Trump, the self-proclaimed “Tariff Man,” is back, likely bringing renewed volatility to financial markets with his unpredictable statements. This could impact certain trade-sensitive assets over the coming years.

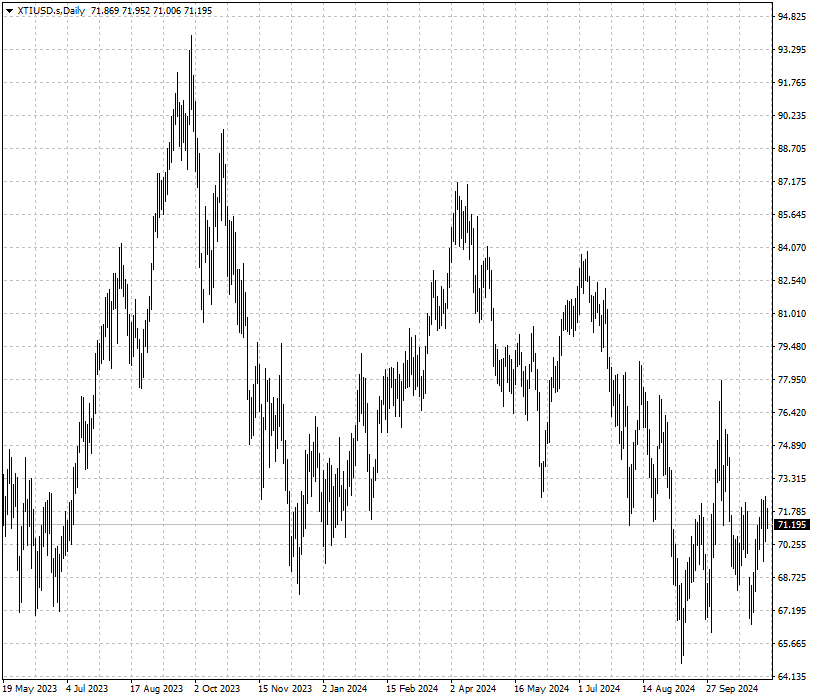

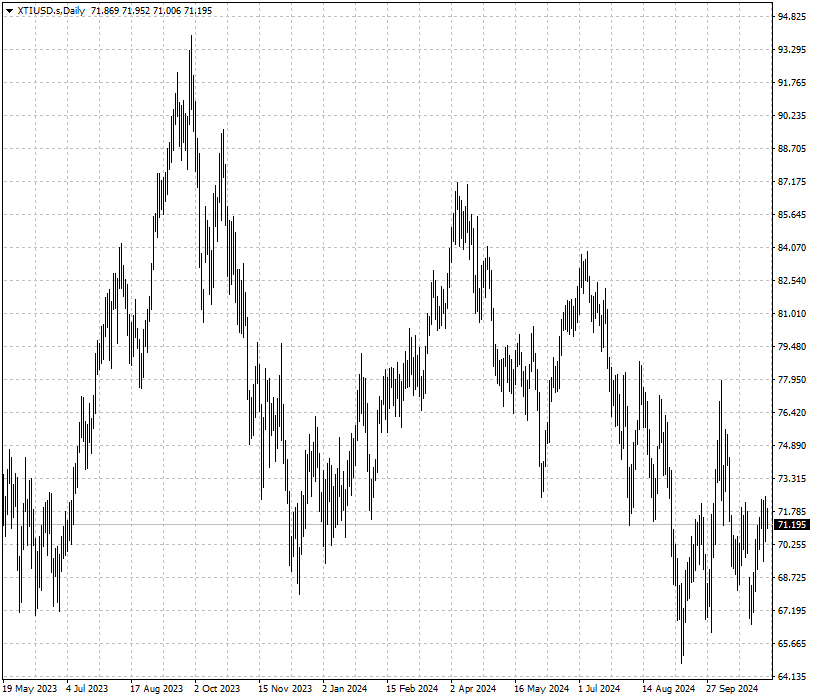

Oil prices dipped moderately on Wednesday as Trump declared victory. However, their stability remains uncertain, considering the nearly 20% drop seen in 2018 when the last trade war began.

The U.S. has recently become the world's largest oil producer, a position Trump plans to expand further if given a second term, promising to roll back Biden's climate initiatives. During his last term, he withdrew the U.S. from the Paris Agreement in 2020, citing its competitive disadvantage, especially against China.

Biden, in response to rising fuel prices post-Ukraine invasion, authorized the largest Strategic Petroleum Reserve (SPR) release, selling 180 million barrels, with only around 50 million barrels replenished since. Under new leadership, there may be a strong push to lower energy costs for replenishing reserves, curb inflation, and impact Russia’s war economy.

Meanwhile, inflation measured by the PCE price index rose just 2.1% annually last month, its lowest since 2021, aligning with the Fed's goals. Trump continues to emphasize inflation concerns in his campaign, calling for stronger measures.

Peace In the Gulf Region

Concerns over demand from China, potential supply increases from major producers, and easing geopolitical risks are expected to keep oil prices under pressure this year and next, according to a Reuters poll.

Survey respondents now predict WTI crude to average $76.73 per barrel this year and $72.73 in 2025, slightly down from the September estimates of $77.64 and $73.03.

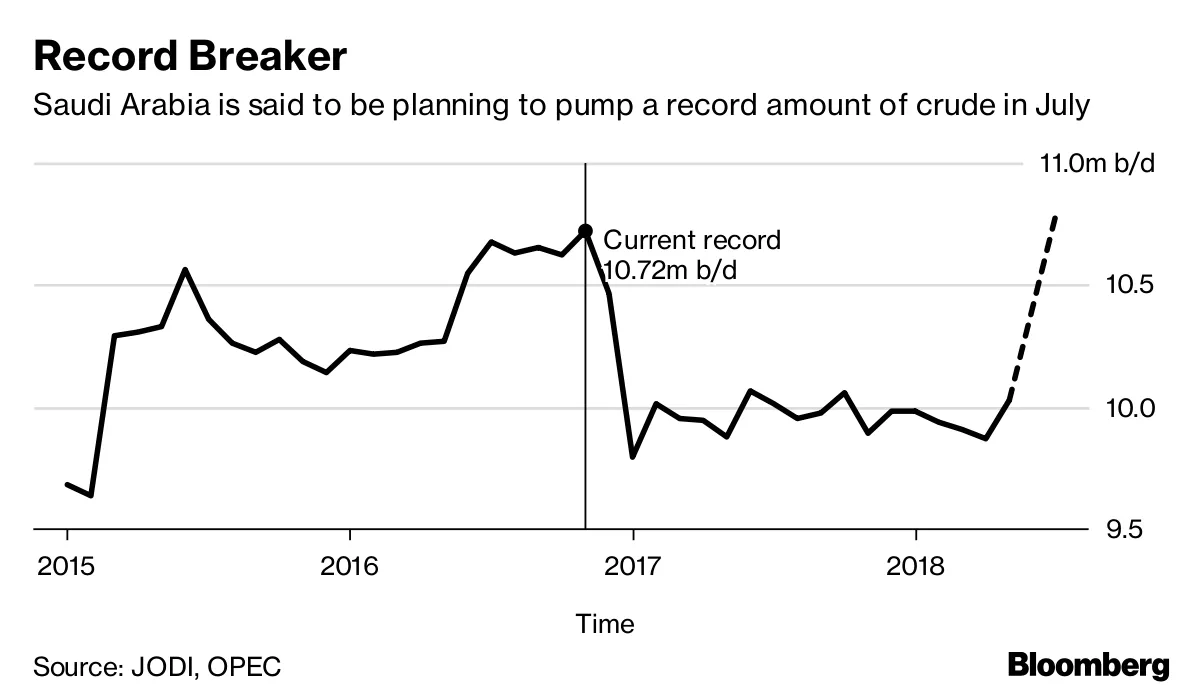

Despite rising Middle East tensions, the benchmark price has remained relatively stable this year, though it started to dip in the second half as U.S. economic indicators weakened. To support prices, OPEC+ has postponed a planned December production increase by one month, echoing their approach from a similar 2017 decision to maintain output cuts.

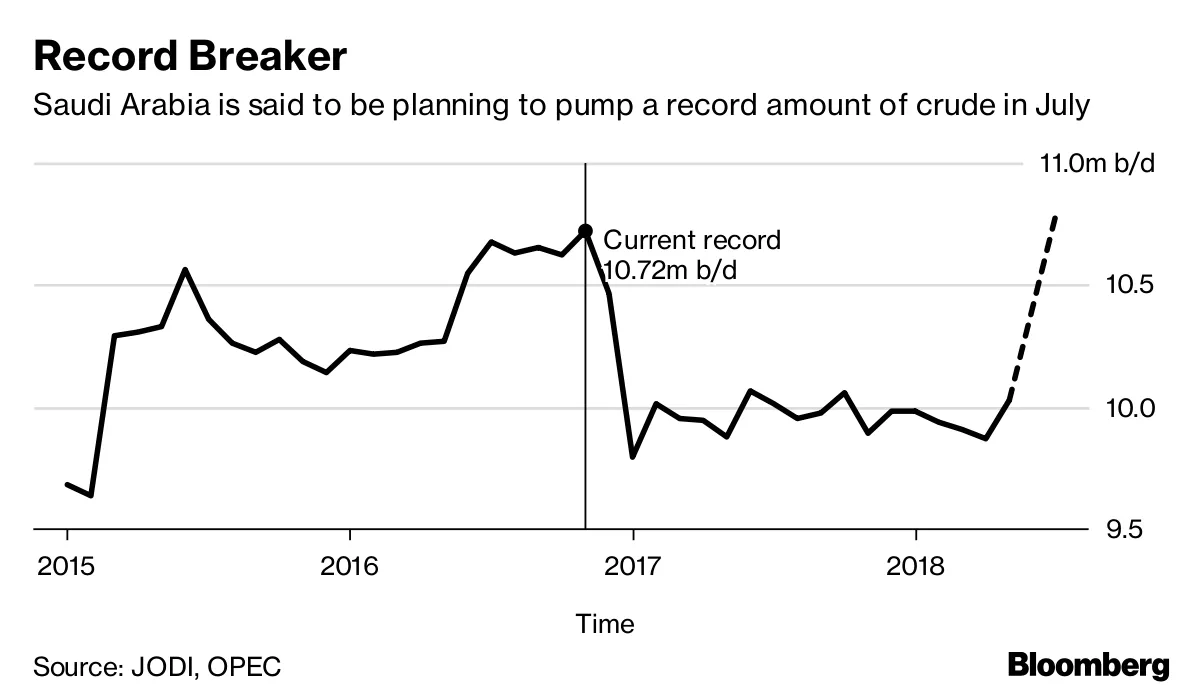

But the following year, Trump pressed Riyadh to back down from the strategy

in face of costly gasoline in the US. A remarkable increase in supply sent WTI

tumbling below $50 in Q4 2018.

Even if he does not push for it afresh, geopolitics sounds an alarm. In a

call ahead of the election, he told Israeli PM Netanyahu to wrap up major

military operations in Gaza before Inauguration Day.

When the year-long conflict is solved, normalising relation between Saudi

Arabia and Israel could be back on the table. A knee-jerk crude selloff will be

triggered in that circumstance.

Resignation of a Trade War

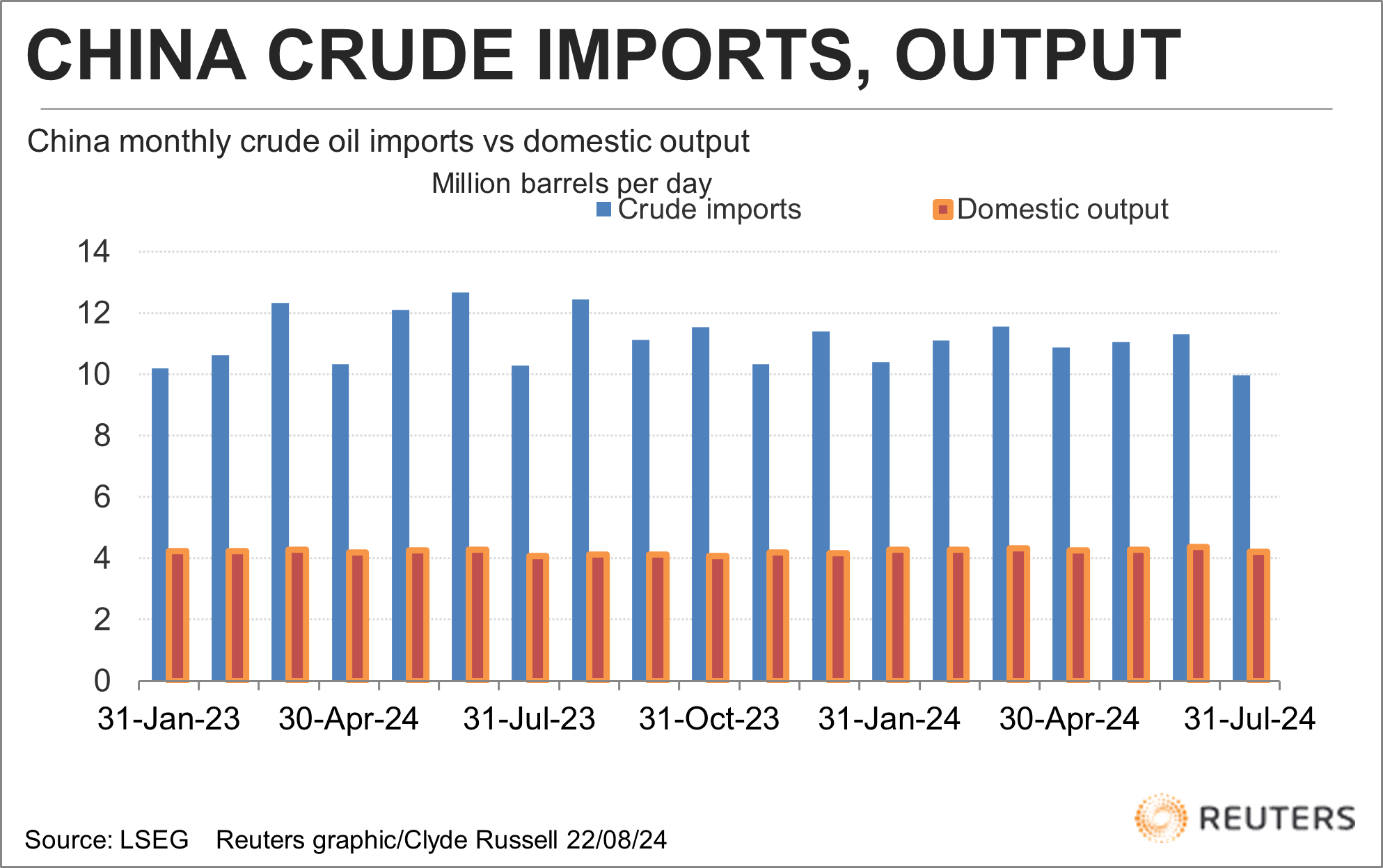

Earlier this month, the EIA slashed its 2025 global oil demand growth

forecast, citing weakening economic activity in China. OPEC also lowered its

demand growth forecast for 2024 and next year.

Tariffs were not baked into the estimate which came in ahead of US election,

so the actual demand should be even more discouraging. The precedent has shown

us their harm.

The IMF cut its global economic growth forecasts for 2018 and 2019 on Oct

2018, saying that the US-China trade war was taking a toll and emerging markets

were struggling with tighter liquidity and capital outflows.

Trump has vowed to adopt blanket 60% tariffs on US imports of Chinese goods

compared with the 7.5% to 25% levied in his first tern - a heavy blow to an

economy grappling with weak consumption and real estate slump.

Notably China's share of US goods imports have fallen from 22% to around 13%

since then. Further trade barriers will likely lead to a decoupling between the

world's top two economies.

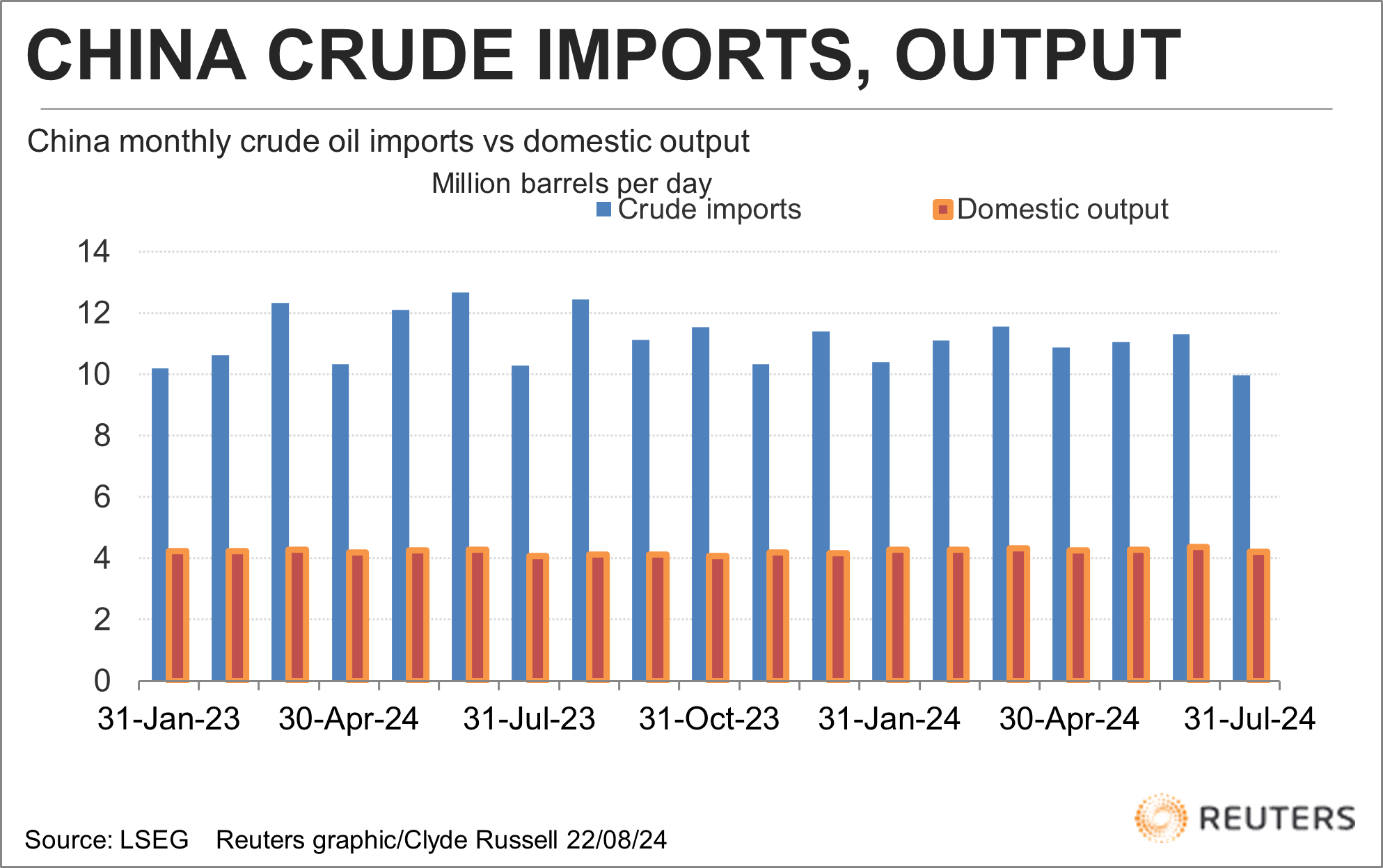

There is no lack of signs of China's weak oil demand. October marked the

sixth consecutive month in which crude cargo arrivals have lagged behind the

imports in the same months of 2023, official data showed.

The US is poised for strong growth next year with Trump's loose fiscal policy

and Fed's easing cycle, but the potential increase in US demand is presumably

not enough to offset the loss from China.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.