commission (SEC).

Unlisted REITs are also registered with the SEC, but their shares are not listed on stock exchanges, are less liquid, and investors need to purchase them through specific channels and may take longer to redeem their investments. Private REITs, on the other hand, are private companies that are not registered with the SEC and are not listed on a stock exchange. They are usually aimed at high net worth or institutional investors, have a more private fundraising process, are less liquid, and require investors to invest through specialized channels.

The formation of a REIT requires that it meets specific asset and income requirements, at least 75% of which must be derived from real estate-related activities such as rental income, real estate interest, and proceeds from the sale of real estate assets. This requirement ensures that its business activities are primarily focused on real estate. In addition, at least 75% of its assets must be real estate assets, meaning that the majority of its assets need to be invested in real estate or real estate-related assets.

At the same time, the REIT must distribute at least 95% of its income as passive income (e.g., rents and interest), ensuring that the main income comes from passive investments and is used to pay dividends to shareholders. It is also required to distribute at least 90% of its taxable income to shareholders as dividends in order to avoid taxation at the corporate level, thereby realizing tax benefits.

However, it is important to note that shareholders will be taxed at the ordinary tax rate (up to 39.6%) on the dividend income they receive from the REIT, rather than enjoying the lower qualified dividend tax rate. Despite the tax advantages they enjoy on their own, shareholders will still be subject to dividend taxes at the higher ordinary tax rate.

As the real estate industry and economic environment have changed, REITs have evolved but have always maintained a core mission: to make income-producing real estate returns accessible to a broad range of investors. By providing liquidity, diversifying risk, and distributing income, it enables the average investor to participate in stable real estate investments, thereby facilitating broad participation and capital flows in the real estate market.

In summary, REITs enable investors to enjoy the benefits of real estate without having to directly manage or purchase real estate by providing a means of collectively investing in real estate. This structure not only increases the liquidity of the investment but also provides a stable source of income that allows the average investor to participate in real estate market investment opportunities.

REITs Pros and Cons

REITs Pros and Cons

REITs enable investors to participate in the real estate market at a lower cost and enjoy the income and capital appreciation that real estate assets provide. This is its main advantage, but there are also a number of disadvantages. Therefore, investors need to fully evaluate these advantages and disadvantages when choosing REITs.

REITs offer several advantages. Compared to direct real estate purchases, their shares can be traded in the secondary market, which is more liquid and enables investors to liquidate them quickly. It also offers a high degree of flexibility, as investors can buy and sell shares at any time and easily adjust their portfolios.

At the same time, a real estate investment trust avoids taxes at the corporate level by distributing at least 90% of its taxable income to its shareholders. This means that most of the income it earns is exempt from corporate income tax, thus increasing the returns for investors. And it also enjoys tax benefits, such as exemption from real estate profits tax, making investment returns even more attractive.

It offers professional property management services so that the investor does not have to deal with rent collection or property maintenance matters personally. These funds are usually managed by experienced teams of professionals who are responsible for sourcing, acquiring, and managing real estate assets, allowing investors to focus on the investment itself without having to be directly involved in property management.

In addition, REITs provide investors with a diverse range of real estate investment opportunities that can effectively diversify investment risk and enhance return potential. Whether shopping centers, hotels, or office buildings, they cover a wide range of real estate assets and provide investors with a wide range of investment options.

As a passive investment vehicle, REITs do not require significant investor involvement, making them ideal for investors who want to save time and effort. A team of professionals takes care of property management and investment decisions, allowing investors to enjoy stable returns without having to deal with rent collection or property management matters themselves.

Investing in a real estate investment trust makes it more feasible to participate in large-scale real estate investments with a lower investment threshold. Unlike direct real estate purchases that require a high down payment, it allows investors to participate in the real estate market with less capital, lowering the cost of investment and making real estate investment easily accessible to more people.

However, REITs also have drawbacks. For example, fixed-income products may become more attractive when interest rates rise, leading to capital outflows from REITs and depressing their share prices. And it is sensitive to changes in interest rates, which can increase financing costs and squeeze profit margins as well as raise the cost of debt financing, further impacting profitability.

At the same time, REITs are highly sensitive to changes in the real estate market. For example, REITs investing in areas with declining rental income may see shareholder returns affected even if there are many tenants. And, such as hotel REITs, are more sensitive to economic downturns. And REITs typically focus on specific types of real estate, whose industry-specific risks (e.g., retail downturns) can lead to volatility in share prices.

And because REITs are required to distribute at least 90% of their income as dividends, companies have limited funds left for reinvestment and business development. This distribution requirement could cause REITs to face a shortage of capital to expand and develop new projects, limiting their growth potential. While a high dividend return is attractive to investors, this high distribution ratio may undermine its ability to accumulate capital and jeopardize its long-term growth opportunities.

There are also REITs with high management fees, which may reduce overall investment returns. High management fees are used to pay the fund manager and management team's salaries and operating costs, which ensure professional management but also deduct a portion from investment returns. Even if the REIT's properties perform well, high management fees may still erode actual returns.

The operation and management of a REIT are handled by a team of professionals, which brings with it a certain amount of trust risk. Problems or poor decision-making by the management team may directly affect investors' returns. Moreover, its performance is highly dependent on the condition of the assets. Poor property management may result in lower rental income or higher maintenance costs. In addition, fierce competition in the market may bring about rental pressure and asset depreciation, while investors have limited knowledge of the operation, and information asymmetry increases the investment risk.

In addition, the level of dividends payable by a real estate investment trust is affected by its operating performance and income level. While it usually distributes most of its income to its shareholders, a decline in income or deterioration in operations may lead to a decline or suspension of the level of dividends. Therefore, investors need to keep an eye on its financial health and income performance to assess potential dividend risk.

While REITs offer the advantages of high dividends, liquidity, and professional management, they are also exposed to market risk, interest rate risk, operational risk, dividend risk, liquidity risk, financial risk, policy and tax risk, and industry-specific risk. Investors should carefully assess and manage these risks according to their own investment objectives, risk tolerance, and market conditions when considering investment.

How to choose REITs?

How to choose REITs?

Real estate investment trusts (REITs) have attracted many investors as they offer advantages such as professional management, diversified investments, stable returns, and low investment thresholds. However, they also face disadvantages such as interest rate sensitivity, market volatility, and high management costs. Therefore, investors need to fully consider these factors and make an informed decision when choosing.

Before choosing REITs, it is important to first clarify whether the investment objective is to seek a stable income stream, capital appreciation, or both. Different REITs may focus on different objectives, such as certain focusing on high dividend returns while others are more concerned with asset appreciation. It is also critical to assess risk tolerance, as the performance of different types of REITs can vary widely in the face of economic volatility.

For example, hospitality and retail REITs are typically more sensitive to economic cycles and changes in consumer spending and may face greater operating pressures and revenue volatility during economic downturns. In contrast, residential or healthcare facility REITs typically hold up better during economic fluctuations due to their more stable underlying needs. Understanding risk tolerance and selecting a type that matches it will help achieve more stable investment returns in different market environments.

As it has to distribute a large portion of its income to shareholders in the form of dividends, they usually provide higher and more stable dividends. This characteristic makes it an ideal choice for those seeking stable cash flow and passive income. Holding it for a long period of time not only allows you to enjoy consistent dividend returns but also capital appreciation through the long-term growth potential of the real estate market. At the same time, REITs invest in a wide range of real estate assets, helping to diversify risk and reduce the impact of market volatility on investment returns.

REITs offer significant advantages over direct investments in physical real estate, such as low cost, low time commitment, and high liquidity. While direct property purchases require a high initial investment and ongoing management and maintenance, REITs allow participation in the real estate market with a low capital threshold, eliminating the need to personally manage the property. It is listed on the stock exchange, and investors can buy and sell shares at any time, enjoying real estate income while maintaining high liquidity. This makes it easy for investors with limited budgets to enter the real estate market and earn stable returns.

When choosing REITs, it is crucial to evaluate financial metrics. This includes reviewing capital operations such as cash flow and liquidity efficiency to ensure adequate liquidity; focusing on net operating income (NOI) to assess property profitability; looking at occupancy to see how well the property is rented; and analyzing rent levels per square foot to assess market value and rental potential. Together, these metrics help assess the investment value and potential risk of a REIT.

To reduce investment risk, it is advisable to diversify your assets by spreading your funds across multiple REITs. This will minimize the impact of a single REIT's underperformance on overall investment returns. Also, optimize investment choices based on key metrics such as average dividend yield, average dividend growth rate, and annual growth rate.

For example, an average dividend yield of 4.31% reflects stable cash flow; an average dividend growth rate of 15.71% shows potential for sustained growth; and an average annual growth rate of 10.56% indicates capital appreciation potential. Taking these indicators into consideration, investors can choose a top-performing REIT to achieve the goals of risk diversification and return optimization.

Investment projections show that an initial $10.000 portfolio is expected to increase in value to $11.487 in one year, to $44.161 in ten years, to $263.812 in twenty years, and potentially to $2.546.624 in thirty years, with an annual dividend of approximately dollars. By diversifying funds across multiple REITs, investors not only reduce risk but also realize strong returns and stable dividend income, resulting in the dual benefits of capital appreciation and stable cash flow.

In conclusion, REITs are an effective way to participate in real estate investment with lower capital. It offers the advantages of professional management, diversification, and stable returns, along with high liquidity and a low entry barrier. If you want to step into real estate investment but don't want to take on the high cost and management complexity of buying real estate outright, it is definitely an option worth considering.

Pros and Cons of REITs and Selection Guide

| Advantages |

Disadvantages |

Select key points |

| Low-cap real estate. |

May still require high initial investment |

Choose income, appreciation, or both. |

| High liquidity, like stocks. |

Private and unlisted REITs are illiquid |

Evaluate rate and market sensitivity. |

| Stable income, dividends. |

Income is market- and rate-dependent. |

Review cash flow and income levels. |

| Hassle-free management. |

High overhead may depress returns. |

Invest in multiple REITs to reduce risk. |

| Diversified, lower risk. |

Industry risks, like retail recession. |

Focus on overhead and dividend levels |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

REITs Pros and Cons

REITs Pros and Cons How to choose REITs?

How to choose REITs?