When it comes to international investing, most people's preferred markets are likely to be the US and other western countries, such as the UK and Canada. However, the performance of the Indian stock market has been particularly impressive in recent years. It has doubled in the last decade, far outperforming Taiwan, the US, and other major global stock markets. Today, this market is too big to ignore. Next, we will take a deeper look at the strong growth of the Indian stock market and its investment outlook.

Current status of Indian stock market trends

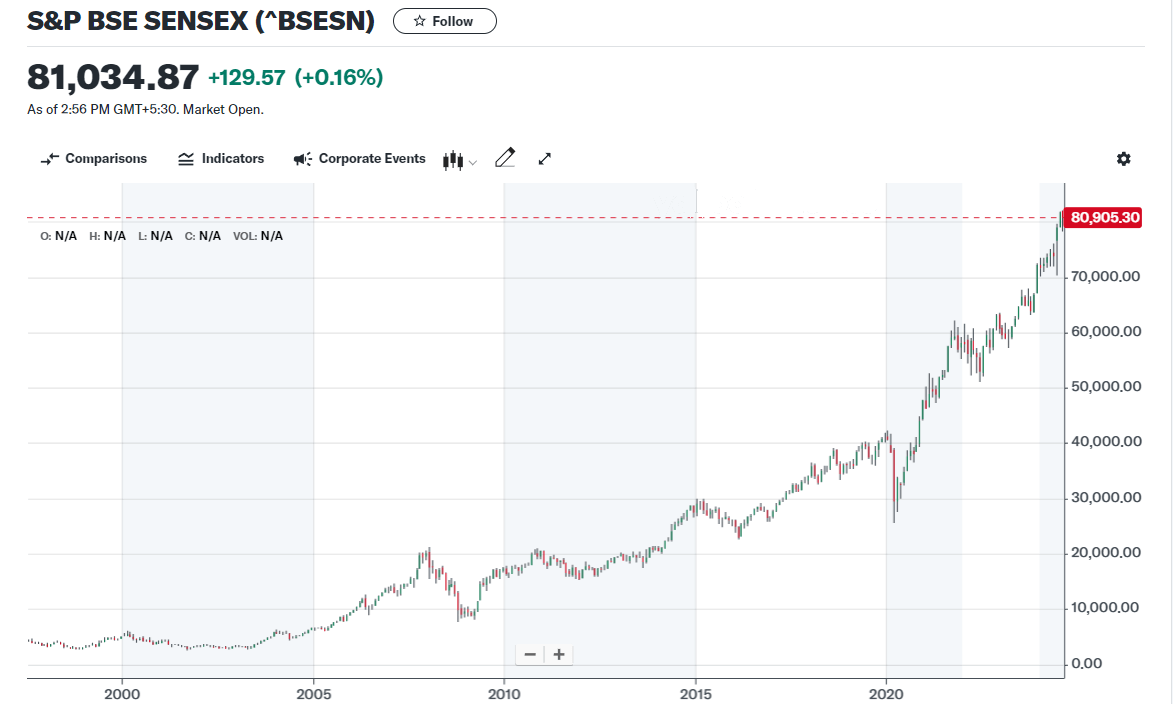

Looking back at the last decade, India's economy has undergone a sea change. Over the last decade, the Indian stock market has grown by a cumulative 250 percent, surpassing the 170 percent growth of the US stock market over the same period, making it one of the best performers amongst the major stock index markets in the world. Today, the market capitalization of the Indian stock market has overtaken that of Hong Kong to become the fourth largest in the world, after the US, China, and Japan.

The Indian stock market consists of two major exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Established in 1875. the Bombay Stock Exchange is the oldest stock exchange in India with a long history and tradition of trading. The National Stock Exchange, on the other hand, was established in 1992 and has quickly become one of the largest stock exchanges in India, particularly known for its high liquidity and technological innovation.

Of the two, the Nifty 50 and the Sensex are the two most critical market indices. The Nifty 50. launched in 1996. consists of 50 of the largest and most liquid stocks listed on the National Stock Exchange and is broadly representative of the performance of the Indian market as a whole. The Sensex was created in 1986 and consists of 30 representative stocks listed on the Bombay Stock Exchange, reflecting the performance of the Indian market as a whole. The Sensex, on the other hand, was created in 1986 and consists of 30 representative stocks listed on the Bombay Stock Exchange, reflecting the core stock performance of the Indian economy.

In recent years, major indices of the Indian stock market, such as the Nifty 50 and the Sensex, have performed strongly and have continued to set new all-time highs. The Sensex is approaching 80.000 and the Nifty 50 has crossed 25.000. both up more than 10 times, demonstrating the strong growth potential of the Indian equity market.

This remarkable growth has not only attracted widespread attention from global investors but has also attracted a large influx of international capital, further fueling the global reach and investment appeal of the Indian market. In addition, the total market capitalization of the Indian stock market has jumped to the fourth largest in the world at around $3 trillion. This position not only reflects the size and importance of the Indian market but also demonstrates its prominence as one of the major global economies.

The Indian stock market is concentrated in key sectors such as information technology, financial services, consumer goods, and pharmaceuticals, and companies in these sectors dominate the market and have a profound impact on overall stock market performance. In particular, many listed companies in the information technology and consumer goods sectors have demonstrated strong earnings growth, which has significantly improved the overall performance and investment attractiveness of the market. The buoyancy of these sectors has not only provided solid support to the Indian stock market but has also attracted the attention of global investors.

At the same time, the Indian market has witnessed the emergence of many top performers. For example, the National Grid of India's net profit of more than 48 percent, since 2007 profits rose by a cumulative total of 1.317 percent, while the Indian tobacco companies in the past 20 years have had revenue growth of 19 times, a net profit margin of 14 percent, and a return on investment (ROE) of 25 percent. The outstanding performance of these companies not only highlights the profitability and growth potential of Indian companies but also provides investors with attractive investment opportunities.

Over the past two decades, the Indian economy has been steadily advancing at an average annual growth rate of about 7 percent, laying a solid foundation for the long-term performance of the stock market. Strong economic growth, a youthful labor force structure, and structural reforms by the government, such as tax reforms, infrastructure investments, and digital transformation, have combined to drive the stock market's good performance.

Despite its strong long-term performance, the Indian equity market remains exposed to market volatility, including global economic uncertainty, policy changes, and geopolitical risks. These factors could lead to sharp market volatility, affecting investor confidence and investment returns. In addition, exchange rate fluctuations may also have an impact on the returns on foreign investments, thereby putting pressure on real returns in the Indian equity markets. Investors need to carefully address these risks in order to protect and optimize their investment returns.

Overall, the Indian stock market has shown significant growth potential on the back of strong economic growth, market reforms, and foreign inflows. However, investors also need to be mindful of the risk factors in the market, including global economic uncertainty, policy changes, and their impact on the market. Taking all these factors into account is the only way to effectively manage risk while seizing opportunities.

Why does the Indian stock market keep going up?

Why does the Indian stock market keep going up?

Volatility in the stock market is the norm, but the Indian stock market has caught the attention of many investors mainly because it has demonstrated a strong momentum of consistent gains over the years. The market has now remained up for eight consecutive years without any significant decline.

There are a number of reasons behind this performance, the most critical of which has been India's steady economic growth in recent years. Over the past few years, India's economy has grown at a steady average annual rate of between 6-7 percent, which has not only driven a steady rise in corporate profits but has also provided solid support for the stock market.

In addition, the sustained rise of the Indian stock market has also benefited from relatively loose economic policies and a favorable market environment. The Indian government's economic policies have created a stable and friendly market environment for companies and investors, which has laid a solid foundation for long-term stock market growth.

The trading mechanism of the Indian stock market also plays an important role compared to the Chinese A-share market. It allows retail investors to trade T+0. i.e., buy and sell on the same day, which provides significant flexibility to retail investors. This flexibility allows retail investors to react quickly to market changes and take advantage of short-term opportunities, effectively reducing the advantage of institutional investors to profit from information gaps.

Such flexible trading rules not only promote market activity but also increase retail investors' participation in market volatility. Frequent trading by retail investors injected more capital into the market, further fueling the upward momentum of the stock market. This mechanism has provided additional support to the robust growth of the Indian stock market, which has continued to gain traction in the global market.

Moreover, India has a stringent delisting mechanism in place to protect the interests of shareholders. In India, if a listed company decides to delist, it must buy back the shares in the hands of its shareholders, and the buyback price must be reasonable and fair. If the company is unwilling to buy back the shares, the stock exchange will commission experts to assess the actual value of the company and carry out the share buyback on the basis of the assessment results.

This stringent delisting mechanism provides investors with important protection against losses that may be incurred by shareholders if a company delists arbitrarily. This protective measure not only safeguards investors' rights and interests but also greatly enhances investors' confidence in the market and encourages more people to participate in stock market investment, thus further promoting the healthy development and stable growth of the market.

India has taken stringent legal measures against financial fraud in order to maintain the fairness and transparency of the market. Under the Indian Companies Act, 2013. financial forgery is considered a felony, and penalties include hefty fines and imprisonment of up to 10 years. The fines can be up to three times the amount involved in the case, which has led companies to be extremely careful in their financial reporting to avoid irregularities.

This stringent penalty regime has significantly increased market transparency and prompted companies to be more disciplined in disclosing financial information. This not only reduces the risk faced by investors but also enhances the trust of global investors in the Indian market and attracts more foreign capital inflows, further contributing to the stability and growth of the Indian stock market.

In addition to this, foreign capital inflows are one of the key factors driving the Indian stock market higher. Last year, net inflows into exchange-traded funds (ETFs) focused on the Indian market reached $8.6 billion, significantly surpassing the 2021 peak of $7.4 billion. These funds accounted for one-third of the total buying by emerging market funds, demonstrating the high level of investor interest and confidence in the Indian market. This strong inflow of funds has not only injected new vigor into the market but has also further fueled the sustained gains in the Indian equity markets.

Japanese financial institutions are also increasing their investments in India, a move that reflects the global capital market's recognition and confidence in India. Japanese investors and financial institutions are actively positioning themselves in the Indian market and increasing their holdings of investment assets in India with a view to benefiting from the strong growth of the Indian economy and market potential. This increase in investment not only reflects a positive outlook towards the Indian market but also indicates the growing importance of India as an emerging market in the global capital markets.

India is expected to become the third largest economy in the world within the next five years, according to IMF expectations, which are based on the country's significant economic growth fundamentals. India's strong economic performance is widely recognized and bodes well for its future potential. The country's economic growth is fuelled not only by stable domestic demand but also benefits from the confidence of international markets in its economic prospects.

In addition, India's large and young demographics provide strong support for economic growth. India's GDP growth of 2.8 percent year-on-year in FY2023-2024 is further evidence of its economic dynamism. India's average age of 28 makes it one of the youngest countries in the world, a demographic dividend that lays a solid foundation for future economic development and market expansion. Meanwhile, as the second largest English-speaking country in the world, India has a significant linguistic advantage in global expansion, which not only enhances its competitiveness in the international market but also attracts a large number of foreign companies to enter the Indian market.

India's e-commerce market and mobile payments sector is experiencing rapid growth and has become an important force driving the economy. The proliferation of digital payments and fintech has not only accelerated access to financial services but has also fuelled innovation and growth across industries. This trend is expected to usher in an even brighter digital revolution in the coming years as more and more consumers and businesses adopt digital payments, further transforming and upgrading the Indian economy.

In conclusion, the Indian stock market has performed well over the past few years and has become an important part of the global economy. Its youthful demographics, fast-growing economy, and rising market position have made the Indian market highly desirable. Despite certain risks and challenges, India's stock market continues to offer tremendous growth potential in the long run. Investors should keep an eye on the changes in the market and be well prepared to capitalize on the opportunities presented by the Indian market.

Investment analysis of the Indian stock market

Investment analysis of the Indian stock market

The long-term potential of the Indian market is huge, with its young demographics and fast-growing economy providing vast scope for future growth. A young labor force and an expanding consumer market provide strong support for economic growth. While the future development of the market will be influenced by the global economic and policy environment, the Indian stock market continues to offer significant growth opportunities over the long term, especially as the structure of the economy continues to optimize and the market matures.

For the average investor, it is advisable to invest in the Indian stock market using a regular fixed-amount investment approach. This strategy can effectively counter short-term market volatility by spreading the investment risk and smoothing out the impact of market fluctuations by investing a fixed amount of money at fixed intervals.

By adhering to this investment approach over a long period of time, one can achieve solid asset appreciation even with short-term market volatility and gain good returns from the long-term growth potential of the Indian stock market. This approach not only simplifies the investment process but also improves the discipline of investing, which helps the average investor to realize financial goals in a complex market environment.

Whereas, professional investors can allocate their funds wisely for a diversified investment strategy, such as investing 60 percent of their funds in US stocks, 20 percent in Taiwan stocks, and the remaining 20 percent in the Indian market. When investing in the Indian market, investors can choose different types of stocks based on their personal risk tolerance.

Large-cap stocks are usually more robust, offering relatively stable returns, and are suitable for investors with a lower risk appetite, while small-cap stocks are likely to offer higher returns but come with greater volatility and are suitable for investors willing to take on a higher level of risk. Such an allocation helps to balance risk and reward and capitalize on investment opportunities across markets.

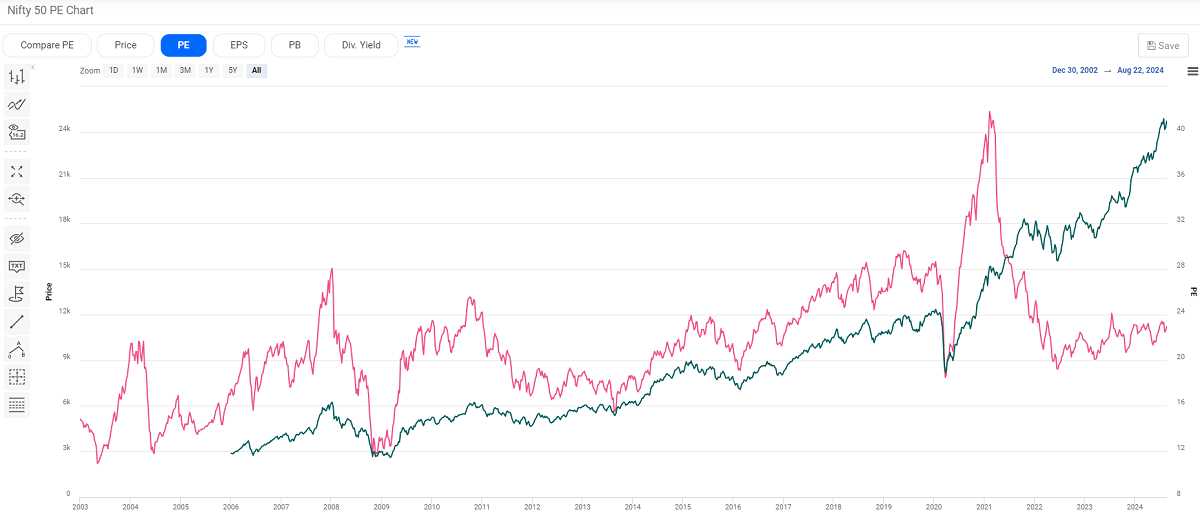

It is important to note that despite the rapid growth of the Indian economy, one needs to be cautious about potential risks when investing in the Indian market. The overall price-to-earnings ratio for India is currently 22x, which is still high, although it looks cheap compared to valuations that have been above 25x for the past decade. Investors need to consider the risk of a market correction as a result of high valuations and make a comprehensive assessment of the true value of the market when making investment decisions.

At the same time, while the Indian stock market has consistently outperformed the US market in terms of historical returns, demonstrating its strong potential for long-term investment, investors need to exercise caution when making investments. Whether future growth can be sustained is a key question, especially in the current context of high valuations, and the market could be at risk of a correction. It is therefore particularly important to assess the long-term growth prospects versus potential valuation risks when considering the Indian market as an investment option.

At the same time, the Indian stock market is relatively more volatile and may be more risky than the US market. Investors need to be aware that the Indian market is more sensitive to fluctuations in the US stock market and may move in line with the US stock market. This high degree of correlation means that changes in both the global economy and the U.S. market may have a significant impact on the Indian stock market, and investors participating in the Indian market will need to take appropriate risk management measures to address possible market volatility.

In addition, India faces political risks and uncertainty over economic reforms. The upcoming prime ministerial election in May this year could have an impact on the Indian economy and could trigger market jitters if the incumbent Prime Minister Modi fails to win a second term. The continuation of reforms is also a key issue, with some economists criticizing Modi for becoming conservative in his reform measures during his second term. If the economic reform process slows down, this could have a negative impact on future growth, and investors need to keep a close eye on these risk factors.

Therefore, while the Indian stock market offers attractive investment return opportunities, it is important to fully assess its potential risks before investing. Due to the high volatility of the Indian market and its sensitivity to global economic turmoil, investors should carefully consider these factors and tailor their investment strategy accordingly to their risk tolerance.

Overall, the Indian stock market has significant growth potential, with economic growth and a young demographic offering long-term investment opportunities. However, investors should be cautious in assessing risks and be mindful of market volatility and sensitivity to changes in the global economy. Through adequate market research and effective risk management, investors can capitalize on opportunities while avoiding potential risks.

India's stock market status and investment outlook

| Aspects |

Content |

| Market Performance |

Ten-year gain doubles, outpacing major global stock markets |

| Reasons for the surge |

Growth driven by stability, reforms, and foreign inflows. |

| Market Size |

World's 4th largest stock market, $3 trillion market cap. |

| Key Indicators |

Nifty 50 and Sensex |

| Risk Factors |

High volatility, policy and exchange rate risk |

| Investment Strategy |

High long-term investment potential, need to maintain a long-term perspective |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Why does the Indian stock market keep going up?

Why does the Indian stock market keep going up? Investment analysis of the Indian stock market

Investment analysis of the Indian stock market