The FTSE China A50's rally has literally stalled since March when the Chinese

government announced a raft of fiscal stimulus to revitalise the plateauing

economy and plunging stock market.

While earlier this year Japan's Nikkei 225 surpassed the previous all-time

high in Dec 1989, apparently it will also be an arduous journey for the A50 to

retest its peak around 23,000 hit in 2007.

China's State Council recently published the "Nine-Point Guideline", which

includes measures to encourage dividend payment and plug corporate governance

loopholes.

Local investors are hoping those measures will mirror Japan's efforts to

boost the value of listed companies. Several Wall Street banks lately echoed the

view, such as UBS and Goldman Sachs.

UBS Group raised its recommendation on a key Chinese stock index to

overweight in a rare upgrade call this year, given early signs of a pickup in

consumption.

In light of improvements in shareholder returns, corporate governance

standards, and institutional investor ownership, Goldman’s analysts project

significant potential upside for A-shares.

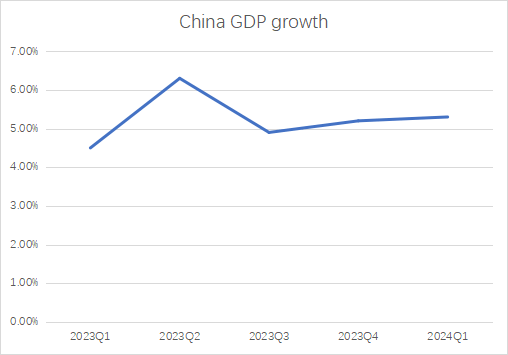

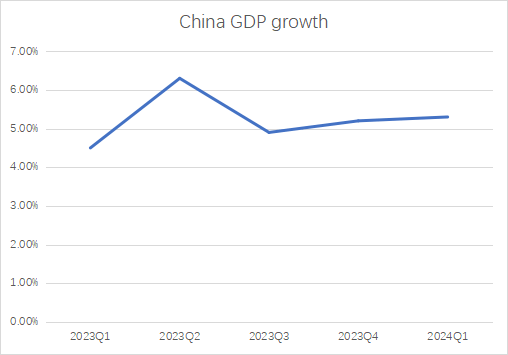

The growing confidence has been in part spurred by stronger-than-expected

China Q1 GDP after rating agency Fitch downgraded its outlook on the country

from neutral to negative this month.

High concentration

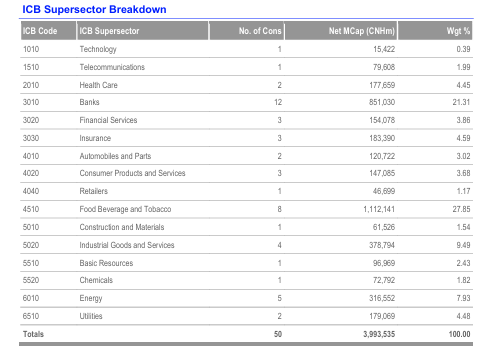

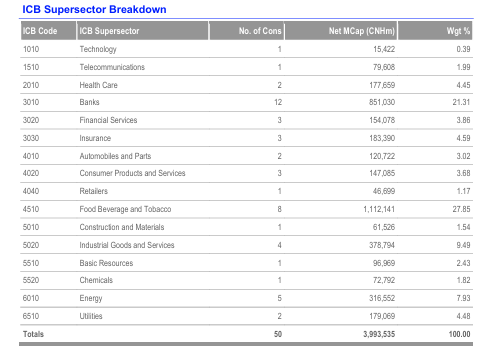

According to LSEG data, food beverages and tobacco ranks highest (27.85%)

among all sectors within the A50, followed by banks (21.31%). The third largest

sector accounts for less than 10% of the index.

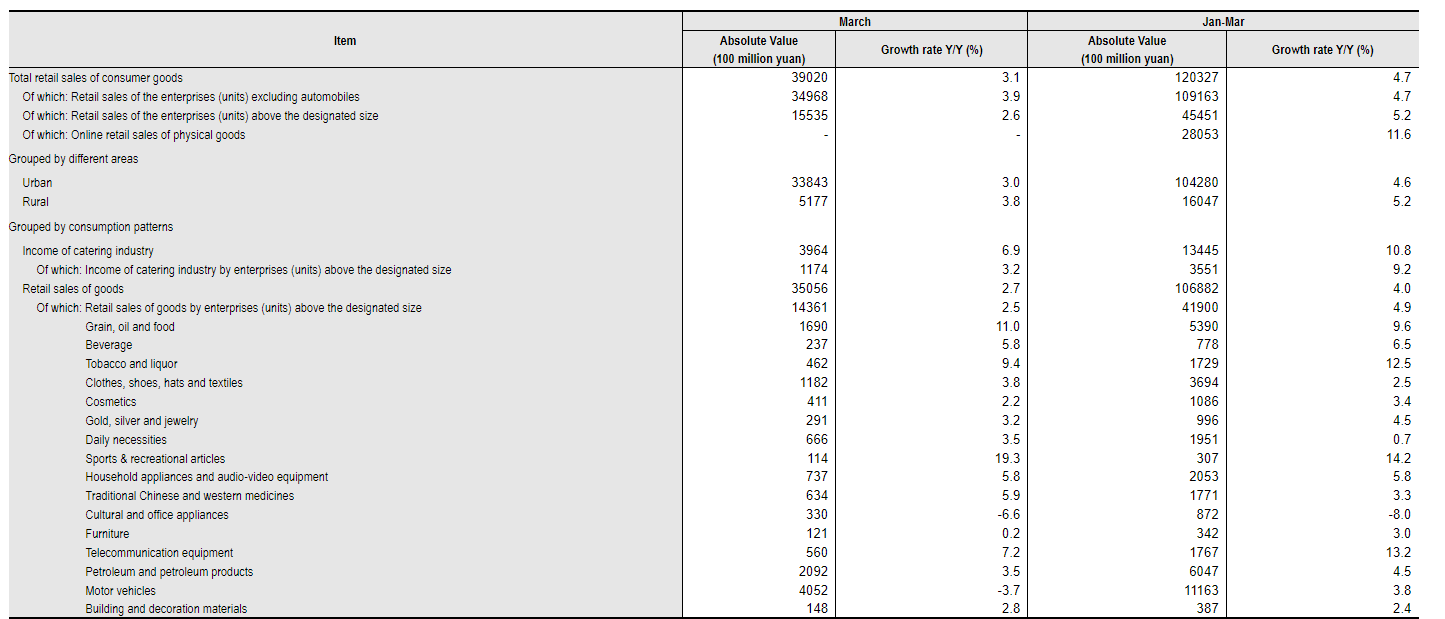

China's consumer prices edged higher in March against a year earlier, missing

forecasts. Analysts said CPI during the first two months of the year was boosted

by the Lunar New Year holiday.

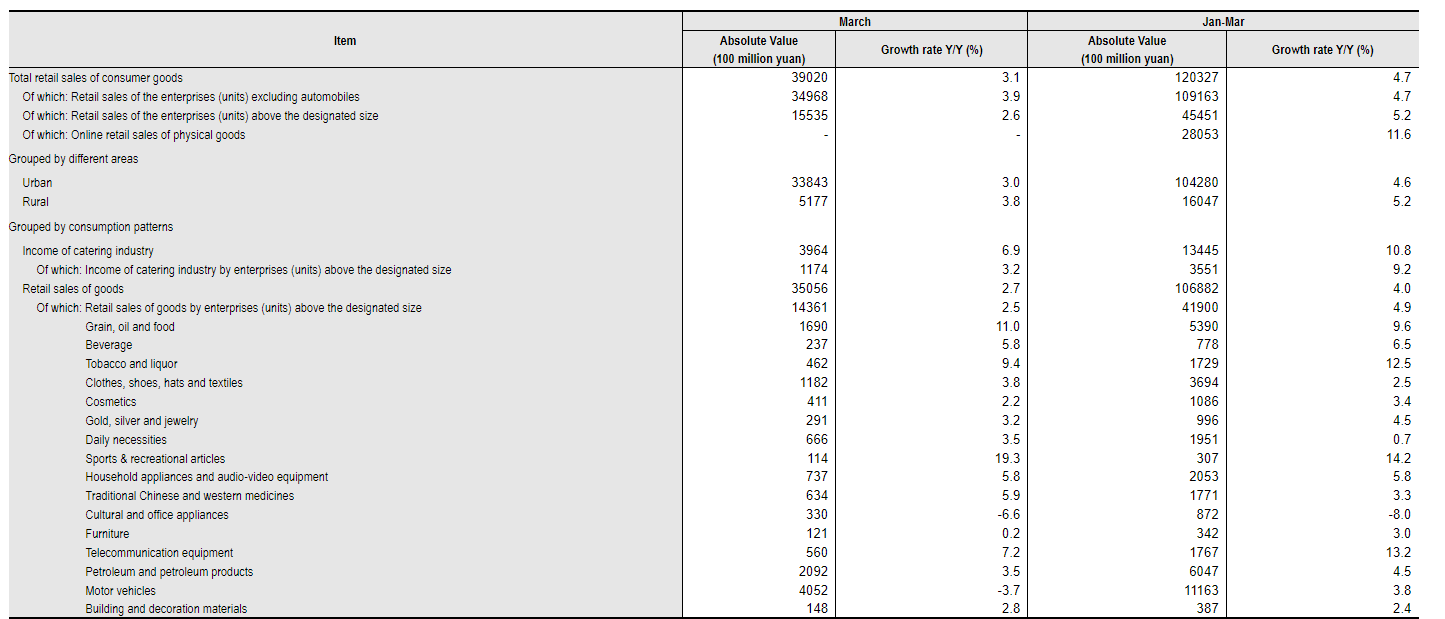

Retail sales expanded 3.1% in March, down from 5.5% for the January-February

period. Tobacco and liquor sales witnessed a notable growth of 12.5% while

beverage sales grew 6.5%.

The figures are in line with the rosy picture painted by liquor giants’

quarterly earnings reports. Maotai's Q1 revenue increased by 18% year-on-year

with a slightly lower net profit margin of 54.4%.

IWSR’s research conducted among middle and upper-income Chinese consumers

showed that broader economic concerns are becoming less influential in the

premiumization trend within the industry.

Premium liquor brands, which make up of a good part of the index, will

benefit from "drinking less but better,” which leaves plenty of room for

additional upside in the sector.

But the banking sector does not look that promising given ailing property

market. China announced its biggest ever reduction in the benchmark mortgage

rate at the end of February.

The attempt to stem a prolonged property crisis is yet to take effect with

residential real estate investment down 10.5% and new housing starts tumbling

27.8% by construction area year-on-year in Q1.

Real estate led the latest wave of defaults between 2020 and 2024, according

to S&P. Vanke is going the way of Evergrande and Country Garden, which both

defaulted on their debts and are at risk of being liquidated.

Competing poles

Asia will contribute roughly 60% of global economic growth this year and

India and China are projected to be the biggest drivers, the IMF said in its

latest outlook.

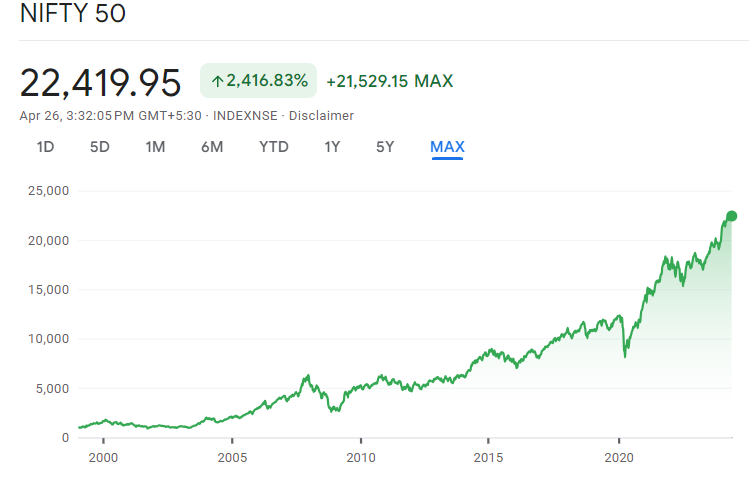

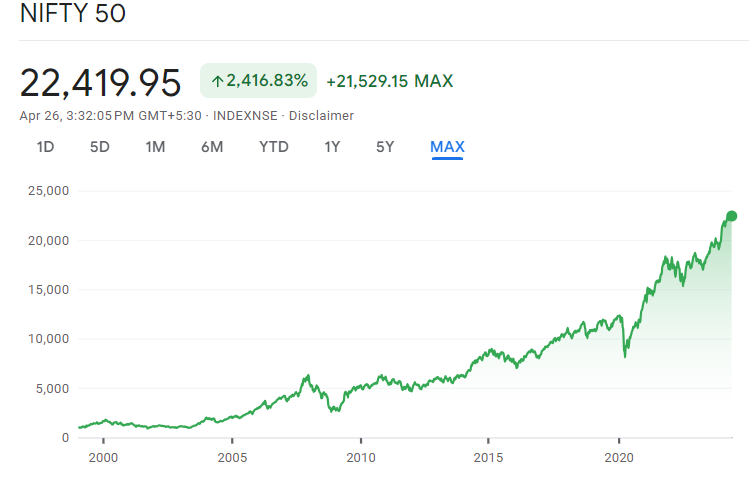

But the Indian stock market has outperformed its more developed neighbour for

a long stretch with the benchmark nifty 50 index heading for its ninth straight

year of gains.

India's more youthful population switched places with China in April 2023 to

become the world's biggest nation. Deep political rifts between China and the US

also adds to the appeal of the Asian market.

The country's ability to turn its economic expansion into corporate profits

makes it a better prospect for investors than China, according to the latest

Bloomberg survey.

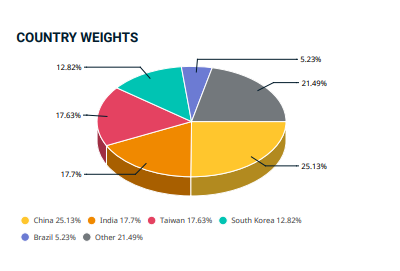

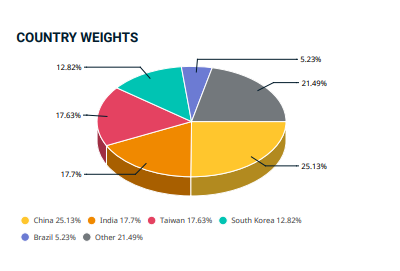

The correspondents expect China's equity market to underperform India's over

the next 12 months. Indian shares now make up 18% of the MSCI Emerging Markets

Index, less than China's 25% weighting.

Indian equities attracted $25 billion in net inflows for the year through

March, compared with just $5.3 billion for China. Despite that,"buy India, sell

China" may have reached an inflection point.

More than 90% of emerging market funds are adding back their positions in

mainland Chinese shares, which were underweight, while also dialling back

exposure to India, according to HSBC.

"Some of our Chinese investments have become less valuable but the investment

case for them has increased," said James Donald, head of emerging markets at

Lazard Asset.

The fund manager's China portfolios are aligned with the index weight, while

India "has been a source of negative attribution for our portfolios" due to its

rich valuations, he said.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.