The dollar started the week slightly higher

2024-01-29

Summary:

Summary:

The dollar edged up on Monday as investors assessed US economic data before the Fed meeting. A 48% probability is assigned for a March rate cut.

EBC Forex Snapshot

26 Jan 2024

The dollar started the week slightly higher on Monday as investors weighed US

economic data ahead of the Fed meeting this week. Markets are currently pricing

in a 48% chance of a rate cut in March.

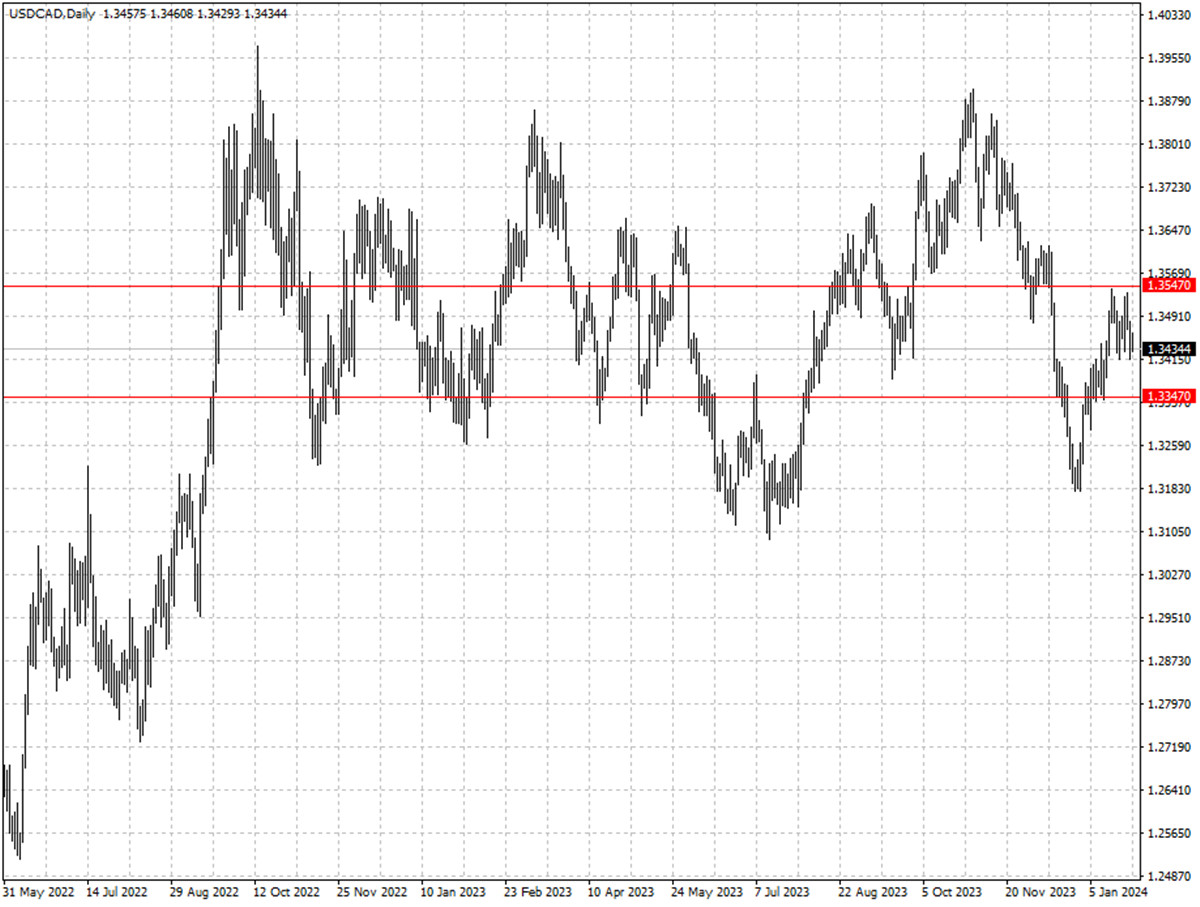

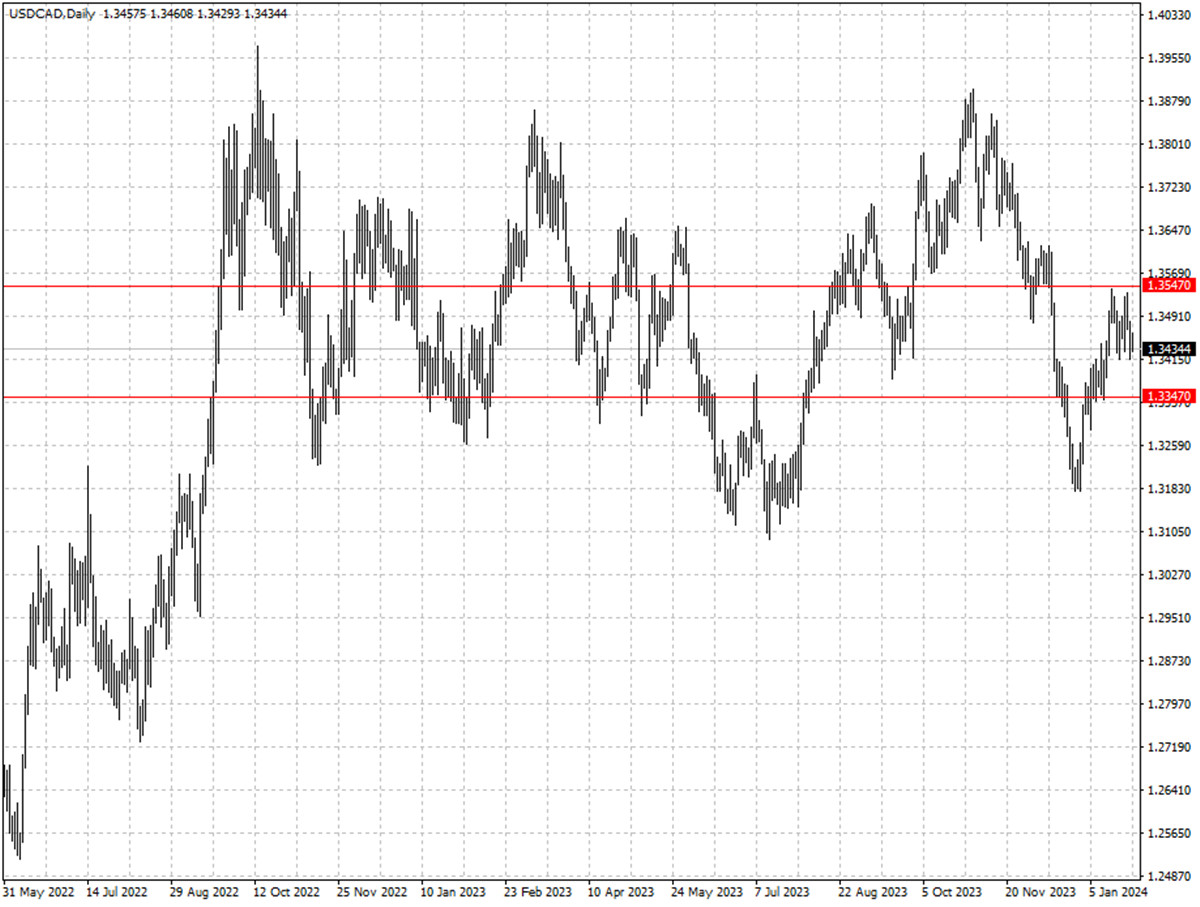

The Canadian dollar steadied after a two-week straight decline. Three-month

implied volatility for the currency is trading at an annualised rate of about

5.25%, nearly its lowest level since March 2020.

Oil prices jumped as more attacks had been seen in the Red Sea. The BOC said

its focus is shifting to when to cut borrowing costs rather than whether to hike

again at a meeting last week.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 22 Jan) |

HSBC (as of 29 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0848 |

1.1139 |

1.0779 |

1.0958 |

| GBP/USD |

1.2536 |

1.2848 |

1.2602 |

1.2794 |

| USD/CHF |

0.8333 |

0.8667 |

0.8511 |

0.8753 |

| AUD/USD |

0.6526 |

0.6900 |

0.6489 |

0.6694 |

| USD/CAD |

1.3177 |

1.3619 |

1.3347 |

1.3547 |

| USD/JPY |

140.59 |

148.80 |

145.37 |

149.87 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.