While many may associate the title of "most profitable" with large tech companies such as Apple, Microsoft, or China's Tencent and Jingdong, sovereign wealth funds often hold much larger assets than these companies and play a significant role in the global investment market. Let's now take a look at the overview and investment trends of sovereign funds, a central force in the global economy.

What is Sovereign Fund?

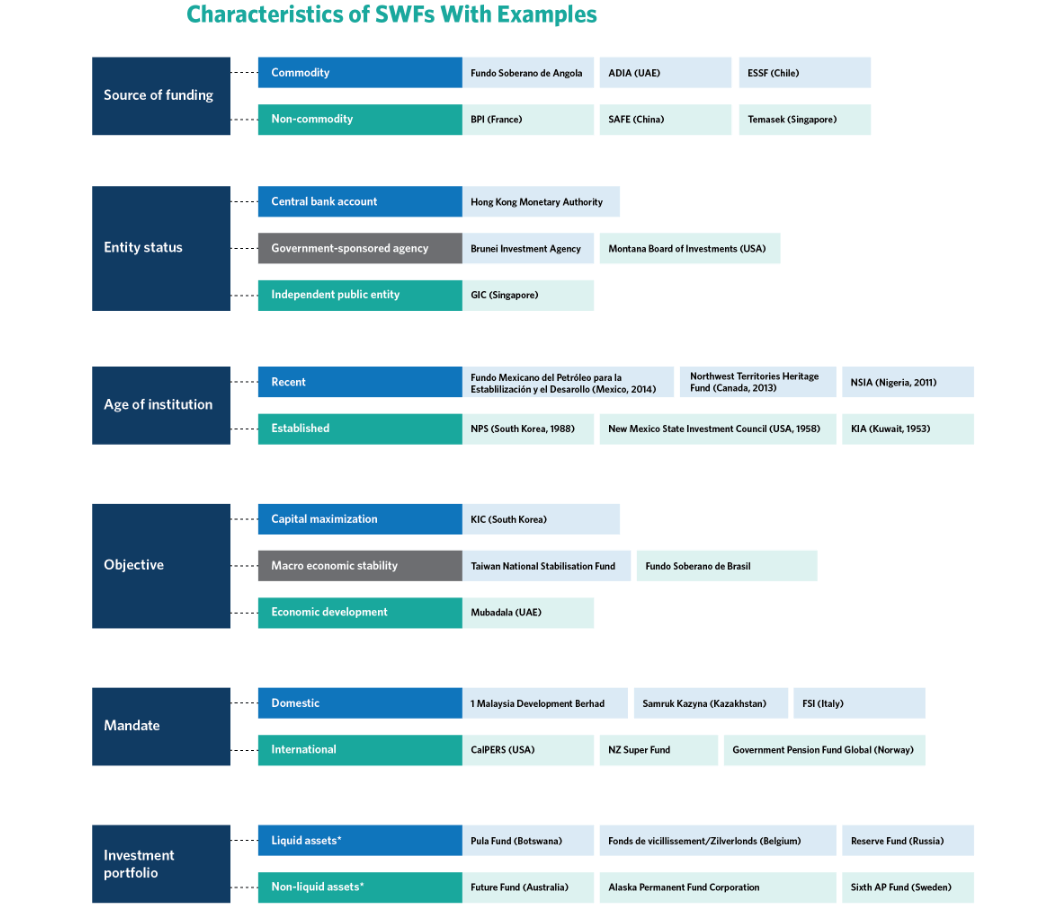

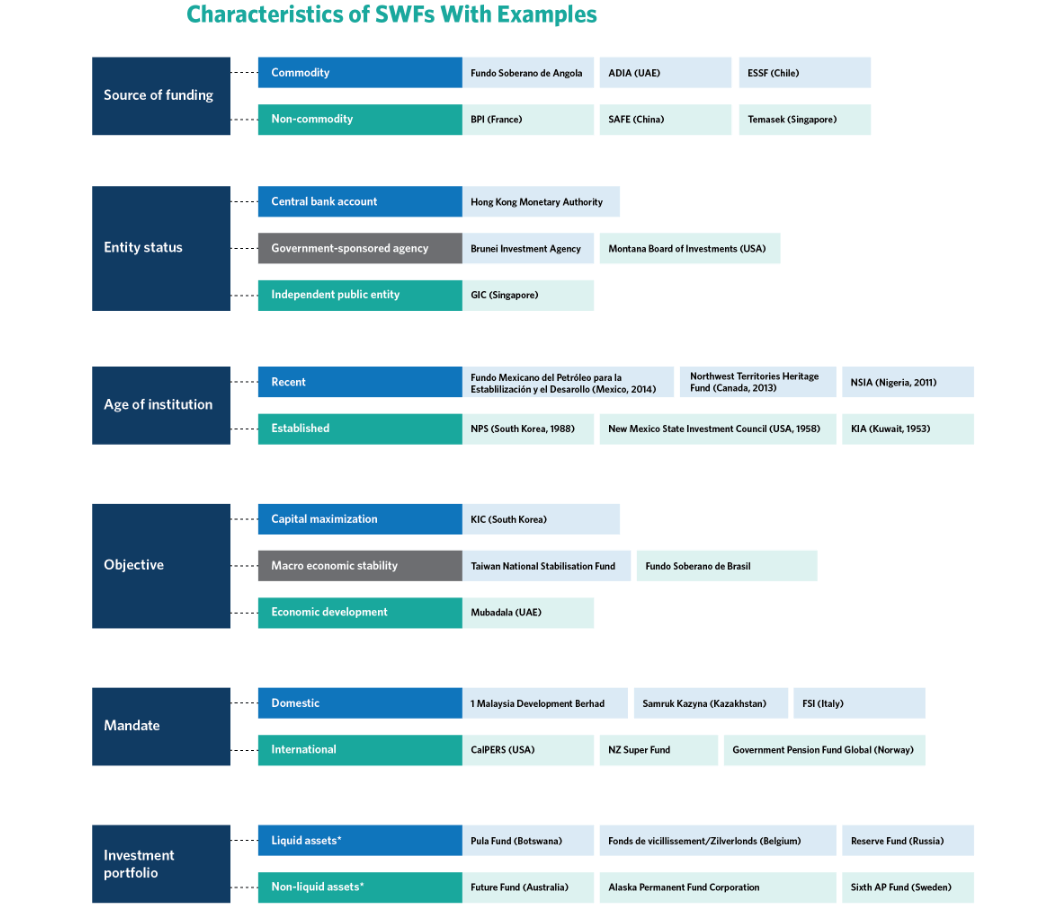

The Sovereign Wealth Fund (SWF) is an investment fund owned and managed by a national government, usually used to manage and invest the country's fiscal surpluses, foreign exchange reserves, or natural resource revenues in order to achieve long-term economic and financial goals.

In simple terms, SWFs are funds established by national sovereignty with the aim of generating income from investments. These funds usually utilize the country's natural resource revenues, fiscal surpluses, or foreign exchange reserves to make investments for the purpose of wealth enhancement. At the same time, they can help balance national budgets, reduce fiscal deficits, cope with economic fluctuations, and prepare for future financial needs. Through diversified investment strategies, these funds aim to achieve long-term economic stability and sustainable development.

With origins dating back to Kuwait in 1953 and Abu Dhabi in 1976. sovereign wealth funds were established by Middle Eastern oil-producing countries to turn lucrative oil revenues into long-term economic security. The aim was to ensure that the country would remain economically secure after its resources were depleted.

Kuwait's Kuwait Investment Authority (KIA), the world's first sovereign wealth fund, aims to effectively invest and add value to its abundant oil revenues, providing stable funding for future financial needs. It was followed by Abu Dhabi's sovereign wealth fund. These early funds not only helped these countries effectively manage and add value to their natural resource revenues but also provided economic security for future generations.

Their successful practices established the importance of sovereign funds in the global economy and served as pioneers of similar funds. In addition, the successful practice of these funds has demonstrated their central role in the global economy and has given impetus to the development of savings funds, particularly in resource-limited countries. By adding value to their investments, such funds address the risk of resource depletion or price volatility and ensure that national economies can maintain stability in the face of dwindling resources or market volatility.

In addition to savings funds, sovereign funds also include fiscal stabilization funds, which are specifically designed to provide financial support in times of economic downturn or emergency. Their main purpose is to provide a fiscal buffer during periods of economic volatility in order to ensure the stability and sustainability of national finances. Such funds are usually highly liquid so that they can be utilized quickly when needed.

Fiscal stabilization funds are similar to monetary funds in that, although they offer lower rates of return, they are particularly important in times of economic stress or fiscal constraints because of their high liquidity and low-risk characteristics. For example, some countries have established fiscal stabilization funds to maintain public services and economic stability by providing quick access to funds needed in emergencies, such as economic downturns and natural disasters.

In addition, it has development funds dedicated to enhancing the country's long-term productivity and economic development. It promotes sustainable growth by investing in key areas such as infrastructure, education, healthcare, and digitalization. For example, China's National Semiconductor Fund supports the semiconductor industry and reduces technological dependence, and the U.S. 5G Sovereign Investment Fund promotes 5G technology to ensure global leadership. These investments have enhanced technological capabilities, promoted economic growth, improved national living standards, and ensured that the country maintains a competitive edge in the global economy.

The largest of the current sovereign fund classifications is the pension fund, which manages pension assets, ensures future pension payments, and reduces the financial burden on the state. Often operated by governments or specialized agencies, they provide retirees with a stable income through long-term investment appreciation. For example, the Norwegian Global Pension Fund uses oil revenues to invest in global equities, bonds, and real estate to ensure pension stability; the Japanese Pension Fund responds to the financial pressures brought about by the increase in the number of retirees by diversifying its investments. These funds not only provide retirement security but also help to address the challenges of population aging.

Sovereign funds have the advantage that they are usually managed by governments, and their sources of funding tend to be more generous. They are financed mainly from the country's natural resource revenues (e.g., oil or mineral resources), fiscal surpluses, or foreign exchange reserves. These funds are able to secure sufficient capital to support their long-term investment objectives and strategies. With stable and abundant sources of capital, sovereign wealth funds are able to withstand higher investment risks and pursue higher returns in order to achieve long-term wealth appreciation.

Moreover, sovereign wealth funds typically have the ability to withstand high risk, allowing them to invest for the long term. This investment strategy allows the fund to pursue higher rates of return. By investing in a diversified range of asset classes, including equities, bonds, real estate, and infrastructure, sovereign wealth funds are able to achieve long-term wealth appreciation. Long-term investments not only help to cope with short-term market volatility but also provide stable long-term returns through robust portfolios and strategic allocations.

At the same time, sovereign wealth funds are committed to creating wealth through strategic investments. This accumulation of wealth not only supports the current economy but also preserves assets for future generations, ensuring the long-term stability of the national economy and the well-being of society. Through efficient asset management and investment strategies, sovereign funds are able to accumulate wealth to provide for future financial needs and support a country's economic development and social progress.

However, it is important to note that sovereign wealth funds can be influenced by governments and political forces, which can lead to a lack of transparency in investment strategies and decision-making. Political interference may cause the fund's investment choices to be driven by short-term political interests rather than based on long-term economic benefits, thus affecting the fund's independence and investment results.

Moreover, sovereign wealth funds require highly specialized and independent management structures. Clear policy objectives and a rigorous governance structure are required to ensure effective operation. However, complex governance requirements may lead to implementation difficulties and potential management failures, which in turn may affect the performance of the fund.

In addition, the operations of sovereign wealth funds may affect the exchange rate policies of central banks and macroeconomic stability. For example, the investment activities of foreign exchange reserve-based funds may trigger market exchange rate volatility, which is of concern to regulators. How to ensure the fund's effectiveness while avoiding adverse effects on national economic policies is an issue that needs to be addressed on an ongoing basis.

In conclusion, a sovereign fund, as a national-level investment vehicle, has unique advantages and challenges. It can be established to encompass single or multiple policy objectives, such as combining investment and development functions. As it involves the management of public resources, a sovereign wealth fund needs to follow a specific investment strategy with stringent risk management guidelines in order to rationalize the allocation of public assets, diversify value preservation and value-added investment projects, and strive for better medium- to long-term investment returns.

Sovereign Fund Rankings

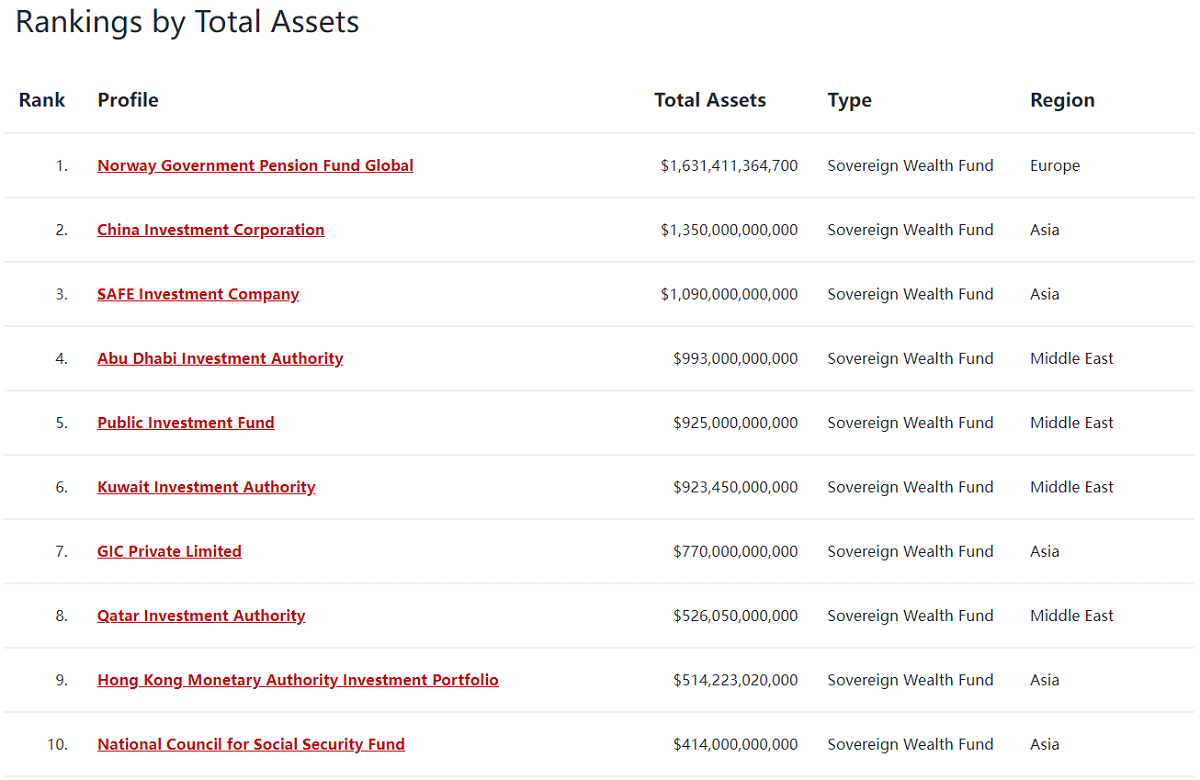

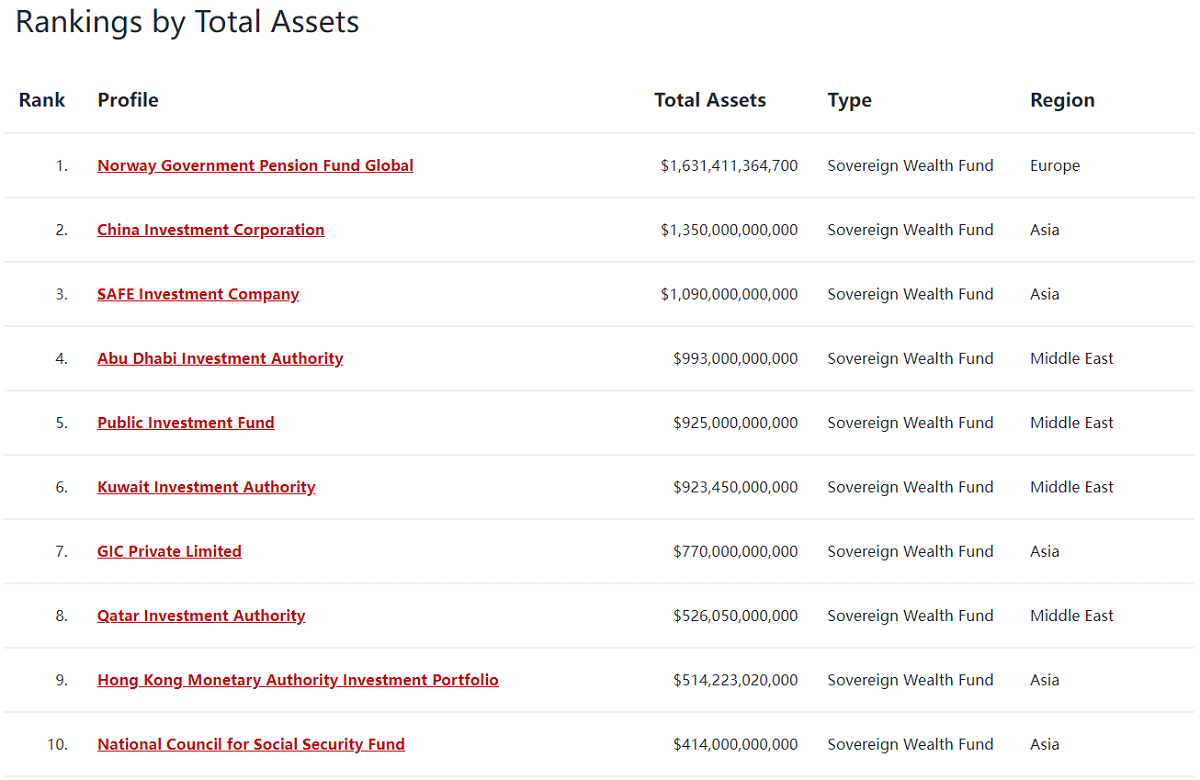

Foreign wealth funds play an important role in the global financial market. With their large asset size and far-reaching influence, they not only occupy an important position in major markets but also actively promote the development of the global economy. Understanding the rankings of these sovereign funds helps to better grasp their position and influence in the global economy.

According to the ranking of asset size, Norway's global pension fund (the Government Pension Fund Global) is ranked first. The fund was established in 1990 to convert Norway's oil revenues into long-term wealth to support the welfare and economic stability of future generations. By 2023. the Norwegian Global Pension Fund will have reached $163.1 billion in assets, making it the largest sovereign wealth fund in the world.

The fund has generated a 16% return over the past year and has trillions of NOK in assets under management. It has a broad portfolio of investments across global equity markets, real estate, and other asset classes, with a particularly heavy exposure to U.S. tech companies such as Apple, Google, and Amazon, which has brought it significant returns.

The Norwegian Global Pension Fund's success is due to its diversified investment strategy and long-term investment perspective, which have enabled it to respond effectively to market volatility and achieve sustained wealth growth. At the same time, its important role in global financial markets reflects its successful investment strategy, which not only provides Norway with sound financial support but also offers valuable management experience for other sovereign funds.

In second place is China Investment Corporation (CIC), one of China's largest sovereign funds with assets of $135 billion.Founded in 2007. CIC's primary mission is to manage China's foreign exchange reserves with a commitment to asset appreciation and risk diversification. The fund optimizes China's foreign exchange reserves through a wide range of global investments, including in the areas of equities, real estate, and private equity, and seeks effective investment opportunities in the global market.

In addition to CIC, China's sovereign wealth funds include China Hua An, which focuses on investment management of foreign exchange reserves. 20 In 2023. the Hong Kong Exchange Fund's overall revenue exceeded HK$200 billion, realizing a return of approximately 6% and generating approximately HK$30.000 in returns for each Hong Kong resident. By effectively managing its foreign exchange reserves, CIC has made a significant contribution to Hong Kong's economic stability and the growth of residents' wealth.

CIC's success is attributed to its diversified investment strategy and global perspective, which enable it to diversify risks across different markets and asset classes and achieve long-term investment returns. It was established to meet the challenge of the large size of China's foreign exchange reserves and to support the country's continued economic development by optimizing the investment structure and enhancing returns to strengthen the potential for adding value to the nation's wealth.

Abu Dhabi Investment Authority (ADIA) is ranked the third largest sovereign wealth fund in the world, with assets amounting to US$99.3 billion. Established in 1976. ADIA's primary mission is to utilize Abu Dhabi's oil revenues for global investments to achieve long-term wealth growth and risk diversification.

ADIA was established to effectively convert Abu Dhabi's lucrative oil revenues into long-term wealth, ensuring that future generations will benefit from them. As a leading wealth management organization, ADIA is responsible for investing these funds globally across a wide range of asset classes, including equities, real estate, infrastructure, and other financial instruments. Its strategic goal is to achieve solid asset growth through diversification and to provide continued support for Abu Dhabi's economic future.

The Public Investment Fund (PIF) is saudi arabia's sovereign fund, established in 1971 to manage the country's wealth and promote economic diversification. With assets of US$92.5 billion, PIF is Saudi Arabia's largest sovereign wealth fund, with the strategic objective of transforming oil revenues into long-term economic growth and sustainable wealth. sustainable wealth.

The PIF's investment universe is very broad, covering a wide range of asset classes globally, including equities, real estate, infrastructure, technological innovation, and private equity. The PIF has a particular focus on strategic investments to modernize and diversify the country's economy, such as supporting new energy sources, scientific and technological innovations, and urban development projects. Through these investments, the PIF aims to reduce Saudi Arabia's dependence on oil revenues, promote structural transformation of the economy, and enhance the country's competitiveness in the global economy.

Kuwait Investment Authority (KIA), founded in 1953. is one of the first sovereign funds in the world. With assets of approximately $92.345 billion, it was originally established to transform Kuwait's oil revenues into long-term wealth to support the country's stable and sustained economic development.KIA aims to optimize returns and diversify risk through a diversified investment strategy covering global markets in equity, bonds, real estate, and other assets to ensure that wealth maintains its growth in the global economy.

KIA's success is not only reflected in its large asset size but also in its extensive global investment footprint and long-term investment strategy. This has allowed the KIA to gain a significant foothold in the international financial markets, demonstrating its excellence in wealth management and economic stability.

Understanding the rankings of these sovereign funds, we can see that they play an important role in the global financial system through their extensive investment portfolios and strategic placement. With their large asset size and diversified investment strategies, these funds not only optimize the management of national wealth but also soundly achieve asset appreciation and risk diversification in the global market.

How to Invest in Sovereign Wealth Funds?

How to Invest in Sovereign Wealth Funds?

From the above article, it can be seen that the Norwegian Global Pension Fund mainly invests in global equity, especially U.S. technology stocks, and its 2023 return performance is strong, while China's sovereign fund is relatively less involved in the European and U.S. stock markets and is more inclined to concentrate on investing in the domestic market and international blue-chip stocks.

In the past, sovereign wealth funds have focused their investments mainly on fixed-income securities and equities in pursuit of stable returns. In recent years, however, these funds have begun to shift their investment strategies by actively exploring the private equity market and venture capital in search of higher returns. This shift has also included investing directly in companies and increasing managerial involvement in investee companies.

Through these strategies, sovereign funds not only seek capital appreciation but also aim to achieve higher investment returns through deeper management and strategic involvement. This diversification reflects the adaptability of sovereign wealth funds in responding to market changes and enhancing the effectiveness of their investments.

Sovereign wealth funds have begun to expand their investment direction to startups with high growth potential, such as Alibaba and Ubiquiti. These investments have not only driven changes in the business landscape but have also provided sovereign wealth funds with opportunities for high returns. By investing in startups, sovereign funds are able to participate in the growth process of emerging industries and reap substantial returns when these companies succeed.

Foreign wealth funds actively support the digital transformation of countries by investing in areas such as smart city infrastructure and digital healthcare to drive technological innovation and urbanization. These investments not only enhance the country's competitiveness in the digital space but also contribute to the modernization of the economy and the development of society. By participating in these cutting-edge projects, sovereign funds not only reap potentially high returns but also accelerate the country's pace in the global digital economy.

While sovereign wealth funds are primarily geared towards institutional investors, retail investors can still benefit indirectly in a number of ways. For example, by investing in companies, investment funds, and financial products associated with sovereign wealth funds, as well as by tracking the performance of the funds, retail investors are able to share to some extent in the investment returns and market opportunities offered by sovereign wealth funds.

Retail investors may choose to invest in listed companies that are owned by sovereign wealth funds. These companies are usually strong performers in the market, and the sovereign wealth fund's investment is often a recognition of their future growth potential. For example, the Norwegian sovereign fund's heavy positions in technology companies such as Apple, Microsoft, and Amazon are an indirect way of benefiting retail investors who invest in these companies.

A number of investment funds and financial products will hold assets invested in by the sovereign wealth fund, and retail investors can indirectly participate in the sovereign wealth fund's investment strategy by investing in these funds. These funds typically include exchange-traded funds (ETFs), mutual funds, and hedge funds, among others, that include in their portfolios companies or assets in which sovereign wealth funds invest.

By purchasing these investment funds, retail investors are not only able to share in the potential returns of the assets held by sovereign wealth funds but also to utilize professional asset management and diversification strategies to generate relatively stable investment returns. This approach allows retail investors to capitalize on the investment wisdom of sovereign wealth funds while participating in the long-term growth opportunities of these large funds.

Retail investors can also learn about market investment trends by following the investment movements and performance of sovereign wealth funds, which they can use to adjust their investment strategies. For example, understanding the Norwegian global pension fund's investment layout in technology stocks can help retail investors identify potential opportunities in the technology sector.

To summarize, the investment strategies and performance of global sovereign funds vary by country and economic background. These differences not only reflect countries' different strategies for wealth management but also the far-reaching impact of the global economic environment on sovereign wealth funds' investment decisions.

Overview of sovereign funds and investment trends

| Topics |

OVERVIEW |

Investment Trends |

| Definition |

Government funds for growth and stability. |

Boosting private market investments for high returns. |

| Objective |

Long-term stability via diversification. |

Investing in startups to boost innovation and growth. |

| Fields |

Includes stocks, bonds, and real estate. |

Boost tech investments to aid digital transformation. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

How to Invest in Sovereign Wealth Funds?

How to Invest in Sovereign Wealth Funds?