Although China's stock market is red up and green down, the United States is green up and red down. However, there is one kind of red that has the same ominous connotation when it comes to finance, and that is the deficit. Although the U.S., as one of the world's largest and strongest economies, has always viewed its Treasury bonds as an absolutely safe investment, But when it maintains fiscal deficits year-round, the debt level reaches a certain ceiling that also raises concerns about default. And it has the potential to cause economic turmoil around the world. Let's take a look at the causes, effects, and strategies to address the fiscal deficit that is the source of all this.

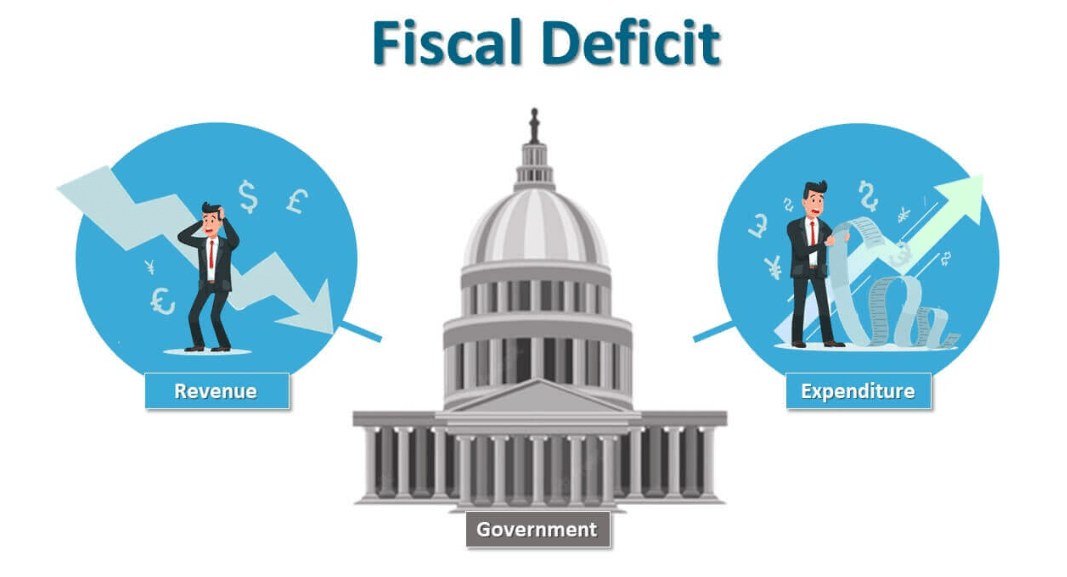

What is the fiscal deficit?

What is the fiscal deficit?

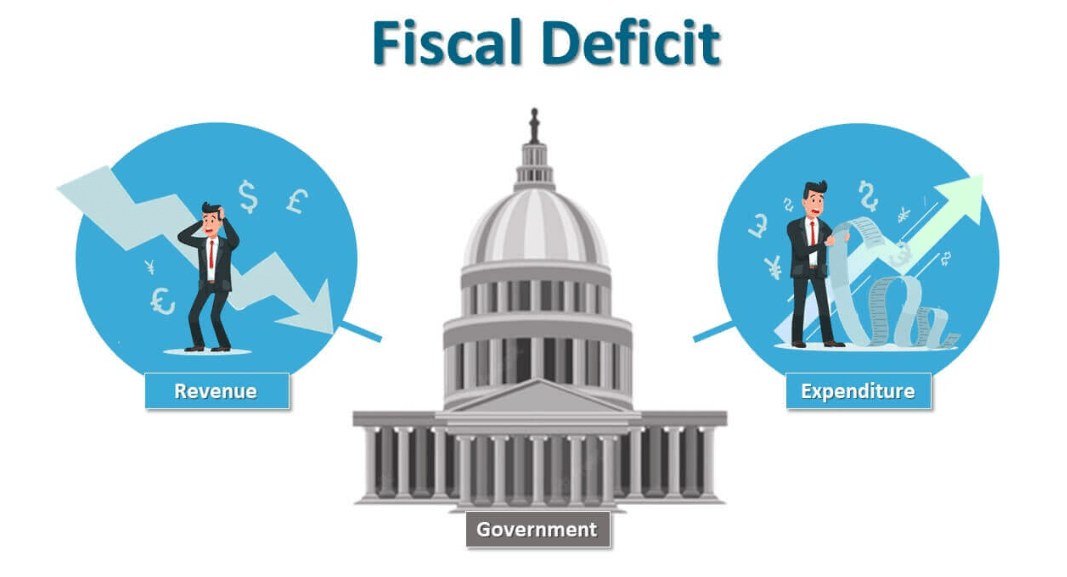

It is a situation where government expenditure exceeds the revenue of a country or region in a fiscal year. Generally speaking, businesses or government organizations often spend more than they earn and less than they make, and the part of the expenditure that is greater than the income is written in red in the accounting, which is the deficit.

The opposite concept is the fiscal surplus, which refers to the situation where the government's revenues exceed its expenditures during a fiscal year, i.e., the government has a surplus during that period. The existence of a fiscal surplus indicates that the government has made a profit during the fiscal year, which can be used to pay off debt, save, or invest in other areas of the economy. Fiscal surpluses, as opposed to deficits, help to reduce the level of debt, increase the government's financial flexibility, and help to maintain macroeconomic stability.

The sources of deficits for a country can be categorized into two situations. One is a deficit created by mismanagement. The country's fiscal revenue comes from taxes, and most of the expenditures are used for the government's daily expenses and the construction of public facilities. If the government mismanages tax revenue, resulting in a large number of tax leakages and evasions, or if the government does not control the expenditure, it is too large to produce a deficit.

There is another kind of deficit policy adopted by the state. In the 1920s and 1930s, the United States was caught in the Great Depression. When the economy was in the doldrums, the function of its automatic regulation failed. At this time, the Roosevelt government used the deficit to increase public spending and launched some big projects to build bridges and roads to improve employment, so that the stagnant market once again functioned.

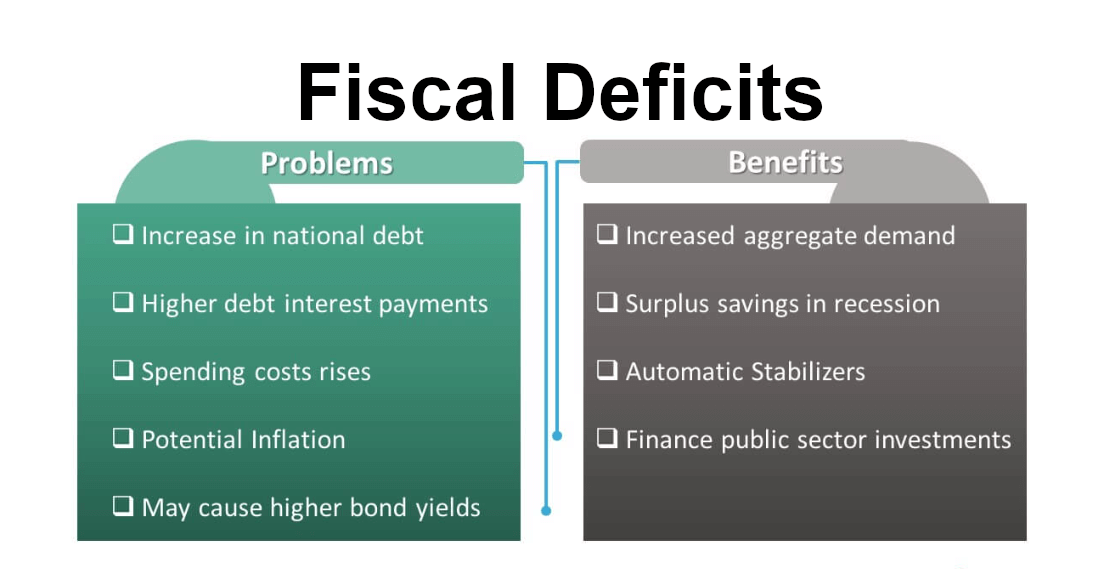

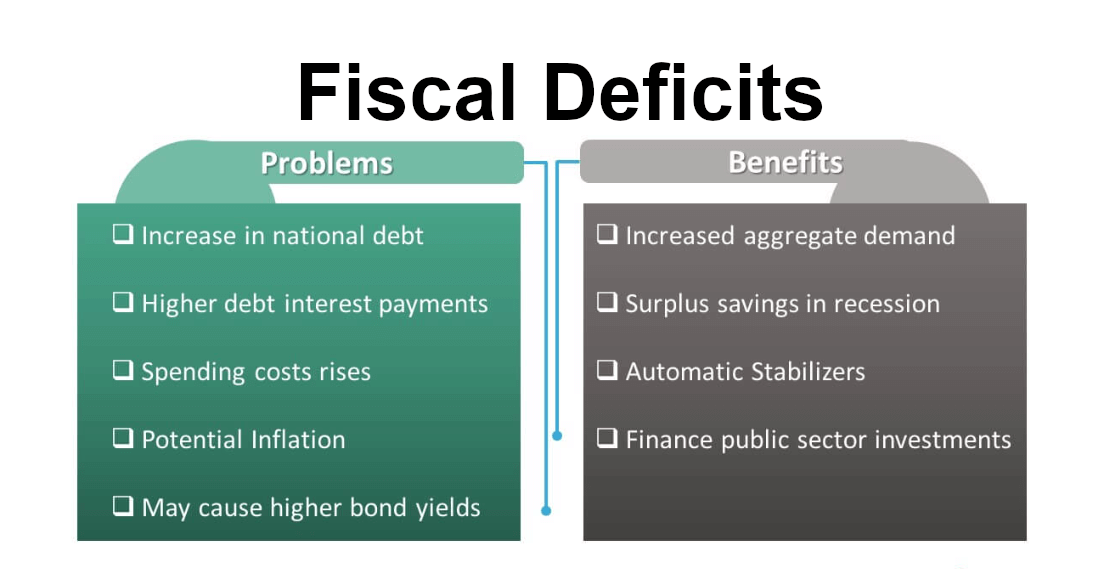

So deficits are not always negative, especially when the economy is in the doldrums. The government may stimulate economic growth by increasing spending. However, prolonged and persistent deficits can be a cause for concern as they can lead to an unsustainable accumulation of debt, which can have a negative impact on economic stability.

Nonetheless, this type of deficit finance has since been frequently emulated by other countries. It is used to stimulate economic development and energize the market in times of recession. However, although it is a good medicine to cure the economic downturn, governments will mostly adopt it cautiously because its side effects are not small.

This is because it usually occurs when the government adopts stimulus policies, increases public expenditure, or faces other urgent financial needs. And the commonly used means are borrowing to cover the deficit, issuing Treasury bonds, or other debt instruments. Not only will this increase the country's debt level to some extent, but it will also trigger inflation if the supply of money in the market exceeds the demand of the real economy.

In short, a fiscal deficit indicates that the government is facing a financial loss for a specific period of time and needs to cover the budget gap by borrowing or other means. Investors and economic observers usually focus on its size and causes to assess the fiscal condition and economic health of a country or region.

Relationship

between fiscal deficits and inflation

| Situation |

Fiscal Deficit |

Inflation |

| Positive correlation |

Government boosts economy via deficit spending. |

Excess money can cause inflation. |

| Negative correlation |

Deficits raise debt, potentially deterring investment. |

Fiscal tightening may reduce inflation |

| Neutral |

Deficit policies stimulate but lack sustainability. |

Deficits don't strongly affect inflation. |

What a Fiscal Deficit Means

A fiscal deficit occurs when the government spends more than it takes in during a fiscal year. But deficits are not necessarily a bad thing in themselves, as governments sometimes need to increase spending to respond to emergencies, promote economic growth, or improve social welfare. However, excessive deficits can lead to a number of problems, including increased debt inflation and fiscal instability.

When a government faces financial losses, it may need to rely on borrowing or other forms of financing to meet its expenditure needs. This may be done by issuing bonds to the market, borrowing from domestic and foreign sources, or printing money. Deficits therefore mean that the government's level of debt is likely to increase unless there are other ways to cover the deficit.

Sometimes governments adopt policies to stimulate the economy by increasing spending to promote employment and economic growth. Deficits can be seen as part of such policies, especially in times of economic downturn. Deficits may reflect government investments in areas such as infrastructure, social welfare, and education. These investments may help to promote economic growth and increase employment levels.

Long-term and persistent deficits may raise concerns about fiscal sustainability and, if they are not managed effectively, may lead to an accumulation of debt with negative implications for future economic stability. Therefore, there is a need to strengthen the structural adjustments and efficiency of fiscal spending in order to maintain fiscal sustainability and stability.

According to the EU's fiscal requirements, it sets out two main indicators. Specifically, the deficit cannot exceed 3% of GDP, and the ratio of government debt to GDP cannot exceed 60%. These requirements are designed to ensure fiscal stability and sustainability in Eurozone countries to prevent excessive debt and fiscal austerity.

The 3% deficit ceiling is a relatively loose standard, and fiscal sustainability can be maintained as long as the fiscal deficit ratio is kept below 3% for a long period of time. However, sometimes the government chooses to raise the deficit rate in order to respond positively to the downward pressure on the economy. This is to increase government fiscal expenditure to provide support for economic growth. The implementation of such a proactive Fiscal Policy will help stabilize society and promote the smooth operation of the economy.

Of course, excessive deficits over a long period of time will bring certain risks. For example, in order to increase the pressure and cost of debt repayment in the future, it may lead to a debt crisis or the risk of default, triggering market concerns about currency credit and stability. It may lead to exchange rate volatility or capital outflows, spurring inflation expectations and actual levels. May lead to price increases or a decline in purchasing power, crowding out space and resources for private investment. It may lead to a decline in investment efficiency or a weakening of the incentive to innovate.

The impact of fiscal deficits depends on the government's fiscal policy, the state of the economy, and how it handles the deficit. In some cases, deficits may be a deliberate policy choice, while in other cases, measures may be needed to reduce the level of deficits.

How fiscal deficits are addressed

How fiscal deficits are addressed

This usually involves a range of economic policies and fiscal instruments to balance government spending and revenues and reduce the level of the deficit. The first step is to reduce fiscal expenditures, raise revenues, and improve fiscal efficiency and transparency to establish a sustainable fiscal system.

Specifically, the government should cut some unnecessary and inefficient financial expenditures, such as some image projects, some duplicated construction, some ineffective subsidies, some corruption and waste, etc. At the same time, it should increase necessary and efficient fiscal expenditures, such as infrastructure construction, social security, and investment in education, health, environmental protection, science, and technology, in order to increase the potential growth rate of China's economy and social welfare.

Tax revenues should also be increased by adjusting tax policies. This may include raising personal income tax rates, corporate tax rates, or implementing new tax measures. For example, it should reduce some excessively high tax rates, broaden some excessively low tax bases, simplify some overly complex tax systems, and eliminate some overly favorable tax policies in order to improve the fairness and effectiveness of taxation.

Finally, the government should improve the transparency and supervision of finance, such as by publicizing the budget and final accounts of finance, publicizing the prelude and sources of finance revenue and expenditure, publicizing the scale and structure of finance debt and assets, and accepting the supervision and evaluation of society in order to improve the credit and responsibility of finance.

Then the government should strengthen economic reforms to change the economic development model, optimize the economic structure, improve economic efficiency, and enhance economic resilience to build a high-quality economic system. The government can take measures to encourage investment, increase productivity, and promote innovation to stimulate economic activity. It should also carry out structural fiscal reforms to improve fiscal sustainability.

Specifically, the government should change the mode of economic development from over-reliance on investment and exports to greater reliance on consumption and innovation, from the pursuit of speed and scale to the pursuit of quality and efficiency, and from singularity and closure to pluralism and openness, in order to improve the economy's endogenous dynamics and external competitiveness.

The government should also optimize the economic structure, shifting from a focus on the secondary industry to a greater emphasis on the tertiary industry, from a preference for the manufacturing industry to a greater preference for the service industry, and from a reliance on the low-end and low value-added to a greater reliance on the high-end and high-value-added, in order to increase the value-addedness of the economy and the level of income.

At the same time, the government should improve economic efficiency by shifting from protecting and supporting state-owned enterprises to more protecting and supporting private enterprises, from intervening in and controlling the market to more respecting and unleashing the market, and from prescribing and restricting entrepreneurship and innovation to more encouraging and supporting entrepreneurship and innovation to improve the economy's vitality and creativity.

The government also needs to enhance the resilience of the economy by shifting from ignoring and rejecting risks to more recognizing and responding to them, from resisting and opposing reforms to being more proactive and deepening them, and from rejecting and resisting external shocks to being more adaptive and taking advantage of them in order to improve the stability and adaptability of the economy.

Again, the government should strengthen debt management to control the scale of debt, reduce the cost of debt, and optimize the debt structure to improve the repayability and controllability of debt and establish a healthy debt system. And renegotiate the terms of the debt, extend the term of the debt, and reduce the debt burden. This will help ease the pressure of debt repayment in the short term and provide fiscal flexibility.

Specifically, the government should set a reasonable debt limit, such as keeping the fiscal deficit ratio within 3%, keeping the government debt ratio within 60%, and keeping the growth rate of government debt to GDP at a reasonable ratio to ensure debt sustainability.

The government should reduce the cost of debt, for example, by issuing some long-term and low-interest bonds, by using some foreign exchange reserves and state-owned assets to replace some high-interest and short-term bonds, and by using the funds of some international organizations and the market to diversify some of the risks of the debt so as to ensure the repayability of the debt.

The government should also optimize the structure of debt, such as through the issuance of bonds linked to GDP, through the issuance of bonds linked to inflation, and through the issuance of bonds linked to project income, in order to ensure the controllability of debt.

At the same time, the government should improve the transparency and supervision of debt, such as by publicizing the issuance and use of debt, publicizing the debt repayment plan, publicizing the default and restructuring of debt, and accepting the supervision and evaluation of the market and society, so as to ensure the creditworthiness and responsibility of the debt.

The resolution of fiscal deficits is a complex process that requires systematic policy measures and comprehensive consideration of various factors. It requires the government to take into account the impact of the macroeconomic environment and political realities on society and the economy and to formulate and implement long-term fiscal planning to ensure that the government is able to maintain fiscal balance in the medium to long term.

What are the ways

to cover the fiscal deficit

| Compensating for the way |

Description |

| Raise taxes |

Increase tax revenues to cover the deficit |

| Cutting spending |

Reduce government spending to reduce the deficit |

| Issuing national debt |

Borrowing to raise funds through national debt issuance |

| Creating economic growth |

Increase revenue by promoting economic growth |

| Asset sales |

Sell state-owned assets to generate cash |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is the fiscal deficit?

What is the fiscal deficit? How fiscal deficits are addressed

How fiscal deficits are addressed