China took its first step to shore up the ailing stock market this year by

cutting the RRR for all banks by 50 bps from 5 Feb. The move could free up ¥1

trillion of liquidity, according to the PBOC.

The central bank said it would also cut re-lending and re-discount interest

rates by 25 bps for the rural sector and small firms from 25 Jan. That headline

sent both A-shares and H-shares soaring.

On Wednesday Hang Seng Index ended the session up 3.6% to clock its biggest

one-day gain in two months. Mainland stocks staged a significant rally likewise

before the announcement.

The major decision followed Bloomberg news that the world’s second largest

economy is considering to mobilise about ¥2 trillion for to help stabilize the

market by purchasing stocks onshore through HK markets.

Jack Ma, one of China’s most famous businessmen, has instilled more

confidence among local investor. He and his right-hand man Joseph Tsai have

scooped up some $200 million of Alibaba shares.

Consequently, the combined shareholding of the two co-founders eclipsed

SoftBank Group. The tech giant gained the most in half a year in the previous

session, contributing the most to HK market’s long-awaited comeback.

Harsh trial

Chinese fund management companies have been confronted with heavy

redemptions. A total of 148 equity and balanced funds were forced to liquidate

last year because of being too small to be viable, the most in five years.

Those companies are increasingly setting up "sponsored funds" amid risk-off

mood. The number of sponsored equity funds and balanced funds jumped nearly 40%

to 122 last year, according to fund consultancy Z-Ben Advisors.

Moreover, Chinese authorities are restricting access to funds that invest in

offshore Securities, a third of which have announced suspension of or reduced

caps on sales to retail investors.

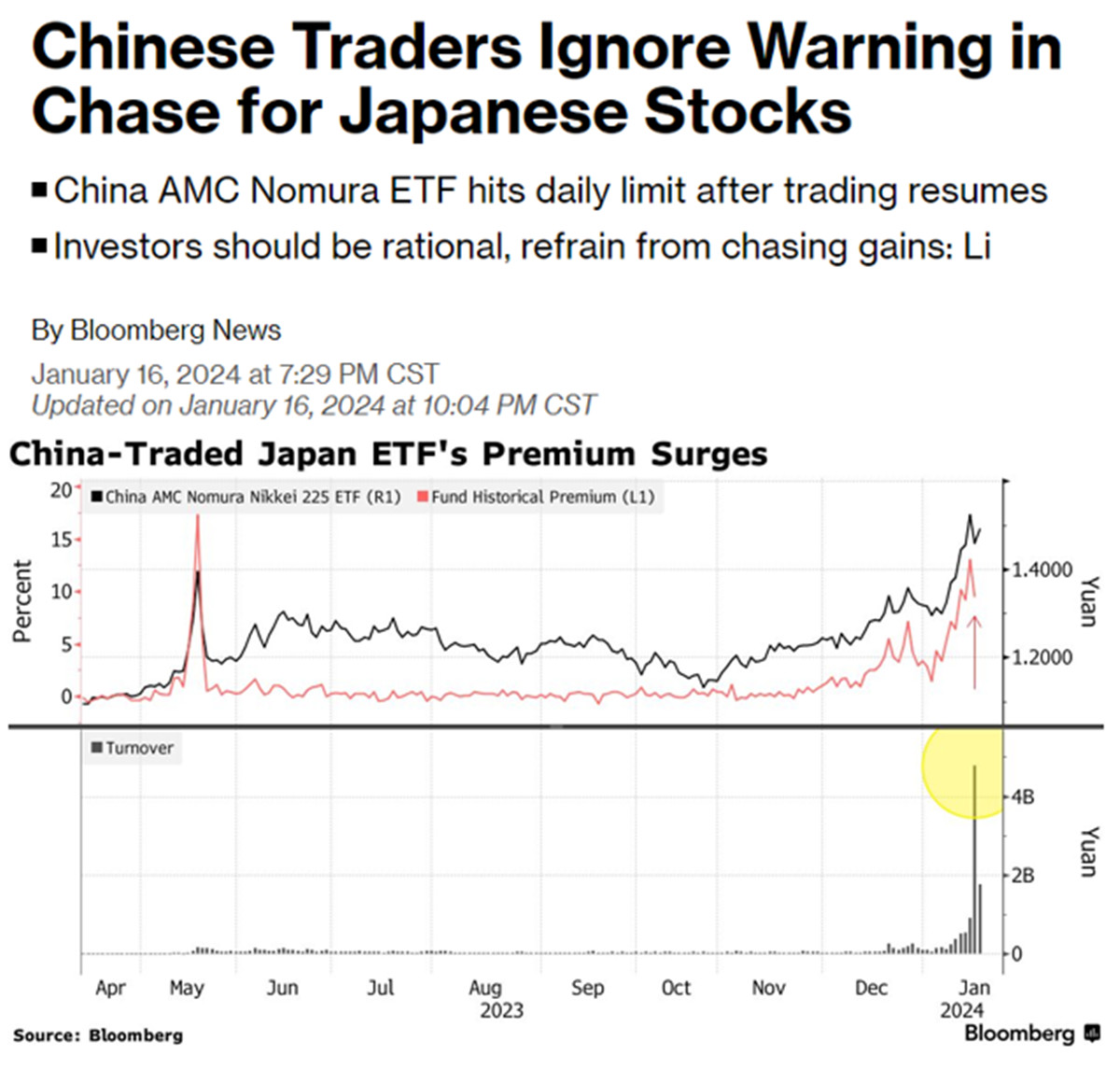

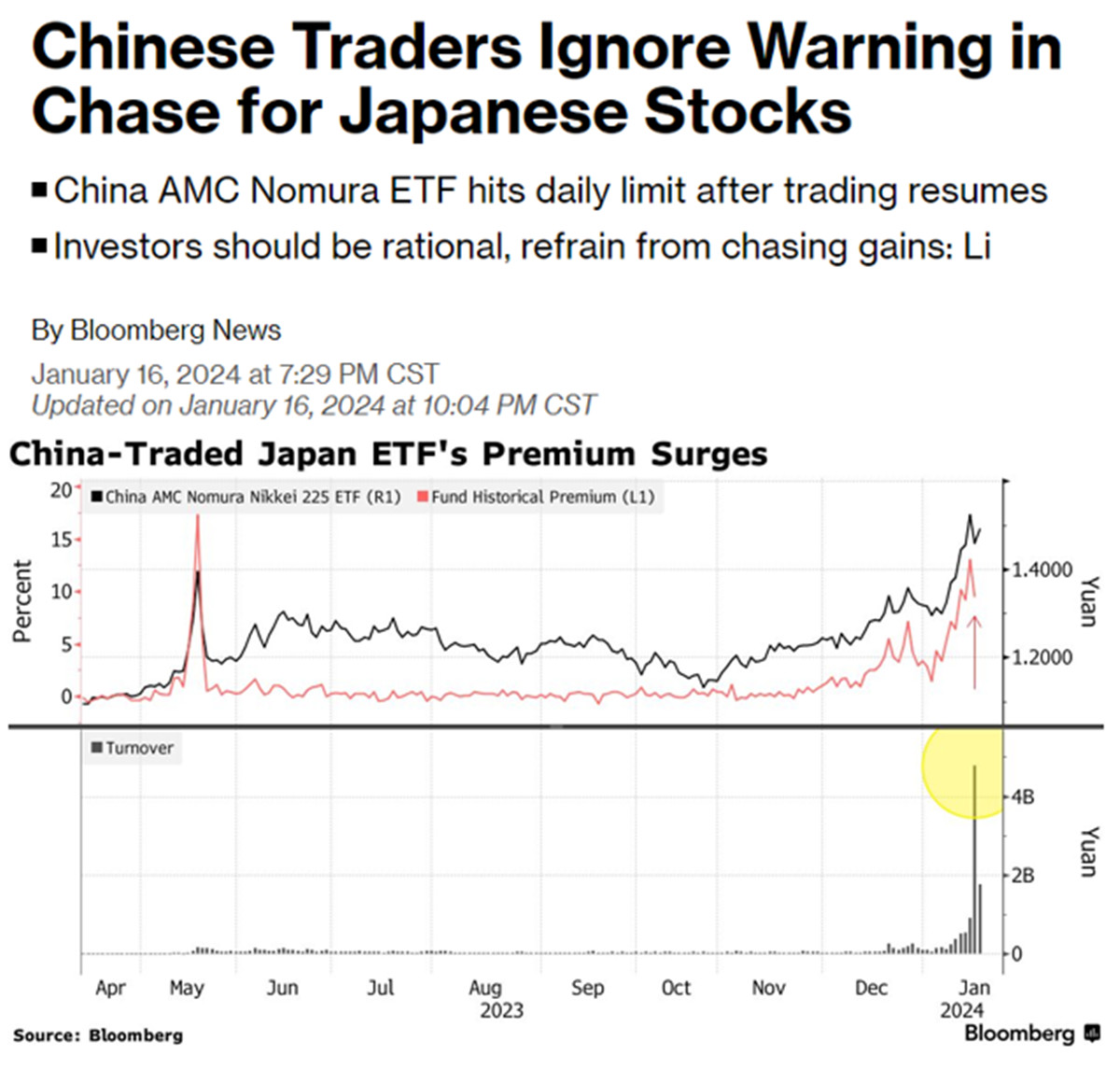

The China AMC Nomura Nikkei 225 ETF was trading at a 20% premium over its NAV

earlier this week. ETFs targeting India and the US were others among the most

popular.

US professionals barely rode out the downturn either. Index Fund manager

Vanguard closed its China office last November after its partnership with Jack

Ma’s Ant Group fell apart.

BlackRock China made losses on all of its eight stock-focused funds last

year. However, not all asset managers with heavy exposure to China met their

Waterloo.

Bridgewater China Investment Management quadrupled its assets under

management last year at the end of last year from two years ago, while Two Sigma

China doubles its assets over the same period.

Turning point

Some analysts say the collapse in its already Cheap Stocks merits a wager on

an eventual rebound. The forward PE ratio is roughly eight in HK and 10 for

Mainland China, half as expensive as that in the US.

Short interest on US-listed Chinese equities dropped sharply over the 30 days

to 22 Jan, according to analytics firm S3 partners.

The cost of Hang Seng China Enterprises Index put options has slid in the

past few months to hover around multi-year lows, BNP Paribas estimates.

Morgan Stanley estimates 70 of 80 global emerging market funds they track are

either equal or underweight China.

Herald van der Linde, head of equity strategy for Asia Pacific at HSBC,

forecasts 30-40% gains for Chinese equities if and when the gloomy sentiment

lifts.

Another UK-based firm M&G Investments pivoted to long China at the end of

2023 and now favours the market as its top conviction calls in Asia for

2024.

Bridgewater Associates told investors it was “moderately bullish” on Chinese

stocks and bonds as policy will remain accommodative to support growth and

valuations look attractive.

Ben Powell, chief Asia Pacific investment strategist at BlackRock Investment

Institute, said he remained neutral on China stocks.

“There may be some selective opportunities maybe in companies with balance

sheets which allow them to do self-help, maybe their own buybacks rather than

relying on a government stabilisation fund.”

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.