Against the backdrop of the rapid development of the e-commerce industry, Costco has not only successfully resisted the impact of e-commerce but also achieved solid annual revenue growth of up to 10%. In the stock market, Costco has been a standout performer, with its market capitalization approaching that of Walmart, even though its revenues are only one-third those of Walmart. Many are puzzled by this phenomenon while curious about the reasons for its success. Next, let's dive into the analysis of Costco's success advantages and long-term investment value.

Costco's Business Model and Success Factors

Costco traces its roots back to Price Club, founded in 1976 in San Diego, California, and Costco, founded in 1983 in Seattle, Washington, which merged in 1993 to form today's Costco, which has grown to become the world's second-largest retailer, behind Walmart.

Costco's core business model is membership, and it has two main types of members. The first is the commercial membership, which mainly serves small businesses and suppliers, helping them to purchase goods at wholesale prices. Secondly, there is the Gold membership, which is aimed at general consumers and offers a range of benefits and discounts.

This membership model, which requires customers to purchase a membership card in order to shop in shops, not only provides a steady cash flow but also enhances the company's financial stability. By charging membership fees, Costco ensured a stable source of revenue and effectively increased customer loyalty and shopping frequency.

Although it faced some initial resistance, it succeeded in attracting a large number of members by increasing the cashback system. The annual membership fee and spending habits make Costco's main source of income from membership fees rather than sales profits. A high 93% renewal rate shows the success of the membership system, and future annual fee increases will likely drive the stock price.

Costco has been able to sell at low prices through large-scale purchasing and a low-margin strategy that has been successful in attracting a large number of price-sensitive consumers. The company has focused its main source of profitability on membership fees, and by doing so, it has clearly differentiated itself from its competitors. Despite a gross margin of only 11%, much lower than Wal-Mart's 25%, Costco still manages to make a profit with its high sales volume and fast merchandise turnover.

By establishing long-term relationships with suppliers and centralizing purchasing, Costco has effectively reduced costs and achieved efficient supply chain management. Its shops serve not only as retail shops but also as warehouses, a layout that optimizes logistics and operating costs and allows savings to be passed back to consumers, further enhancing the company's competitiveness in the market.

In addition, the company maintains strict control over the number of SKUs (stock keeping units), offering about 4.000 items, which is significantly lower than that of its competitors. This strategy not only reduces transaction costs but also enhances bargaining power, ensures consistent product quality, and simplifies the selection process for consumers, making the shopping experience more efficient and convenient.

Costco's private label (Kirkland Signature) is one of the key factors in the company's success. By offering high-quality products at lower prices, it has attracted a large number of customers while improving the company's profitability. The brand not only enhances the company's control in the supply chain but also effectively reduces costs and further improves profits. Moreover, its excellent performance in several categories has contributed significantly to the company's revenue, making it an important pillar in Costco's business model.

The company also offers a wide range of additional services, such as restaurants, gas stations, and pharmacies, and these services are often priced below market levels, which greatly enhances the sense of value for members and strengthens consumer loyalty. In addition, Costco's employees are paid at a higher rate, averaging $16 per hour, significantly higher than Wal-Mart's and Target's $12. This higher pay not only reflects the company's corporate culture but also its success in operational efficiency.

Costco has built a strong business moat by successfully delivering high-quality goods and services through large-scale purchasing, low-margin strategies, streamlined SKUs, and efficient supply chain management. Meanwhile, the success of private labels and additional services has further enhanced profitability and member loyalty. Even Charlie Munger recommends it, fully recognizing the success of its business model.

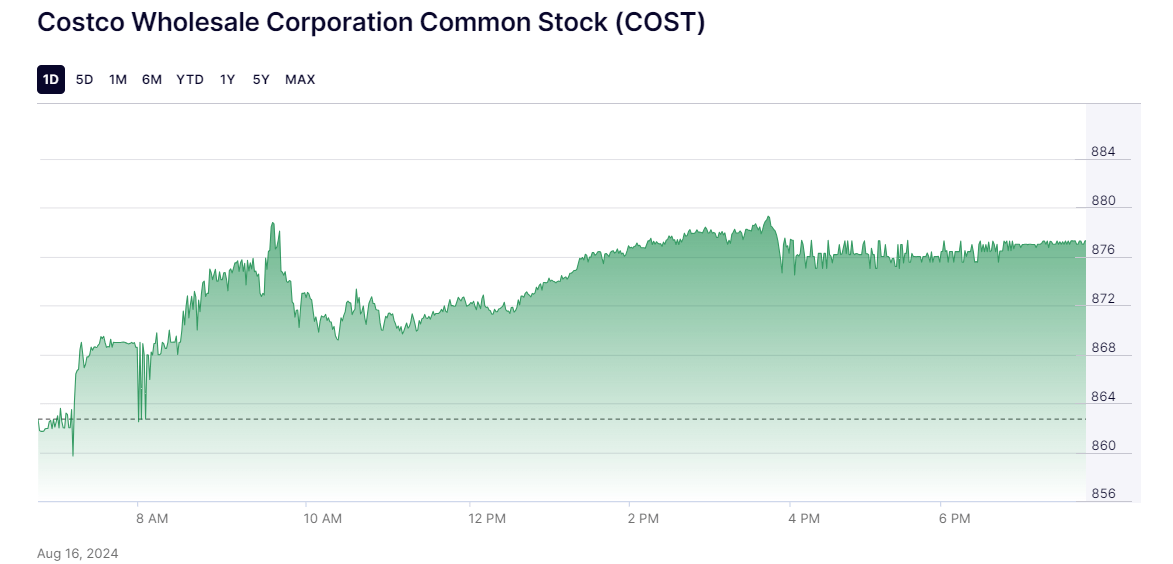

Costco Stock Performance

Costco Stock Performance

Costco's market capitalization is close to Walmart's despite its annual revenues being only a third of Walmart's, reflecting the market's high recognition of Costco's future growth potential. Investor confidence in the company is reflected in its relatively high market cap, reflecting full trust in its successful business model in terms of its low-margin strategy, membership model, supply chain management, and private label brands.

Costco's stock price has risen 54% over the past year and has soared more than 600% over the past five years. Such gains are extremely rare in the retail industry, demonstrating the company's strong performance in the market and investors' high regard for its future prospects.

Looking at the Q3 2024 results, Costco achieved total revenues of $58.52 billion, up 6.76% year-on-year, and maintained a steady growth since the previous quarter. This performance highlights the company's solid position in the market and its ability to continue to attract consumers.

In addition, Costco's net income reached $1.68 billion, up 7.67 percent year-over-year. Earnings per share were $3.78. up 7.74 percent year-over-year. These financial figures fully demonstrate Costco's steady growth and strong profitability, further strengthening its leading position in the retail industry.

Costco's current price-to-earnings ratio of 46.0 is significantly higher than the retail industry average, indicating that the market is extremely optimistic about its future growth potential. However, this high valuation also implies a potential risk of overvaluation, and investors need to be cautious in assessing its long-term investment value. Despite the company's strong performance, the high price-to-earnings ratio could expose its shares to a greater risk of correction during market volatility or economic uncertainty.

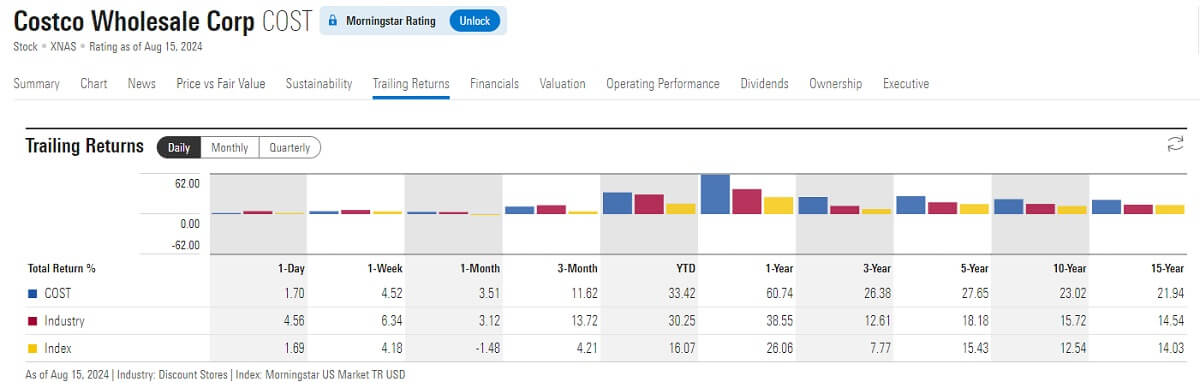

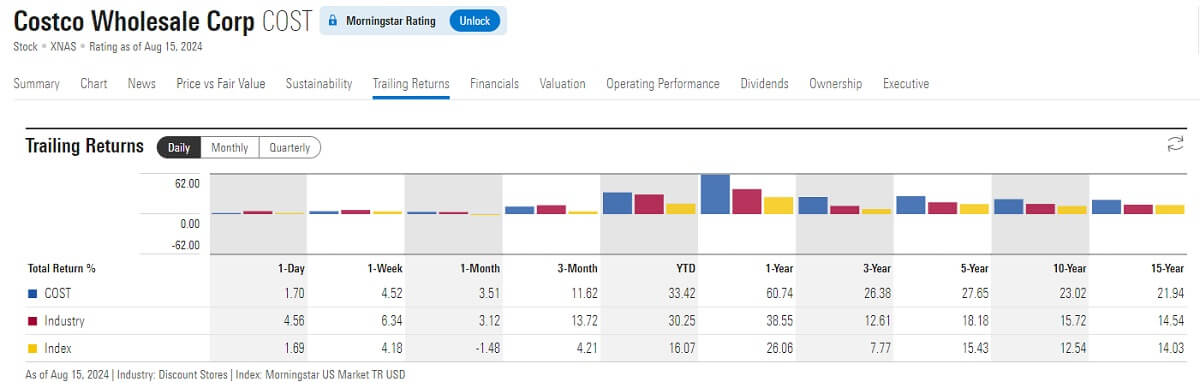

In terms of historical returns, Costco's stock has demonstrated impressive growth over the past 10 years, especially over long-term investments, and has far outperformed market benchmarks. For example, over the past ten years, Costco has returned approximately 23.02% annualized and achieved a return on investment of approximately 670%. This remarkable return performance demonstrates the company's strong growth in the stock market and reflects the market's high regard for its long-term success and profitability.

On a five-year historical return basis, Costco has an annualized return of approximately 27.65% and a return on investment of approximately 245%. This outperformance highlights the company's strong growth momentum in the near term and further validates the success of its business model and market strategy.

Over the past year, Costco's annualized return has been an impressive 60.74%, demonstrating the strong performance of its shares in the market. Such high returns underscore investors' confidence in Costco's future growth potential and provide significant returns on investment.

Over the same timeframe, both industry returns and U.S. market returns have been much lower than Costco. And lengthening the return cycle, Costco's returns have even significantly outperformed the S&P 500 over a ten-year cycle. This significant return differential reflects Costco's strong investment return profile and underscores its attractiveness as a long-term investment target.

Moreover, Costco is aggressively expanding into international markets, including Canada, Mexico, Europe, and Asia, which presents additional growth opportunities for the company. The growing global economy and market interest in its business model will further drive the company's revenue and market capitalization growth.

In conclusion, Costco is certainly a quality company to watch for long-term investors. However, investors need to consider market risks when making decisions and make informed choices based on their investment strategies and risk appetite. Continuously monitoring market developments and planning investment strategies wisely will help achieve solid investment returns in the future.

Costco Stock Investment Recommendations

Costco Stock Investment Recommendations

From the above analysis, it is clear that Costco is a quality company worth investing in, especially for long-term investors. Its sustained growth and solid market position not only demonstrate strong competitiveness but also provide attractive assets for long-term portfolios. Costco's consistent financial performance and unique business model set it apart from the rest of the retail industry, delivering solid long-term returns to investors.

Fundamentally, Costco's core strengths are its membership business model, strong brand loyalty, and superior supply chain management, which together support the company's long-term stable growth. In addition, Costco's private label Kirkland Signature and add-on services (e.g., restaurants, gas stations, and pharmacies) further enhance its market competitiveness and differentiate it from the rest of the retail industry.

If one is confident in Costco's long-term growth prospects, especially its unique competitive advantage in the retail industry and stable profitability, then now may be an investment opportunity worth considering. The company's operating model and financial performance demonstrate strong growth potential, which makes it an attractive long-term investment.

However, it is important to note that Costco's price-to-earnings ratio (PE ratio) is currently 46. which is significantly higher than the retail industry average. This indicates that the market has very optimistic expectations for its future growth, but it also means that there is a risk that the stock may be overvalued, especially if there is volatility in the market or a deterioration in the economic environment.

Despite the company's good fundamentals, the overvaluation of the stock may pose an investment risk. Waiting for the price to come down to a reasonable range before considering an entry will help reduce investment risk. Therefore, given the higher valuation, buying in tranches or waiting for the share price to retrace may be a more prudent strategy.

And from a technical perspective, Costco's stock price has shown strong support in its historical moves, especially on declines when it often returns to the vicinity of rising averages and bounces back quickly. Technical analysis charts show that over the past 15 years, Costco's stock price has never fallen below its long-term rising averages, indicating a solid uptrend and investor confidence in its future growth. This characteristic has allowed Costco to show strong resilience during market volatility, providing strong technical support for long-term investors.

Based on the discounted cash flow model, Costco's intrinsic value would be approximately $717 per share if the future free cash flow growth rate remains at 15% per year. However, if valued at a lower growth rate, the calculated intrinsic value could be lower than the current market price, meaning that there is a risk that the current share price may be overvalued.

Investors are advised to keep an eye on potential buying opportunities when Costco shares pull back to near its long-term rising average. This is because a pullback to the long-term rising average usually signals a rebound point in the share price after a correction, which could be a favorable time to enter. At the same time, investors should be on the lookout for share price enhancement potential from a possible increase in a company's annual fee.

A rise in annual fees may not only directly increase the company's revenue but may also further boost shareholders' confidence and market expectations of its future growth, thus driving the share price higher. The combination of these two factors could allow investors to invest at the right time with a view to earning solid returns over the long term.

Overall, while Costco's share price has performed very well over the long term, investors should approach the investment opportunity with caution due to its high PE multiple and the general market perception that the shares are overvalued. It is advisable to look for suitable buying opportunities on the downside or correction in the share price, especially when the share price retraces back to near the long-term rising average to gradually add to the stock.

Looking at the current chart, Costco shares have seen a market pullback, which may be a good time to gradually add to Costco stock. However, investment decisions should still be made based on one's risk tolerance and investment objectives, ensuring that the investment strategy matches one's financial situation and market expectations.

Overall, Costco is suitable for investors who have a high risk tolerance and are confident in its long-term growth prospects. By buying in tranches when the share price retraces, it can effectively reduce the overall investment risk while capturing potential investment opportunities. This strategy not only balances risk and return but also provides good investment returns against the backdrop of the company's long-term stable growth.

Costco's Successful Strengths and Long-Term Investment Value

| Advantageous factors |

Long-term investment value |

| Membership model |

Strong long-term share price growth and market recognition. |

| Low Gross Profit Strategy |

Stable revenue and profitability. |

| Efficient supply chain |

Current P/E ratio is above industry average. |

| Own Brand |

Long-term returns outperform market benchmarks. |

| Additional Services |

Growth from global expansion and model innovation. |

| Employee Salary |

Strong brand loyalty and membership model. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Costco Stock Performance

Costco Stock Performance Costco Stock Investment Recommendations

Costco Stock Investment Recommendations