For many retail investors, smart investment choices are usually those businesses that are closely tied to our lives. The payments industry is closely tied to the lives of nearly everyone and has tremendous growth potential. However, many people may not know this industry as well as they would like to, or even have misconceptions. Therefore, this article will take MasterCard, a leading company in the payment industry, as an example and focus on analyzing the investment profile and key points of MasterCard stock.

Mastercard Company Profile

Mastercard is a leading global multinational payment technology company headquartered in New York, USA. As a pioneer in international payment solutions, Mastercard is committed to enhancing the security and convenience of global financial transactions through its innovative payment technologies and services.

Founded in 1966. the company was originally created by a consortium of U.S. banks as the Master Charge International Organization. The organization was created to provide a unified credit card payment solution to meet the financial market's need for cross-bank transactions at the time.

In 1979. the company underwent a major rebranding, changing its name to MasterCard to better reflect its global and modern business development strategy. Since then, the company has continued to expand its payment technology and services to become one of the world's leading payment companies.

MasterCard offers a broad range of payment solutions, including credit, debit, and prepaid cards, and supports a variety of electronic payment methods, such as online, mobile, and digital currency payments. The company is committed to providing consumers around the world with convenient payment options and continues to innovate to keep pace with developments in payment technology.

However, it does not offer these payment products directly to consumers but rather through partnerships with banks and financial institutions. This model enables it to leverage its strong payment network and technology to help its partners issue credit, debit, and prepaid cards and to promote the popularity of e-payments and other payment methods, thereby effectively expanding its market reach.

With its strong global network and advanced technology, the company not only drives the development of the global payments industry but also plays a key role in promoting cashless payments, digital finance, and global economic integration. Through continuous innovation and optimization of its payment solutions, the company provides consumers around the world with a more convenient and efficient payment experience.

At the same time, MasterCard focuses on developing new digital payment solutions that respond to changing consumer needs and market trends. These innovations have not only helped the company maintain its leadership position in payment technology but have also continued to enhance the user experience. Its brand is widely recognized globally, with a network covering more than 210 countries and territories, supporting settlement in over 150 currencies and processing millions of transactions every day.

As a leading payments technology company, it not only specializes in payment processing but has also made significant advances in the areas of data analytics and artificial intelligence. The company has significantly enhanced its data analytics capabilities through mergers and acquisitions and technology investments, such as the acquisition of companies like Applied Predictive Technologies and Dynamic iOS. These initiatives have enabled the company to provide more accurate advisory services and solutions, marking the expansion of its business model from pure payment processing to data analytics and corporate advisory services.

This shift has opened up new revenue streams for MasterCard and enhanced its competitiveness in the market. Through the use of data analytics and artificial intelligence technologies, the company was able to help enterprises optimize their operations and improve efficiency, thus further consolidating its market leadership in the payment technology sector.

Meanwhile, its high international market revenue share has enabled it to take a leading position in the global payments market, while its advanced data analytics technology has opened up new market opportunities for the company. Together, these factors have fuelled its continued growth and market share expansion in the payments technology sector.

In addition, MasterCard is committed to sustainability and social responsibility, actively contributing to social and economic progress by promoting financial inclusion, fostering education, and supporting innovation. The company participates in a variety of projects aimed at expanding the reach of financial services and enhancing the fairness and accessibility of the global financial system.

In short, MasterCard dominates the global market in the payments industry alongside companies such as Visa and American Express. Through continuous innovation and technological advances, these companies have driven the modernization of payment systems, providing secure and convenient global payment solutions. At the same time, it ranks second in market capitalization among global payment technology companies, further earning it widespread favor among investors.

MasterCard Stock Analysis

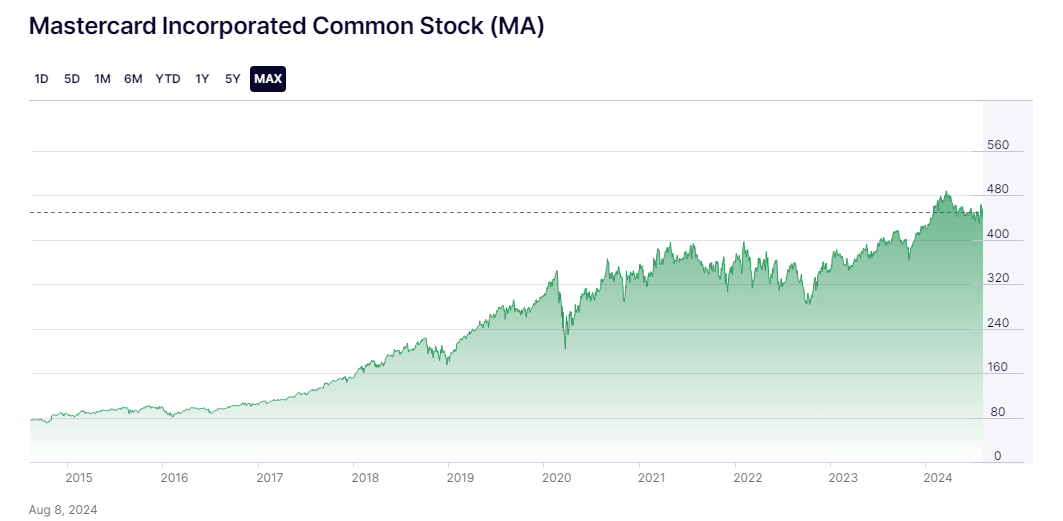

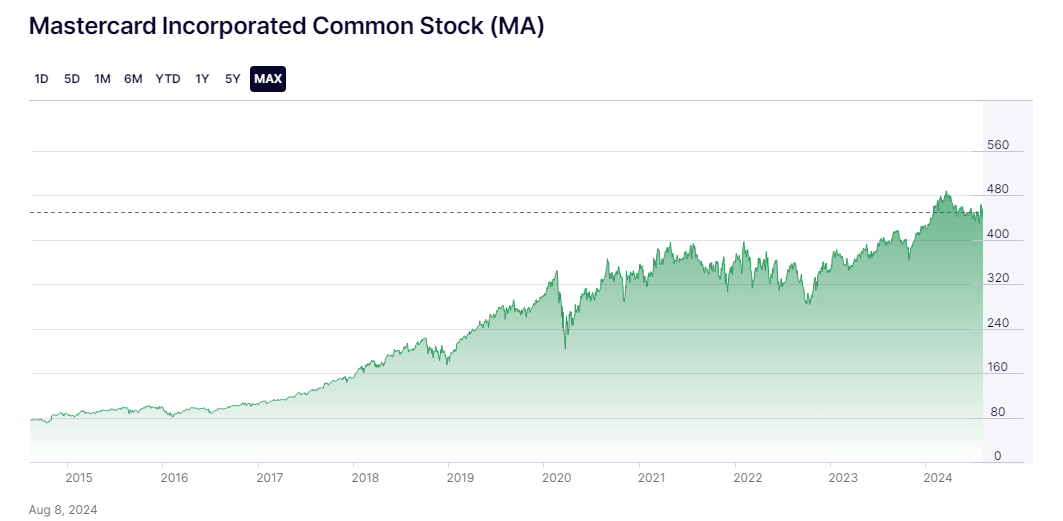

The company's stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol MA. As one of the world's leading payment technology companies, MasterCard's stock price has risen a cumulative 91% since its May 2006 ipo. This outperformance reflects the company's steady growth and widespread market recognition over the past decade or so, highlighting its continued competitiveness and innovation in the payments industry.

In particular, during the market volatility that followed the outbreak, Mastercard's share price rose by 42.8 percent, an increase significantly higher than Visa's rise over the same period (23.6 percent). This performance suggests that Mastercard demonstrated stronger market performance and resilience during the outbreak, reinforcing its leading position in the payments industry.

And according to its latest earnings report, MasterCard's revenue for the most recent quarter reached $6.96 billion, up 9.56 percent year on year. This performance was significantly higher than market expectations, suggesting that the company exceeded expectations in terms of revenue and demonstrated strong earnings growth. Meanwhile, net income reached $3.26 billion, up 12.74 percent year-on-year and 8.2 percent from the previous quarter. Earnings per share, meanwhile, came in at $11.83. up 15.72 percent year-over-year and 8.78 percent from the previous quarter.

This earnings growth not only reflects the company's success in controlling costs and improving profitability, but also its strong performance in the market and effective business strategy. These financials demonstrate Mastercard's continued success in optimizing operations and enhancing profitability.

This growth has been driven by the recovery of the global economy, in particular the pick-up in travel and cross-border transactions, which have driven significant increases in consumer spending and transaction volumes. This trend is expected to continue to fuel Mastercard's business expansion and further drive the company's revenue growth as the economy continues to recover.

Meanwhile, the company's international revenue share was 65 percent, significantly higher than Visa's 50 percent. This high ratio indicates that the company has a broader source of revenue from cross-border transactions and is able to generate higher margins, especially in the high-draw cross-border card business. And this advantage will put MasterCard in a strong position in the global payments market and enable it to more effectively capitalize on the growth potential of international markets.

It also hastens to say that whether it is the popularity of credit cards in emerging markets or the growth of payments in mature markets, these factors can directly drive the company's performance. Such market positioning enables Mastercard to capitalize on opportunities in different economies that will continue to drive the company's growth.

Overall, Mastercard has performed well in the current economic environment and is expected to continue to benefit from the global economic recovery and business growth in the future. In April this year, Mastercard's share price even broke through an all-time high of US$490. This new share price high not only marks the company's strong performance in payment technology but also reflects recognition of its continued growth and market leadership. Investors are positive about Mastercard's long-term growth potential and business performance, which is reflected in the record-breaking share price.

Moreover, Mastercard's dividend has remained stable and is expected to continue to increase in the future, reflecting its continued profitability and commitment to shareholder returns. At the same time, the company typically trades at a price-to-earnings ratio (P/E ratio) of 30 times or more, indicating that investors hold high expectations for its future growth prospects.

In other words, under the current economic environment and market trends, MasterCard has demonstrated significant investment potential with its strong competitive advantages, stable and growing financial performance, and innovative business model. The company's financial performance has exceeded market expectations, which, combined with its leadership position in the global payments industry and solid business foundation, makes Mastercard an attractive investment going forward.

Mastercard Stock Investment in a Nutshell

Based on the analysis of Mastercard stock, the company's strong performance and financial growth in international markets demonstrate its investment potential. However, successful investment requires attention to the company's business model, market competition, global economic trends, and financial statements. It is also key to assess market risk and volatility to ensure that the investment strategy matches one's risk tolerance.

MasterCard is a dominant player in the payments industry, with a perennial gross margin of approximately 78 percent, comparable to that of a high-margin cloud services company. This reflects the company's strong market position and efficient business model. As an industry leader, the company ensures stable revenues and sustained competitive advantage through its extensive payment network and technological innovations.

In the payments space, its key competitors include Visa and American Express, among others, which also have strong market positions. However, the company has a slightly higher global market share than its major competitors and continues to consolidate and expand its market share through its extensive network and innovative technology, maintaining its leadership position in the global payments industry.

The payments industry, however, has a large market volume and a natural monopoly, which has enabled major companies such as Visa and Mastercard to maintain stable revenues. These companies control a large volume of global transaction traffic and have high market entry barriers, which allows them to continue to maintain stable profits in adverse conditions such as economic shocks or epidemics. This market control provides them with a sustained competitive advantage and financial resilience to continue to perform well in uncertain markets.

During the epidemic, MasterCard demonstrated excellent stability and continued to do well in business. As the global economy recovered, the company's financial results showed significant earnings growth, further reinforcing its long-term investment potential and highlighting its strong market position and continued growth in the payments industry.

Moreover, with strong user stickiness and premiumization, the company has not only consolidated its leading position in the global market but also demonstrated great potential for growth. Its extensive payment network and innovative technology have attracted and retained a large number of international users, enhancing its competitive advantage in the market and driving sustained growth.

At the same time, the current high valuation reflects investors' strong confidence in MasterCard's long-term growth. This valuation not only shows the market's high recognition of the company's future growth potential but also reflects the expectation that it will continue to innovate and maintain its market-leading position in the payments industry. Investors are positive about its future performance and growth, making the current valuation an important indicator of the company's long-term success.

As a financially sound and stable business, MasterCard stock has outperformed over the past several years, delivering significant returns to investors. The company's strong financial foundation and stable business model have not only demonstrated resilience in the face of market volatility but have also provided solid support for future investments. This solid financial position and sustained business growth have enabled it to maintain a reliable and attractive position in the minds of investors, laying a solid foundation for future investment opportunities.

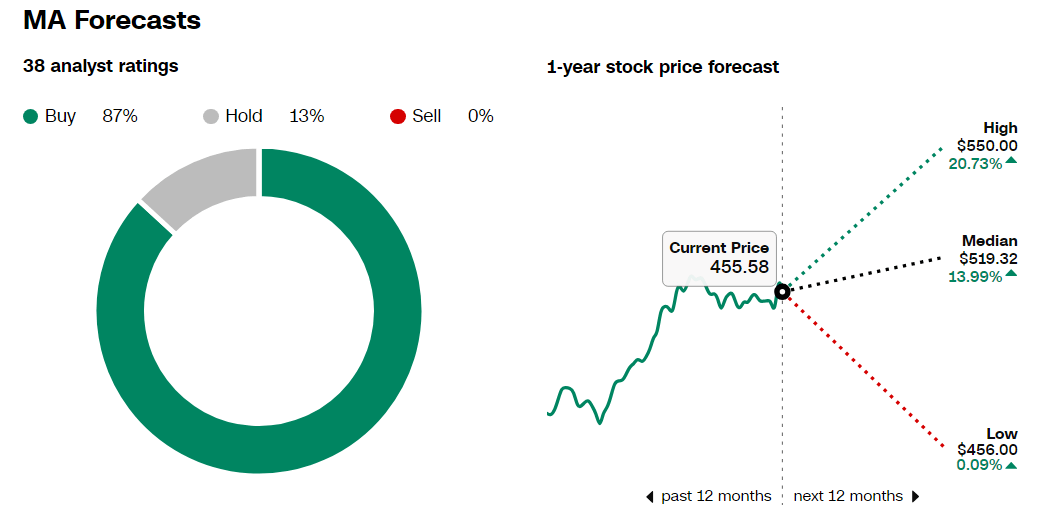

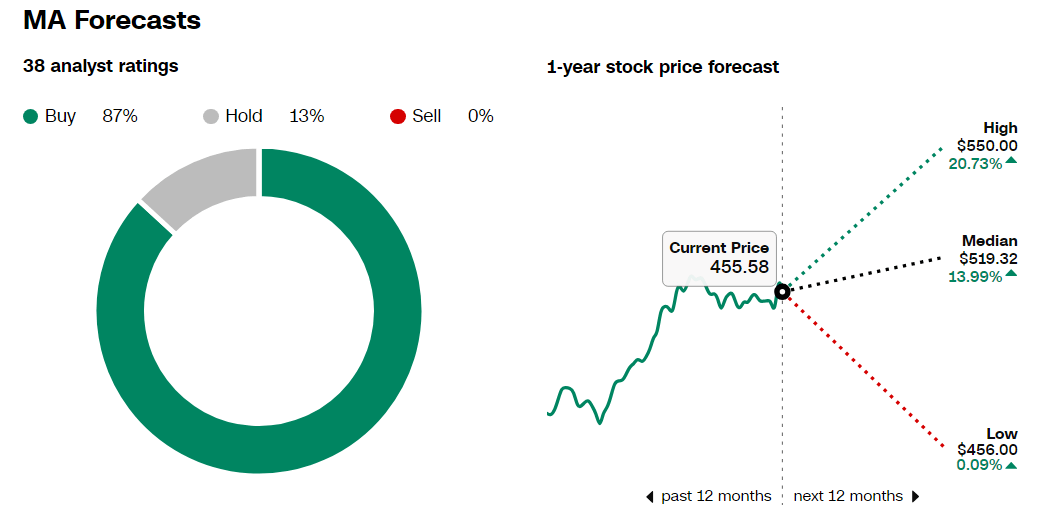

With its leading payment technology and dominant position in the global market, MasterCard not only has the potential for continued growth but is also able to maintain strong financial performance. As a result, analysts are optimistic about the company's earnings expectations and expect it to continue its solid growth in the coming quarters.

Of course, despite the company's past performance, market volatility remains a significant investment risk. Good past performance is not a complete predictor of future earnings, and investors need to remain alert to market uncertainties. In addition, changes in the macroeconomic environment, such as recession, policy adjustments, or global economic turmoil, may pose challenges to the company's financial position and stock performance.

Based on technical analyses, MasterCard's stock price shows a long-term uptrend. Although the current share price has fallen from recent highs, the market is in a consolidation phase, which provides a good time for investors to enter the market. A consolidation zone usually signals a potential buying opportunity, as it suggests that the market may be gearing up for the next leg higher. The current period of market correction provides investors with an opportunity to buy at relatively low prices and thus gain when the market resumes its uptrend in the future.

Of course, since the stock has fallen back to $452 and is currently in a downtrend, investors with a conservative strategy could wait for a support signal before considering entering a long position. Support signals usually mean that the stock is likely to stop falling and bounce back, which reduces risk and increases the likelihood of a successful investment.

In conclusion, MasterCard, a well-known payment technology company, has seen its stock perform steadily over the past few years and show strong growth potential. Nonetheless, investors should keep in mind that any investment involves risks. It is advisable to conduct thorough research and analysis, assess one's own risk tolerance, and formulate a reasonable investment plan based on investment objectives before making an investment decision.

MasterCard Stock Investment Overview and Highlights

| Key Points |

Description |

| Company Profile |

Founded in 1966, a New York-based global payment solutions provider. |

| Business Model |

Issues payment cards through banks, not directly to consumers. |

| Stock Performance |

Up 91% since IPO, shares top $490 in 2024. |

| Financial Data |

Recent revenue of $6.96 billion, net income of $3.26 billion, EPS of $11.83. |

| Market Advantage |

65% of revenue is international; competitors: Visa, American Express. |

| Investment Potential |

Financial stability, market leadership, stable dividends, long-term growth. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.