The euro remained on the back foot on Friday

2024-01-26

Summary:

Summary:

On Friday, the euro weakened as the ECB maintained its expected stance at the policy meeting. Investors increasingly anticipate a rate cut in April.

EBC Forex Snapshot

26 Jan 2024

The euro remained on the back foot on Friday after the ECB stood pat as

expected at its policy meeting. But investors ramped up bets that the bank will

cut rates in April.

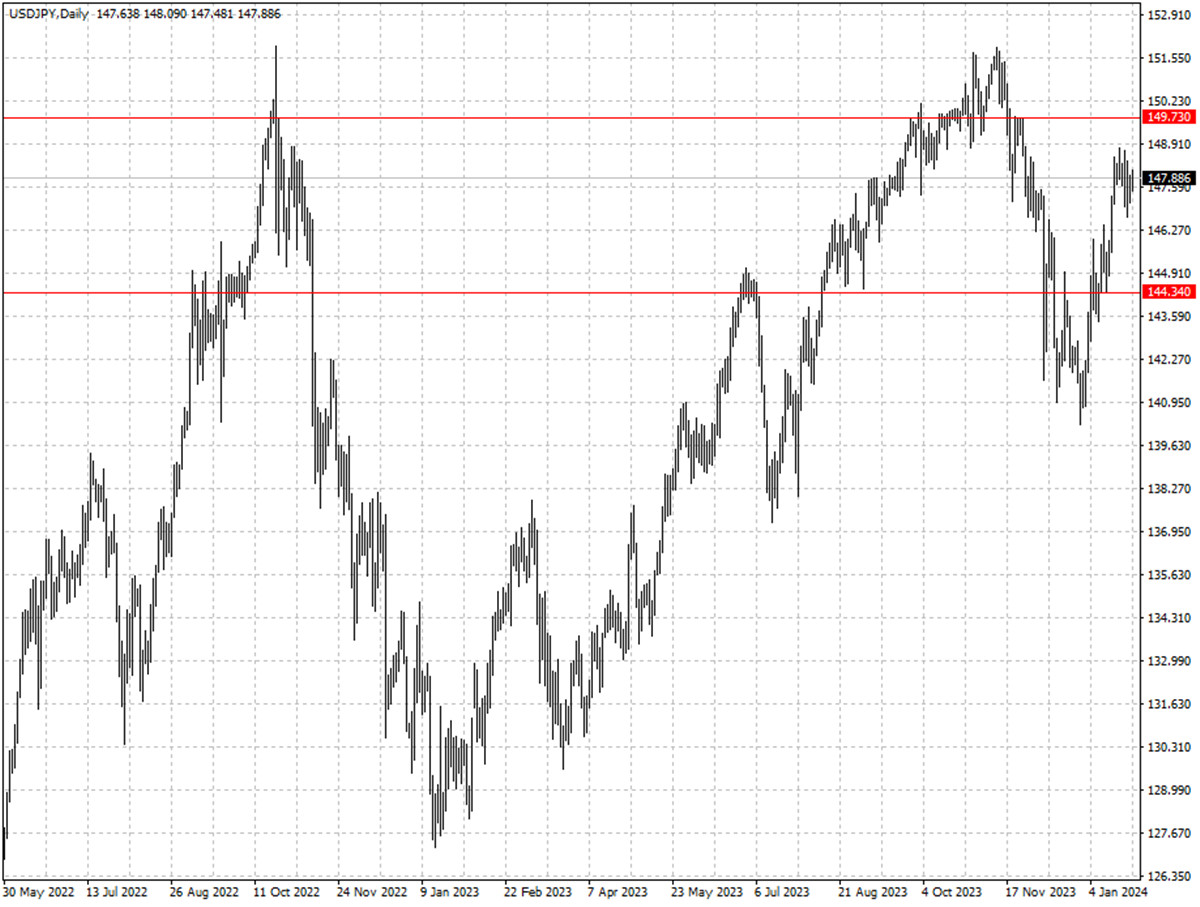

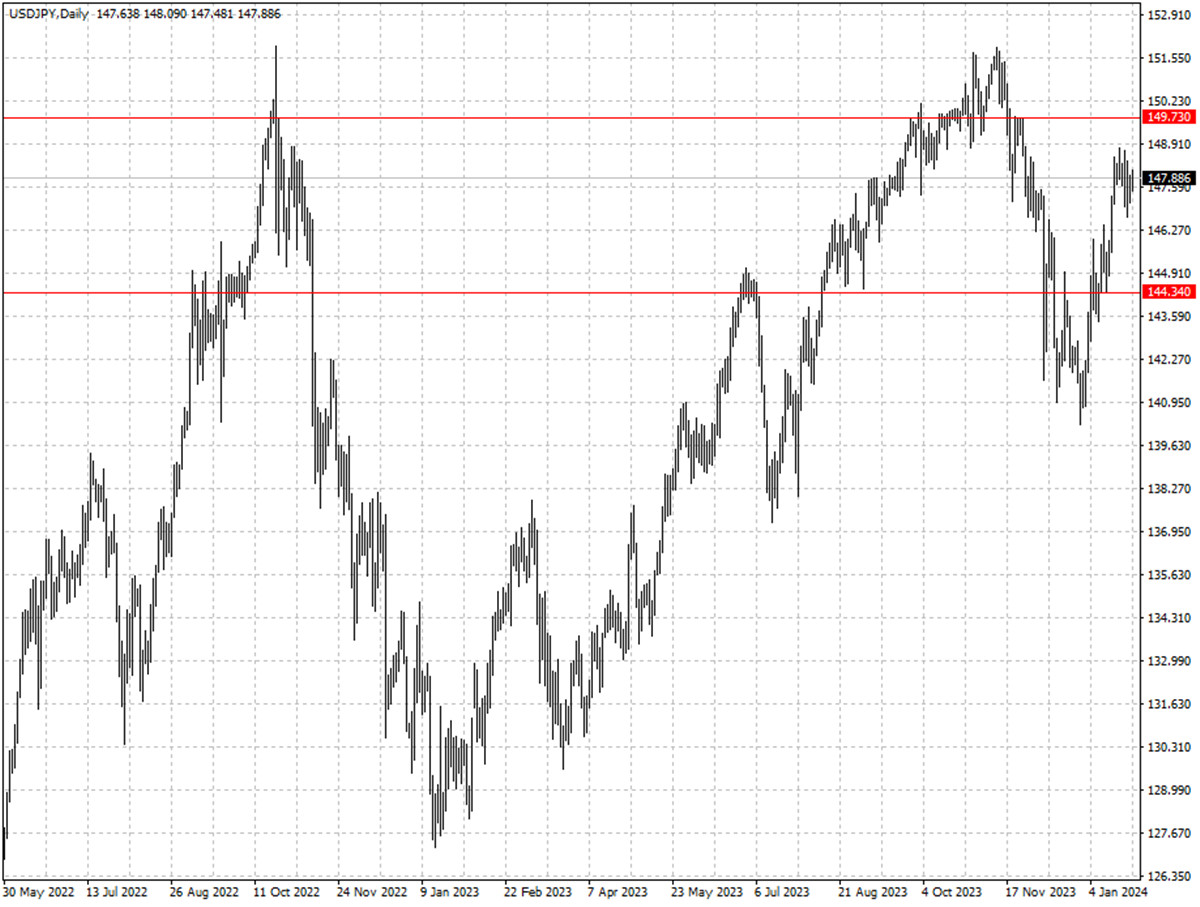

Elsewhere, the yen bounced around the upper 147 range against dollar. Core

inflation in Japan's capital slowed to 1.6% in January from a year earlier,

below the central bank's 2% target.

Minutes released of the BOJ's December meeting, meanwhile, showed

policymakers actively debated in December the conditions for phasing out

stimulus.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 15 Jan) |

HSBC (as of 25 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0848 |

1.1139 |

1.0803 |

1.0981 |

| GBP/USD |

1.2536 |

1.2848 |

1.2616 |

1.2808 |

| USD/CHF |

0.8333 |

0.8667 |

0.8477 |

0.8752 |

| AUD/USD |

0.6612 |

0.6900 |

0.6483 |

0.6708 |

| USD/CAD |

1.3093 |

1.3177 |

1.3358 |

1.3614 |

| USD/JPY |

140.59 |

146.49 |

144.34 |

149.73 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.