Investing in crude oil exchange-traded funds (ETFs) offers a strategic avenue for those wanting exposure to the oil market without directly trading futures contracts.

As of April 2025, the energy sector presents various ETF options tailored to different investment strategies and risk appetites. To save you the trouble of searching for one, we have compiled our list of the best crude oil ETFs for long-term investment.

Ranking the 10 Best Crude Oil ETFs to Invest in 2025 and Beyond

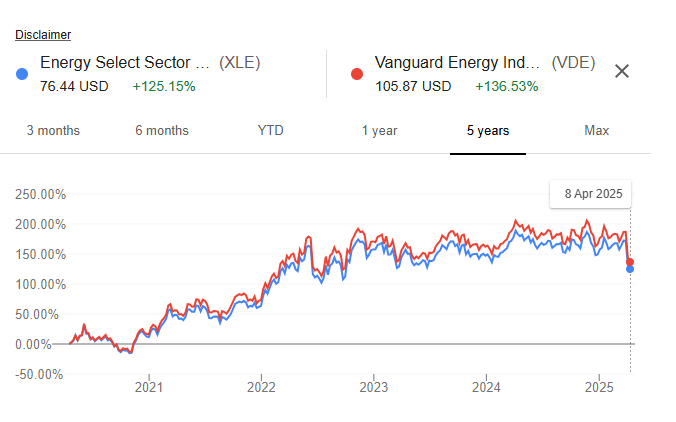

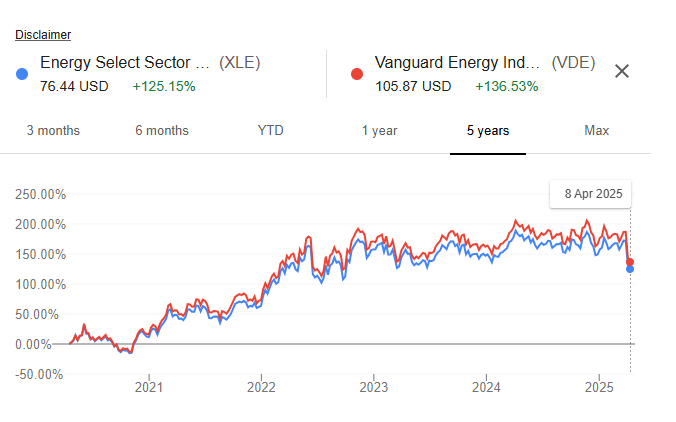

1) Energy Select Sector SPDR Fund (XLE)

The Energy Select Sector SPDR Fund is one of the largest crude oil ETFs focusing on energy stocks within the S&P 500 index. As of mid-2024, it held 22 energy companies, with significant allocations to industry giants such as ExxonMobil and Chevron.

The fund offers diversification across leading energy firms with a relatively low expense ratio of 0.09%, making it an attractive option for investors seeking broad exposure to the energy sector.

2) Vanguard Energy ETF (VDE)

Vanguard's Energy ETF offers comprehensive exposure to companies exploring and producing energy products, including oil, natural gas, and coal.

By mid-2024, the fund encompassed 113 energy stocks, providing a diversified portfolio within the energy sector. Its broad scope and cost-effectiveness appeal to investors in extensive industry coverage.

3) SPDR S&P Oil & Gas Exploration & Production ETF (XOP)

This crude oil ETF targets companies engaged in the exploration and production of oil and gas. With a diversified portfolio of 51 holdings as of mid-2024, it offers exposure to established and emerging players in the upstream segment of the industry.

The fund's equal-weighting approach mitigates concentration risk, providing balanced exposure across its constituents.

4) Alerian MLP ETF (AMLP)

The Alerian MLP ETF (AMLP) focuses on midstream energy infrastructure and oil companies, primarily master limited partnerships (MLPs). These entities are integral to transporting and storing crude oil and natural gas.

The fund's structure offers potential tax advantages and attractive yield opportunities, making it suitable for income-focused investors.

5) United States Oil Fund (USO)

The United States Oil Fund (USO) is one of the most recognised oil ETFs, designed to track the daily price movements of West Texas Intermediate (WTI) light, sweet crude oil. USO primarily invests in near-month WTI futures contracts, aiming to reflect the spot price of crude oil.

However, it's important to note that USO has an expense ratio of 0.79%, and its structure may lead to performance deviations from the actual spot price over extended periods due to factors like contango.

6) United States Brent Oil Fund (BNO)

Similar in structure to USO, the United States Brent Oil Fund focuses on Brent crude oil, the international pricing benchmark. By investing in near-month Brent futures contracts, BNO exposes investors to global oil price dynamics, which can differ from domestic WTI prices due to regional factors.

BNO's expense ratio stands at 0.84%, and investors should be aware of potential tracking errors over the long term due to the fund's rolling of futures contracts.

7) United States 12 Month Oil Fund (USL)

The United States 12 Month Oil Fund (USL) differentiates itself by holding WTI crude oil futures contracts spread evenly over the nearest 12 months.

This approach aims to mitigate the adverse effects of contango by diversifying contract maturities. USL's expense ratio is 0.84%, and its strategy may offer a closer approximation to the average price of oil over a year, potentially reducing volatility compared to funds focusing solely on near-month contracts.

8) iShares Global Energy ETF (IXC)

The iShares Global Energy ETF offers investors exposure to many global energy companies. Tracking the S&P Global 1200 Energy Index, IXC includes major players like ExxonMobil, Chevron, Shell, BP, and TotalEnergies.

This crude oil ETF provides diversification across U.S. and international energy firms, making it suitable for investors seeking global energy sector exposure. The expense ratio stands at 0.41%, reflecting the costs associated with managing a globally diversified portfolio.

9) Invesco Energy Exploration & Production ETF (PXE)

The Invesco Energy Exploration & Production ETF targets companies primarily exploring and producing oil and natural gas. PXE tracks the Dynamic Energy Exploration & Production Intellidex Index, focusing on firms demonstrating strong fundamentals and investment merit.

This crude oil ETF appeals to investors aimed to capitalise on upstream energy activities. The expense ratio is 0.63%, reflecting its specialised investment approach.

10) Global X MLP & Energy Infrastructure ETF (MLPX)

Focusing on midstream energy infrastructure, MLPX invests in master limited partnerships (MLPs) and corporations involved in energy transportation, storage, and processing. This ETF offers exposure to the infrastructure segment of the energy value chain, which can provide stable income through distributions.

With an expense ratio of 0.45%, MLPX appeals to investors interested in energy infrastructure with potential tax advantages.

Market Outlook and Considerations for Long-Term Investment

As of early 2025, the crude oil market has experienced fluctuations influenced by geopolitical events, supply-demand dynamics, and global economic conditions. Investors should stay informed about these factors, as they can significantly impact the performance of oil-related investments. Diversifying across different ETFs and sectors within the energy industry can help mitigate risks associated with market volatility.

When evaluating crude oil ETFs for long-term investment, several factors merit attention:

Expense Ratios: Higher fees can erode returns over time. Comparing expense ratios is crucial to ensure cost-effective investment choices.

Tracking Error: Assessing how closely a crude oil ETF tracks its underlying index or benchmark is vital to meeting investment objectives.

Market Conditions: The oil market is influenced by geopolitical events, supply-demand dynamics, and macroeconomic factors. Staying informed about these elements can aid in timely investment decisions.

Tax Implications: Understanding the tax treatment of ETF investments, including potential K-1 forms for certain funds, is essential for effective tax planning.

Conclusion

In conclusion, investing in crude oil ETFs offers a practical way to gain exposure to the energy sector without the complexities of direct commodity trading. The ETFs highlighted provide options catering to different investment strategies and risk appetites.

Conducting thorough due diligence and aligning ETF selections with individual financial goals and market perspectives are essential in building a resilient investment portfolio in the energy sector.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.