While technology stocks are undoubtedly a popular choice in the market today, energy remains a key element in the foundation of the economy in today's industrial age. As such, oil stocks remain relevant as value stocks worth holding for the long term. While saudi arabia's oil companies have been at the top of the global market capitalization charts, the U.S. oil giant is Exxon Mobil Corp. Now, let's take a look at Exxon Mobil Corporation and its long-term growth potential.

Exxon Mobil Corporation at a Glance

It is one of the largest publicly traded oil and gas companies in the world and is headquartered in Spring, a suburb of Houston, Texas. As an industry leader, ExxonMobil's operations span the entire spectrum of oil and gas exploration, extraction, and production, as well as refining and marketing.

The company was founded in 1999 through the merger of Exxon and Mobil Corporation. Both companies have long histories, dating back to the late 1800s as Standard Oil. After the merger, ExxonMobil quickly grew to become one of the world's largest oil and gas companies, with operations covering oil exploration, production, refining, and marketing.

ExxonMobil's businesses are organized into three main segments: upstream, midstream, and downstream. The upstream business covers the exploration, development, and production of oil and natural gas; the midstream business involves the transportation and storage of oil and natural gas; and the downstream business includes refining, chemicals, and the sale of refined products. Through this diversified business structure, the company is able to maintain stable profitability in different market environments.

The Upstream Division's main activities include the search for new oil and gas resources and the development of existing resources, as well as working to expand the company's energy reserves and production capacity. The company has significant assets and extensive operations in exploration and production worldwide, particularly in the Permian shale oil basins of Texas and New Mexico. These strategic assets enable it to remain competitive in the global energy market and ensure long-term resource availability.

The company owns and operates an extensive network of pipelines and storage facilities, assets that not only ensure the efficient transportation of energy but also maintain supply chain stability. Through these facilities, the Midstream Division is able to effectively manage the flow of energy, reduce transportation costs, and improve overall operational efficiency.

The downstream segment operates multiple refineries and chemical plants around the world that produce and market gasoline, diesel, lubricants, and chemicals. These facilities help the company meet the global demand for energy and chemicals and, as a result, have a significant presence in the global energy market. And one of its chemical divisions not only provides a stable source of revenue but also serves diverse industrial needs through high-quality petrochemical products.

ExxonMobil also leads the industry in technological innovation. The company invests heavily in improving energy efficiency, developing new refining technologies, and advancing new energy sources. For example, research and application of carbon capture and storage (CCS) technology demonstrate the company's commitment to reducing carbon emissions and protecting the environment.

In addition, the company has made significant achievements in the research and development of new refining and production technologies, not only introducing innovative technologies into traditional energy refining and production processes but also actively exploring sustainable solutions. These R&D efforts have resulted in a number of awards for technological innovation and environmental protection, which have not only recognized the company's efforts to improve energy efficiency and reduce environmental impact but have also strengthened its position as a technology pioneer in the global energy sector.

ExxonMobil is also committed to promoting sustainable development and reducing the environmental impact of its operations in a number of ways. The company invests in renewable energy projects, such as wind and solar, and is committed to improving energy efficiency and reducing greenhouse gas emissions. In addition, the company is actively involved in community development programs and supports philanthropic activities in the areas of education, health, and environmental protection.

Turning to the market capitalization ranking, the company, a giant in the oil and gas industry, is firmly positioned among the top 500 companies in the world due to its financial strength, extensive business network, and continuous innovation. This ranking not only reflects the company's leadership position in the market but also proves its significant influence in the global energy industry.

In terms of profitability, ExxonMobil has broken several all-time records, notably setting new all-time highs for full-year profits in 2008 and 2022. respectively. These feats demonstrate the company's excellence in financial management and market strategy and signal its unrivaled profitability in global energy markets. These achievements reflect not only the company's strong business performance in the oil and gas industry but also its effective execution of cost control and strategic investments.

As a leader in the global energy market, the company's strong position in the oil and gas sector and its diversified business layout provide it with strong resilience to market volatility. Its stable cash flow, continuous technological innovation, and commitment to sustainable development make its stock a quality choice for long-term investment.

In summary, ExxonMobil Corporation is a leader in the energy industry due to its rich history, extensive global presence, strong technological innovation, and commitment to sustainability. It has demonstrated its superior competitiveness and growth potential, both in the traditional oil and gas sector and in the emerging renewable energy market.

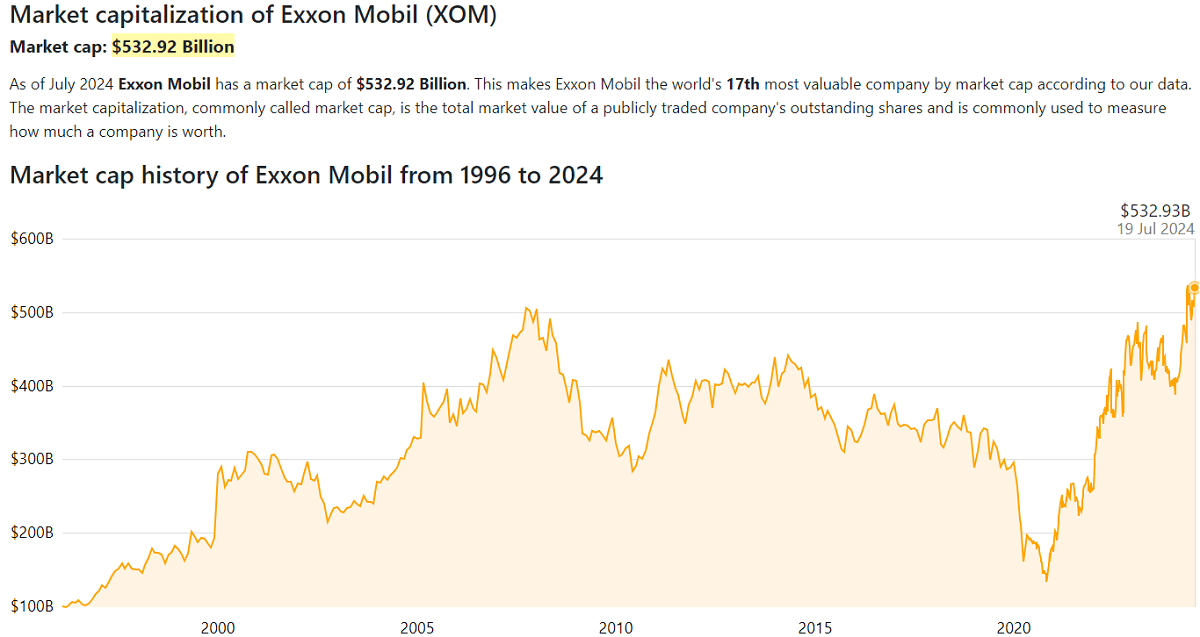

ExxonMobil Market Capitalization

ExxonMobil Market Capitalization

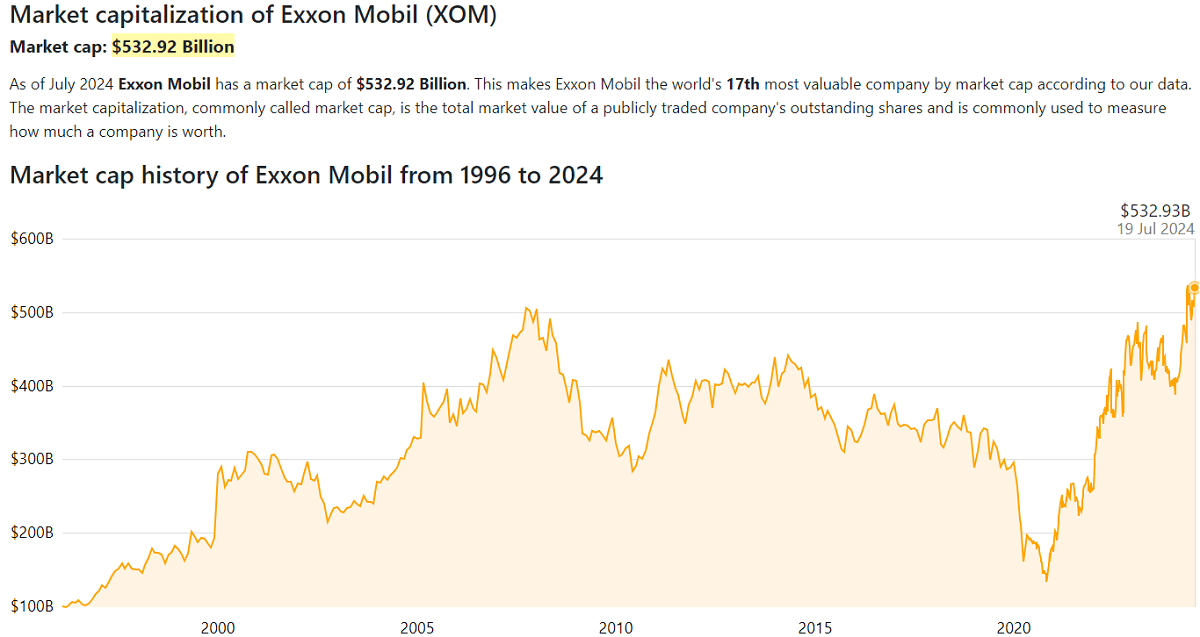

As of July 2024. ExxonMobil's market capitalization reached $532.92 billion, cementing its position as one of the world's top oil companies by market capitalization. This makes it the 17th most valuable company in the world by market capitalization. This market capitalization not only reflects the company's strong position in the market but also the high level of investor confidence in its future growth.

In fact, back in the mid-2000s, a surge in global oil demand and a sustained rise in the price of oil led to the company's market capitalization exceeding $500 billion at one point.Between 2014 and 2015. ExxonMobil's market capitalization experienced a significant pullback as a result of the dramatic drop in global oil prices. This price crash had a notable impact on the company's revenues and profits, causing its market capitalization to shrink.

It was not until 2020 that the outbreak of the global New Crown epidemic led to a sharp decline in oil demand, which had a severe impact on the energy market. As one of the world's largest oil companies, ExxonMobil was not spared. Affected by the epidemic, the company faced unprecedented challenges, and its market value once fell below $200 billion.

However, with the gradual recovery of the global economy and the rebound of oil prices, its market performance has improved significantly. The company's market capitalization has recently grown again and is now back above $500 billion. After the challenges posed by the epidemic, the company has managed to regain its leading position in the market by optimizing its operations and adjusting its strategies.

As you can see, ExxonMobil's market capitalization is closely related to the volatility of international oil prices. A rise in oil prices usually boosts the company's profit growth, which in turn boosts its market capitalization, while a fall in oil prices reduces the company's revenue, leading to a decline in market capitalization. This highly oil-price-dependent market characteristic makes the company's financial performance and market capitalization fluctuate significantly in oil price volatility, and it needs to continuously adapt to oil price changes in order to maintain its market competitiveness and financial stability.

At the same time, the company's oil and gas reserves and production capacity have a direct impact on its market capitalization. The company has ensured the steady growth of its oil and gas reserves through continuous exploration activities and technological innovations. This steady reserve growth not only supports the company's long-term growth but also strengthens the market's confidence in its future profitability, thus positively contributing to its market capitalization.

Moreover, the state of the global economy has a direct impact on its market capitalization. Global economic growth and increased industrial activity typically drive up the demand for oil, which positively impacts the company's revenues and profits. As the demand for oil rises, the company's business performance improves, which drives its market capitalization. Companies are able to benefit from economic booms, especially when industrial and transportation demand increases, which is reflected in the rise in their market capitalization.

Also, geopolitical factors have a profound impact on its market capitalization. The global political situation and the stability of major oil-producing regions have a direct impact on the balance of supply and demand in the oil market and, thus, on the price of oil. Political unrest, sanctions, wars, or conflicts may lead to disruptions in the oil supply, pushing up oil prices and boosting the company's revenue and market capitalization. Conversely, political stability and adequate supply can help stabilize a company's operations and market capitalization.

Of course, as a giant in the oil and gas industry, ExxonMobil has demonstrated strong resilience to market volatility thanks to its solid market position and rich resource reserves. The company's broad global asset portfolio and long-term strategic planning enable it to effectively respond to oil price volatility, geopolitical risks, and economic uncertainty. Through continuous technological innovation and sound financial management, the company is able to maintain business stability and profitability, thereby maintaining its leading position in the industry and demonstrating long-term market resilience and solid growth potential.

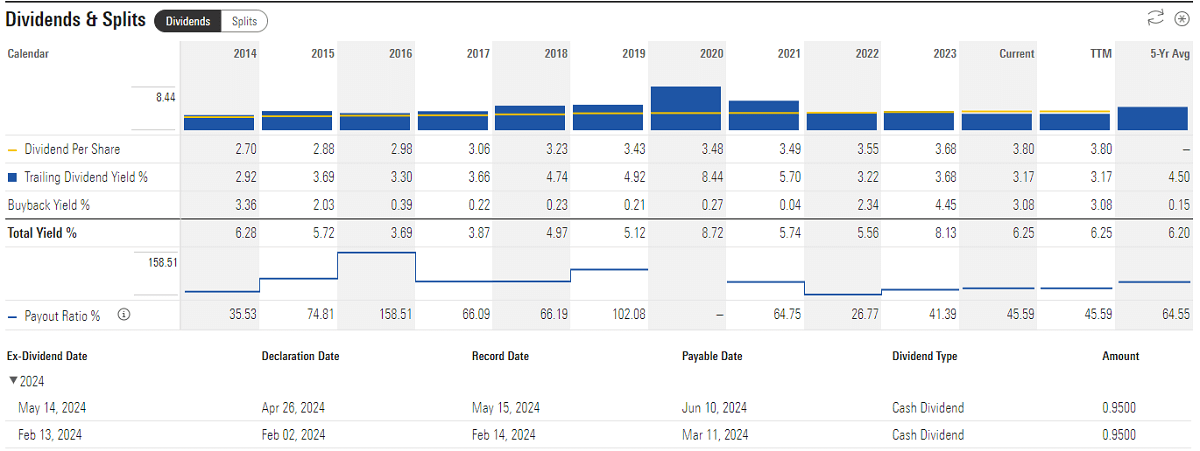

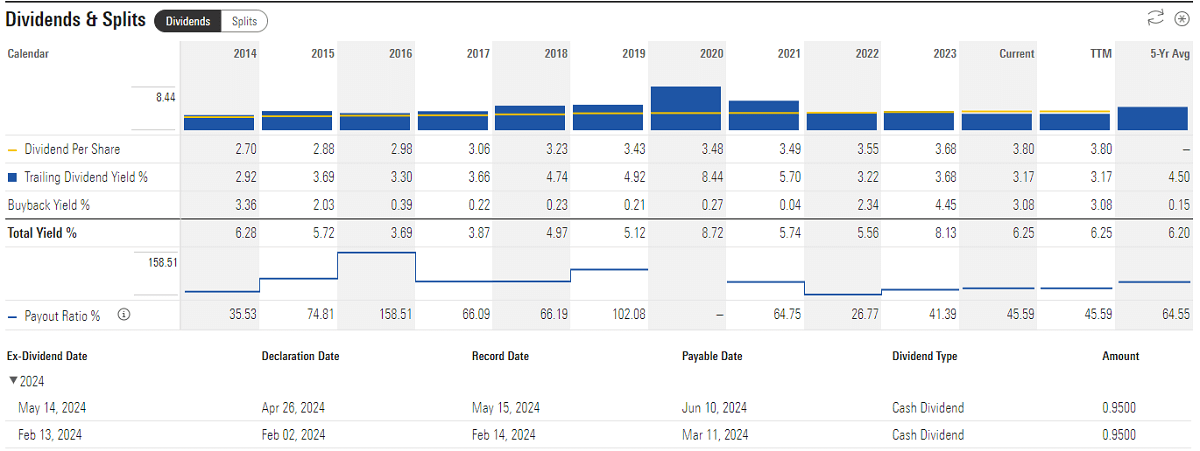

Consistent dividend payments have also been an important factor in attracting long-term investors to ExxonMobil. The company is committed to providing reliable returns to shareholders, demonstrating its financial soundness, and focusing on shareholder value through consistent dividend payments. This steady dividend income not only provides investors with stable cash flow but also reflects the company's strong profitability and financial health despite market volatility, earning it widespread trust and support in the capital markets.

In addition, its investments in environmental protection and sustainability provide a significant competitive advantage in its future energy transition. The company is committed to reducing carbon emissions, improving energy efficiency, and actively investing in renewable energy and clean technologies. These initiatives not only comply with stringent environmental regulations but also enhance the company's competitiveness in the marketplace and lay the foundation for long-term growth.

As a result, ExxonMobil's market capitalization reflects its significant position in the global energy market and investors' confidence in its future growth potential. Despite oil price volatility and market challenges, the company remains one of the world's top oil companies by market capitalization, with long-term investment appeal, thanks to its solid business model, continued technological innovation, and commitment to sustainable development.

ExxonMobil Stock Long-Term Investment Potential

ExxonMobil Stock Long-Term Investment Potential

A major player in the energy industry, ExxonMobil's stock is listed on the New York Stock Exchange (NYSE) under the symbol XOM. Over the past two years, ExxonMobil's stock price has risen by 124%, significantly outperforming its industry peers and market indices. This strong share price growth not only reflects the company's superior performance in the marketplace but also underscores its attractiveness to investors.

The company's long history of stable dividend payments provides significant appeal to investors seeking long-term, stable income. The company has demonstrated a strong commitment to shareholder returns with a long history of dividend payments and good continuity. Currently, the company's dividend yield is 3.17%, and the dividend has grown at an average annual rate of 1.8% over the past five years. This steady growth trend not only reflects the company's financial soundness but also demonstrates its commitment to continued investor returns.

ExxonMobil's financial performance has historically demonstrated relative stability, particularly through the recovery phase following the 2020 outbreak. Between 2020 and 2022. the company has shown favorable growth in both operating income and net income. In particular, in 2022. the company's net profit increased significantly, reflecting its strong financial performance and business resilience during the market recovery.

In addition, the company demonstrated strong financial performance in 2022. with the Upstream segment realizing a profit of $36.5 billion, while the Chemicals segment contributed $3.5 billion. These financials not only reflect the company's resilience in the face of market challenges but also demonstrate its continued profitability in the energy markets and chemicals sector.

The global economic recovery drove a rebound in oil demand, which had an immediate positive impact on ExxonMobil. Demand for oil and natural gas is expected to continue to grow as transportation and industrial activities resume. This trend is contributing not only to business growth but also to market share and profitability. The company's extensive business network and resource pool enable it to effectively capitalize on this market opportunity and achieve solid performance.

However, it should be noted that its revenue and profit are highly sensitive to international oil prices. Dramatic fluctuations in oil prices have a direct impact on the company's financial performance, as the price of oil and natural gas sales determines the main source of revenue. Higher oil prices usually lead to higher revenues and profits, and vice versa.

In the early 2020s, WTI Crude Oil Futures prices had fallen to lows, affected by the impact of the epidemic and plummeting market demand. However, as the market recovered and investors such as Warren Buffett bought aggressively, oil prices gradually recovered to over a hundred dollars, leading to a rebound in the share prices of oil companies, including ExxonMobil.

At the same time, increased global concern about climate change and environmental protection could lead to more stringent environmental regulations and policies, such as carbon emission limits and environmental taxes. This will increase ExxonMobil's operating costs and limit its dependence on traditional fossil fuels. The company will need to adjust its operating strategy and increase its investments in green technologies and renewable energy to address these changes. Effectively managing the risks posed by environmental regulations is critical to the company's competitiveness in the marketplace and its long-term strategic position.

The company's global operations cover several politically unstable regions, which exposes it to geopolitical risks such as international conflicts, policy changes, and trade restrictions. These factors may affect the company's production, transportation, and supply chain, resulting in operational disruptions or impaired financial performance. The company needs to address these challenges through a diversified supply chain and risk assessment to ensure business stability and global supply reliability.

Despite its strong market position in the oil and gas industry, ExxonMobil faces intense competition from competitors such as Chevron, Shell, and BP, as well as new energy companies such as Tesla. This requires the company to innovate, optimize operations, and improve cost control to maintain its leadership position and respond to rapid changes in the energy market.

Meanwhile, its current one-year forward P/E ratio of 12x is slightly higher compared to the industry average of 9x but lower than its median of 18x over the past 10 years. This suggests that while the company's current valuation is higher than the industry average, it is still lower than its historical long-term levels, likely reflecting the market's more cautious expectations for its future earnings growth. Investors considering purchasing XOM stock should take into account its relative valuation levels as well as its future earnings potential.

Despite these risks, it is an ideal choice for long-term investors with its stable dividend payment and strong market position in the global oil and gas industry. The company has demonstrated strength in resource reserves and technological innovation, and the stable dividend yield provides a reliable source of income. For investors seeking long-term stable returns, ExxonMobil stock (XOM) is significantly attractive due to its solid financial performance and industry leadership.

Despite the volatility of the oil and gas industry, these risks are effectively balanced by its diversified businesses and global operations. The company covers upstream exploration and production, downstream refining and marketing, and chemicals, and this diversification has helped it remain consistently profitable in different market environments. Including XOM stock in your portfolio can effectively diversify risk and capitalize on the company's solid market position and financial soundness to achieve stable returns over the long term.

In conclusion, as a company with long-term investment potential, when investing in Exxon Mobil Corporation stock, investors need to pay attention to global oil price trends, geopolitical risks, and environmental policy changes. Closely tracking these factors can help investors adjust their strategies to maintain investment stability and growth potential.

ExxonMobil and its long-term growth potential

| Category |

Detailed Information |

| Company Profile |

A leading oil and gas company, founded in 1999 and based in Texas. |

| Upstream Business |

Produces oil and gas, mainly in the Permian Basin. |

| Midstream |

Extensive pipeline and storage network for efficient energy transport. |

| Downstream Business |

Global refineries and plants produce gasoline, diesel, lubricants, and chemicals. |

| Technology Innovation |

Invests in energy efficiency, refining technology, CCS, and renewables. |

| Market Capitalization |

US$532.92 billion (as of July 2024), ranked 17th globally. |

| Financial Stability |

Strong finances and diverse revenue ensure stability amid oil price swings. |

| Risk Challenges |

Oil price volatility, environmental regulations, and geopolitical risks. |

| Long-term potential |

Its strong market position and dividends make it a top investment choice. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

ExxonMobil Market Capitalization

ExxonMobil Market Capitalization ExxonMobil Stock Long-Term Investment Potential

ExxonMobil Stock Long-Term Investment Potential